How to Invest for Your Kids Without Falling into Tax Traps

Ankita Rai

Thu 23 Oct 2025 7 minutesEvery parent wants their kids to get off to a good start. That means more than just keeping them safe and happy. It’s also about helping them grow into financially confident, independent adults.

Investing for your children is one of the most effective ways to do that. Whether you’re saving for Uni, helping with a first home, or simply showing them how money grows, starting early can make all the difference.

More Australian parents are doing just that.

Finder’s 2024 Wealth Building Report shows that 34% of parents already have shares or other investments set up for their children.

What’s interesting is that this isn’t just something high-income families are doing. In fact, 38% of families earning between $50,000 and $99,000 are investing for their children.

That’s because starting early lets even small amounts add up. Finder’s analysis shows $15,000 invested over 15 years generating an 8% p.a. return could grow to more than $49,000 by your child’s 18th birthday.

So, turning today’s allowance into tomorrow’s nest egg isn’t as far-fetched as it sounds.

But before you open a brokerage account or buy shares in your child’s name, it’s worth understanding the tax rules and how the money is managed.

The Tax Problem Most Parents Miss

In Australia, minors face punitive tax rates on passive income like dividends, interest, and capital gains. The rules are purposely tough to prevent parents from shifting their own investments into their kids’ names to dodge taxes.

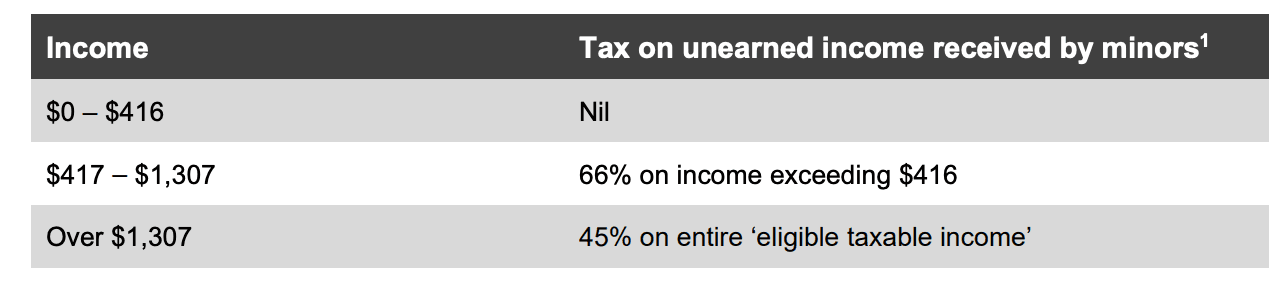

Children can only earn up to $416 in investment income before a 66% tax rate applies:

As such, once your child earns more than a few hundred dollars in unearned income, nearly half of it could end up in the ATO’s hands.

Yet, most parents don’t think about tax structures when they start investing for their kids. But it’s important to because how you set things up, whether it’s in your name, theirs, or through a trust or bond, can make a significant difference to the long term outcomes.

The right setup doesn’t just save tax. It helps your money work harder and stay focused on what matters most: your child’s future.

Here’s how the main options stack up, and how to choose the one that best fits for your family:

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

1. Ownership matters

If you’re new to investing for your children, it might seem easiest to put the assets in their name. But that’s rarely a good idea, unless it’s just a small savings account, because of the way minors are taxed.

A simpler option is to invest in your own name. This can work well if one parent is on a lower tax rate. You also keep full flexibility to choose your investments and stay in control until your child is ready.

The catch here is that when you eventually gift or transfer the investment, you trigger capital gains tax (CGT). Without planning, this can mean a bigger tax bill, especially if your investment has grown a lot

2. Setting up a minor trust through a broker

Another way to invest for your child is through a minor trust account. Many brokers let you open one easily. Here, you list yourself as the trustee and your child as the beneficial owner, meaning you control the investment but the asset belongs to your child for tax purposes.

This setup can help separate your investments from theirs and provides a way to manage the funds until your child is ready.

The beauty of this setup is that no CGT happens later. So when your child turns 18, ownership can be transferred to them without any CGT.

Setting one up isn’t complicated either. There’s no legal paperwork or trust deed to draft, just the broker’s application form. But you’ll need to provide a tax file number (TFN) for your child. That TFN ensures any investment income is taxed in your child’s name, not yours.

That said, it’s worth remembering that minors face higher tax rates on unearned income like dividends. This is why many parents choose to focus on growth-oriented investments, such as international shares and small caps.

For bigger contributions or more flexibility, you can also look into a family trust.

They let you distribute income or capital gains between family members, depending on who’s on the lower tax rate. For smaller investments, though, the cost and paperwork usually outweigh the benefits. They’re best for high-net-worth families with more complex estate planning needs.

3. Use your mortgage offset account

For parents already paying down a mortgage, this can be one of the simplest and most tax-efficient ways to build wealth for their kids. Instead of parking money in a separate savings account, you can direct it to your mortgage offset. The balance reduces the interest charged on your loan, effectively earning you a risk-free return equal to your mortgage rate.

Over time, those savings compound. You’ll pay off your home sooner and have more flexibility later to help your child. Just keep the gifting rules in mind if you plan a large transfer.

This strategy does take a bit of discipline. You need to treat that offset balance as your child’s future money, not a rainy-day fund.

