Don’t Miss Out on These Tax Savings as EOFY Looms

Ankita Rai

Thu 12 Jun 2025 7 minutesAs the financial year draws to a close, it’s the ideal time to get your tax planning in order if you haven’t already.

The good news is it’s not too late. A few smart moves now can still lower your tax bill and free up some extra savings.

Here’s are five tax-saving steps to take before the month wraps up…

1. Boost Your Super

EOFY or not, superannuation remains one of the most powerful tax-saving tools available.

There are a few contribution strategies that can fatten your super balance and reduce your tax bill:

a. Concessional Contributions:

If you haven’t reached your $30,000 concessional contributions cap, including employer and salary sacrifice payments, now is the perfect time to top it up. This helps reduce your taxable income.

Moreover, if your super balance is under $500,000, you can also tap into unused concessional caps from previous years.

b. Non-concessional Contributions:

After-tax contributions are a great way to boost retirement savings in a low-tax environment. In some cases, you can even claim a tax deduction on these contributions. But remember that if you claim the deduction, they'll count as concessional contributions which will apply toward the $30,000 cap.

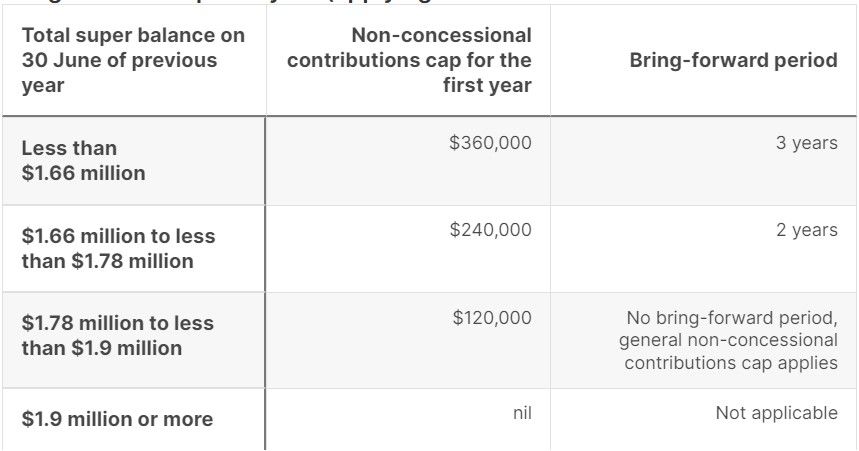

Don’t forget to factor in any employer contributions or salary sacrifice payments for the year. The usual non-concessional cap is $120,000. But if you received an inheritance, sold a property, or just have extra funds to put away, you can go above that limit using what’s called the bring-forward rule.

This rule lets you pull forward the next two years’ caps and contribute up to $360,000 in one hit, as long as you’re under 75, as shown below:

Bring forward caps

Once triggered, the rule applies across three years, starting from the year you go over the standard cap. It happens automatically and keeps you from being slugged with extra tax for going over.

One thing people often mix up is the bring-forward rule with carry-forward contributions. They’re not the same. Bring-forward applies to non-concessional (after-tax) contributions while carry-forward is about concessional (before-tax) ones and lets you use up any unused cap space from the past five years.

c. Government Co-contribution:

If you earn less than $60,400 in 2025, a government co-contribution could be available.

The government matches eligible super contributions by 50 cents per dollar, up to a maximum of $500 per year. So if your total income is equal to or less than the lower threshold and you make personal non-concessional contributions of $1,000 to your super account, you will receive the maximum co-contribution of $500.

d. Maximise Spouse Contributions:

In households where one partner earns significantly less, contributing to the lower-income spouse’s super can unlock a handy tax offset.

For example, if your partner earns less than $40,000 p.a., contributing up to $3,000 to their super can secure a tax offset of up to $540.

e. Downsizer Contribution:

If you’re 55 or older and planning to sell your home, you and your spouse can each contribute up to $300,000 from the sale proceeds into your super without affecting your usual caps.

However, it does count towards the transfer balance cap when you eventually move your super into the pension phase.

The transfer balance cap sits at $1.9 million for 2024-2025 and any amounts exceeding this must move into an accumulation account or be withdrawn, with earnings on excess amounts taxed at 15%.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Claim Every Deduction You’re Entitled To

Claiming the right tax deductions is one of the simplest ways to lower your taxable income. That includes work-related costs such as professional development, industry subscriptions, uniforms, and home office expenses.

With so many of us working from home these days, getting your home office claims right is worth the effort. You can claim 70 cents per hour using the fixed rate method for FY2025, which covers electricity, internet, phone, and office supplies. Or you can total up actual costs. Either way, keeping solid records is key to staying on the ATO’s good side.

Car expenses count too, if you use your vehicle for work. Just make sure your records are accurate.

