Don’t Overlook Small Caps After Twelve Years of Underperformance

Simon Turner

Mon 16 Jun 2025 5 minutesSmall cap stocks have long been the hunting ground of discerning investors seeking outperformance through the market inefficiencies that exist in this less-followed corner of the market.

However, after twelve long years of underperformance, small caps, which are generally defined as having a market cap below $1 billion, have fallen firmly out of favour. Only the most dedicated of believers have maintained exposure.

Yet, history shows that when an entire asset class is shunned for like this, the conditions are often ripe for mean reversion and substantial outperformance…

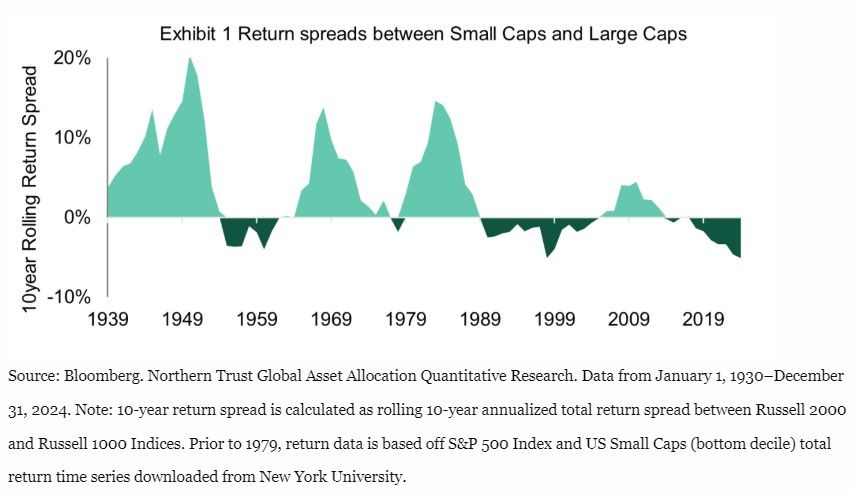

Exhibit 1: The Historical Cycle Is Long & Turning

One of the more useful investment lessons to learn is that market cycles tend to last longer than investors expect. That applies to both booms and busts.

So when small caps begin to lag large caps, their underperformance can stretch for years, not months. The historical data confirms this to be the case. There have been multiple prolonged periods of small cap underperformance, such as 1955–62, 1977–78, and 1989–2005. On average, these down cycles have lasted nine years.

Today, we find ourselves in the twelfth consecutive year of global small cap underperformance. That’s well beyond the historical average and confirmation that this has been a brutal underperformance cycle for small cap investors.

As shown below, U.S. small caps have dramatically lagged the S&P 500 in recent years.

The same trend is evident in other developed markets, including Australia.

👉 Investor takeaway: Global and local small caps have rarely been so unloved for so long. Historically, the longer the lag, the stronger the rebound. So it may be time to start watching, and perhaps accumulating, small caps again.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Exhibit 2: The Role of Interest Rates

One of the lesser-known drivers of small cap performance is interest rates, and the link is stronger than many investors realise.

In fact, research based on U.S. data shows a correlation of 0.6 between falling interest rates and small cap outperformance.

There are sound reasons for this:

- Takeover activity increases when borrowing costs fall as smaller companies become cheaper targets.

- Debt costs matter more to small caps, which often operate with thinner margins and less predictable cash flows than their large cap peers.

- Investor risk appetite tends to increase in lower-rate environments, which favours small cap allocations.

Now may be a good time to be aware of this correlation for Australian investors as the Reserve Bank of Australia is widely expected to continue cutting rates in the second half of 2025 and beyond.

👉 Investor takeaway: If the RBA and Fed continue cutting rates, small caps globally, and particularly in Australia, stand to benefit significantly. Easier financial conditions could act as a major tailwind for both recovery and M&A.

Exhibit 3: Valuations Are Historically Attractive

After such a prolonged period of underperformance, it’s no surprise that small caps are now trading at deep discounts relative to large caps.

