Asset Allocation Secrets: The Thing with Risk

Simon Turner

Mon 20 Oct 2025 8 minutesWhen you were attracted to the exciting world of investing, risk management probably wasn’t a primary drawcard. Worrying about all the things that could go wrong is at odds with the reasons most independent investors enjoy investing. Yet, the truth is it’s hard to succeed long term as an investor without mastering risk. So maybe it’s high time you turned this less-than-sexy skillset into an investment superpower.

How Risk is Commonly Framed

When you think of investment risk, do you think of all the aspects of investing you’d like to avoid? Like volatility, drawdowns, and bad years, for example.

If this is the way you think about risk, you’re in esteemed company. Most investors are in the same boat.

But this framing gets the relationship backwards.

Risk is essentially the unknown battlefields which are yet to turn into a place of battle, but may do in the future.

These unknown unknowns are an inherent part of investing, so they should be regarded as core components rather than nasty after-thoughts.

If you accept that markets are uncertain, volatile, and sometimes pathological, you can design a portfolio that doesn’t just survive stress. It actually leverages it.

With this mind-set, risk isn’t a nuisance. Done well, it becomes a lever.

The trick is to accept that volatility ≠ risk, but that unknown, large losses = risk. And then build your portfolio around that.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why Traditional Risk Tools Often Fail

Most traditional risk theories also miss the mark.

Modern portfolio theory (mean-variance, CAPM, Value at Risk, etc.) is elegant. But its core assumptions that returns are normally distributed, correlations hold during periods of market stress, and markets tend to mean revert often break during tail-risk events. Few models predict just how violent markets can be. Even fewer assume that crashes are part of the system rather than outlying events.

In practice, correlations rise during periods of market stress, volatility clusters, and large losses come in almost-instant gaps lower that standard deviation-based risk models don’t predict.

For those in the drawdown phase such as retirees and income-focused investors, another danger looms: sequencing risk. Two portfolios with identical average returns are on track for very different long-term outcomes if one suffers early losses while withdrawals are ongoing. It’s important to understand that in the early years of drawdown, losses are harder to recover from, and compounding works against you.

Then there’s the misconception about diversification protecting investors during periods of volatility. Yes, in calm times, mixing equities, bonds, infrastructure, property, and alternatives tends to spread risk well. But during extreme market events, correlations usually converge as equities collapse, credit weakens, and alternatives get hit. Yet, by relying on risk modelling many investors are wrong-footed by the illusion of safety being diversified gives them.

In short, we’ve got major misconceptions about risk to contend with. The risk theories all focus on volatility as a gauge for risk even though it’s a normal part of a functioning market. And even with this flawed focus, they don’t reflect the reality of the way markets behave during extreme market events.

Ground control to Major Tom, we have a problem.

So the question for investors is: how can you build a portfolio that assumes volatility is normal, that doesn’t rely on unrealistic assumptions, that doesn’t break down when regimes shift, and that manages sequencing risk structurally?

A Fit-for-Purpose Toolkit

The key is to move from reactive risk management to structural resilience as the goal.

That means not just diversifying your portfolio by sector and asset class, but also by market scenario.

In other words, how is your portfolio likely to perform in falling, volatile, stable, and rising markets?

If your portfolio is invested in funds and ETFs, a simple way to gauge this is to look at how they’ve performed during various market scenarios in the past. The pandemic-selloff provided an unforgettable lesson in what can happen during selloffs which provides useful bear-market context. And we’ve had plenty of bull-market context since then.

