2025’s Match of the Year: Growth vs Value

Simon Turner

Wed 19 Feb 2025 6 minutesWelcome to 2025’s investment style match: between growth versus value stocks.

The audience are fired up and ready for an exciting competition.

Some of you may remember that last year’s winner, value stocks, ended up underperforming in 2024. You may feel tempted to blame the referee. Fair dues. But that’s the nature of the investing game. You can make the right call based on the data, and still be wrong. Short term market sentiment is often the over-riding swing factor and is hard to predict.

So this year’s match will once again be based on the best available data — with all the usual caveats.

The two teams will be tested against one another on four key factors for a steer as to which investment style is best positioned to outperform during 2025…

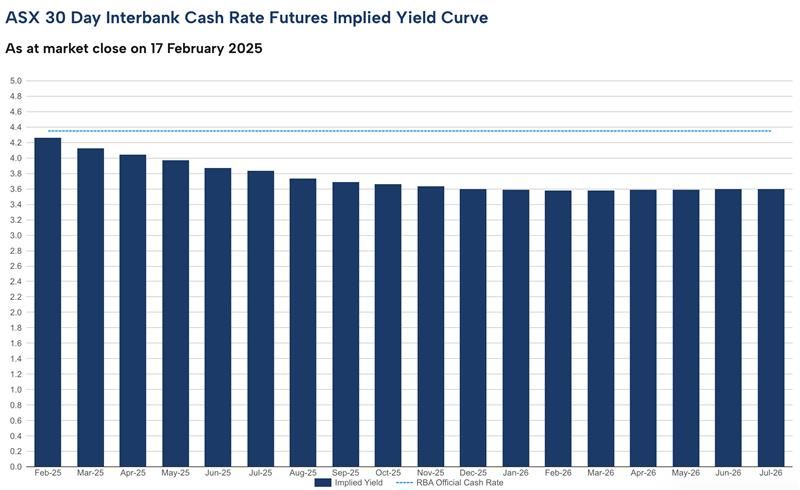

Test One: Impact of Falling Rates on Relative Valuations

To kick off the match, the performance of growth and value stocks will be compared in a falling interest rate environment — since the RBA is expected to initiate a rate cutting cycle during 2025.

Let’s start with what financial theory suggests.

In short, in a falling interest rate environment, the value of discounted future cash flows increases more for growth companies, which have a higher portion of their expected cash flows in the future, than for value stocks.

That means growth stocks should theoretically outperform in a falling interest rate environment, and vice versa.

Having said that, the value team won this battle last year based on research by Nir Kaissar, the founder of Unison Advisors, which showed that, contrary to financial theory, value outperformed growth in 9 out of the 11 periods of falling rates.

However, those trends don’t appear to be in play since the Fed began its recent rate cutting cycle, so we’re going to prioritise financial theory over that research.

That’s a point to the growth team who move to a one-nil lead.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Test Two: Performance Data