U.S. data shows small caps are trading at a price/book ratio of 1.66x which represents a 36% discount versus large caps. Similar trends are evident in Australia, where smaller companies are trading at multi-year valuation lows relative to the ASX 100.

👉 Investor takeaway: These are the kind of valuation gaps that long-term investors dream of. Small caps are currently cheap versus larger companies, and they don’t tend to stay this cheap on a relative basis forever.

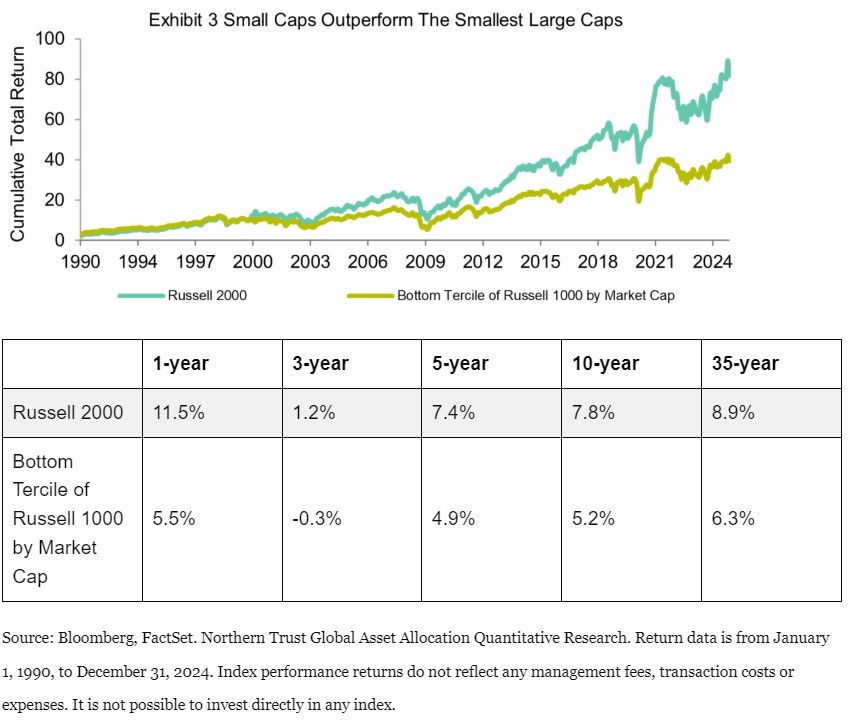

Exhibit 4: Rethinking the Quality Argument

Of course, valuation discounts are only an investment opportunity if they’re not present for a justified reason. On that note, some investors argue that many small caps are simply low quality businesses that failed to ‘graduate’ into large-cap status.

However, the strong outperformance of small caps versus the smallest large caps doesn’t support this claim—as shown below.

In other words, smaller companies are indeed a growth driven asset class which aligns with most investors’ expectations.

👉 Investor takeaway: It’s not that the small cap universe is filled with junk. It’s that investors have stopped looking closely enough to see the difference. So Australian and global small cap investors who invest in quality funds with long term track records of outperformance may be well placed to outperform the large cap sector from these depressed levels.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Don’t Wait for the Headlines to Tell You Small Caps are Back in Favour

The best investment opportunities are rarely comfortable. They often arise after long, grinding bear markets when sentiment is poor, flows are negative, and the consensus has moved on.

That’s exactly where we are today with small caps:

- Valuations are depressed;

- The rate cycle is shifting;

- History suggests a turning point is near.

This is a rare setup comprising depressed prices both locally and abroad, improving macro tailwinds, and an increasingly attractive risk/reward profile. Whether through global small cap funds, Australian small cap funds, or Australian micro cap funds (companies with a market cap below $30 million), now may be a good time to start positioning for the next smaller companies outperformance cycle.

Australian Small Cap Funds Worth Checking Out

Global Small Cap Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.