Can the Energy Sector Bounce Back?

Simon Turner

Mon 10 Mar 2025 6 minutesHere’s a shocking stat for energy investors: the energy sector comprises only 3% of the S&P 500’s value, down from 30% in 1980. That’s serious underperformance. It’s understandable why only the most ardent of energy bulls currently own what remains of the energy sector’s once great market cap.

But we all know Warren Buffet’s famous quote about buying when others are fearful. Could it be that this is one of those moments for the energy sector? Will it rise like a phoenix from the ashes at the very moment it’s been written off and ignored by most investors?

The elephant in the room

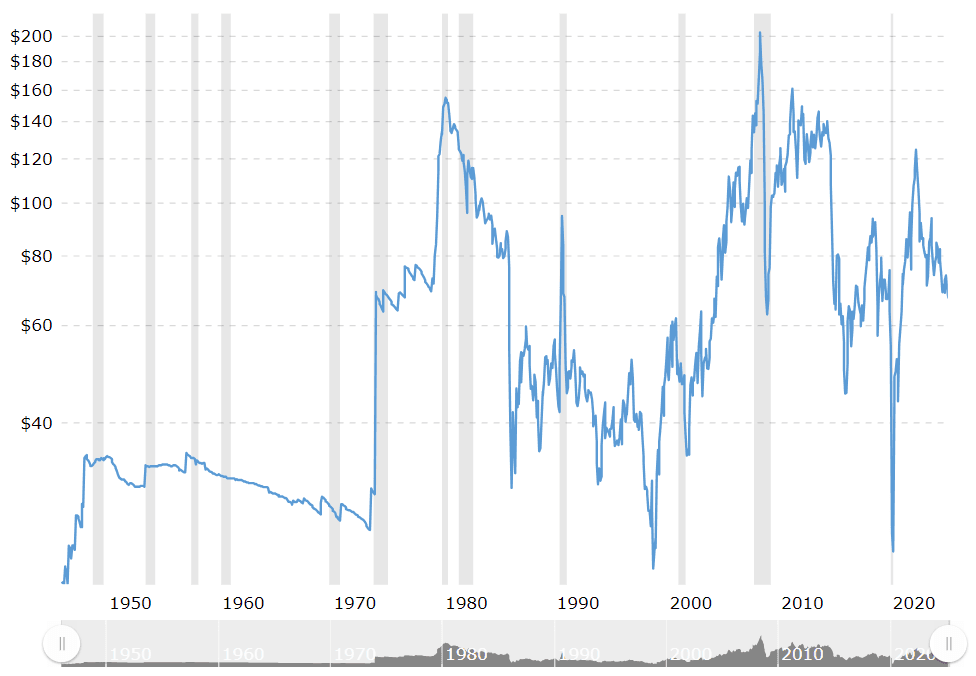

The elephant in the room for energy sector investors has long been the weak oil price.

The oil has been under pressure over most short- and long-term timeframes, and has confounded expectations more often than not…

This weak backdrop led to a 5.7% return for the non-renewable energy sector in 2024, which was barely one-fifth of the S&P 500’s 25% return. The fossil fuel sector has now underperformed the S&P 500 in seven of the last 10 years.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A cycle at play

Most commodity investors understand that bear markets contain the seeds of bull markets, and vice versa. Often, bull markets are the mirror image of the bear markets they were born out of.

So where is the global energy sector in its cycle?

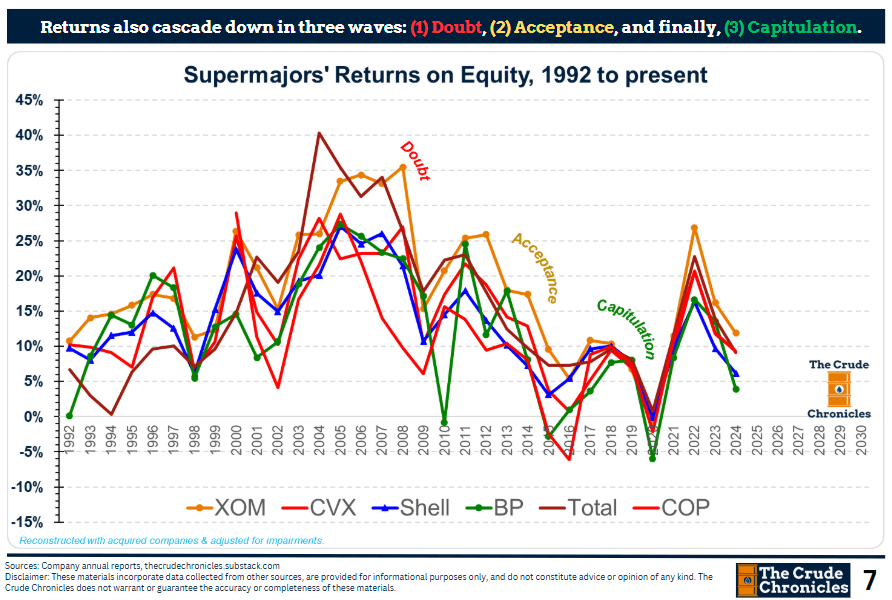

By way of background, bear markets tend to play out in three distinct phases:

Doubt and denial that the cycle has turned negative;

Acceptance that a bear market is indeed in force;

A capitulation process which clears out the weak hands at the end of the cycle. This is usually the worst time to sell but it’s the stage at which many investors step out of their losing trades.

