The Best Investment You’ll Ever Make

Simon Turner

Mon 8 Dec 2025 8 minutesIf you’ve ever met a master investor, the first thing you’re likely to notice about them is their humility. Markets have a way of humbling us while teaching us valuable lessons. The second thing you’re likely to learn about them is the extent of their financial education. Not only did they learn from each and every investment mistake they’ve ever made, they’re also likely to have invested a lot of time and money in their financial education.

It’s easy to understand why. Financial education compounds more reliably than any equity, generates fewer surprises than any bond, and remains accessible to anyone willing to cultivate it. For investors, it’s arguably the single most powerful determinant of their long-term health, wealth, and wellbeing. It’s the ultimate investment.

The Case for Financial Education Has Rarely Been Stronger

The case for treating financial education as a lifelong investment has rarely been more compelling, particularly for Australians.

The OECD’s recent global survey of financial literacy found that only 63% of Australians could correctly answer basic questions about inflation, diversification, and interest calculations, placing the country well behind the leading group of advanced economies.

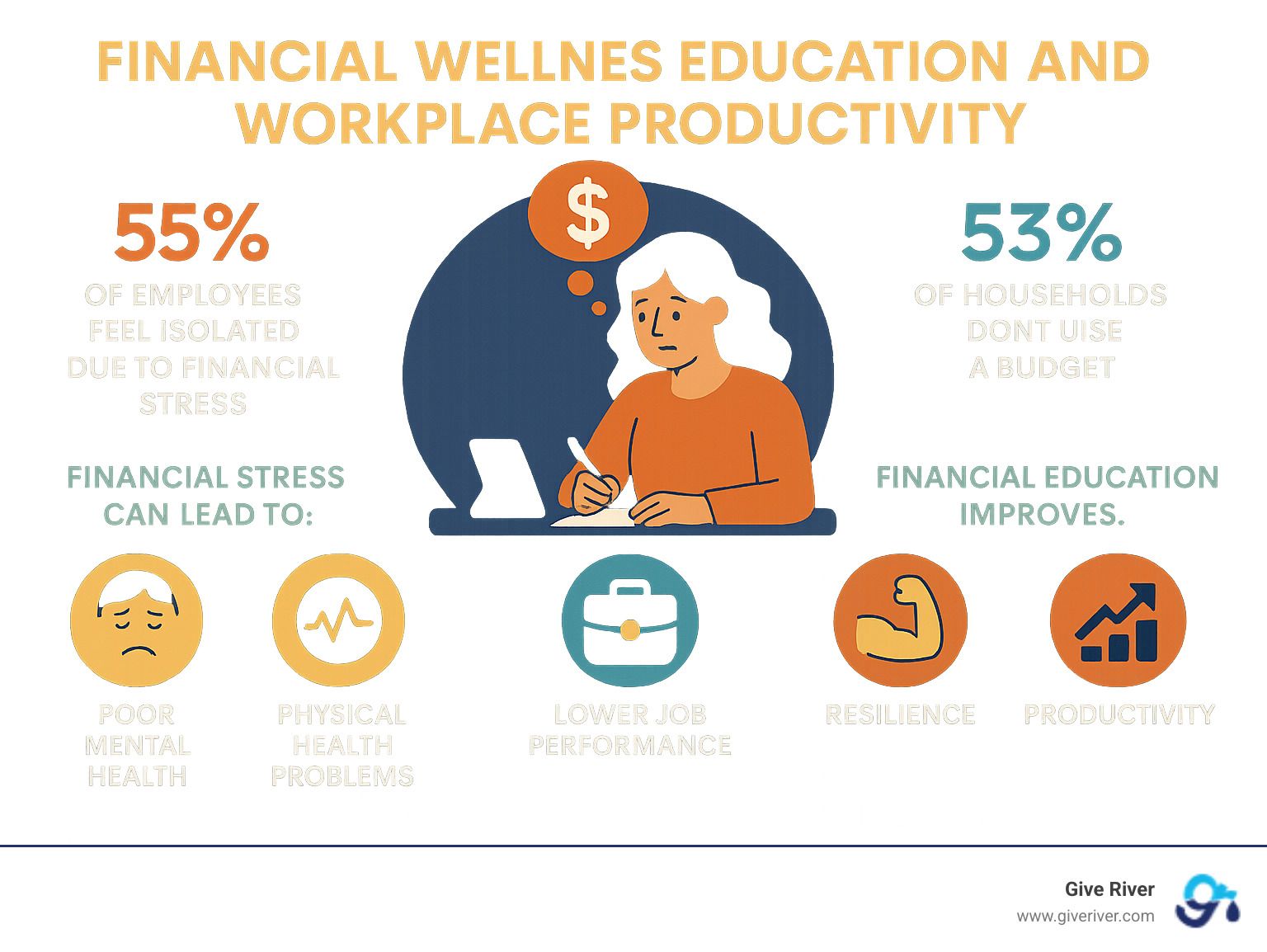

Moreover, low financial literacy is connected with low economic security, weak retirement planning, and higher levels of financial stress. This was reinforced by the Household, Income and Labour Dynamics in Australia Survey, which showed that respondents with low financial literacy reported markedly lower life satisfaction scores.

