Are You a Victim of Home Market Bias?

Simon Turner

Wed 18 Jun 2025 6 minutesOne of the more common and financially painful biases to be aware of is home market bias. It’s a major issue for Australian investors.

Home market bias is easy to understand. After all, investing with conviction is a lot more natural when you know a country well. However, with the Australian market representing less than 2% of the global market, home market bias translates into a seriously limiting strategy which underexposes many investors to the vast array of global opportunities available to them. That invariably translates into lower risk-adjusted returns over the long term.

It’s time to look beyond the small Australian market to ensure you’re doing your future self a favour…

The Global Market is a Big Place

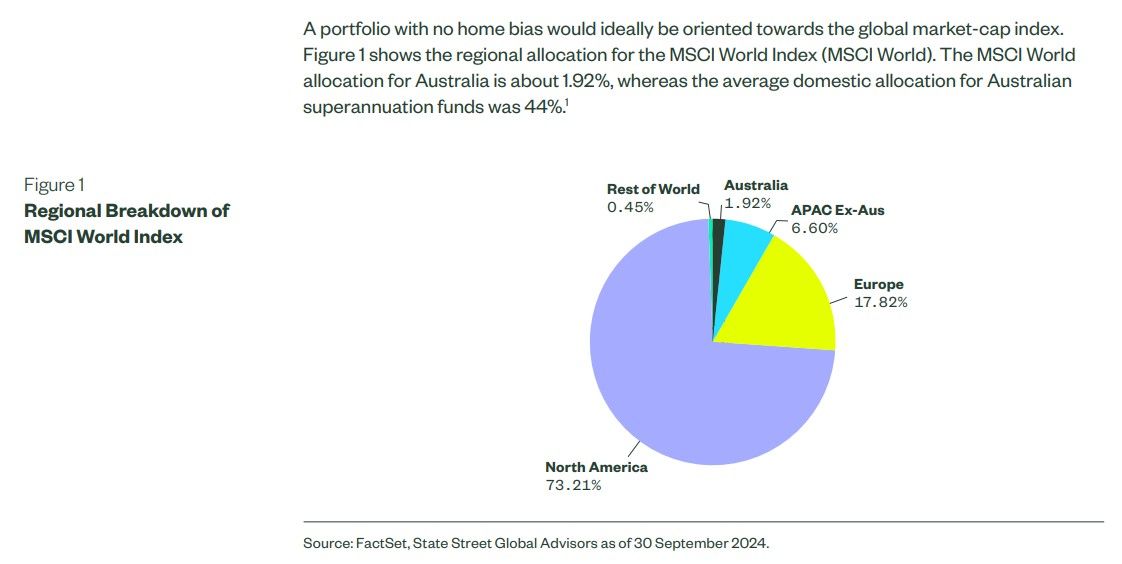

First, some context. Using the MSCI World Index as a guide, Australia represents just 1.9% of the global market while North America represents a hefty 73.2% and Europe represents 17.8%.

1.9% is a tiny percentage. Just think about the chances of the Australian market outperforming a global market which is more than fifty times its size each and every year. Of course, some years it may indeed outperform. But solid portfolios are made out of diversified asset allocations which pay heed to the fact that each year different regions and assets will outperform.

In other words, don’t place all your eggs in one basket.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Prevalence of Home Market Bias

According to State Street: ‘Home bias is defined as having a portfolio where the proportion invested in the domestic market is larger than the proportion that market is of the global index.’