4. Investment and education bonds

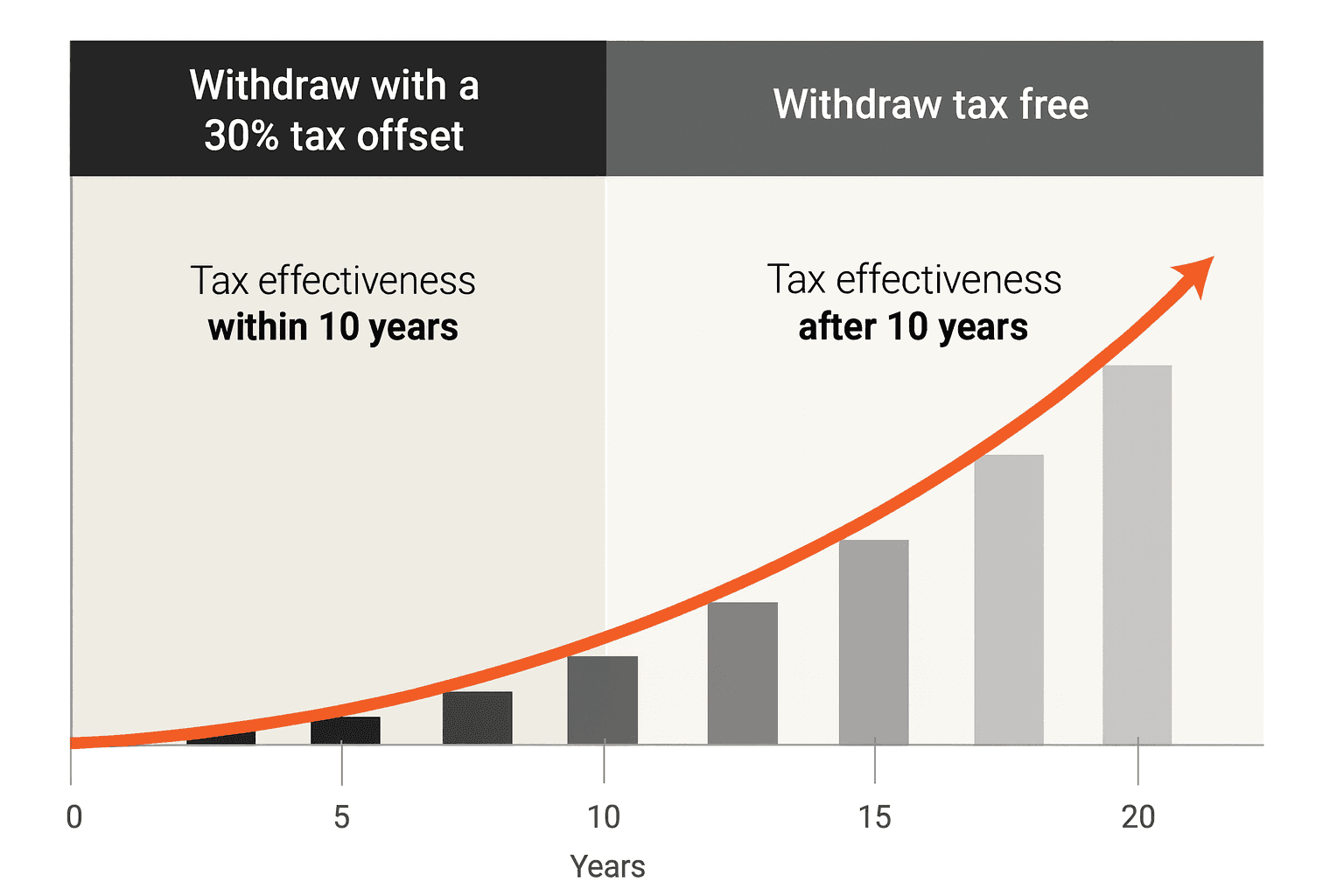

Investment and education bonds are tax-paid investments, meaning the provider pays up to 30% tax on earnings inside the bond. For parents on higher marginal rates, this can be a low-maintenance way to invest and avoid the punitive rates that apply to children’s investment income.

Both types of bonds follow the 10-year rule: if you hold the bond for more than ten years, withdrawals are generally tax-free. You also stay in control of the investment, choosing when it vests (typically between ages 10 and 25) and transferring ownership later without triggering CGT.

Education bonds go a step further. When you use the money for eligible education costs, you can claim an education benefit, a refund of tax already paid by the bond.

5. Investing in Super

Super’s long-term nature makes it powerful for compounding, but it’s rarely the best way to give kids a financial head start. Contributions don’t come with a tax deduction or offset, and the money is locked away until around age 60, far beyond when most young people will need it. On top of that, small balances can be eaten up by fixed fees.

Still, there’s value in starting early. Opening a super account when your child begins working helps them take ownership and understand how super fits into their financial future. It’s also a good moment for parents and grandparents to start a real conversation about why super matters, even if it’s something they won’t benefit from for decades.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Real Gift: Teaching Your Child to Fish

Investing for your kids isn’t just about money. It’s about showing them how patience and consistency can quietly build something lasting.

Whether you’re a parent or a generous grandparent, it helps to start with a clear goal: what you’re saving for, what you can realistically put aside, and which structure works best for you.

When you teach them how to fish instead of handing them the catch, you’re giving them confidence, discipline, and a valuable skill that’ll serve them for life.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.