This bear market cycle has been true to form in the energy sector. The oil supermajors’ returns on equity provide useful context. As shown below, the sector experienced the doubt stage in 2006-2009, the acceptance stage in 2009-2017, and the capitulation stage in 2018-2020.

So if the energy sector has already been through the three bear market stages, where are we in the cycle today?

Let’s step back for a longer term view of the sector to answer that question.

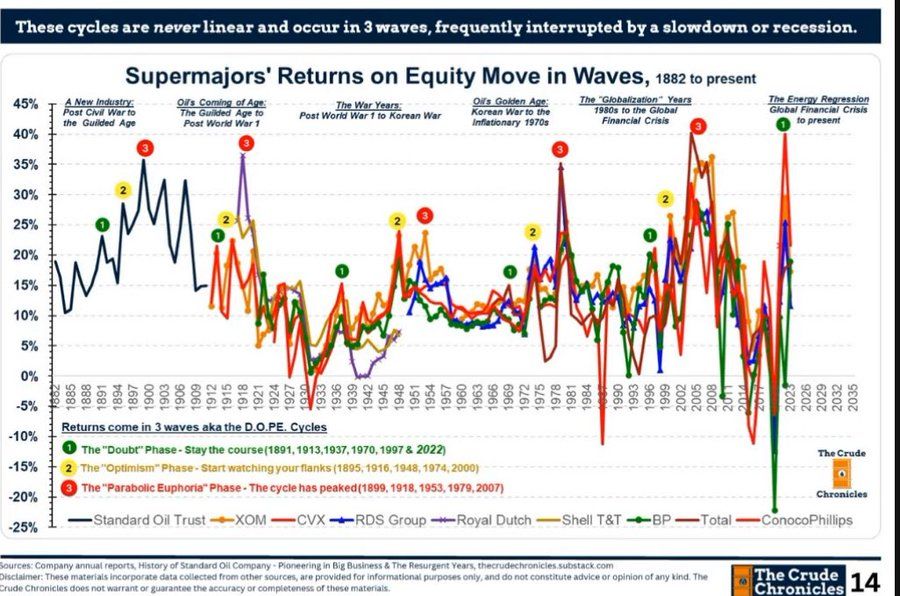

As shown below, there have generally been three longer cycles at play: doubt, optimism, and parabolic euphoria.

Despite experiencing the three bear market stages, the energy sector is yet to really exit its most recent doubt phase. That means the sector has been stuck in no man’s land for a while now. The longer term doubt phase appears to be over, but the energy sector is yet to enter the optimism phase.

If this is picture of the energy cycle is roughly correct, then it’s likely that the sector will enter the early stages of a bull market in the coming months or years.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Potential bull market catalysts

Of course, the big question is what could drive the global energy sector to enter a new bull market?

We see a few potential catalysts…

Low capex

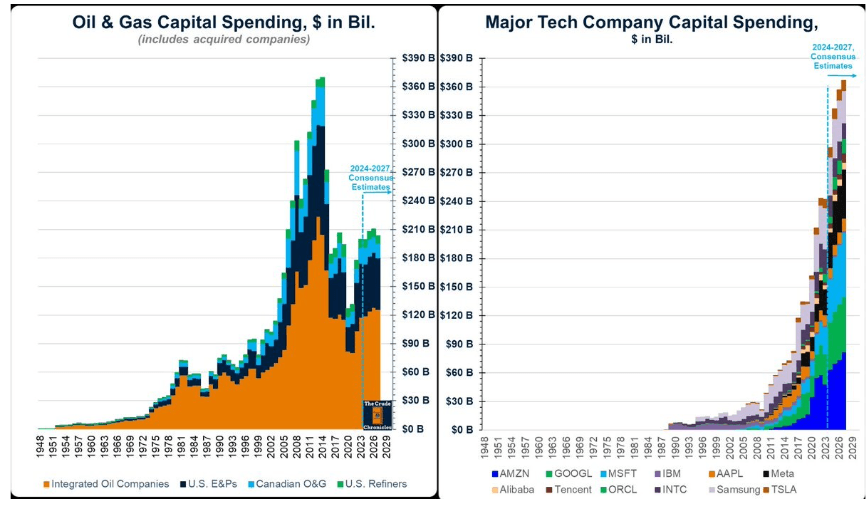

The sector’s capex cycle fell significantly after the Global Financial Crisis and still hasn’t recovered—partially due to the ongoing energy transition which has made it harder to justify capex investments.

