Should you invest with a manager enjoying a purple patch?

Simon Turner

Mon 23 Sep 2024 5 minutesYou may remember the pre-2021 years when Cathie Wood’s ARK Innovation fund was riding high as one of the strongest performers in the global fund management sector. Her philosophy, strategy, stock picking, and track record were all working in her favour. Investors were even in the habit of following Cathie into stocks whenever the ARK Innovation fund purchased a new position.

Fast forward to September 2024 and what a different market environment we’ve experienced since then. Unfortunately, all the investors who bought into Cathie Wood’s star manager appeal prior to her fund’s early 2021 peak have had to weather significant losses since then.

This cautionary tale is not uncommon and raises the question: should you invest with a manager enjoying a purple patch?

The attraction of a winning manager

Everyone loves a winner. Correction: those who don’t engage in tall poppy syndrome love a winner.

The winners’ attraction is particularly seductive in the investment world when a fund manager develops star status. Once their name becomes synonymous with making money, a fast growing population of investors tend to start believing they can do extraordinary things year in, year out. Eventually, a star fund manager will even develop a cult-like following amongst investors.

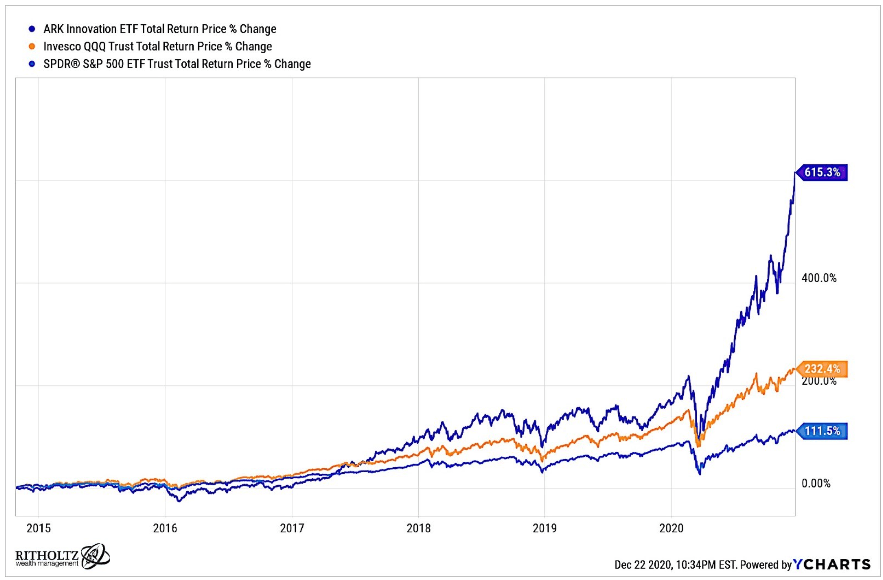

Cathie Wood’s story is a case in point. Investors assessing her ARK Innovation fund at the end of 2020 were faced with this rather daunting chart of her performance track record at the time.

Over that six-year period, the ARK Innovation fund generated almost six times the return of the S&P 500, one of the world’s strongest performing equity markets. You can just imagine how much FOMO was being generated by this insanely positive track record.

