The Lessons 2025 Taught Us All

Simon Turner

Wed 10 Dec 2025 6 minutes2025 has been a year when it has paid to learn from the markets. And there have been plenty of lessons flying at investors open to learning. For example, structural dynamics often override thematic hopes, macro-regime shifts matter, diversification remains the only free lunch in finance, and cost-control plus discipline still beats speculative glamour.

Before 2026 kicks off, now’s the ideal time to ensure you’ve learnt this year’s money-making lessons so you’re starting the new year on the right foot to compound your learnings into real returns...

1. Inflation is Never Really Conquered, Just Tamed in the Short Term

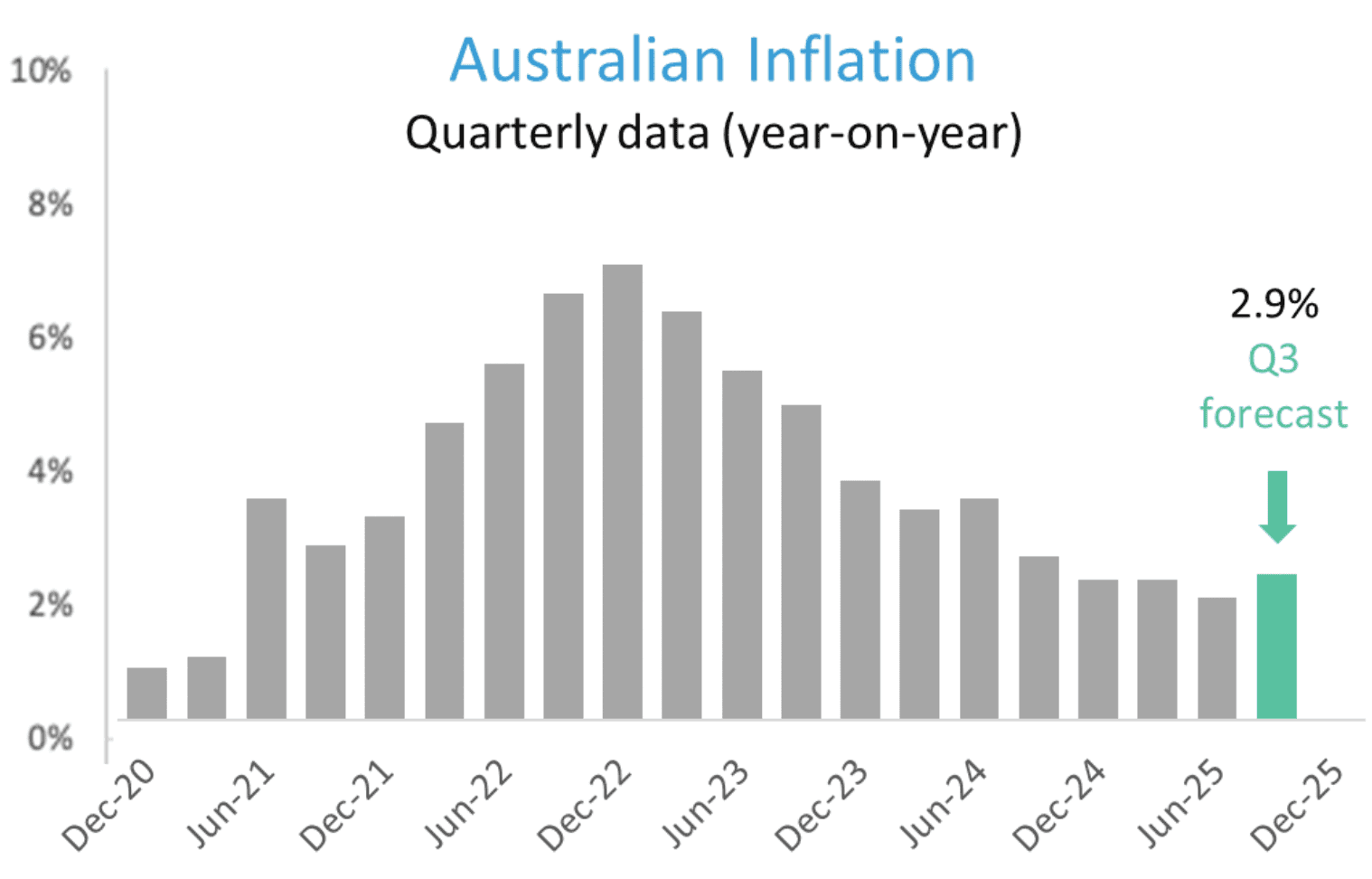

One of 2025’s most important lessons relates to inflation: once it flares up, as it did in the aftermath of the pandemic, it’s usually premature to say it’s been conquered. More typically, central bank action tames it in the short term, whilst largely ignoring the structural drivers of inflation which are outside of its control and lying dormant.

