$3 Million Super Tax Cap: Why It's Time to Revisit Your Retirement Strategy

Ankita Rai

Thu 22 May 2025 6 minutesAustralia’s retirement planning landscape is shifting. Labor’s proposal to introduce a 30% tax on super balances above $3 million has sparked significant concern and has forced many wealthy Australians to revisit what they once considered to be rock-solid, tax-efficient retirement plans.

The Treasury estimates the changes will initially impact around 80,000 people. But the real concern lies in the long game. The Financial Services Council projects that up to 500,000 Australians could eventually cross the $3 million super threshold, largely because the cap won’t be indexed to inflation, as shown in the chart below.

It’s not just the reach of this tax that has investors worried. It’s also the mechanics.

Division 296 will apply to both realised and unrealised gains. That means you’ll pay tax on paper profits even if your underlying assets haven’t been sold. This is a shocking evolution for many investors since being taxed on unrealised gains goes against the fundamental nature of Australia’s taxation system, and that of developed countries in general.

As a result, many high-balance investors are already reviewing their super strategies, while waiting for the legislation to be finalised.

What’s clear is that every investor, whether they’re near the threshold or well below it, needs to understand how this tax could shift the entire super landscape.

Understanding the New Reality

Self-managed super funds (SMSFs), which often hold larger balances and invest heavily in illiquid assets like property, are likely to be the hardest hit by this policy.

Unlike capital gains tax, which applies only when an asset is sold, Division 296 taxes both realised and unrealised gains—based on annual asset valuations. That means SMSFs may be required to pay tax on paper profits without having sold anything to generate the cash. For funds holding property or other illiquid assets, this could create a serious liquidity challenge.

On top of that, trustees may face heavier compliance burdens. Most SMSFs aren't currently structured to track and report unrealised gains in the way larger APRA-regulated funds often are. This could mean not just more paperwork but, in some cases, forced sales to meet tax obligations.

The policy is also expected to reshape super investment strategies with a shift away from high-growth, illiquid assets—like property and venture capital—towards lower-return, more liquid investments.

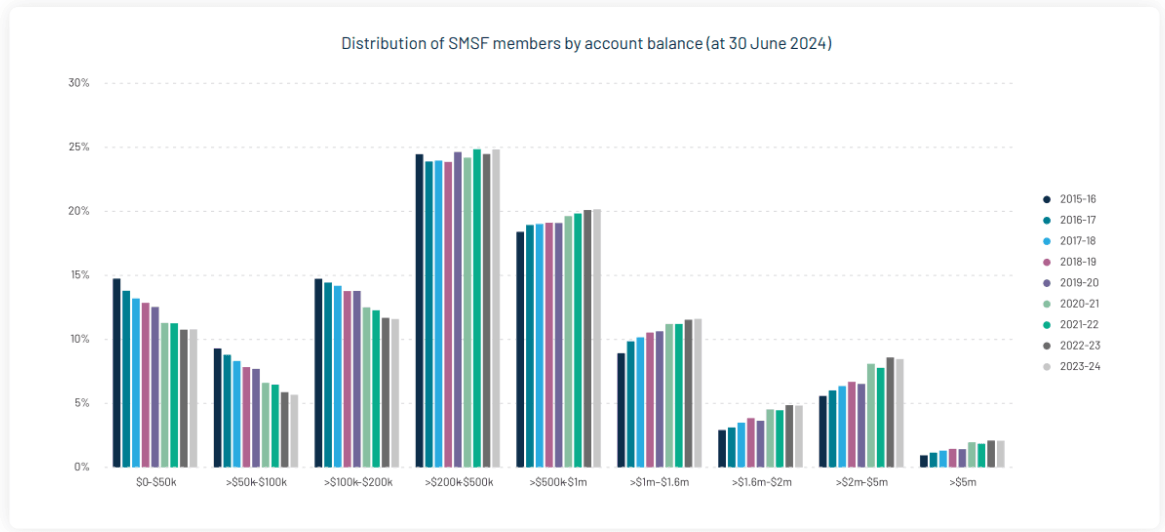

According to ATO data, approximately 31,000 SMSF members currently have balances between $3–5 million, with another 20,000 exceeding $5 million. The chart below shows a decade-long decline in low-balance SMSFs and a shift towards balances above $500,000.

Without indexing, these figures will only continue to climb.

Navigating the Tax Storm: Strategies to Consider

While the full impact of Division 296 is yet to unfold, investors can start planning ahead.

Here are some practical strategies to consider as you adapt your retirement plan:

1. Pause and Evaluate

First things first: don’t rush. The new tax won’t apply until legislation is passed. And even if it does begin from 1st July 2025, there’s still a window to act. An individual with more than $3 million in super at the start of the financial year can avoid the tax—provided their balance is brought below the cap by 30th June 2026.

That gives investors a full financial year to put their revised strategy in place. Any withdrawals or restructuring can be done gradually over the next 12 months.

2. Rebalance Assets Strategically

For those unable to withdraw (i.e. under preservation age), one tactical move is to shift growth assets outside of super and keep income-generating investments inside. This can help manage exposure to unrealised gains and reduce volatility in your super balance.

3. Consider Withdrawal and Reinvestment Options

For members who are retirement age and able to access their funds, it may be tempting to pull money out of super and reinvest it.

But tread carefully: such moves can trigger immediate capital gains tax and reduce your investable capital. Scenario-based modelling is essential—especially since the new tax applies only to capital growth from July 2025 onwards.

4. Start an Account-Based Pension

Super in pension phase still counts toward the $3 million threshold, but pensions benefit from more flexible tax treatment and CGT exemption. With the transfer balance cap rising to $2 million, there may be scope to maximise tax-free income streams while keeping overall balances in check.

5. Gift Strategically, Not Reactively

Some investors are considering gifting to children now to bring their balances below the cap. While this might make sense as part of an estate or succession plan, it should align with your broader goals. Don’t sacrifice your financial stability just to avoid a tax.

6. Plan ahead for legacy taxes

Division 296, when combined with existing death benefit taxes, could significantly erode the value of your estate, especially if super is passed to adult children.

Strategic withdrawals before death may allow assets to exit the super system tax-free via your estate. Others may benefit from moving high-growth assets outside of super or revisiting fund structures, trusts, and re-contribution strategies. However, these choices must be balanced against the loss of super’s concessional tax environment.

7. Diversify Outside Super

For investors looking to future-proof their strategy, spreading wealth beyond the super system is becoming increasingly important.

Investment bonds are gaining traction for their tax-free status after 10 years. Family trusts allow for flexible income distribution and asset protection, while direct property appeals to those who want more control over timing and structure.

Each option has its trade-offs, so the right approach will depend on your goals, age, risk appetite and estate plans. The key is to avoid relying solely on super when building long-term financial security.

A More Active Era for Retirement Planning

Division 296 doesn’t make superannuation unattractive. It’s still one of the most tax-effective ways to build long-term wealth. But it does mean you’ll need to be more hands-on with how you manage it.

Whether you are years away from retirement or already drawing a pension, one thing’s clear: set-and-forget won’t cut it anymore. Now’s the time for smarter thinking, regular check-ins, and a more strategic approach.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.