Investing in Line with Your Values Without Sacrificing Returns

Simon Turner

Tue 25 Nov 2025 9 minutesFor a growing number of investors, what they own in their portfolios is as important as the returns they generate. Or, at least it’s a much more important consideration for them than it used to be. As a result, the various forms of responsible and value-driven investment have been transitioning from niche to mainstream for some time now. The Responsible Investment Association Australasia (RIAA) estimates that Australian responsible investment assets reached $1.6 trillion in 2023, and accounted for 41% of total managed funds assets.

This isn’t a charity movement. It’s as much about performance as it is about feeling good. To that point, RIAA’s latest benchmark report shows that over the last decade, responsible Australian equity funds delivered returns above 13% p.a., versus 9% p.a. for the broader market. That’s a material return premium for investing consciously.

The important takeaway is that the old trade-off between positive change and returns is outdated. Equally, responsible investing requires more nuance, especially in the face of heightened regulatory scrutiny and greenwashing risk…

What Investing in Line with Your Values Actually Means

In short, investing in line with your values means looking in the mirror:

- You know what your investment values are.

For example, you may know you’re opposed to defence and tobacco stocks because you believe in a healthy, peaceful world. Or, you may know you’re opposed to fossil fuel stocks because you want to be invested in the energy transition rather than the heavy emitters which are still contributing to climate change.

- You put a high value on your values.

You’re the type of person for whom it’s important to take action when you have strong beliefs. In other words, you’re authentic in your beliefs.

- But you also believe your values should be aligned with strong financial outcomes.

Not only do you value your own values, you’re aware of the macro trends at play such as the energy transition and the electrification of the transport system which provide compelling evidence that your values should be aligned with good financial outcomes.

So you’re not worried about sacrificing financial returns to honour your values. Quite the contrary, you’re of the opinion that investing in line with your values will improve your investment prospects.

The Smorgasbord of Available Strategies

So how do you translate your investment values into an investment portfolio that aligns with your financial goals?

