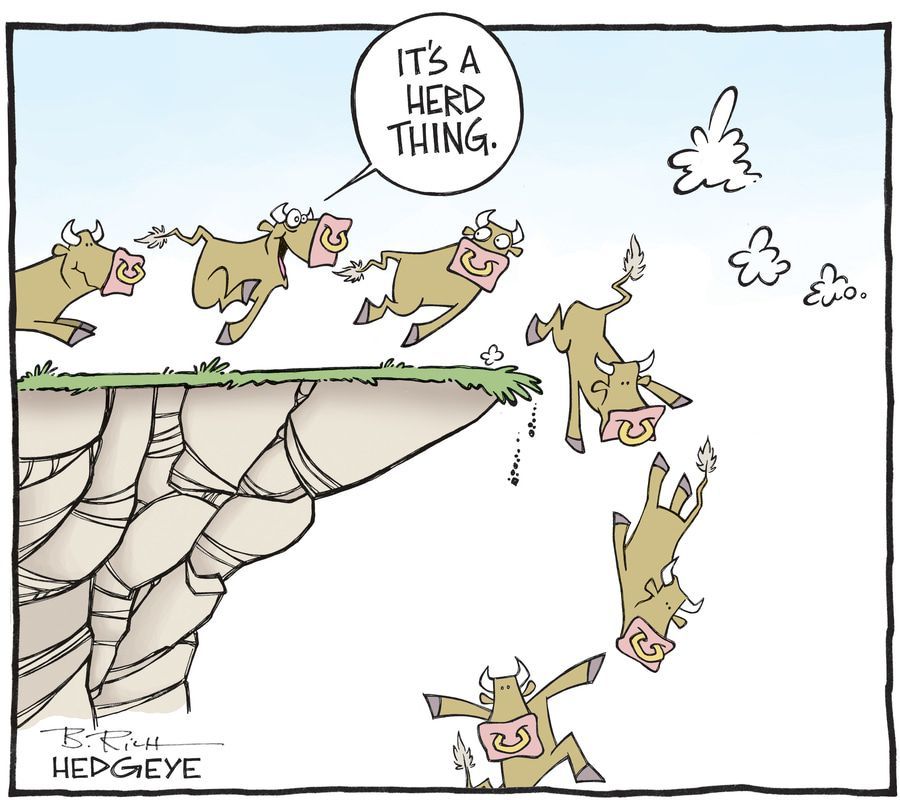

Avoid the Herd for Outsized Returns

Simon Turner

Wed 9 Jul 2025 6 minutesAs an investor, following the crowd often feels like the safest strategy, especially when markets are volatile or the headlines are dire. But history has repeatedly shown that following the herd is one of the most reliable ways to underperform over the long term.

As such, the discipline of going against the grain when selecting managed funds and ETFs often represents the difference that makes the difference between mediocre and outstanding outcomes. Of course, this is easier said than done. Not following the herd involves not chasing recent performance, buying popular themes at peak valuations, or abandoning promising long-term opportunities simply because they’re currently out of favour. Yet, it’s essential if you want to generate solid long term returns.

The Perils of Herd Mentality

Behavioural finance has long documented the pitfalls of following the herd as an investor. It’s also shown that most investors are compelled to follow the herd despite the evidence against it. Recency bias, fear of missing out (FOMO), and confirmation bias all contribute to herd following en masse.

Case in point: each year, vast amounts of global capital pour into ETFs and managed funds just after they’ve outperformed only for investors to then experience mediocre or negative returns.

In fact, according to Morningstar, the average investor return in managed funds consistently lags the average fund return, purely due to poor timing. In other words, most investors buy high and sell low. They are misguided by the herd.

Why Smart Investors Look the Other Way

In contrast, great investors, from Warren Buffett to Howard Marks, have consistently outperformed the market by stepping away from the herd. Their winning approaches tend to be rooted in valuation discipline, independent thinking, and a deep understanding of market cycles.