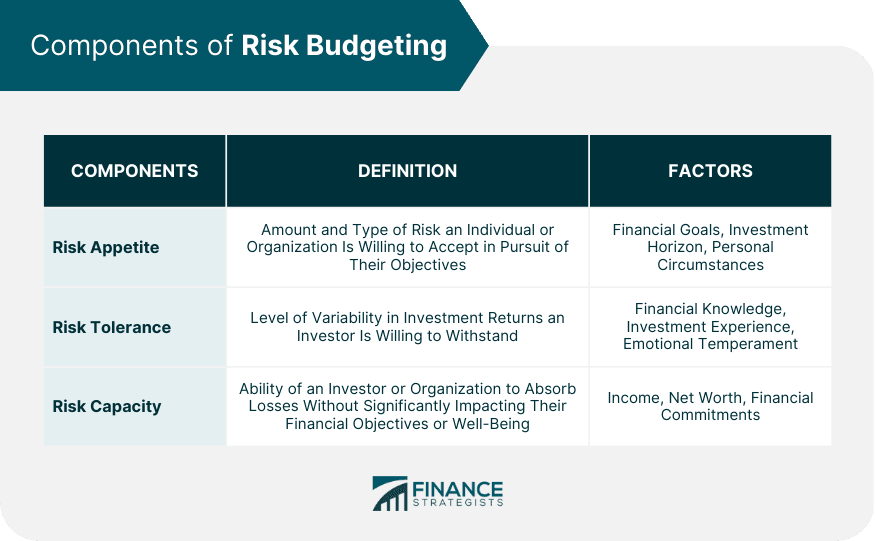

Then there’s risk budgeting which is worth considering. Instead of treating risk as a by-product or your asset allocation decisions, you can allocate (or budget) risk across different layers such as growth exposure, protective and defensive exposure, and volatility monetisation.

Think of this strategy as a pre-emptive strike against being made a victim by markets. By embedding your pre-emptive defences within your asset allocation plan, rather than bolting it on later as an after-thought, your resulting portfolio can heal itself, lock in gains, reset protection, and recycle capital without needing a trader’s timing or gut instincts.

When Theory Meets Battlefield Stress

Abstract philosophy is fine, but all good theories need to prove their worth in the real world.

So a real-world example… Absolute return fund Gyrostat Risk-Managed Equity Fund has a track record of generating positive returns during market selloffs largely because they’ve mastered the art of risk management.

Case in point: the fund has had no quarterly losses >3 % over 14 years. For example, in April–June 2022, the ASX accumulation index fell 11.9%, while Gyrostat’s Class A units generated +8.7% return. Similarly, in Jan–Mar 2020 (the onset of the pandemic), the ASX was down 23.1%, while their fund returned +9.2%.

It’s an example of a fund using risk as an investment superpower rather than an afterthought.

Investor Takeaways

For investors, there are a few important takeaways:

1. Risk Management Should Be a Top Priority.

Risk management is no longer a drag to be grudgingly accepted by investors. It has evolved into a functional necessity which needs to be deeply integrated into all long-term asset allocation plans.

2. Focus on the Right Performance Metrics.

Instead of comparing risk metrics in stable and rising-market environments, you should compare outcomes in times of stress to maximise your chances of avoiding future drawdowns, generating consistent returns, and creating a resilient, fit-for-purpose portfolio.

3. The Comparative Value of This Approach is Higher When Markets Are Buoyant.

When everyone is chasing returns, like now, the risk of complacency is high. A portfolio built to thrive in all market regimes will shine when volatility returns, whenever that may be.

Now’s the time to be focused on risk.

4. The Right Funds & ETFs Require Best-in-Class Risk Management.

Picking the right funds and ETFs means picking the fund managers who’ve mastered risk management. It’s no longer a nice-to-have. It’s essential.

Efficient, dynamic fund overlays, low-cost execution, transparent trading rules, and real-time protection resets are core features of the funds and ETFs well-positioned to weather the ups and downs of markets.

5. Investor Behaviour is Better Served by Using Risk to Your Advantage.

One of the biggest leaks in long-term investment outcomes is investors’ behaviour. For example, panicking at the wrong time, chasing momentum, and selling during a drawdown, can decimate performance.

An asset allocation plan targeting resilience changes the narrative from ‘stay the course’ (which often fails when losses mount) to ‘the structure will stay the course for me.’

👉 The upshot is that using risk to your advantage will allow to stay on the front foot by positioning yourself for a smoother, more predictable investment journey.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Transforming Risk from Liability to Asset

If investors adopt this mind-set, risk becomes a lever you use to your advantage, rather than a tax you pay. You shift from reacting to volatility to embedding volatility as a factor you can harvest or defend against. The unpredictability of markets stops being a failure of your assumptions or modelling. It becomes the very condition on which your model is built to absorb and profit from.

Imagine if, instead of fearing adverse markets, your portfolio was calibrated such that when volatility spikes a portion of your portfolio behaves like insurance, redeeming value and cushioning the core. Imagine being ready for rising, stable, volatile, and falling market regimes to emerge, and using them to your advantage. That’s the kind of portfolio design that can turn risk from foe into superpower.

Learn More About Asset Allocation here

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.