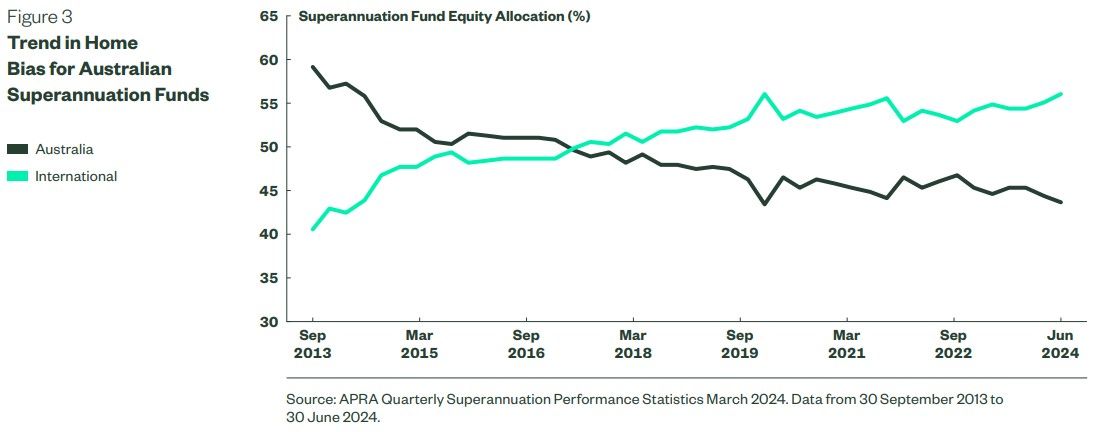

Research indicates that Australian investors maintain a substantial home bias. According to a recent study by State Street Global Advisors, Australian investors’ home bias decreased from 58% in 2014 to 44% in 2024. No doubt, the rise of the Magnificent Seven had a role to play in that shift. Despite this decline, Australians’ home market bias remains pronounced.

Australian investors are far from being alone in maintaining a high home market bias. In fact, this bias is even more extreme in South Korea, Hong Kong, and Japan.

Understanding the Drivers of Home Market Bias

When a bias is as common as this, it’s worth delving deeper to understand the drivers behind it.

Several factors contribute to its persistence:

- Familiarity: Investors are more comfortable with companies and markets they know well.

- Easier Access to Information: Some investors prefer their home market because they find it easier to access the relevant information.

- Perceived Safety: Domestic markets tend to be viewed as more stable and less risky than unknown international markets.

- Currency Considerations: Concerns about currency fluctuations can deter international investments.

- Regulatory Environment: Favourable tax treatments and policies (e.g. franking credits) often encourage domestic investment.

- Hedging Local Liabilities: Some institutional investors overweight the local market as a means of hedging their assets against local liabilities.

While these factors are understandable, home bias comes at a heavy cost which not all investors may be aware of.

The Cost of Home Market Bias

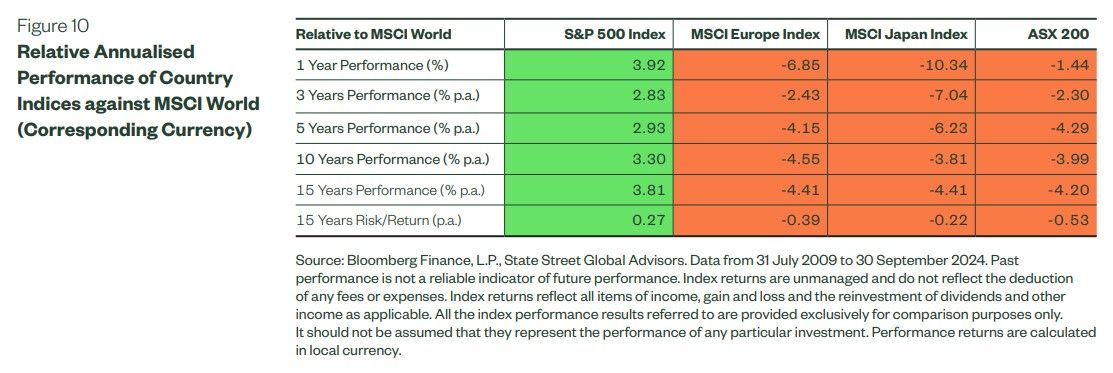

The cost of maintaining a home market bias is evident when comparing the performance of Australian and global equities.

For example, during 2023, Vanguard’s global equities ETF delivered a return of 23.3%, while its Australian equities counterpart returned only 12.0%.

Recent State Street research went so far as to put an annual cost of home market bias for local investors: ‘Australian investors are potentially missing out on 1.4% p.a. based on the current allocation versus the optimal allocation we have modelled.’

