How to Tap into Asia’s Superior Growth Prospects Without Taking on Unnecessary Risk

Simon Turner

Wed 13 Aug 2025 6 minutesWhile most Western economies are growing at a modest rate, Asia stands out in a global context for its superior structural economic growth drivers. For Australian investors, the region offers both opportunity and complexity, especially when balancing the potentially strong returns with the region’s unique risks…

Why Asia Now?

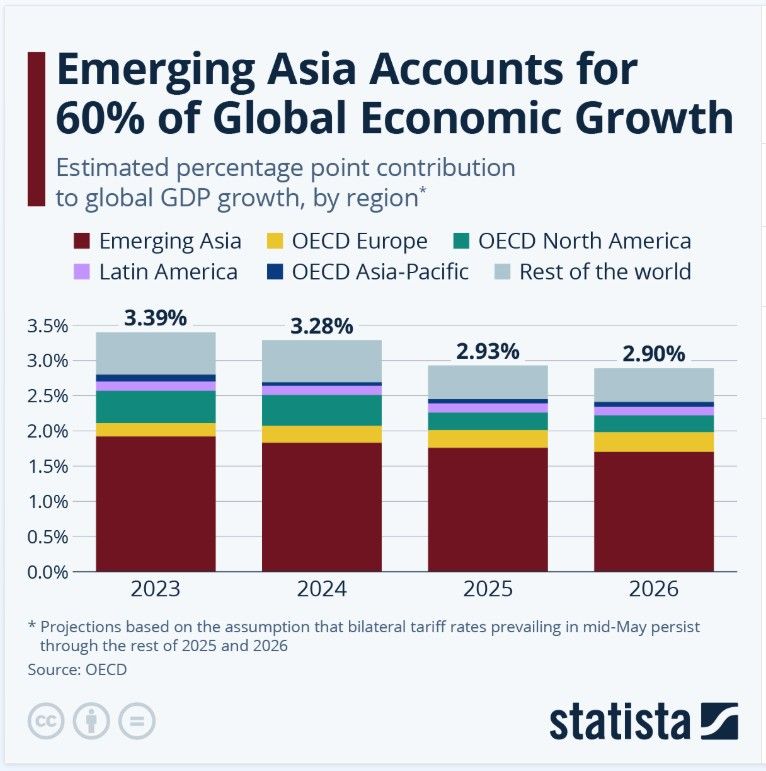

Asia is generally viewed as the world’s main economic growth driver. In fact, the Asian Region is projected to account for over 60% of global GDP growth over the next decade, driven by rising consumer demand, expanding digital infrastructure, and favourable demographics.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