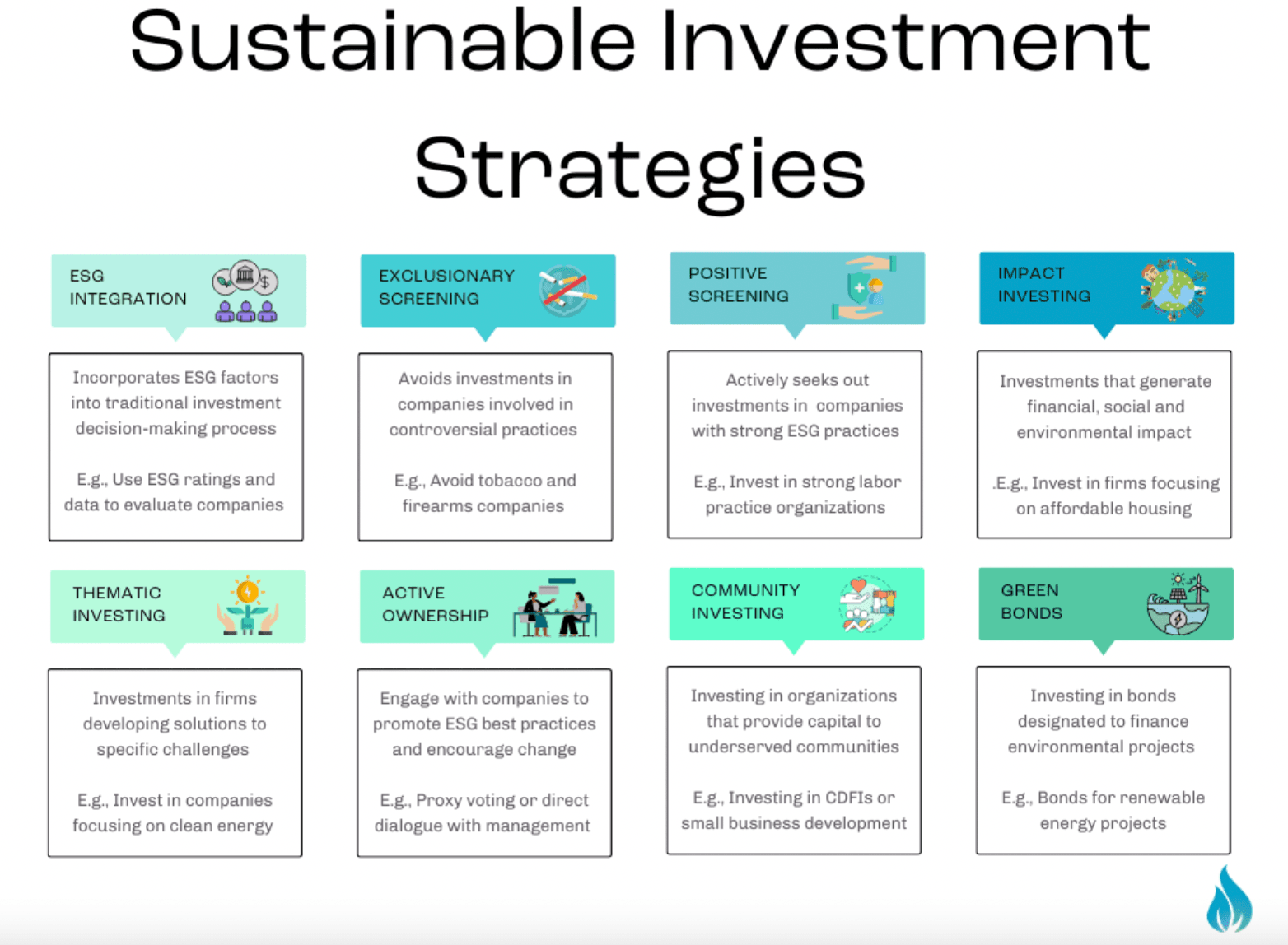

Welcome to the smorgasbord of sustainable (also known as responsible) investment strategies:

This smorgasbord encompasses a range of investment styles which prioritise sustainability to varying extents. Some are more focused upon and effective at generating positive change than others.

So back to the mirror.

As with all investments, the right sustainable investment strategy for you depends on your personal circumstances and investment goals.

For example, if you’re new to value-based investing and want to test the water with some lighter sustainability strategies which may be associated with outperformance, you may want to focus on:

- Thematic Investing

This type of strategy provides exposure to major sustainability themes such as the energy transition, biodiversity loss, and water scarcity.

For example, JP Morgan Climate Change Solutions Active ETF (ASX: T3MP) is an actively managed global equity ETF targeting companies developing and scaling solutions to climate change – from renewable energy and energy efficiency to sustainable infrastructure and enabling technologies. It uses natural-language processing and thematic research to identify climate-solution leaders, and then applies fundamental analysis and ESG screens. T3MP has delivered returns of 12.94% p.a. since inception (December 2022), with a management fee of 0.55% p.a. – demonstrating that a climate-solution focus can coexist with competitive returns.

And Octopus Australia Sustainable Investments Fund (OASIS) invests in a diversified portfolio of wind, solar and battery storage projects, so investors can benefit from the long-term growth potential of these structural themes.

- Exclusion Screening (or Ethical Investing)

Exclusion screening ensures a portfolio is not exposed to companies which are causing harm. Many ethical portfolios exclude fossil fuels, tobacco, weapons, gambling, and predatory lending.

For example, Hejaz Global Ethical Fund applies a strict screening process in combination with the knowledge and advice of Sharia scholars to offer investors a Sharia-compliant portfolio.

- Positive/Inclusion Screening

Inclusion screening ensures a portfolio is exposed to companies which are benefiting from being sustainable. In particular, this type of screening helps investors focus on companies benefiting from climate change, biodiversity loss, and global water scarcity.

For example, Bell Global Sustainable Fund (Hedged) is an actively managed, high-conviction global equity fund that invests in high quality companies with strong ESG characteristics. The fund employs a fundamental, bottom-up approach to stock selection that combines financial analysis with active ESG screening and evaluation.

- Active Ownership

Active ownership involves fund managers communicating their sustainability expectations to management teams to signal the importance of these issues. This strategy helps drive the required sustainability action.

All four of these strategies provide exposure to portfolios which are likely to be aligned with most investors’ values, are simple to understand, and benefit from potential performance–enhancing benefits care of their values-based strategies. So they are a solid starting point.

And if you’re an old hand at values-based investing and ready to aim for more focused positive change, you may want to move further up the sustainability investment spectrum to:

- Impact Investing

The Global Impact Investing Network (GIIN) defines impact investing as investments made ‘with the intention to generate positive, measurable social and environmental impact alongside a financial return.’ They estimate the global impact investing market is managing $US1.6 trillion, with most of those investors targeting risk-adjusted, market-rate returns, and reporting their portfolios meet or exceed those expectations.