As shown below, the battle against Australian inflation appeared to have been won during the first half of 2025. However, it once again started edging upwards in Q3.

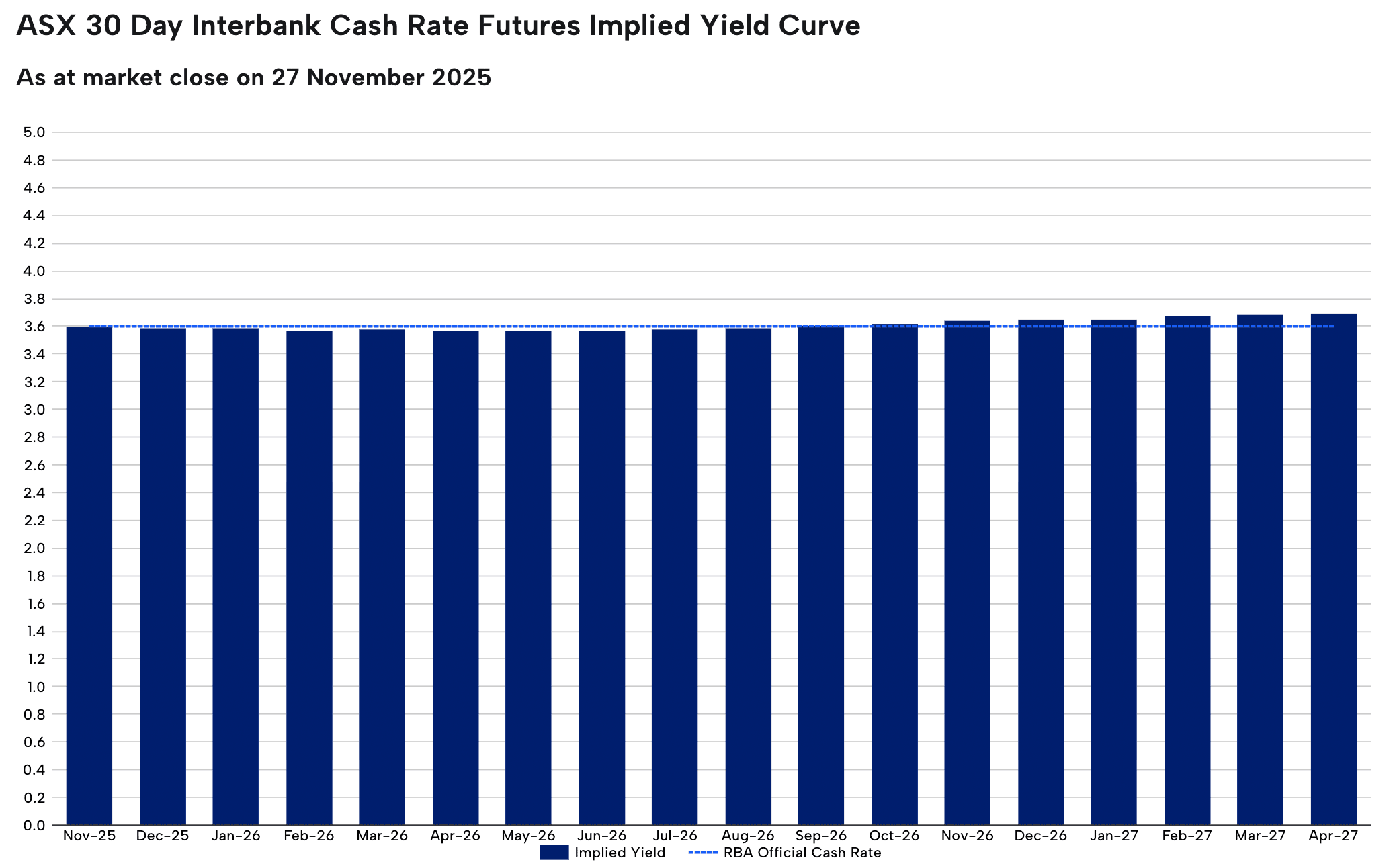

This lesson matters so much to investors because it’s inextricably connected with rate expectations. As and when inflation rears its ugly head, as it has done of late, rate expectations quickly adjust upwards. Only a few months ago, the RBA was expected to cut rates by 2-3 times in 2026. However, thanks to the recent resurgence in inflation, that’s changed. As shown below, the RBA is now expected to keep rates steady throughout 2026.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Beware the Overcrowded Investment Themes.