A Smorgasbord of Growth & Evolution

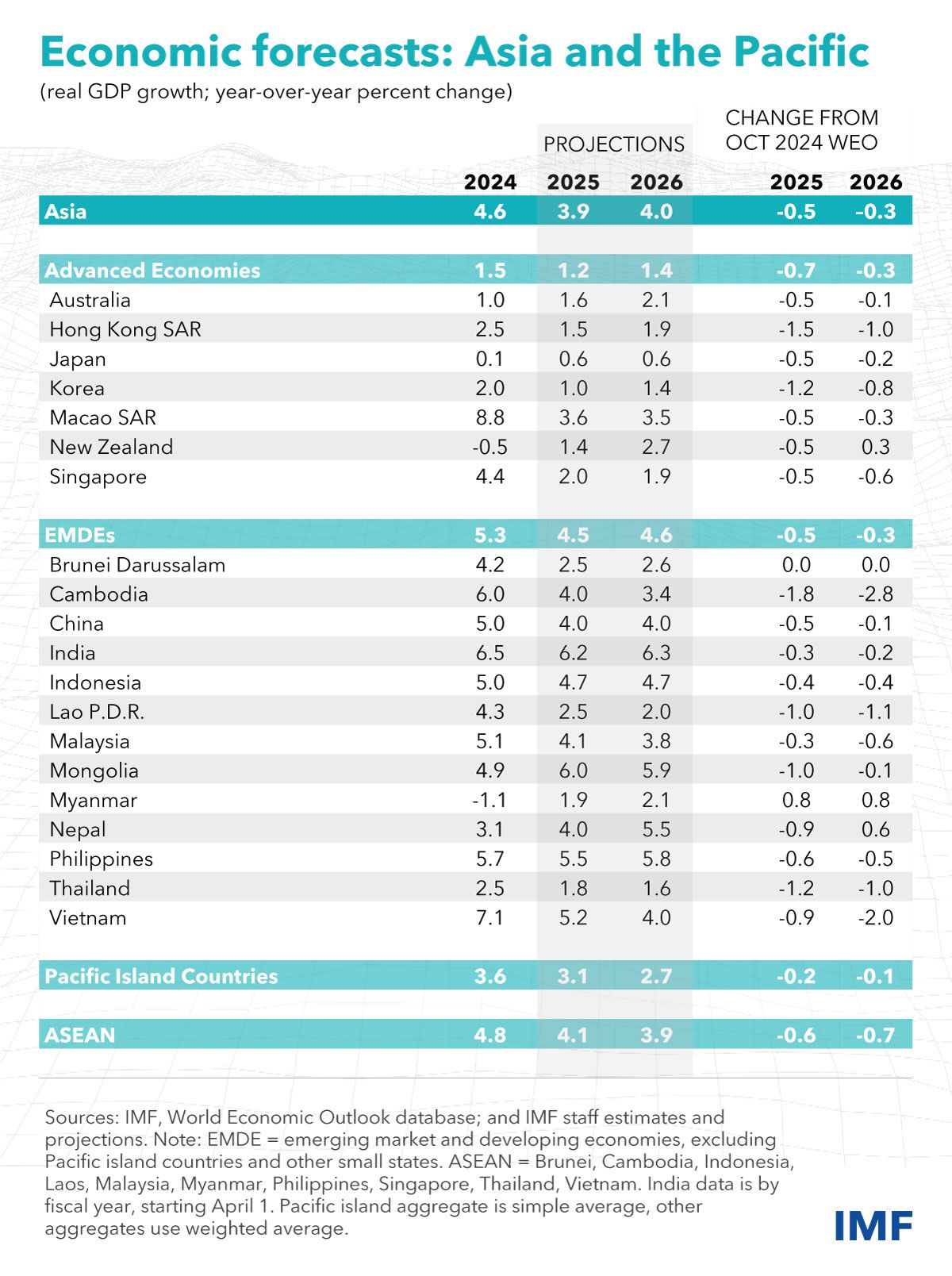

Whilst the overall Asian region’s outlook is bullish, it’s more nuanced at a country level.

- China

Chinese economic momentum is stabilising as the property sector’s drag fades, manufacturing upgrades accelerate (boosted by AI breakthroughs like DeepSeek), and targeted policy support lifts domestic demand.

Trade tensions and high U.S. tariffs remain key risks, potentially slowing Chinese exports. Currency stability against the USD is likely, though the Chinese Yuan may weaken against other currencies.

Chinese equities have rallied sharply, narrowing their valuation gaps with U.S. tech, but near-term upside is probably capped without a resolution to the tariff standoff.

- Japan

Domestic Japanese demand remains resilient thanks to strong wages growth and AI-linked industrial demand, offsetting external trade headwinds. Inflation and bond yields are normalising, supporting a structural reflation cycle.

Corporate reforms and low foreign equity participation underpin Japan’s medium-term equity appeal, although valuations are near historical averages. The yen may strengthen in the short term on USD diversification flows, enhancing foreign investors’ returns.

- India

India is benefitting from demographic and innovation tailwinds. Recent rate cuts by the Reserve Bank of India, stable inflation below target, and possible fiscal stimulus are supportive of continued strong economic growth momentum. Low export dependence shields India from a trade war fallout, and potential U.S. trade agreements could be beneficial.

Indian equities are positioned for potential outperformance in the coming months. Any dips may be buying opportunities despite slightly above-average valuations.