As per Brandon Mull’s famous quote: ‘Smart people learn from their mistakes. But the real sharp ones learn from the mistakes of others.’

Hence, smart investors resist the pull of the most popular ETFs or funds simply because they’ve delivered recent outperformance or dominate the headlines. Instead, they deliberately seek opportunities in areas that are:

- Under-researched or under-owned;

- Unloved or out-of-favour;

- Supported by long-term structural tailwinds, but currently facing cyclical headwinds.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Areas Currently Out of the Herd’s Favour & Possibly Undervalued

So where should contrarian, valuation-conscious investors be looking at this juncture?

Here are five asset classes, sectors and themes that are broadly unloved by the herd, so may offer compelling opportunities for long-term investors willing to be patient and selective:

After years of underperformance relative to the U.S. and developed markets in general, many emerging market (EM) economies now trade at significant valuation discounts. Yet, countries like India, Indonesia, Vietnam, and Brazil offer:

- Younger demographics;

- Expanding middle classes;

- Structural growth in consumption and infrastructure.

Broad EM Funds with a ‘quality growth’ bias such as Antipodes Emerging Markets can provide diversified exposure to this structural EM opportunity. The key is to avoid over-concentration in China, which continues to dominate many EM indices despite its unique geopolitical and regulatory uncertainties.

2. Global Small & Mid-Cap Funds

Large Cap U.S. stocks have dominated fund flows for many years, but Global Small and Mid Caps are now trading at multi-decade valuation discounts to their Large Cap peers. That’s surely worthy of note given these companies often have:

- Higher growth potential;

- More focused business models;

- Lower analyst coverage and therefore greater market inefficiencies.

Managed funds such as Artisan Global Discovery Fund and Pengana Global Small Companies Fund provide diversified exposure to global portfolios of smaller companies positioned to benefit from a narrowing of this valuation discount.

3. Commodities & Resources Funds

Iron ore and lithium have experienced boom-bust cycles in recent years, but broader commodities equities, especially energy and diversified miners, remain out of favour in ESG-dominated portfolios while demand for raw materials is growing with a couple of structural drivers that are here to stay:

- The green energy transition requires a massive amount of copper, nickel, and rare earths;

- Underinvestment in traditional energy supply may support higher-for-longer prices.

Diversified and targeted commodities equity exposure can be gained through resource funds like Sequoia Commodities Series 18 and Acorn Capital NextGen Resources Fund.

4. Value & Dividend Strategies

Growth stocks have significantly outperformed value stocks since the Global Financial Crisis. But with rising interest rates and ongoing inflationary pressures, high-quality value and dividend-focused funds are well-positioned for long-term outperformance. These strategies typically offer:

- Defensive characteristics;

- Attractive income streams;

- Mean reversion potential as and when growth stocks falter.

Australian value strategies such as Prime Value Opportunities Fund and income funds such as Vertium Equity Income Fund provide diversified exposure to these strategies.

5. Healthcare & Biotech

Healthcare is typically a defensive sector, but the biotech sector has suffered a significant de-rating since 2021. As a result, valuations in early-stage healthcare innovators are compressed, despite benefitting from powerful structural tailwinds including:

- The aging global population;

- Significant genomic advances;

- Personalised medicine step-changes.

Diversified exposure to this theme can be gained through managed funds such as Cordis Global Medical Technology Fund.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Independent Thinking Pays Dividends

The allure of top-performing funds or the latest ETF trend can be hard to resist, especially when they dominate the media or appear to offer effortless growth. But history suggests that strong long-term performance is driven by patience, valuation discipline, and independent thinking.

In other words, it’s not just about what you own. It’s also about what you avoid. By stepping away from crowded trades in favour of unloved but fundamentally sound sectors, investors can set themselves up for stronger and more sustainable long-term returns.

The key lesson is that the herd rarely leads investors to the best pastures for the simple reason that sentiment tends to mean revert. Often, the best opportunities lie quietly in the places no one else is looking.

Funds mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.