Smart Investing Toolbox: New InvestmentMarkets Features Make Finding the Right Funds Easier Than Ever

Simon Turner

Mon 21 Jul 2025 5 minutesWith more investors understanding the importance of high quality information which helps them identify the right funds and ETFs for their portfolios, the InvestmentMarkets (IM) platform is evolving. Morningstar performance data has been added to the platform for a large portion of the listed funds, while fund comparison functionality has also been added.

It’s great news for IM website users who use the platform to help them identify funds and ETFs aligned with their investment needs.

Introducing Fund Performance Functionality

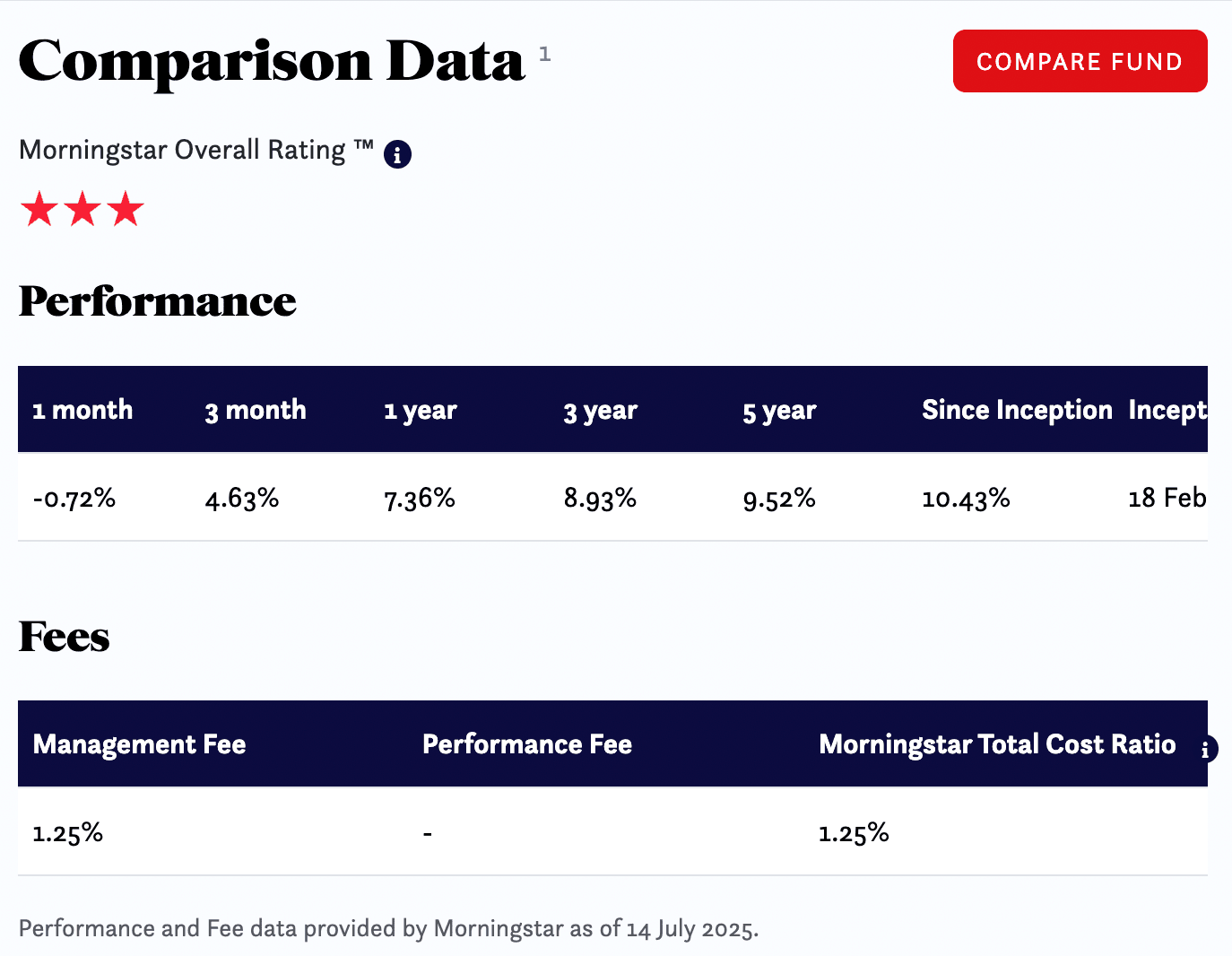

The main evolution IM website users will notice is the addition of performance data at the top of the fund listings for which Morningstar is available. In general, Morningstar data is available for retail products which are marketed to the wider investment community.

