Mastering Your SMSF: Essential Tips to Avoid Common Mistakes

Ankita Rai

Thu 6 Mar 2025 5 minutesA secure and stress-free retirement isn’t just the result of how much you save—it’s about how well you invest and manage those savings when the time comes. If you’re approaching retirement, having a well-planned strategy for your SMSF is crucial.

Unfortunately, many SMSF retirees make avoidable mistakes that erode their wealth over time. For example, staying in accumulation mode too long, withdrawing funds inefficiently, or failing to adjust their investments can all take a toll.

For retirees with SMSFs, avoiding the common pitfalls can pave the way to a more secure and abundant retirement.

Key SMSF Mistakes to Avoid

Here are some of the biggest SMSF mistakes to avoid…

1. Keeping super in the accumulation phase

Research shows that over 1.4 million Australians over 65 still have their super in the accumulation phase, unnecessarily paying a 15% tax on investment earnings—money that could be working harder for them in retirement.

Trustees in the retirement phase have very different needs from those in the accumulation phase. They need their SMSF to generate a reliable income while preserving capital. Moving to the pension phase at the right time can save thousands in tax, as investment earnings become tax-free.

There are two options for starting an SMSF pension: Account-Based Pension or a Transition-to-Retirement Income Stream (TRIS). The latter allows trustees who have reached their preservation age to access their super while still working. The right choice depends on your financial goals, work status, and tax strategy.

2. Not checking your trust deed

Reviewing and updating the trust deed, when needed, is essential.

For example, your SMSF’s trust deed must permit account-based pension payments.

Also, ensure your fund has enough assets to meet pension payments and notify the ATO upon commencement to stay compliant.

3. Being more frugal than needed during retirement

Many retirees worry about outliving their savings, leading them to withdraw only the minimum.

While caution is understandable, being too conservative can mean missing out on the lifestyle you have worked hard to achieve.

Treasury’s 2020 Retirement Income Review found that half of retirees leave a quarter of their super untouched. As superannuation balances grow over time, this trend is expected to become even more pronounced. Estimates suggest that without changes in withdrawal patterns, outstanding superannuation death benefits could rise from $17 billion in 2019 to $130 billion by 2059.

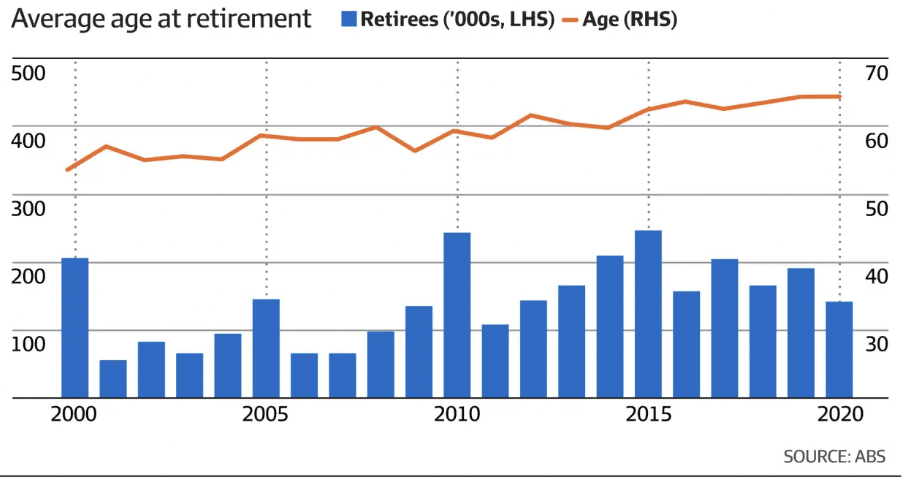

Additionally, with Australians living longer and the average retirement age increasing from 53.5 to 64.3 over the past two decades, more people are staying in the workforce longer and delaying their transition to the pension phase due to concerns about running out of money.

Rather than letting savings sit idle, smart planning and professional advice can help retirees strike the right balance—allowing them to enjoy their wealth while maintaining financial security for the long haul.