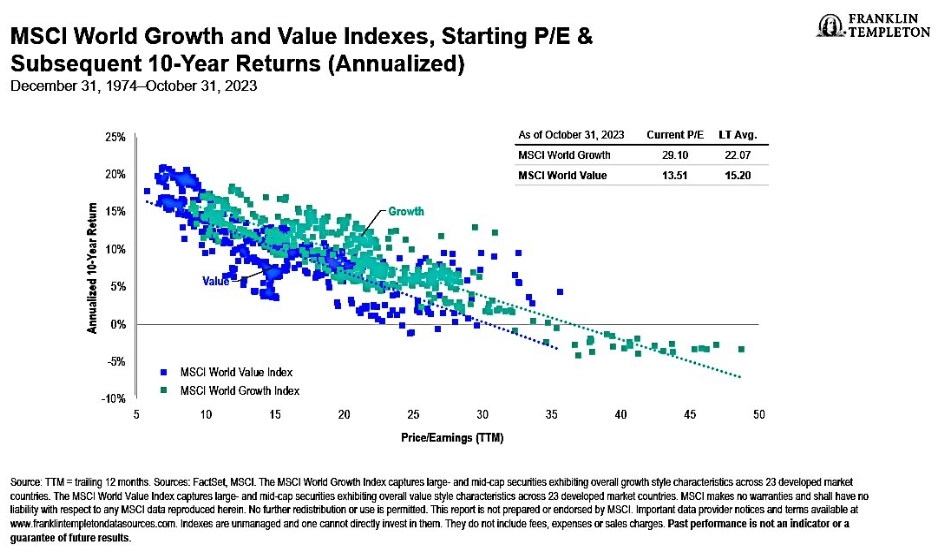

For the next test, let’s check out the longer term data comparing how growth and value stocks perform.

As shown below, the data shows that value stocks are a safer bet for investors aiming to avoid loss-makers, whilst the cluster of the strongest winners is also dominated by value stocks. In contrast, growth stocks are more hit and miss than value stocks, with a significant portion not living up to their promise.

But timeframe matters a great deal in this battle.

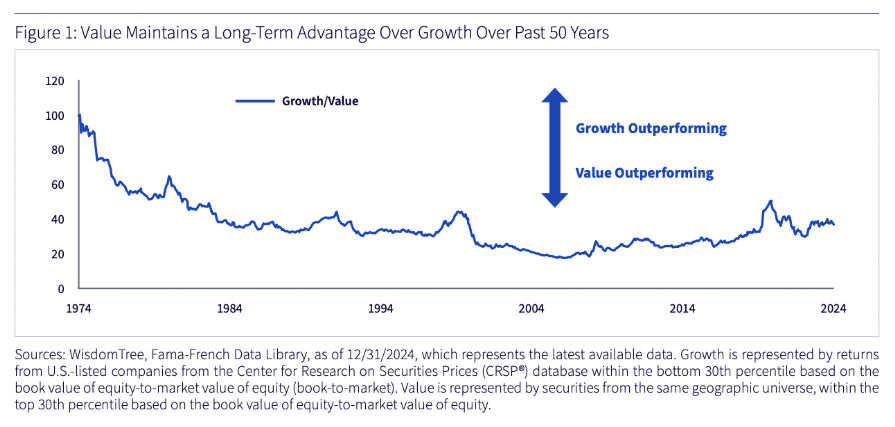

Over the past fifty years, value has outperformed growth—as shown below.

However, growth stocks have trounced value stocks over the past fifteen years with a 907% return compared to a 363% return in value stocks. And over the last two years alone, growth stocks have rallied 94%, tripling the return of value stocks.

Fifteen years is long term investing by most investors’ standards, so despite value investors’ lower chance of investing in loss-makers, the growth team take the point in convincing style.

The growth team move to a two-nil lead, and their supporters are on their feet.

Test Three: Relative Valuations

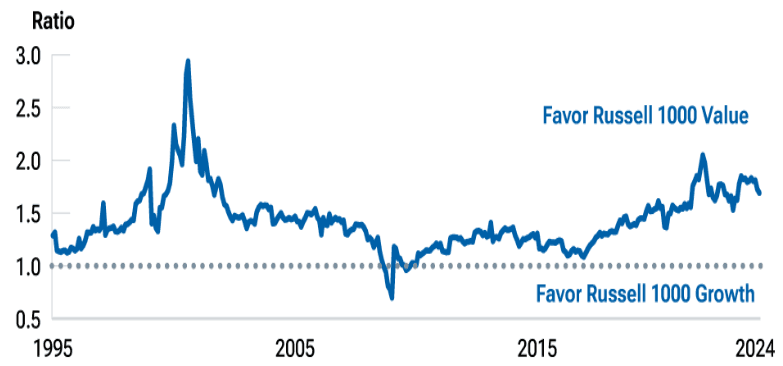

The next battle compares the relative valuations of growth and value stocks.