Bear in mind that a 1.4% p.a. performance difference compounds into a significant amount over the long term.

This outlook is supported by the relatively weak ASX200 performance versus the S&P 500 over all timeframes.

The Benefits of Diversification

The benefits of diversification are hard to overstate for long-term investors focused on addressing their home market bias and optimising their risk-adjusted returns in the process:

- Reduce Volatility: Different markets tend to have their own unique economic and market cycles, so being exposed to many regions is a powerful strategy to mitigate against volatility.

- Access Growth Opportunities: Emerging markets and other international markets may offer higher growth potential than the Australian market.

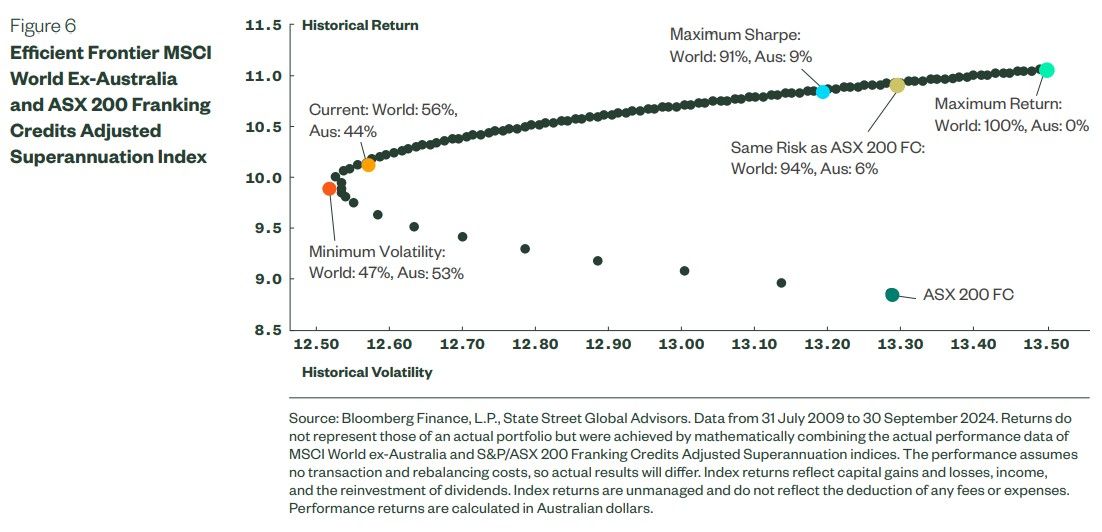

- Enhance Risk-Adjusted Returns: A well-diversified portfolio can achieve better returns per unit of risk. As shown below, State Street research shows that Australian investors’ risk-adjusted returns are optimised with 9% local exposure and 91% international exposure.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Practical Steps to Mitigate Home Market Bias

So you’ve identified that home market bias is holding you back. How do you go about addressing it?

Here are a four simple steps which may help:

1. Invest in Global ETFs: These exchange-traded funds track global indices and provide convenient, diversified exposure to international markets for a low cost.

2. Consider Currency-Hedged Global Funds: These types of managed funds can protect investors against currency risk, one of the major barriers to letting go of home market bias, when investing they’re overseas.

3. Regularly Review Your Portfolio: Ensure your portfolio’s asset allocation aligns with your long-term investment goals and risk tolerance. That means monitoring your home market exposure as an important data point.

4. Seek Professional Advice: Financial advisors can provide personalised strategies to help you achieve optimal diversification.

Global Diversification is a Prudent Long Term Strategy

Overreliance on domestic assets can seriously limit investors’ long term performance. It may not seem like a major limitation on an annual basis, but thanks to the power of compounding home market bias can cost investors an enormous amount of their potential upside over the course of their lifetimes.

By embracing global diversification, Australian investors can enhance their portfolios’ risk-adjusted returns by accessing a broader range of opportunities and reducing exposure to local market fluctuations. Both are essential for sustained investment success.

Global ETFs Worth Checking Out

Global Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.