Trusts vs Bonds: Which Structure Makes Sense After the $3m Cap?

Ankita Rai

Thu 25 Sep 2025 6 minutesFor years, the rule of thumb in retirement planning was simple. Put as much as you can into a super fund.

But the proposed Division 296 tax has shaken the market’s confidence in this strategy. With balances above $3 million set to be taxed at 30%, the question isn’t just what you invest in, but where to hold those investments. That’s the debate many high-net-worth families are currently having around kitchen tables and in adviser meetings.

Two strategies usually come up as investors look to reposition their portfolios: setting up a discretionary trust or investing through an investment bond. Both structures can take some sting out of the new tax, but they work in very different ways...

The Trust-and-Bucket Strategy

Let’s start with trusts. A family (or discretionary) trust is essentially a vehicle that collects income and then allows the trustee to decide how to distribute it among beneficiaries each year. That could mean splitting profits between adult children, parents, or even grandparents, depending on who sits in lower tax brackets.

But what happens when everyone in the family is already paying high tax rates?

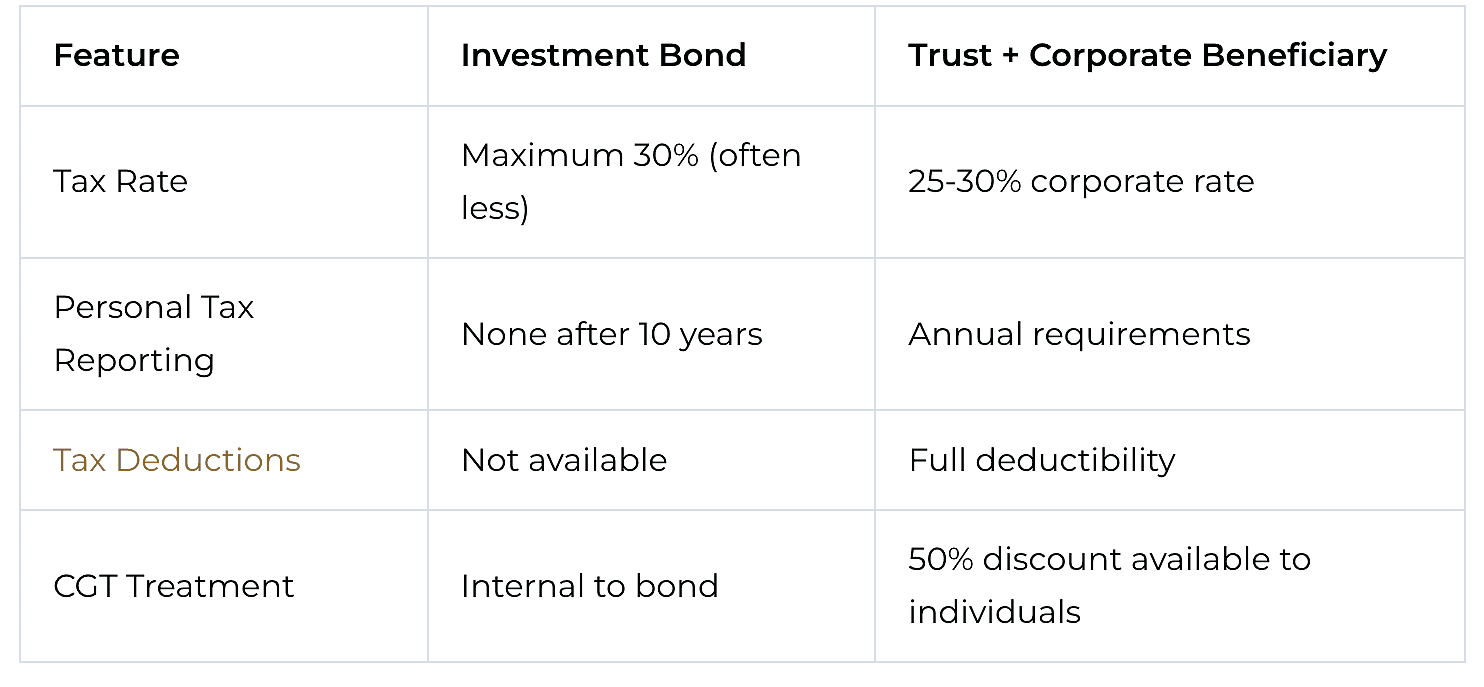

That’s where the bucket company (corporate beneficiary) comes in. The trust can distribute excess income into this company, think of it literally as a bucket catching the overflow, and the company pays tax at the corporate rate. That’s 25%, or 30% if you don’t meet the thresholds. Either way, it’s a big step down from the 47% top marginal rate.

The profits can then be reinvested inside the company or paid out later as franked dividends.

Of course, the more control we have, the more complexity it brings. Trusts and companies require annual reporting, ASIC compliance, and careful documentation. The ATO also keeps a close eye on reimbursement agreements, and if you get it wrong, the penalty can be the top marginal rate plus interest.

