How to Select a High-Quality Mortgage Fund & an Example

Simon Turner

Fri 13 Jun 2025 8 minutesMortgage funds have surged in popularity in recent years due to the attractive yields on offer which are backed by tangible property assets. However, as the sector matures and becomes more crowded, it’s more important than ever that investors understand not all funds are created equal. The vast spectrum of mortgage fund disclosure is also important to understand, since much of it is below the minimum level required by prudent investors.

With protecting long-term returns in mind, selecting the right mortgage fund has rarely been more pertinent. Using GPS Invest Pooled Fund as an example, here’s our list of the six main attributes to look for in a trustworthy, well-managed mortgage fund positioned to deliver on investors’ expectations…

1. Specialisation + Local Market Diversification

One of the sector’s biggest success drivers is local market knowledge. Each manager’s depth of understanding of the property markets their fund is focused on has important ramifications for the quality their portfolio as well as its inherent risk exposures. That includes not just geography, but also asset type, borrower profiles, and market cycles.

What to look for:

- Deep manager knowledge of specific property markets;

- Diversification across sub-regions and property types within local markets;

- Conservative, reality-based valuations rather than ‘blue sky’ assumptions;

- Avoidance of large, high-risk projects that can dominate a fund and skew its risk profile;

- Transparency around each project within a fund’s portfolio.

Example - GPS Invest Pooled Fund:

GPS Invest Pooled Fund has been active in South-East Queensland for over thirty years, focusing its local market expertise on a manageable region between Coolangatta and Noosa. The fund’s philosophy is simple: if they can’t drive to the site regularly, they won’t lend to it.

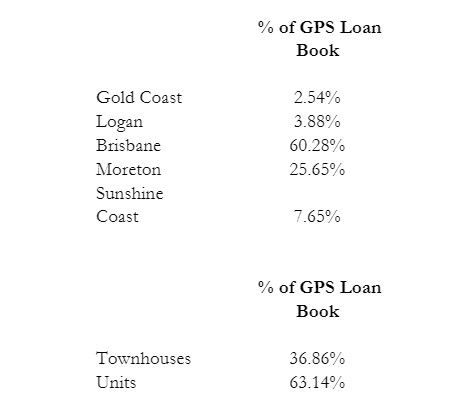

This local focus means their team know where to invest and, critically, where not to. They’re also well diversified, with roughly 60% of the fund’s loans in Brisbane and 40% outside, spread across both townhouses and medium-density unit developments. This strategic spread reduces risk and adds resilience to their portfolio.

2. Manager Experience & Track Record

Mortgage funds can appear to be deceptively safe income-generating strategies until property market conditions turn. When that happens, manager experience, discipline, and strong governance are often the difference between protecting investors’ capital or facing painful losses.

What to look for:

- Proven manager track record across market cycles;

- First mortgage security with conservative loan-to-value ratios (LVRs);

- Extensive manager experience in property development, legal, and valuation;

- Transparent communication and investor alignment (e.g. directors with ‘skin in the game’).

Example - GPS Invest Pooled Fund:

GPS is led by a seasoned executive team with over ninety years of combined experience:

- Richard Woodhead (Chairman) brings over thirty-five years in law and private lending, and has been involved in mortgage funds since 1994.

- Benjamin O’Hara (Executive Director) brings over thirty years in banking and financial strategy.

- Matthew Buckley (Director) brings over thirty years in property valuation and advisory.

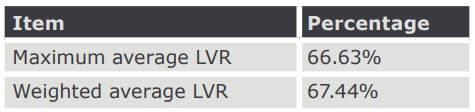

GPS enforces a maximum fund LVR of 70%, with the current weighted average sitting at 67.4%, well below the ceiling. These conservative loan positions offer investors protection against unexpected downturns or project-specific issues.

Additionally, all GPS directors have skin in the game, including founder Richard Woodhead, who’s invested over $3 million in the fund. This alignment of interests is a strong sign of manager confidence in the fund’s future performance.

3. Builder Risk Management Expertise

In the post-COVID construction landscape, builder failures and project delays have become common and costly across the Australian market. As a result, high-quality mortgage funds must actively manage builder risk at both the micro (project) and macro (portfolio) levels.

What to look for:

- Preference for simpler, smaller projects to reduce complexity and delivery risk;

- Diversified fund exposure across builders and project types;

- Contingency planning and experience in stepping in if a builder fails.