4. Not considering your fund’s investment strategy

As you transition from accumulation to retirement, your investment strategy must adapt. Your risk tolerance, income needs, and cash flow requirements will shift, making it essential to reassess whether your SMSF has sufficient assets to cover ongoing costs and pension payments.

One major risk retirees face is sequencing risk—the impact of poor investment returns early in retirement when capital is being drawn down. Market downturns in the withdrawal phase can magnify losses, whereas, during accumulation, ongoing contributions and time can recover help offset volatility.

To mitigate sequencing risk, retirees should maintain a diversified portfolio with both growth and defensive assets, ensuring they have a sufficient buffer to avoid selling investments at a loss during downturns. Adjusting withdrawal rates in response to market conditions can also help preserve capital and enhance financial stability throughout retirement.

5. Not having cash for unexpected expenses

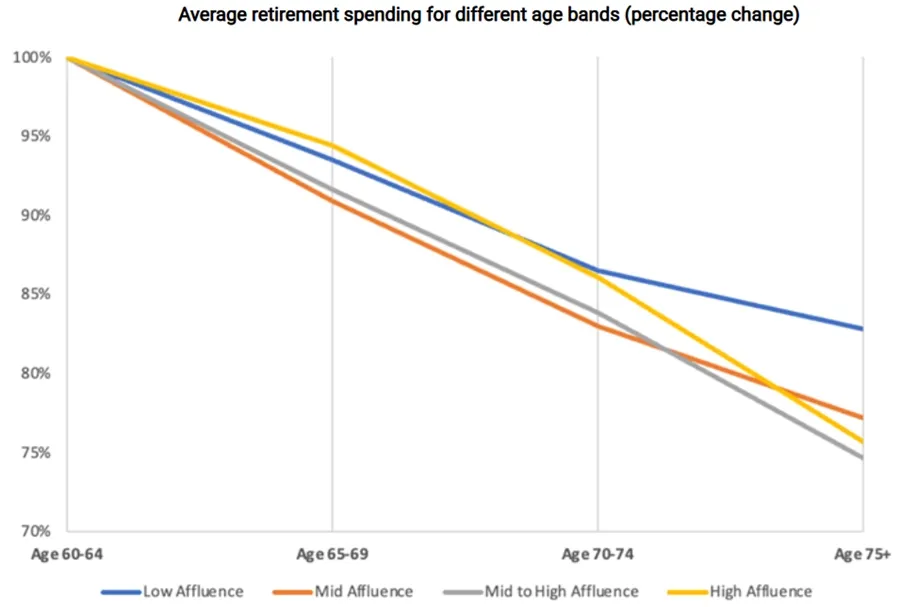

Retirement spending isn’t static—it evolves over time. Unexpected medical expenses, home repairs, or travel opportunities can arise, making it crucial to have liquid funds available within your SMSF.

This allows you to cover unforeseen costs without disrupting your long-term investment strategy. Also, it’s important to keep your SMSF bank account separate from your personal transaction account to maintain clear financial boundaries.

6. Overlooking estate planning

When setting up your SMSF pension, you may have the option to nominate a dependent—typically your spouse—to continue receiving your pension after your death, known as a reversionary pension. Alternatively, you can direct benefits to dependents or your estate as a lump sum or another pension.

Since superannuation doesn’t automatically form part of your estate, the fund’s trustees have significant control over how assets are distributed. Reviewing your trust deed, nominations, and estate planning strategy ensures your wishes are carried out.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Path to a Financially Abundant Retirement

Retirement is more than just a financial milestone—it marks the beginning of a new phase where smart planning and strategic decisions make all the difference.

While building a strong SMSF balance is important, how you manage and draw down your super ultimately determines its long-term value.

Superannuation rules, market dynamics, and personal circumstances will continue to evolve, but staying proactive—by adjusting your investment strategy, transitioning to the pension phase at the right time, and maintaining financial discipline—can pave the way to a stable and fulfilling retirement.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.