The correlation between financial capability and quality of life becomes apparent when tracking long-term behavioural outcomes. The RBA has noted that individuals with strong financial skills are significantly more likely to save regularly, avoid high-cost debt, build emergency funds, and invest for retirement. These behaviours create a stable financial platform that reduces household vulnerability during shocks. For example, a family that understands the mechanics of compounding and manages its balance sheet prudently will experience economic downturns very differently from one that has drifted into debt without a clear investment strategy.

In short, financial knowledge is not an optional accessory. It can soften economic headwinds, improve relationships, and free up time and attention for pursuits more satisfying than the anxiety induced by financial pressures. It’s foundational to living a happy, fulfilling life in the modern world.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Preparing for Retirement Requires Education

The cultural importance of financial learning is rising as more Australians understand that they, and they alone, bear the responsibility for their own retirement outcomes.

Superannuation is front and centre in this shift. Australia’s superannuation has grown into one of the largest pension systems in the world, with assets exceeding three trillion Australian dollars. Its complexity has also expanded. Contribution caps, investment menus, taxation rules, drawdown strategies, and insurance arrangements require investors to understand a vast array of complex financial concepts. In fact, the Retirement Income Review concluded that superannuation works best for those who understand it. For those who don’t, a lifetime of missed opportunities quietly accumulates.

Financial education also shapes how investors view the investment industry itself. For example, a foundational understanding of risk, valuation, liquidity, incentives and market cycles allows individuals to distinguish between noise and signal. As Warren Buffett once explained, the most important investment skill is ‘the ability to think independently about financial decisions, free from the emotions of the crowd’. His point was not that the crowd is always wrong, but that unconscious herd-following is a fragile strategy.

So investors equipped with deep knowledge tend to develop disciplined frameworks that preserve their wealth exactly when markets most tempt them to abandon it.

Where to Start?

Improving your financial capability doesn’t necessarily mean enrolling for a university degree. Research shows that even brief engagement with high-quality financial content can dramatically improve your long-term outcomes.

There’s plenty of generous financial education content out there, like InvestmentMarkets for example (excuse the shameless plug :). Many of Australia’s superannuation funds also publish guides that translate complex financial concepts into simple language.

So the challenge is rarely a lack of resources. It’s the decision to take the first step.

The Best Financial Education is Timeless & Contemporary

Of course, not all financial education content is useful. High quality financial education is usually both timeless and contemporary.

The timeless lessons are those that every prudent investor eventually learns. For example:

- A dollar saved and invested today isn’t the same as a dollar tomorrow; it is the foundation of many dollars.

- Risk cannot be eliminated but it can be priced, managed, and aligned with your personal goals.

- Diversification is the most powerful strategy to protect against unknown risks.

- Patience is a foundational virtue of all successful long-term investing.

- Markets reward long-term discipline more reliably than short-term speculation.

Investors who internalise these ideas tend to think in decades, and treat volatility not as a verdict but as a condition of participation.

Then there are the contemporary lessons which incorporate an understanding of the modern financial landscape. For example:

- Australia’s capital markets have grown more crowded with investment products whose quality varies widely.

- ETFs cater to almost every theme imaginable at a much lower cost than most active funds.

- Private credit and infrastructure investments are increasingly moving into mainstream portfolios.

- Digital platforms make trading more accessible but can amplify impulsive behaviour.

Without education, some of these evolutions can create unwelcome and costly surprises. With it, the same financial landscape reveals opportunities, risk patterns, and productive decision pathways.

Financial education has a way of transforming opacity into clarity.