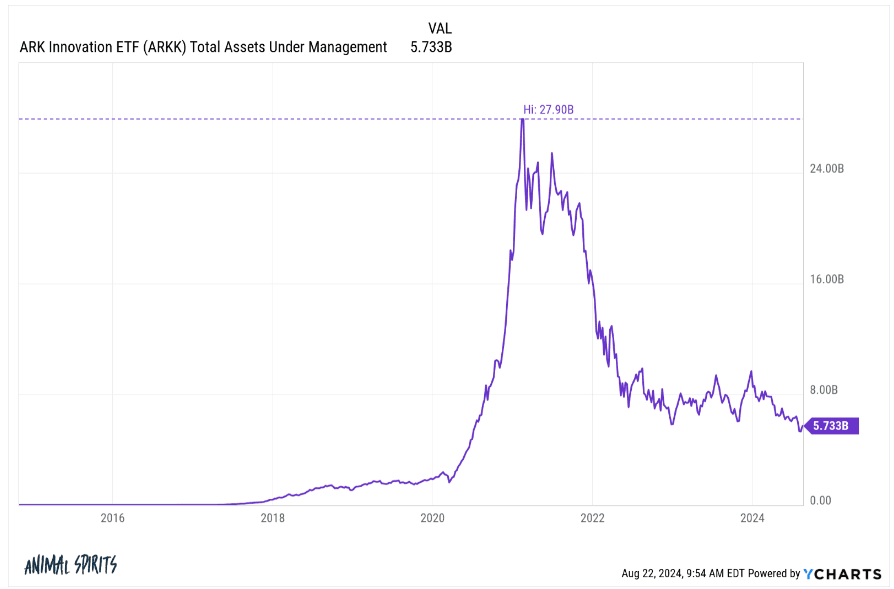

That FOMO translated into enormous assets under management (AUM) growth during 2020. The ARK Innovation fund started 2020 with AUM of under $US2 billion, and ended the year with $US18 billion.

It’s no understatement that Cathie Wood was about the most famous fund manager in the world at the time. Millions of investors listened to every single stock pick she articulated driven by a deep-held belief that there was money to be made by listening to her.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Beware the hot funds that seduce the market

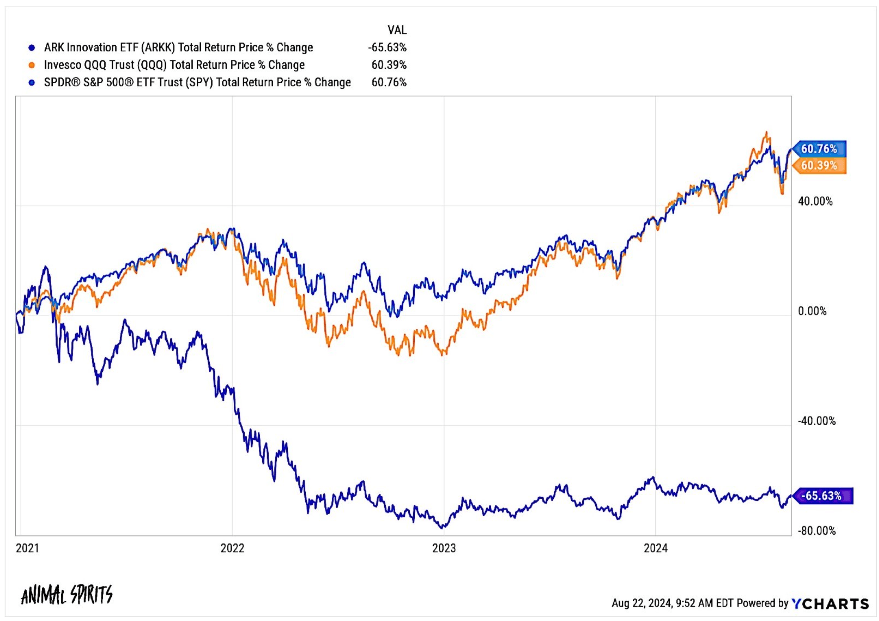

If you’ve followed Cathie Wood’s story, you’ll know that the mother of all periods of underperformance was just around the corner. Since ARK Innovation fund’s AUM peaked at $US28 billion at the start of 2021, the fund’s value has declined by a painful 66%.

Bear in mind that this decline in an innovation-focused fund occurred whilst the S&P 500 appreciated 61% driven largely by the AI boom and the extent of the fund’s underperformance becomes clearer.

Also bear in mind that the fund’s AUM had increased by ten-fold just before its performance was decimated, so the fund did a lot more net damage to the investment population than the positive outcomes generated for earlier investors who were prudent enough to sell before the fall.

In hindsight, the ARK Innovation fund’s glory years were the perfect setup for a panic-driven selloff—and that’s exactly what happened.