Only a few weeks ago, the global tech sector experienced a sharp correction amid worries that the AI surge was over-hyped. The broader message was that revolutionary themes often attract huge inflows, but once they become stretched, crowded and vulnerable, they can reverse just as fast.

The lesson for investors is that the fast-growing, ‘sexy’ sectors such as AI can run ahead of themselves as investors become over-excited and overestimate the potential.

Investors should therefore ask themselves: is this trend supported by earnings, valuations, liquidity and time horizon, or merely investor sentiment?

Equally, the intermittent selloffs in the market’s hottest themes tend to be short and sharp as investors are quick to revisit them.

3. Diversification is the Only Free Lunch in the Investment World.

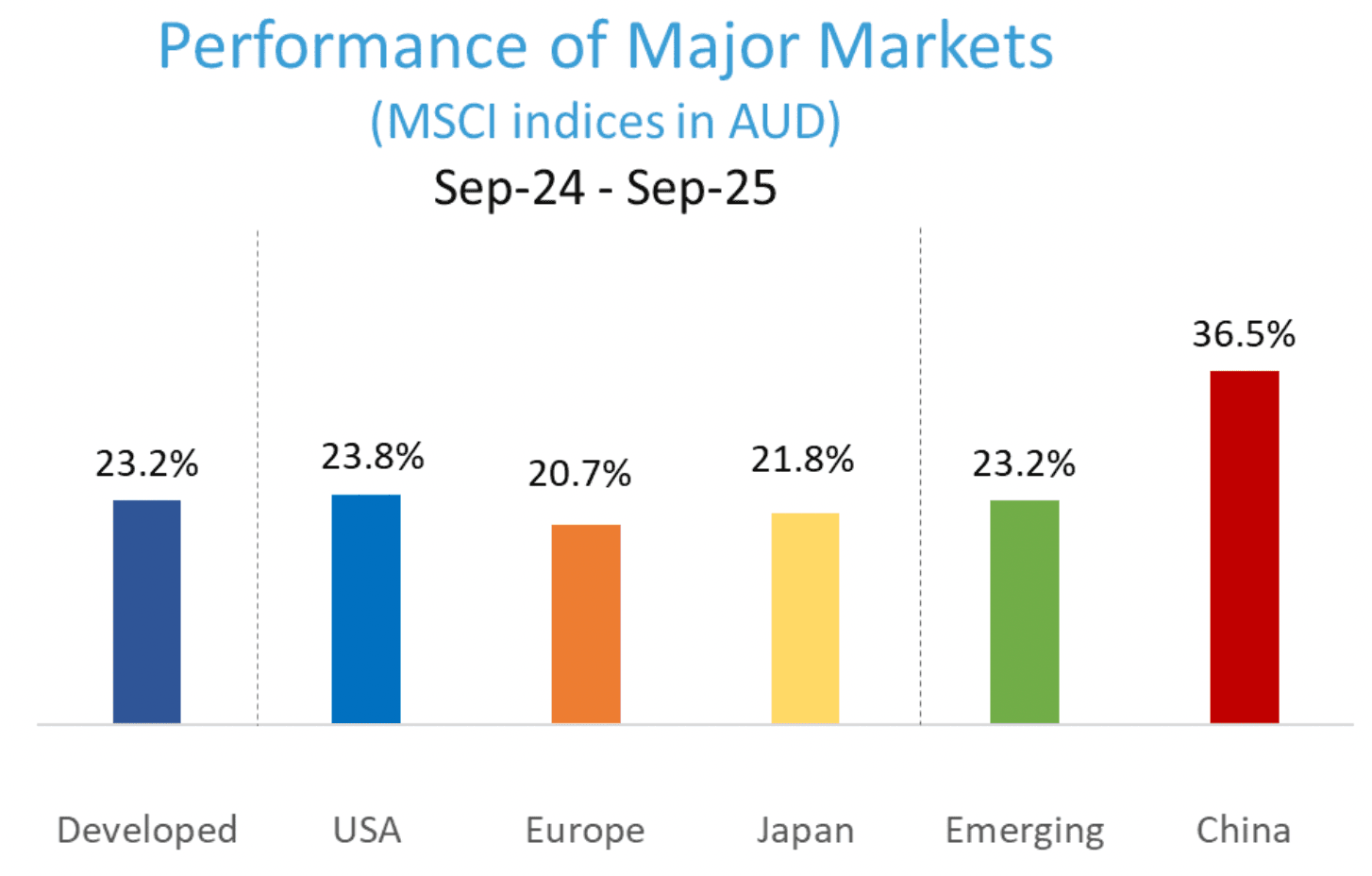

The importance of disciplined diversification has been evidenced throughout 2025. The All Ords put in a solid performance during the first three quarters, rising 16.1%. However, that performance was weak in a global context, as shown below.