The Unavoidable Social Implications

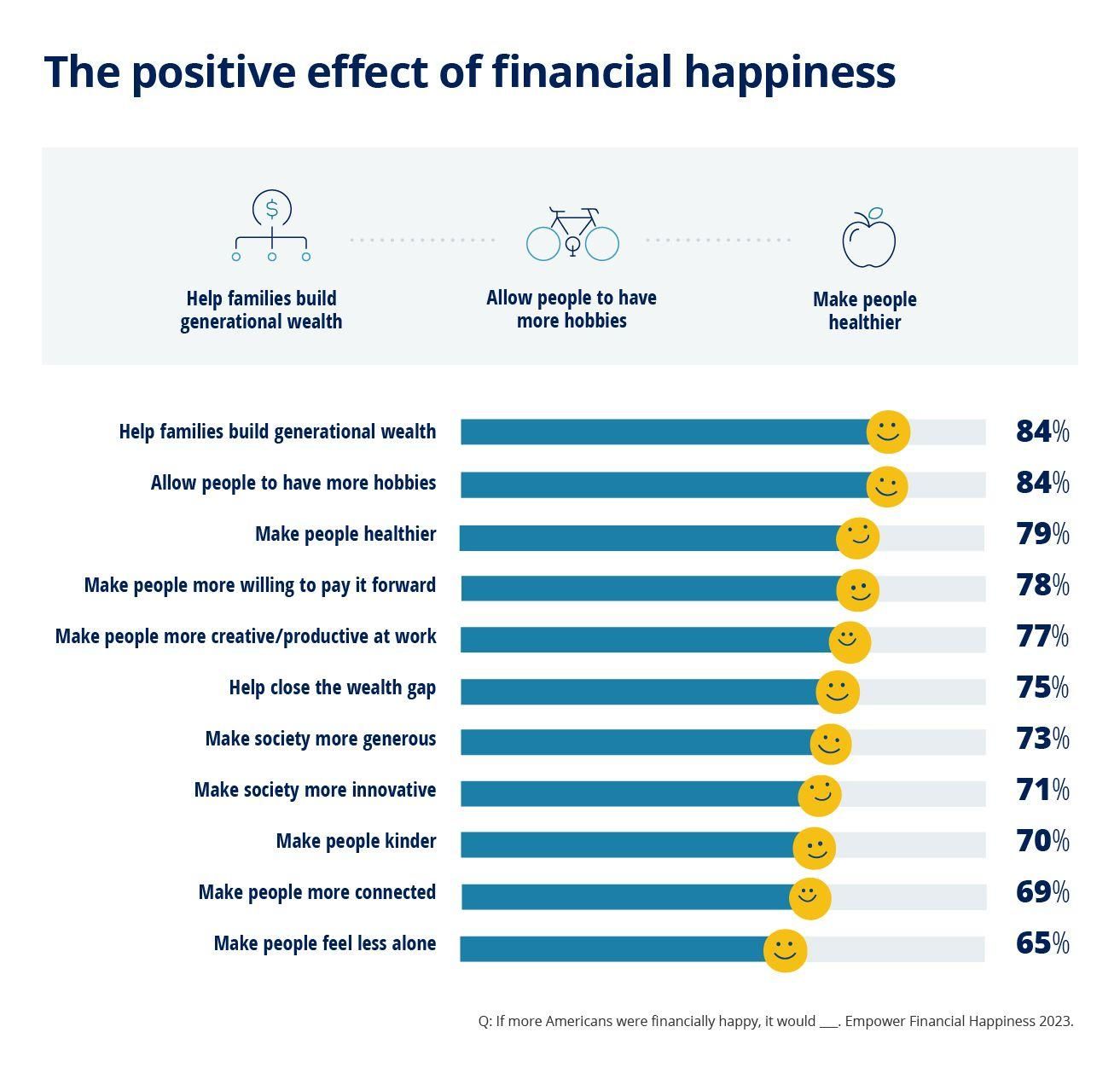

The social implications of improved financial literacy can’t be overstated.

There’s extensive research showing that improved financial literacy is closely associated with reduced anxiety, stronger perceptions of personal control, and a greater sense of life satisfaction.

The World Bank and the OECD are both advocates for financial literacy contributing not only to higher net worth but to improved psychological wellbeing. People who understand how to manage their finances experience less uncertainty, which in turn reduces their stress. In an era of rising cost-of-living pressures, that’s a superpower.

The moral argument in favour of financial education is just as compelling.

In a market economy, individuals carry most of the responsibility for their own outcomes. So when people lack the skills to navigate the financial system, they are disadvantaged through no fault of their own. Financial literacy is therefore not merely a private good, but also a public one. Society benefits when more of its citizens can make informed decisions about saving, investing, and borrowing.

The Australian Government recognised this when it released its National Financial Literacy Strategy, describing financial capability as an important driver of the country’s economic resilience.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Bypass Myths Disguised as Barriers

In the interests of rounding out this discussion, it’s worth mentioning a couple of common myths about financial education that can stand in the way of learning.

One of the most common is that financial knowledge is only relevant for those with substantial wealth.

But the reality is that financial education is of great importance for average households managing ordinary incomes. For example, the difference between saving and investing 5% and 10% of their annual income over a lifetime can determine whether an investor is positioned to enjoy financial security during retirement or austerity.

Another myth is that investing is primarily about predicting market movements. Most successful investors would disagree with this. The most powerful investment decisions are those within our personal control like: how much to save, how to allocate across asset classes, how to behave during downturns, and how to align our investments with our long-term goals.

Thankfully, financial education illuminates these levers to the empowerment of ordinary people.

The Clarity Needed to Navigate a Complex World

Financial education can’t eliminate market, fund, or stock risk. It can, however, equip investors with the clarity to interpret events and the confidence to act deliberately. It can help translate the chaotic nature of markets into something more understandable.

Charlie Munger once observed that the world is full of ‘people trying to be brilliant’ when the essential skill is to ‘avoid being stupid’. He was really speaking of financial education as the most reliable antidote to the costly mistakes that arise from unconscious emotional biases, confusion, or haste.

So the best investment investors can make is not a product, sector, or strategy. It’s the choice to understand the forces shaping our financial lives. Financial education is the steady foundation upon which healthy, happy, fulfilled lives are built.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.