For example, here’s the recently added performance data at the top of Claremont Global Fund (Hedged)’s fund listing:

A few points about this performance data worth highlighting:

- Ratings are Useful but they Aren’t the Be All and End All

As we discussed recently in our article entitled, Cracks in the System: Learning from the Collapse of Shield, First Guardian & Australian Fiduciaries, fund ratings can’t be relied upon by advisers or investors as the entire basis for their investment. Our recommendation is to use them as a useful input, but to do your own research prior to investing in any fund or ETF.

Focus on Long Term Performance Data

It’s generally more helpful to focus on longer term fund performance data. Whilst past performance is not a guide of future performance, the 3-year, 5-year and since inception numbers are likely to provide a picture of the types of returns investors should expect looking forward.

The Short Term Data has a Different Role to Play

The 3-month and 1-year fund performance data has another role to play. It’s useful for identifying ‘hot’ funds and ETFs which are enjoying a purple patch (strong outperformance). In general, waiting for funds experiencing extremely strong short-term performance to mean revert is a prudent strategy for longer term investors.

Fees Matter

And finally, make sure you focus on fund fees prior to investing. They can make a significant difference to your long-term returns.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Introducing Fund Comparison Functionality

The other good news for IM website visitors, is the recent introduction of the fund comparison function. It utilises the same Morningstar performance data to allow investors to compare up to five funds at a time.

All you have to do is click on ‘Compare Fund’ on fund listings where Morningstar performance data is available.

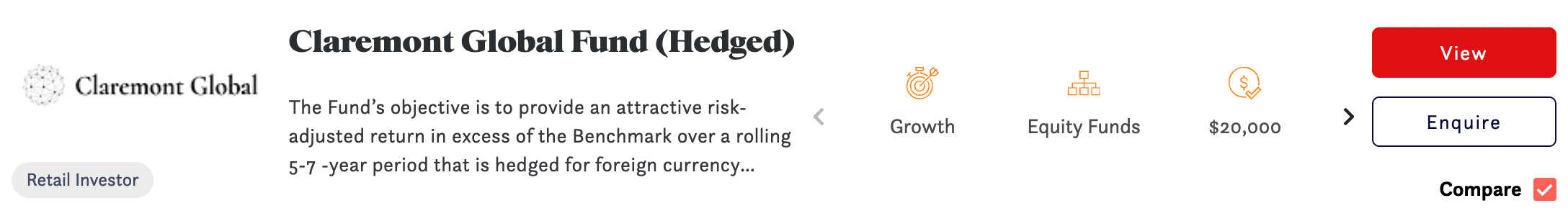

Beyond locating this functionality on each fund listing where performance data is available, you can also click in the ‘Compare Fund’ box when you search for lists of funds in various asset classes. This is what the listings look like in those searches:

To add funds to your fund comparison, it’s then a case of searching for up to four additional funds and again clicking on ‘Compare Fund’. When you’ve clicked on ‘Compare Fund’ for up to five funds you’d like to compare, those five funds will be listed at the bottom of your screen like this:

The final step to compare your five selected funds is to click on ‘Compare’.