They’re also costly to run. Setup is typically $1,500–$3,250, with an ongoing cost of $1,000–$2,000 p.a. in accounting and legal fees. This means on a $50,000 portfolio growing at 10% p.a., more than 20% of your returns could be lost to administration fees — a calculation highlighted by Passive Investing Australia.

That’s why trusts usually only make sense once you’re dealing with much larger sums.

The Investment Bond Alternative

An investment bond, by contrast, is built for simplicity.

You put money in, the provider manages the investments, and pays 30% tax on the earnings inside the bond. If you hold it for 10 years and stick to the contribution limits, you can withdraw your funds completely tax-free.

There are no trust deeds, no distributions, and no annual reporting on your personal return.

That makes investment bonds especially appealing if you value certainty. Investors often use them to build a pot for school fees, to pass on wealth without it getting tangled in probate, and to top up retirement savings once super caps are hit.

But there are trade-offs. If you withdraw capital within 10 years, you may owe tax. The fees also tend to be higher than simply running a portfolio through a trust. Many providers charge a whopping 0.6% p.a. in administration costs on top of investment fees, which can reduce long-term returns.

Capital gains are also treated differently to personally held investments, where tax is paid only when you sell, and you get the 50% CGT discount after 12 months. Bonds don’t work that way. All capital gains are included in income each year. That means you miss out on some of the compounding effect you’d get if you held assets directly.

Investment Bonds vs Trust Structures- Tax Treatment

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

When to Choose Each Structure

So when does a trust make sense, and when is a bond the better fit?

It really comes down to your circumstances and your appetite for complexity.

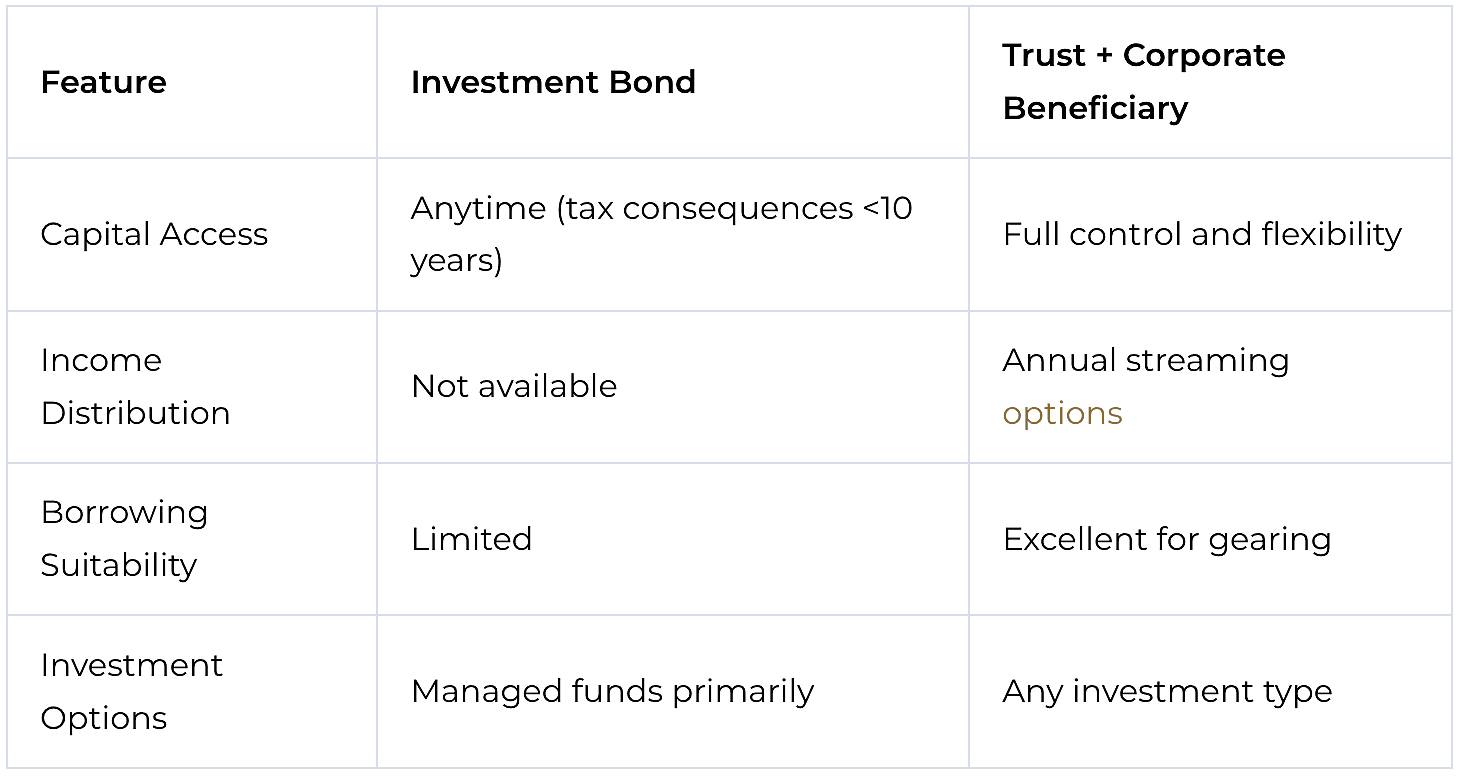

Trusts and bucket companies are built for people who want control, as shown below. Business owners often turn to trusts to protect assets, reinvest profits, buy property, or even pass wealth down through generations.