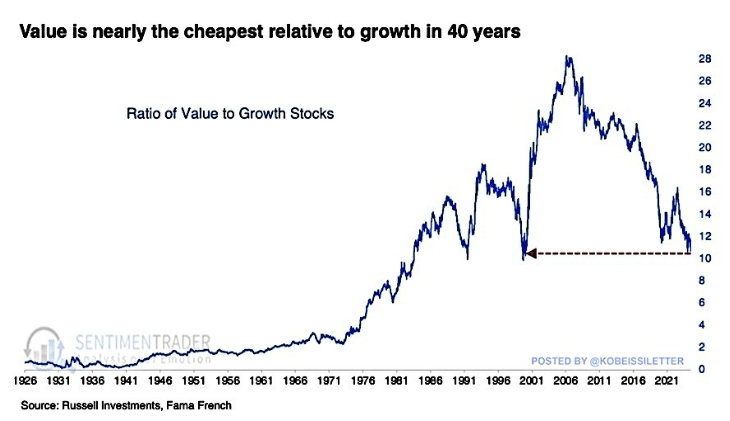

It won’t surprise most investors that after their extraordinary run, growth stocks are currently trading at around double their long-term premium versus value stocks.

In other words, value is trading at around its cheapest level relative to growth since the 90s.

Whilst growth stock valuations could still break out to the upside versus value from here, it generally pays to be cautious on any investment style when it’s unusually expensive like this.

Recent Wisdomtree research concurs: ‘Despite Growth's dominance since 2017, historical data underscores the resilience and long-term potential of Value investing during market reversals. Growth's leadership over the past decade has been fuelled by sentiment-driven multiple expansion, which entails greater risks should investor optimism waver. The valuation gap between Growth and Value suggests a compelling opportunity for portfolio rebalancing in anticipation of a potential shift in market leadership.’

Indeed. Outperformance depends upon selecting the right investment style for what’s coming rather than what’s already occurred.

So all told, this point has to go to the value team although growth supporters are getting rowdy in the stands with the word ‘Momentum’ being called out by some of the more vocal ones.

Test Four: The Predictability and Persistence of Growth

The final challenge is customised to test the predictability and persistence of growth expectations.

This is important information since the persistence of growth is at the heart of the valuation differential between growth and value stocks.

When growth is persistent, it makes intuitive sense to pay a higher premium for it as markets are doing at present. However, when growth is not persistent, there’s a weaker argument to pay a premium for growth stocks, and a stronger argument in favour of value stocks outperforming.

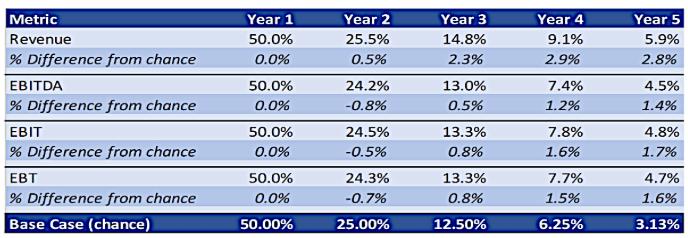

The most recent research on this issue was completed in October 2022 by Brian Chingono and Greg Obenshain of Verdad.

Growth supporters look away. As shown below, they analysed the performance of US stocks between 1997 and 2022, and discovered that there’s no evidence supporting the persistence of growth over the long term on four key measures of growth (revenue, EBITDA, EBIT, and EBT).

The implication is hard to ignore: if growth is not persistent, then markets should be valuing growth stocks at a relatively low premium versus value stocks — unlike at present.

That was an easy point for the value team which brings the match to a close.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

And the winner is…

So it was a well-fought match, but unfortunately there wasn’t a clear winner this year. It was a two-all draw.

Based on the above-mentioned factors, there are strong arguments in favour of growth continuing to outperform in 2025, but there are also strong arguments supporting a change of market leadership in favour of value.

It really comes down to whether market sentiment (read: momentum) can continue driving growth stock outperformance, or whether markets are ready to focus more on valuations. Time will tell.

In the meantime, hedging your investment style bets may make sense.

See you at next year’s investment style match when we’ll have the benefit of more historical context.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.