- Vietnam

Previously a prime ‘China +1; beneficiary, Vietnam now faces tariff threats up to 46% on U.S. exports, risking its high U.S. dependency. Its low-cost manufacturing advantage remains, but aspirations to climb the value chain could be set back if foreign investment slows.

Vietnamese valuations are attractive, but capital inflows may be delayed until the trade policy uncertainty is resolved.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

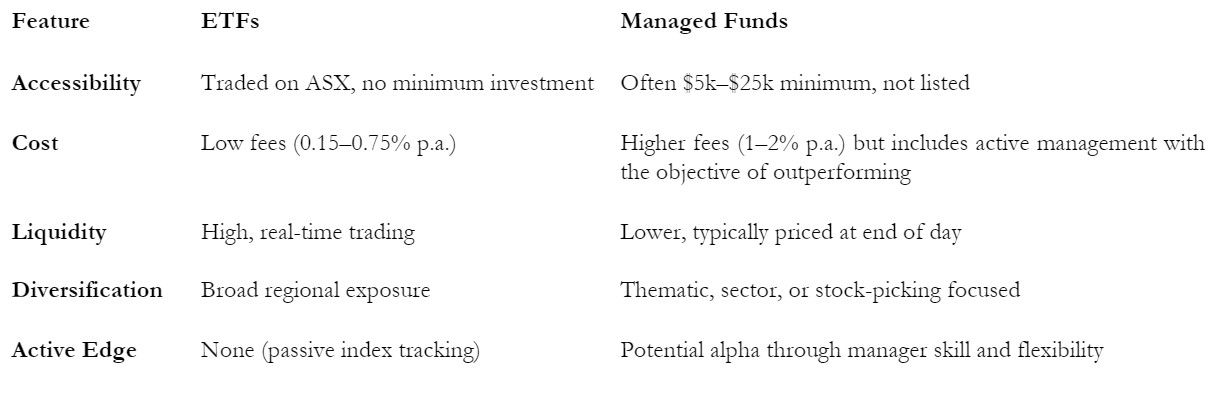

ETFs vs Managed Funds: Choosing Your Entry Point

Once you’re ready to invest in Asia, the next question is: are managed funds or ETFs a better match for you?

Here’s a brief comparison of the two options:

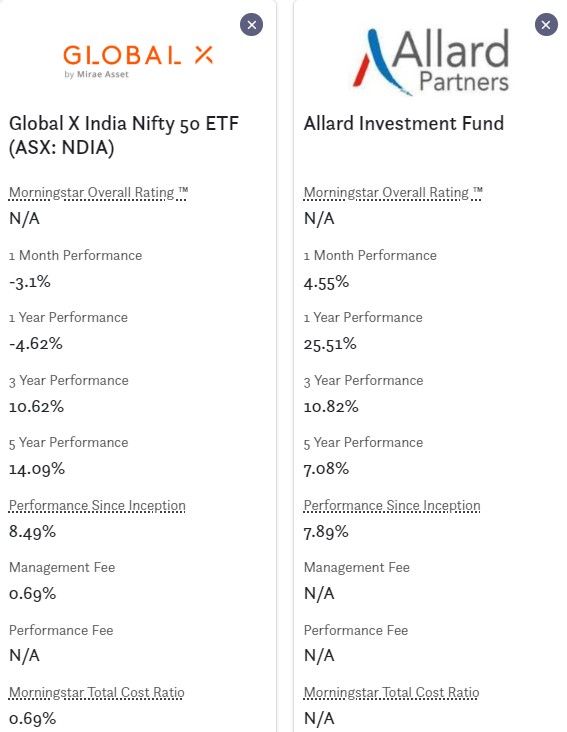

Here’s an example of an Asian ETF worth checking out:

And here’s an Asian managed fund worth looking at:

Using InvestmentMarket’s fund comparison function, here’s a comparison of these two funds:

How to Maximise Asian Returns & Minimise Risk

Once you’ve selected the right Asian fund or funds for your portfolio, it’s time to translate that into a strategy aimed at maximising your returns and minimising your risk.