Flexibility and Access Comparison

Families with several beneficiaries also find them useful, as they can use them to distribute income to beneficiaries in lower tax brackets.

And for pre-retirees expecting their earnings to drop in the years ahead, trusts can help lock in tax at 25–30%.

While it is a flexible tool, it requires a lot of administrative work to keep it running smoothly while ensuring regulatory compliance.

Investment bonds, on the other hand, are built for people who’d rather keep things simple. If you can commit for 10 years or more, they can offer tax-free withdrawals at the end, with no need to juggle distributions or file returns.

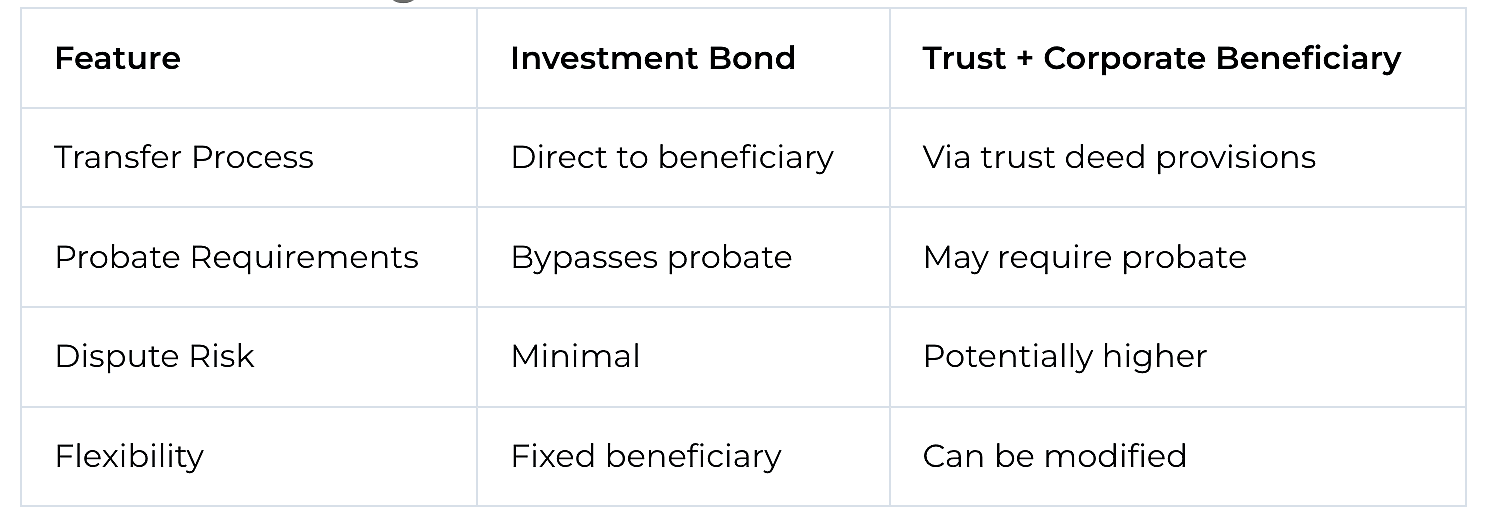

That’s why parents and grandparents often use them to build a fund for kids, while estate planners like the certainty of naming a beneficiary upfront.

Estate Planning Considerations

Money inside a bond sits outside the estate, which means no probate hassles and fewer family disputes.

They’re also useful for high-income earners who’ve maxed out their super and just want a set-and-forget option. But there are trade-offs: no CGT discount, higher fees, and tax penalties if you pull out too early.

Some high-net-worth investors use both. For example, a trust can handle their business and investment income while they use investment bonds for passive long-term wealth accumulation and estate planning.

It’s Not Just About Super Anymore

Division 296 is a reminder that the rules can change, and investors need to be prepared. While super remains a powerful vehicle, it’s also worth considering alternatives such as a family trust or an investment bond.

At the end of the day, a strong plan isn’t only about chasing returns, it’s about building resilience. That means picking structures that give you the right mix of tax efficiency, estate planning, and peace of mind for your family.

But there’s no one-size-fits-all answer. What matters is finding an approach you can stick with, one that fits your financial situation, your goals, and how hands-on you want to be.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.