However, despite all the progress made in raising the portion of global energy supply derived from renewables and low carbon sources, 80% of energy is still derived from fossil fuels. There’s no escaping the fact that oil and gas remain of vital importance as energy sources—and will do throughout the energy transition.

Check out the chart below comparing the oil and gas sector’s capex with the tech sector’s.

After so many years of such low capex, the global energy sector’s future supply growth is far from assured. That’s likely to translate into undersupply in the coming years, even while the energy transition is occurring.

Low inventories

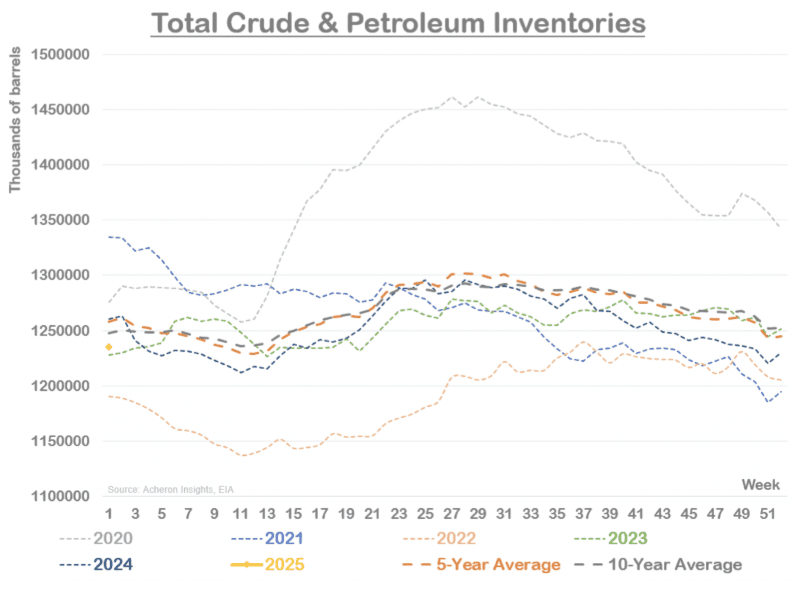

Inventories tell a similar story. As shown below, global crude and petroleum inventories are relatively low versus recent history.

As with all commodities, when inventories become low like this, the risk of supply shocks is elevated.

OPEC+ supply constraints

OPEC+ is focused on improving the sector’s returns. With that goal in mind, the cartel has been withholding over 5 million barrels/day of crude oil production for three years now.

Recent OPEC+ comments suggest they have no intention of unwinding recent cuts with the oil price as low as it is.

‘How much more OPEC+ cohesion can we show? I don't think we've ever been as united as we are right now.’ - OPEC Secretary General

OPEC+’s intention is clearly to await stronger demand and higher prices before they agree a supply increase. That’s bullish for the sector.

The sector’s ROCE is unsustainably low

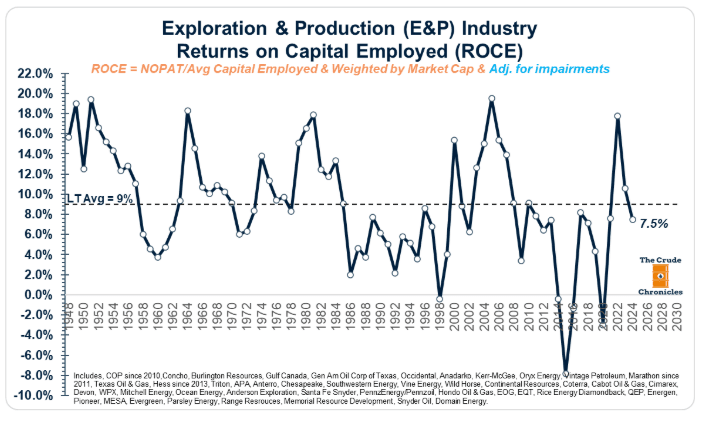

The exploration & production industry reported 2024 returns on capital (ROCE) below the long term average—as shown below.

Whilst last year’s ROCE result wasn’t a disaster, the sector is under pressure from shareholders to report better results. That’s likely to translate into greater management focus on improving returns on existing assets rather than speculating on new supply. That’s also bullish for future sector performance.

Bull markets are born out of bear markets

Energy investing has been a tough slog in recent years.

However, with so many investors having written the sector off and multiple catalysts coming which are likely to lead to a higher oil price in the coming years, maintaining some sector exposure could prove fruitful.

Investing in the sector via ETFs and managed funds with the relevant expertise is likely to be the optimal way to gain sector exposure for most investors.

Funds & ETFs Positioned to Benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.