Markets just hit a Sentiment Extreme

Simon Turner

Wed 12 Mar 2025 4 minutesWhen we wrote a few weeks ago about a potential Volmageddon event brewing, it was hard to know what that meant beyond higher volatility and falling markets.

We have indeed witnessed both of those outcomes with the S&P 500 and the All Ords both falling almost 10% from their all-time highs. What’s been more surprising has been the extent of the sentiment shift that’s occurred behind the market decline.

The implications for what’s coming next are significant…

Sentiment is a powerful guide

Following investor sentiment is a powerful means of seeing through the noise for a picture of what’s going on behind markets. They gauge whether investors are bullish or bearish, and tend to be backward-looking.

Sentiment indicators are particularly useful at extremities. For example, when markets are unusually bullish, it generally pays to be bearish and cautious—and when markets are unusually bearish it often pays to be bullish and aggressive.

One of the most up-to-date sentiment surveys is the AAII weekly sentiment indicator which asks individual investors in the US which direction they believe the market is heading in the coming six months.

Unfortunately, we don’t have the equivalent in Australia but the AAII survey provides a useful gauge anyway. The Australian market invariably trades in the same direction as the US market, and local investors are heavily exposed to the US market.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

AAII shocker

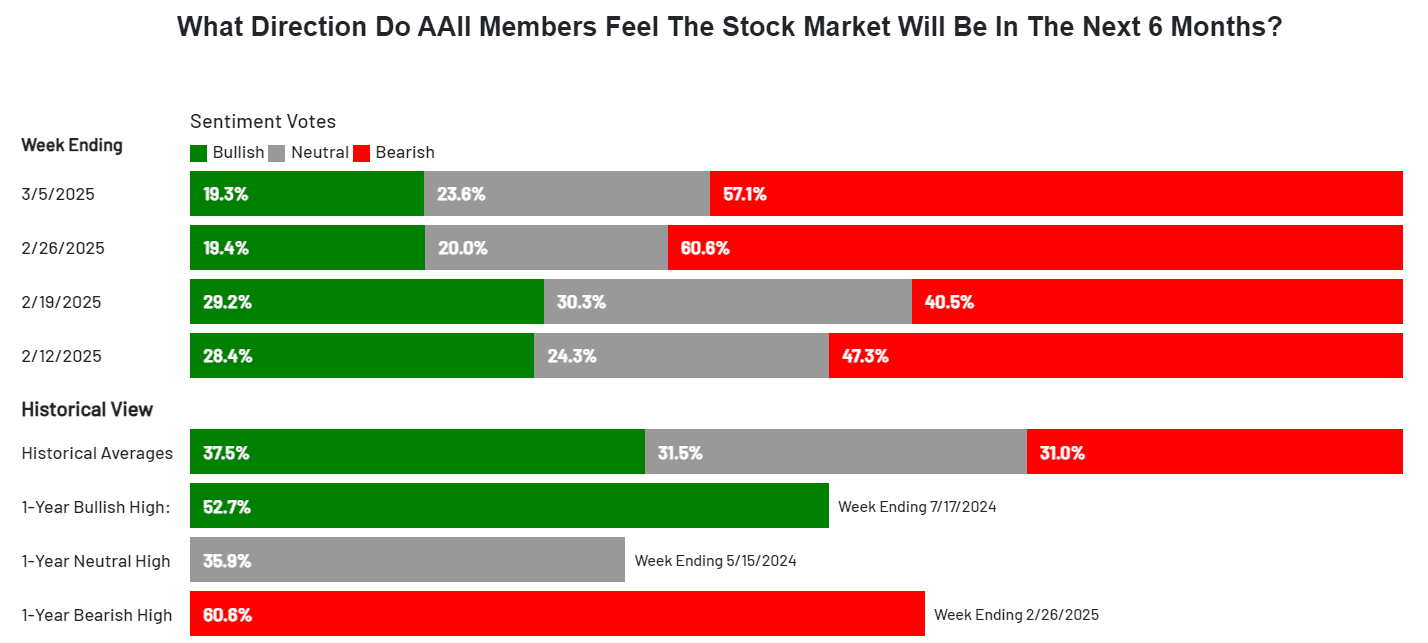

In general, the AAII sentiment survey reveals gradual trend shifts rather than huge directional changes in sentiment.

That’s why the sentiment data for the week ending February 26th was so surprising.

In that single week, the portion of investors who were bullish fell 9.8% to 19.4%, and the portion who were bearish increased an astounding 20.2% to 60.6%.

That reading marked a sentiment extreme versus an historical bullish sentiment average of 37.5% and an historic bearish average of 31.0%.

To put those numbers into context, bullish sentiment was last lower on March 16th, 2023, and the recent reading is among the lowest 65 in the survey’s history.

We’ve had one more week of AAII sentiment data since then—for the week ending March 5th—and it was similarly bearish. Having said that, there was a minor decrease in bearish investors from 60.6% to 57.1%. That may suggest bearish sentiment is close to peaking, at least in the short term.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Implications for the market outlook

The implications for the market’s outlook are significant.

For the AAII survey to return to its long-term historic average, the portion of investors who are bullish must rise 18% from 19.4% to 37.5%, and the bearish portion must fall almost 30% from 60.6% to 31.0%. That would translate into an enormous amount of buying. As and when those investors return to the market, a significant move higher is likely. By way of comparison, when this last occurred, the S&P 500 rallied 16% in the ensuing four months.

Having said that, interpreting sentiment indicators is not a precise science. There could well be more downside before the market resumes its upward trajectory.

Extreme bearishness = bullish

This level of extremely bearish market sentiment tends to be witnessed at or toward the bottom of significant market selloffs. So the implications of this market set-up are bullish for the coming months. Now may well be a good time to top-up your favourite funds and ETFs.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.