For example, Pengana WHEB Sustainable Impact Fund is a global impact fund investing in companies whose activities provide solutions to sustainability challenges, such as resource efficiency, environmental services, healthcare and education.

And NorthStar Impact Australian Equities Fund is a diversified portfolio of Australian shares across impact focus areas, aiming to deliver both financial returns and measurable positive societal and environmental outcomes.

Whatever the right sustainability strategy for you, the key takeaway for investors is: values alignment is no longer about opting out. It’s increasingly about how capital shapes outcomes, not just who pays a dividend.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Do You Have to Sacrifice Returns as a Values-driven Investor?

Of course, even altruistic investors require empirical evidence that they aren’t sacrificing their investment returns to align with their values.

Thankfully, there’s plenty of it:

RIAA’s Responsible Investment Benchmark Report 2024 found that RIAA-certified products delivered 10-year returns above market benchmarks across multiple asset classes. Australian responsible equity funds, for example, returned 13–14% p.a. over ten years, versus ~9% p.a. for the broader Australian equities fund universe.

IEEFA’s global study found that sustainable funds generated a median 12.6% return in 2023, compared with 8.6% for traditional funds – outperformance that extended across both equities and fixed income.

Chant West, found that over five-year+ horizons, responsible investment strategies have delivered returns comparable with or better than conventional approaches, even though short-term dispersion can be higher.

That said, there are times when sustainability strategies underperform.

For example, LGT Wealth Management highlighted that some ESG-labelled funds have faced headwinds in recent years due to factor tilts and sector biases.

The fair conclusion is not that sustainability strategies always outperform, but rather over long-term horizons, values-aligned portfolios are competitive on risk-adjusted returns.

Equally, implementation matters. As with all investment strategies, factor exposures, sector tilts and valuation discipline still drive outcomes.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Navigating Greenwashing, Regulation & Due Diligence

The biggest practical risk in values-aligned investing today is not performance, but misalignment between sustainability marketing and the reality.

As the RIAA warns, greenwashing is the top barrier to responsible investment by Australian investors, with 52% of their survey respondents naming it their primary concern.

Regulators are taking notice. For example, ASIC recently launched proceedings against Fiducian Diversified Social Aspirations Fund, alleging that it was marketed as avoiding harmful industries while still exposed to coal, oil and gas majors.

Meanwhile, Australia’s new climate-related financial disclosure regime commenced on 1st January 2025, and is driving the most significant changes to financial reporting and disclosure standards in a generation.

Here’s a due-diligence cheat-sheet to help avoid the above-mentioned challenges:

- Look through the sustainability labelling.

Review each fund’s strategy and portfolio holdings, not just the marketing language.

- Understand the methodology.

Make sure you’re aware of a fund’s strategy. For example, is it using exclusions, inclusions, best-in-class tilts, thematic focus, engagement, or a combination?

- Check third-party credentials.

Make sure you use external data to your advantage. For example, RIAA’s Responsible Returns tool and Certification Program provide independent verification of whether apparently responsible products meet the minimum standards.

- Align the tool to the goal.

Be clear with yourself about your sustainability goals. How important is impact versus exposure to the thematic winners in the sector?

If you want to generate measurable impact, an impact fund may be a better match than a broad ESG-integrated index. Whereas, if you simply want to reduce your portfolio’s climate risk, a climate-transition or sustainable-infrastructure ETF may suffice.

Aligning Conscience & Capital

Investing in line with your values no longer implies accepting chronically lower returns. The numbers speak for themselves. Australian responsible equity funds have strongly outperformed the broader Australian equities fund universe over the past decade.

But values-aligned investing is not a free lunch either. It demands clarity on what you care about, a thoughtful mix of aligned fund and ETF exposures, and rigorous due diligence on fund methodology, holdings, governance and authenticity, especially in an environment where ASIC and APRA are tightening rules and investors are rightly sceptical of greenwash.

The opportunity for investors is to treat values not as an afterthought, but as a powerful dimension of portfolio design alongside risk, return, and liquidity. Used well, sustainability as a toolkit allows you to express your values, while still aiming for competitive long-term returns.

Sustainability & Values-Driven Funds Mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.