Example - GPS Invest Pooled Fund:

GPS deliberately funds smaller-scale unit and townhouse developments, which are generally lower risk. For example, the average construction cost of their current projects is around $10 million, which will typically fund a 3-4 storey unit complex without the significant timing risks associated with larger projects.

The fund maintains tight control over its builder exposure, with only two builders handling more than one project, and none accounting for over 20% of the fund’s total loan portfolio. So no single builder failure is likely to significantly impact upon fund performance.

GPS’s team also balances technical expertise with real-world insight, lending only on projects that their construction and lending teams can actively monitor and understand.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

4. Avoid Funds with Leverage at a Fund Level

While property-based lending inherently involves leverage at an asset level, adding another layer of debt at the fund level significantly increases a fund’s risk profile, especially during volatile periods. Not all investors are aware of this, but it’s important to understand and watch out for.

What to look for:

- Mortgage funds that operate without leverage at a fund level;

- Transparency about a fund’s capital structure and investor position in the capital stack;

- Disclosure that meets or exceeds the required regulatory standards, even for wholesale investors.

Example - GPS Invest Pooled Fund:

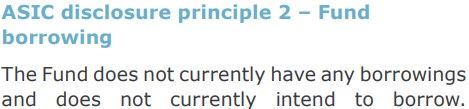

GPS does not employ any leverage at the fund level. So the fund’s returns are driven purely by its underlying property loans, not by borrowing more money and leveraging to amplify performance.

Additionally, despite being open to wholesale investors, GPS voluntarily adheres to retail-grade disclosure standards, updating its Product Disclosure Statement (PDS) twice a year. This is significantly more transparent than many funds in the wholesale space.

5. Investor-Focused Risk Controls & Transparency

It’s easy to promise fund returns, but the protection of capital requires disciplined risk controls, strong compliance, and transparent communication.

What to look for:

- Fund insurance coverage to protect investor funds;

- Regular third-party audits and compliance checks;

- External custodianship of fund assets;

- Clear processes to manage manager risk or operational failure.

Example - GPS Invest Pooled Fund:

GPS holds Professional Indemnity Insurance which protects investors from breaches of trust, dishonesty, or fraud. Most wholesale funds skip this level of protection but prudent investors are focused on it.

GPS is audited twice a year, including a full reconciliation of the fund’s earnings and distributions, as well as compliance with its PDS.

GPS also uses Perpetual as its external custodian, holding all investors’ assets in trust. In the unlikely event GPS should become insolvent, Perpetual can appoint another manager to preserve and manage investor assets. This type of contingency planning is critical for protecting investors’ capital over the long term.

6. Low Default Rates & Transparent Recovery Processes

The quality of a mortgage fund is ultimately judged by its success at returning capital to investors, especially when things go wrong.

What to look for:

- Strong history of timely and full capital returns to investors;

- Minimal defaults or project takeovers;

- Manager willingness and capacity to step in on problem projects when needed.

Example - GPS Invest Pooled Fund:

GPS boasts an unbroken track record of returning 100% of capital to its retail investors. This is the gold standard in the sector.

Their team also have a track record of stepping in as and when required. Out of more than 160 projects they’ve funded, GPS have only had to reclaim control of one project: a case where the manager used their own funds to complete the project and fully repay retail investors.

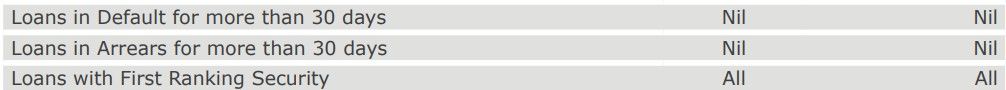

Currently, GPS has no loans in default, and all the fund’s loans are secured by first mortgages at conservative LVRs, thereby offering strong asset protection.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Solid Risk-Adjusted Mortgage Fund Returns Require More Than Yield

Mortgage funds often offer compelling yields, but true value in this asset class lies in solid risk-adjusted returns. That means investing with a manager who knows their market, discloses fully and regularly, manages risk proactively, and has demonstrated resilience through market cycles.

GPS Invest Pooled Fund is a great example of what mortgage fund investors should be on the lookout for. The fund offers investors not just attractive returns, but also robust risk management, deep market expertise, and a proven long-term track record gained through different market environments.

Disclosure: GPS Investment Fund has a commercial relationship with InvestmentMarkets.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.