The Million-Dollar Question: Do You Need a Financial Adviser?

Ankita Rai

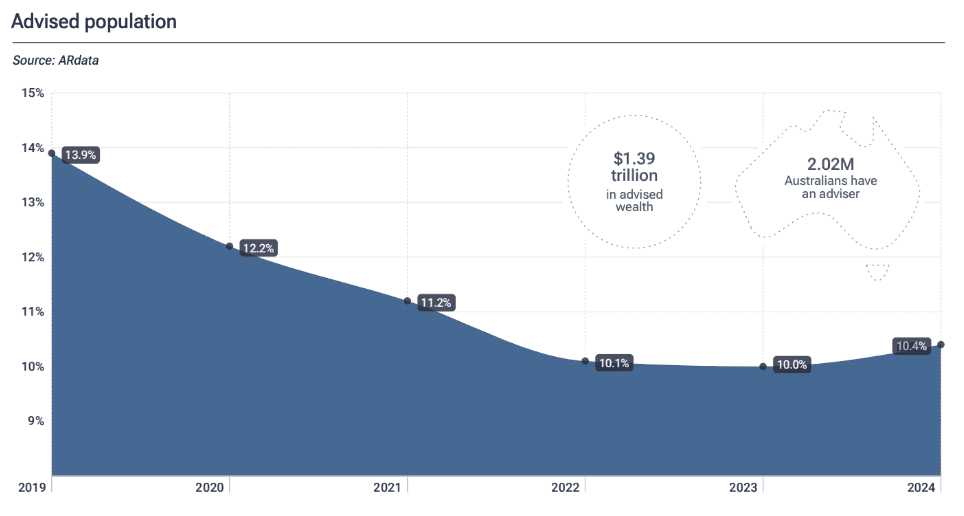

Thu 13 Mar 2025 6 minutesIf you are reading this, chances are you don’t have a financial adviser. You are not alone. Only 10.4% of Australians work with one, while the majority manage their finances independently, often taking a DIY approach to investing, tax planning, superannuation, and retirement.

But as financial decisions grow more complex—driven by economic uncertainty and the rising cost of living - it is not just about whether you can manage your money, but whether you are making the best possible choices.

That leads us to an important question: Should you work with a financial adviser?

The answer depends on your financial situation, your goals, and how comfortable you are managing your money. A good adviser does more than just help invest your money—they help you avoid costly mistakes, seize opportunities, and create a strategy that moves you forward faster.

Before making this decision, it is important to understand not just the cost of financial advice—but the value it brings. Let’s break it down…

What Does a Financial Adviser Do?

A financial adviser is more than just an investment consultant. They bring an holistic approach to your financial well-being, helping with everything from budgeting and superannuation to tax planning and estate management. Their role is to assess your financial situation, understand your goals, and create a tailored strategy that aligns with your needs.

With those goals in mind, financial advisers offer expertise in:

- Investment Strategies: Building a diversified portfolio that matches your risk tolerance and long-term goals.

- Retirement Planning: Ensuring you have a secure income stream in your later years.

- Tax Optimisation: Identifying ways to reduce your tax liability and maximise savings.

- Superannuation Guidance: Advising on contributions, consolidations, and withdrawal strategies.

- Wealth Protection: Helping with insurance, estate planning, and risk management. .

Think of a financial adviser as a coach for your finances. They help you stay on track, make better decisions, and adjust your plan as your life changes.

The Cost vs Value of Financial Advice

Cost is one of the biggest barriers to seeking financial advice. Adviser fees vary widely, depending on the complexity of services provided. Some charge a flat fee, while others take a percentage of assets under management.

While the standard annual fee is often cited as around 1%, fee rates tend to decrease with larger investments. Currently, the median adviser fee sits at $3,960 per year.

But cost alone doesn’t tell the whole story - it is also about value.

A good adviser does more than just manage investments; they help minimise taxes and build wealth more efficiently. If their guidance leads to better investment returns, lower debt, or more financial security, their services may be paying for themselves.

Research backs this up. According to the Value of Advice study by the Financial Advice Association Australia, four out of five Australians who use a financial adviser feel more confident in tackling financial challenges. Additionally, 80% reported reduced stress about money and greater resilience in handling unexpected life events.

This is especially true during major life events such as starting a family, buying a home or inheriting wealth, where financial decisions become more complex. In these situations, expert advice can make a meaningful difference, helping you avoid missteps and make the most of your financial future.

How to Choose the Right Adviser

So you’ve decided you’d like to work with a financial adviser. The next step is choosing the right one to meet your needs.

Some key factors to consider include:

- Scope of Services

Some advisers offer comprehensive financial planning, covering investments, tax strategies, superannuation, and estate planning, while others specialise in specific areas like investment consulting.

Since no single adviser is an expert in everything, it's important to find one whose skills align with your goals. For some, one-off, episodic advice tailored to specific life circumstances may be a better fit than the traditional, full-service model.

- Experience & Expertise:

When evaluating an adviser, ask yourself:

a) Do they prioritise long-term strategies or short-term gains?

b) Have they worked with clients in similar financial situations?

c) How do they charge—are they fee-based, commission-based, or a mix of both?

Understanding these factors will help ensure their approach aligns with your financial goals. Transparent pricing is crucial to avoiding conflicts of interest. Additionally, verifying their qualifications and regulatory history through a government register can provide peace of mind. Clarifying these factors upfront helps ensure their approach aligns with your goals.

- Independence & Affiliations:

Independence is a valuable trait in advisers—bearing in mind some are affiliated with financial services companies.

If an adviser pushes investment products upfront without assessing your needs, be cautious.

- Assessing Risk Tolerance:

Understanding risk tolerance is another critical factor. A responsible adviser will assess your comfort level with risk and align their recommendations accordingly. If they promise high returns with little risk, be cautious.

Ultimately, choosing a financial adviser is about finding someone you trust—someone who listens to your needs, communicates clearly, and prioritises your long-term financial success.

Alternatives to Traditional Financial Advisers

There are also alternative ways to access financial guidance beyond traditional advisers.

For example, some super funds offer digital advice at a low cost to members, while online tools and robo-advisers provide algorithm-based recommendations.

Educational resources like podcasts and financial courses can also help improve financial literacy. While these options can be useful, they don’t offer the personalised, in-depth advice that a professional adviser provides—especially for complex financial situations.

Is a Financial Adviser Worth It?

The short answer is it depends.

If you’re confident in managing your finances, enjoy researching investments, and have a solid strategy in place, you might not need one.

But if you find money decisions overwhelming, aren’t sure if you're on track for retirement, or simply want to maximise your financial potential, an adviser can be a game-changer.

Financial advice isn’t just for the wealthy—it’s for anyone who wants to build and protect their wealth smarter and faster.

At the end of the day, the real question isn’t whether you can afford a financial adviser—it’s whether you can afford not to have one.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.