Here are a few tips which may help:

1. Diversify across countries.

Don’t let your Asian exposure hinge on China alone. Investing in a diversified fund like Allard Investment Fund will ensure you’re exposed to the region’s broad-based growth drivers.

2. Blend active and passive in a core-satellite strategy.

Core-satellite investing is a portfolio construction strategy that divides a portfolio into two separate components.

The core is a diversified, low-cost foundational portfolio designed to deliver long-term, market-like returns. Use ETFs like Global X India Nifty Fifty for your core Asian exposure.

The satellites comprise more specialised, actively managed or tactical investments intended to enhance performance or manage specific risks. Think active Asian managers like Allard Investment Fund who can aim for outperformance whilst responding to volatility.

3. Use currency to your advantage.

Some Asian funds hedge their currency exposure, whilst others don’t.

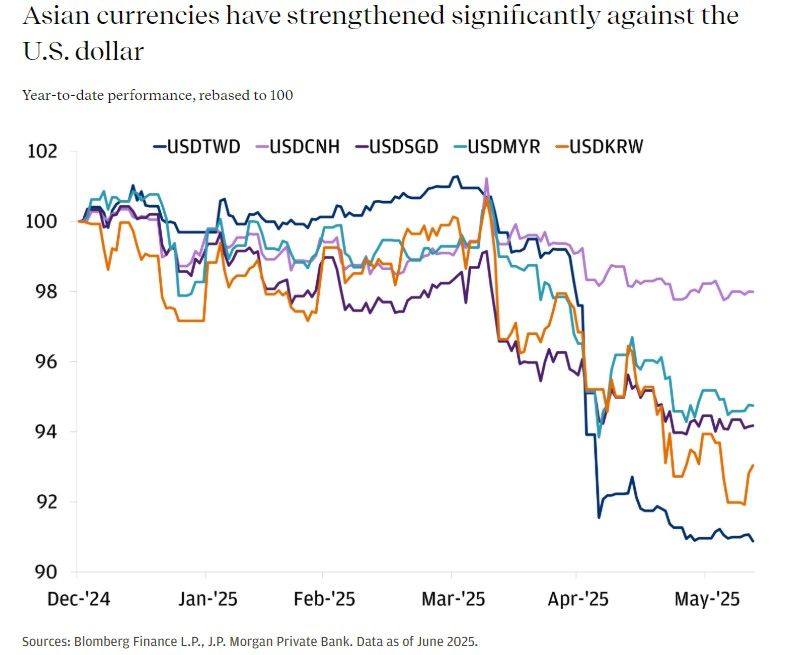

This decision makes a difference during periods of currency volatility (like recently). As shown below, recent Asian currency strength versus the US dollar has significantly enhanced Asian equity returns for US investors.

Be ready to use currency to your advantage rather than it being an after-thought.

💡 Tip: Australian investors should invest in hedged global funds and ETFs if you expect AUD strength versus the main Asian currencies; whereas you should invest in unhedged funds and ETFs if you expect AUD weakness. And if you don’t have a view on the AUD, the best strategy is generally to hedge your currency exposure to ensure you aren’t exposed to any surprise risks.

4. Watch for geopolitical shifts.

Whilst the Asian economic outlook stands out as structurally positive in a global context, be conscious that there are regional-specific risks.

For example, India–China tensions, China-Taiwan developments, and ASEAN realignment could all impact returns in the region.

5. Use dollar cost averaging to your advantage.

Dollar cost averaging involves investing in funds and ETFs at regular intervals rather than going ‘all-in’ via one larger purchase. This simple strategy ensures investors benefit from a fund’s long term value creation rather than attempting to trade its highs and lows, which most investors would agree is almost impossible.

It’s a powerful means of compounding your long-term returns. However, avoid overcommitting during market highs.

Asia is Too Opportunity-Rich to be Ignored

Asia remains one of the most dynamic and opportunity-rich regions globally, but with that superior potential comes increased risk. Long-term investors should focus on the attractive potential risk-adjusted returns on offer and be ready for periods of volatility along the way.

For most investors, the smartest Asian investment strategy is a strategic blend of low-cost ETFs with well-chosen active funds.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.