Once the fund’s selloff began in earnest, it generated enormous negative momentum that led investors to conclude that innovation-focused investing was synonymous with losing money. In other words, the market’s view of the fund whipsawed to the exact opposite of what it had been at the fund’s peak.

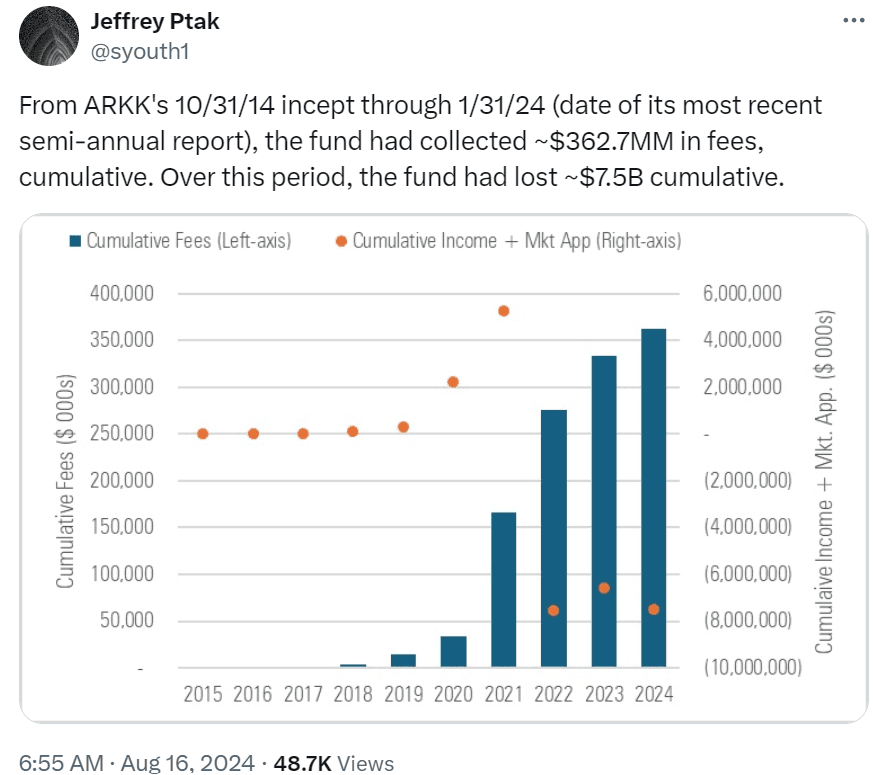

The financial carnage of this story is hard to overstate. Despite the fund’s initial outperformance, investors have lost a cumulative $US7.5 billion since the fund’s inception. And they’ve paid $US363 million in fees for the privilege.

The lesson for investors is unequivocal: beware of the hot funds that seduce the market by seemingly defying gravity.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Questions for investors considering a hot fund

So if a manager is enjoying a purple patch, it’s worth asking yourself:

Is this manager’s outperformance sustainable?

Are the valuations of the fund’s underlying assets becoming too expensive?

Is the manager’s outperformance starting to affect the fund’s valuations? i.e. are investors buying up the fund’s underlying holdings because of the manager’s star status?

Has the manager become so famous that their words can move stocks, and even markets?

Is the manager attracting a cult-like following in financial markets?

Is the fund’s AUM growth entering the stratosphere?

If the answers to these questions are tending to be yes, caution may well be warranted.

Beware the purple patch

Cathie Wood’s fascinating story highlights the way markets often work. Once a fund manager achieves star manager status, enormous AUM growth often follows. But the key point to remember is that the vast majority of investors are likely to mistime the opportunity. Once AUM growth hits an extreme level, the chances of a fund outperforming fall dramatically—and the chances of an extended period of underperformance rises exponentially.

So most investors are generally better off investing with managers who lack star status but who possess stable, repeatable track records of outperforming the market by a little bit each year. The net long term outcome is likely to be far more positive.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.