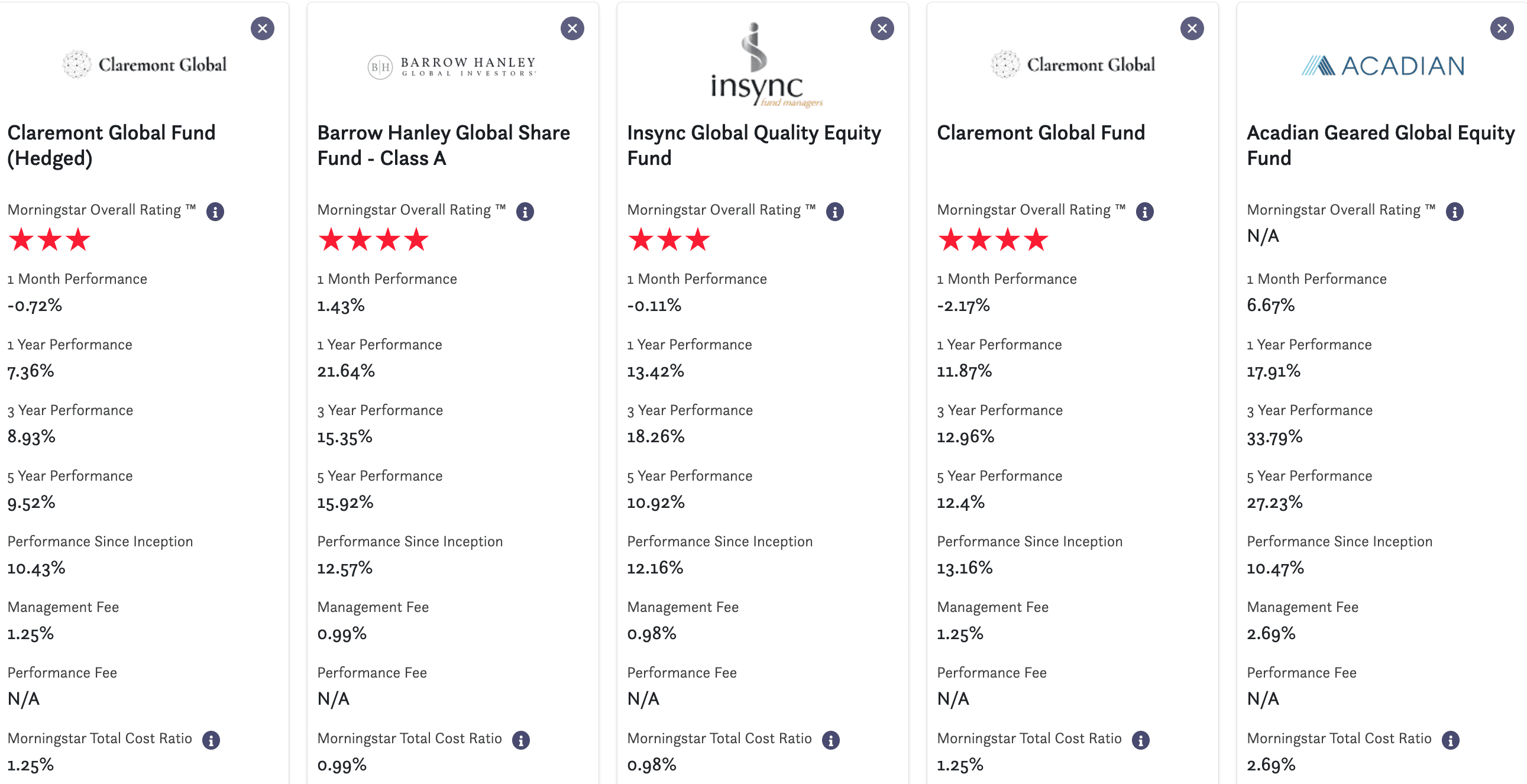

You’ll then be taken to a table comparing your selected funds. For example, here’s the comparison table for the five global equity funds listed above:

As you can see, this comparison function saves investors time and allows them to hone in on the right funds to meet their investment goals.

For example, this global fund search reveals generally solid performance across the board. But the fund comparison function reveals a couple of standout performers over 3 and 5 years:

Arcadian Geared Global Fund has performed particularly well over the longer term, albeit with the use of leverage and in return for a much higher management fee than the other funds and the sector in general.

Barrow Hanley Global Share Fund is the standout ungeared performer over the longer term timeframes, and its fees are the lowest in this search.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

High-Quality Information is Your Friend as an Investor

The intention behind these new InvestmentMarkets performance and fund comparison functions is to enable investors to quickly find the right funds and ETFs for their investment needs. By using the IM platform in this way, investors can use more of their valuable time to conduct due diligence on the funds they’re actively considering investing in.

Funds Mentioned

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.