As a result, being globally diversified in 2025 hasn’t only reduced investors’ risk, it’s also strongly enhanced their returns. The lesson is that diversification across geographies, asset classes, and strategies remains worth paying attention to. It’s about the only free lunch in finance.

4. The Rise of ETFs is a Game Changer for Individual Investors.

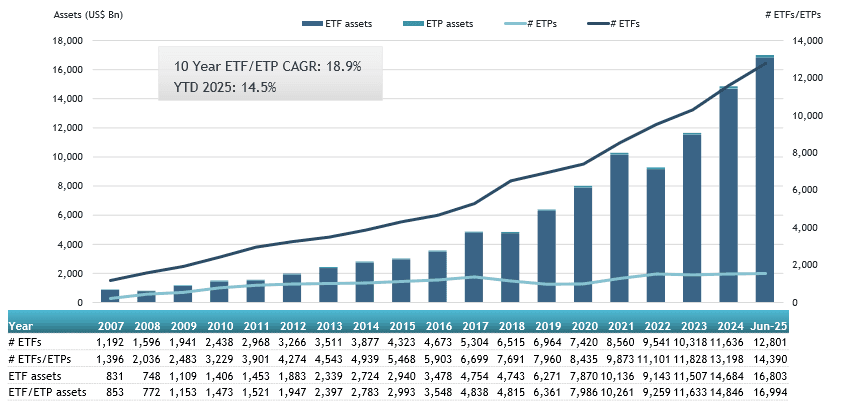

The inexorable rise of ETFs is a structural force to be reckoned with across global investment markets. As shown below, ETF assets under management have been growing at an impressive 19% p.a. over the past decade.

This isn’t a lesson per se as it’s the continuation of a long-term theme. Rather, the lesson is that ETFs are creating opportunities for investors to translate their investment plans into real world portfolios with far more nuance than in the past.

For example, during a year where investment themes shifted and broader market valuations appear stretched, ETFs allowed investors to maintain their core exposure in broad-based, low cost funds, while tilting their satellite positions away from the herd into specialist and thematic ETFs such as commodities, emerging markets, and smaller companies.

So for investors who are up to speed with the current universe of ETF offerings, the opportunity to use ETFs to create immediately diversified, low cost portfolios that reflect their nuanced investment views and beliefs has never been better.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Active Funds Have a Role to Play but be Picky.

Active funds have faced a relatively challenging few years due to the rise of ETFs. Not only do investors have a much larger universe of low cost alternative funds at their fingertips, they can invest in ETFs confident they won’t underperform their benchmarks.

Not so with active funds. As APRA recently warned, more than 40% of active funds with a ten-year track record have exhibited significant investment under-performance. This echoes the broader themes at play behind many of the underperforming funds: cost-drag, style drift, and poor timing erode investment value.

Despite this, successful fund investors have learnt not to paint all active funds with the same brush. There are still many active funds who are worth their fees care of long-term outperformance.

These funds’ defining feature tend to be long-term expertise in a chosen speciality. For example, smaller companies, commodities, and emerging markets are specialist asset classes well-matched to best-in-class active strategies.

So the lesson for investors is that whilst the cost-efficiency of ETFs warrants a growing portfolio presence, being intentional about where you invest actively is also an important long-term return driver.

6. Avoiding Stupidity is More Important Than Being Brilliant.

Charlie Munger captured this year’s final lesson best when he said: ‘The world is full of people trying to be brilliant when the essential task is to avoid being stupid.’

2025 has offered plenty of evidence that avoiding stupidity, through cost awareness, diversification, thematic awareness, and disciplined execution, drove strong investment outcomes more than chasing brilliance.

This lesson extended to picking active fund and ETF managers. By investing with managers with a critical mass of assets under management, strong disclosure, robust governance, and operational resilience, investors were generally able to avoid the underperformers and structurally weak managers.

Markets are Always Adapting

So the lessons have been coming thick and fast this year.

In short, 2025 taught us that markets don’t pause to explain their driving narratives. That structural forces matter more than headlines. That fund cost, transparency, and diversification still pay dividends. And most importantly, that the optimal strategy may not be seeking the hottest theme, but solidly allocating, monitoring, adapting, and avoiding the common fallacies that repeat each cycle.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.