On top of that, if you’ve received a bonus or made a capital gain this year and want to save on tax, prepaying eligible expenses like work-related tech or investment loan interest can make a difference.

3. Timing Your Income, Investments and Property Repairs

Timing matters, especially if you’re near the edge of a tax bracket. Delaying a hefty EOFY bonus or asset sale until July can greatly reduce your taxable income for this year. This simple step could keep you in a lower bracket and save you plenty.

It's also a good time to look at your investment portfolio. Selling investments that have performed poorly can offset any capital gains you've made, reducing your overall taxable income. But be careful—repurchasing the same or similar assets shortly after (wash sales) will catch the ATO’s attention.

If you've been delaying repairs on your investment property or holiday home, act quickly and complete genuine repairs by 30th June for immediate deductions. Just be clear about the difference between repairs and capital improvements. The ATO closely monitors this, and capital improvements must be claimed gradually over several years.

4. Make Your Donations Count

Donating to a cause you care about is not just rewarding, it can also give your tax return a healthy boost.

If you make a donation to a registered charity before 30th June, you can claim it as a deduction on your tax return.

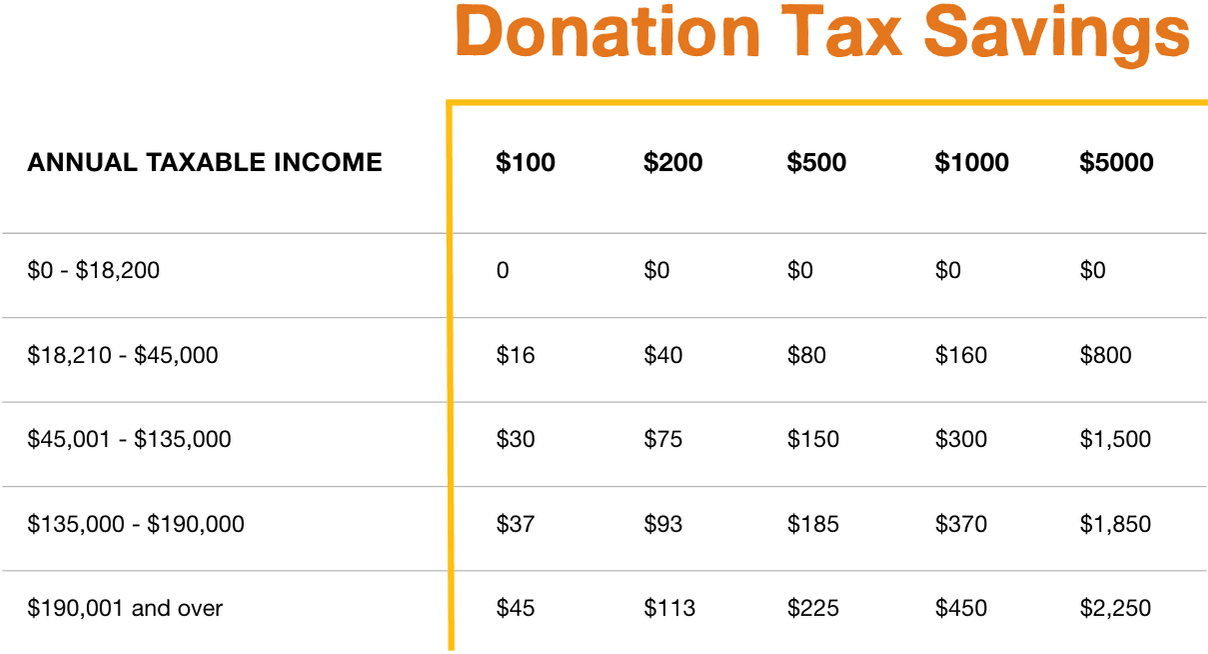

As long as the charity is a registered deductible gift recipient (DGR) and the donation is over $2, it counts. The higher your tax rate, the more it’s worth to you, as shown below.

For example, if you’re in the top tax bracket, a $10,000 donation could reduce your tax bill by around $4,500.

And if you want to lock in the tax benefit now but aren’t sure where to give yet, a donor-advised fund (DAF) could be a great option. You can make the donation, claim the deduction this year, and take your time choosing the charities you want to support.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. Minimum Drawdown for SMSFs

For SMSF trustees, there’s one crucial EOFY task you don’t want to overlook. If you’re drawing a pension from your self-managed super fund, make sure you’ve met your minimum pension drawdown by 30th June.

Missing this step could mean losing the fund’s entitlement to tax-free earnings on pension assets. That income would then be taxed at up to 15%, which is a costly mistake most trustees want to avoid.

A Little Planning Goes a Long Way

EOFY is a great opportunity to pause, reset, and make your money work a little smarter. Whether it’s boosting your super, fine-tuning your deductions, or being more intentional with your charitable giving, each step adds up.

A little planning now can go a long way in positioning your financial assets for a stronger year ahead.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.