Are emerging markets worth the risk?

Ankita Rai

Thu 19 Sep 2024 6 minutesIn recent years, emerging markets haven’t exactly been a sure-fire opportunity for investors. Many have retreated after a decade of flat earnings, turbulence in China, and more attractive returns from the US exposure, resulting in emerging markets trading at lower valuations than their developed market counterparts.

While the MSCI Emerging Markets Index has delivered a return of just 9.8% over the past year, the MSCI World Index of developed markets has gained 24.7%, thanks to the rise of artificial intelligence and the dominance of the Magnificent Seven tech giants that have driven US markets to new heights.

Despite this, many emerging markets offer compelling value which is attracting investors’ attention. For example, the equity markets in India, Taiwan, Brazil, and Mexico are showing positive stock market momentum. It could well be a sign of what’s to come.

Emerging markets offer compelling value

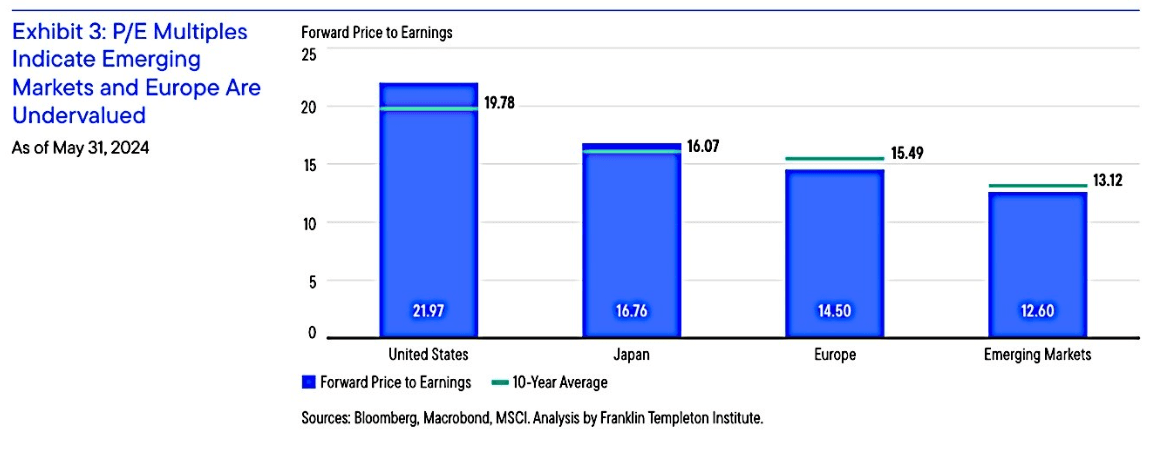

Emerging-market stocks are much cheaper compared to developed-market stocks than they have been in the last 20 years. In fact, they are currently trading at a 45% discount to developed markets based on price-to-book value.

Another measure, the cyclically adjusted price-to-earnings (CAPE) ratio, an indicator of long-term real returns, shows in aggregate emerging markets trade at 12.5x, which is half of the 25x seen in developed markets.

While these numbers might not predict short-term performance, they’ve historically been good indicators of long-term returns.

In fact, according to Franklin Templeton's analysis, the asset class is expected to show the strongest earnings growth in the coming years, with the MSCI Emerging Markets Index reflecting robust forward earnings growth.

However, not all markets are alike. You need to know where to look.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Top emerging markets from a valuation perspective

Emerging markets vary widely, with each country presenting its own set of opportunities and risks. Certain sectors, especially technology and consumer discretionary, are anticipated to see strong growth across these markets. Here’s a closer look at what leading emerging market countries have to offer:

1. India: the macro case is compelling

India is becoming a global favourite, standing out as one of the few larger economies still experiencing rapid growth while others slow down.

Its long-term market potential is underpinned by structural growth drivers: a rising middle class boosting incomes and consumption, a surge in manufacturing and infrastructure development, and a digital revolution supported by affordable data and widespread digital payments.

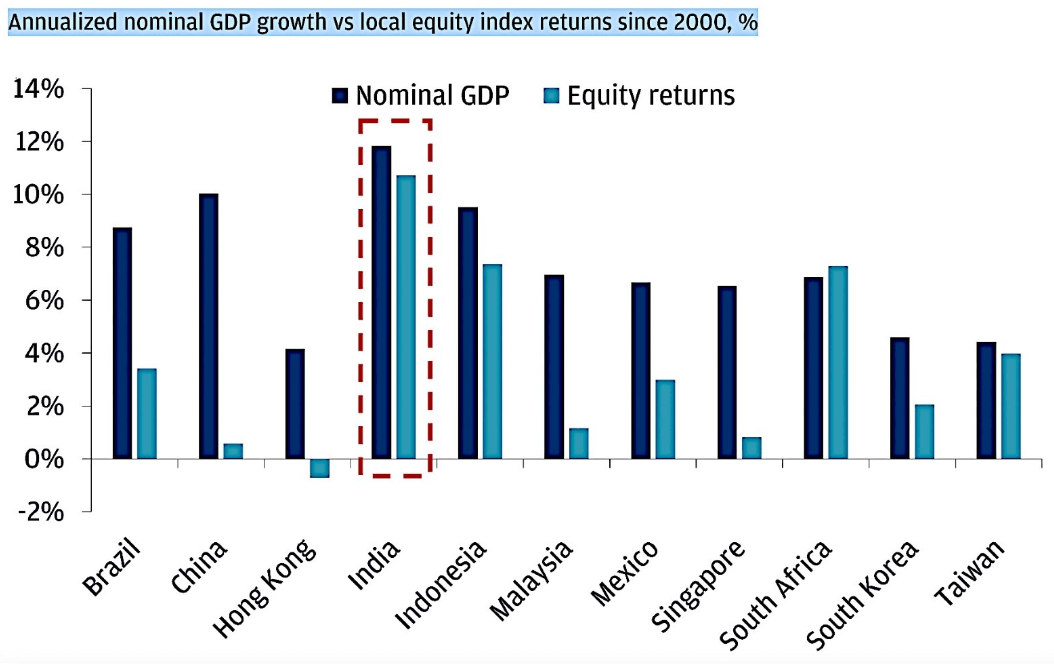

Although Indian equity valuations are relatively high, behind only the US and Japan, its strong link between stock market performance and GDP growth makes it unique within the cohort.

Over the past three years, India’s stock market has soared 46%, outpacing both global equities (up 20%) and emerging markets (down 13%). Much of this success has been driven by rising corporate profits and companies’ ability to generate value for shareholders.

The Global X India Nifty 50 ETF (NDIA) captures this trend by investing in 50 of the largest and most liquid publicly traded companies in India, spanning a range of economic sectors. It has generated a 1-year return of 14.7%.

2. China: inexpensive but challenging

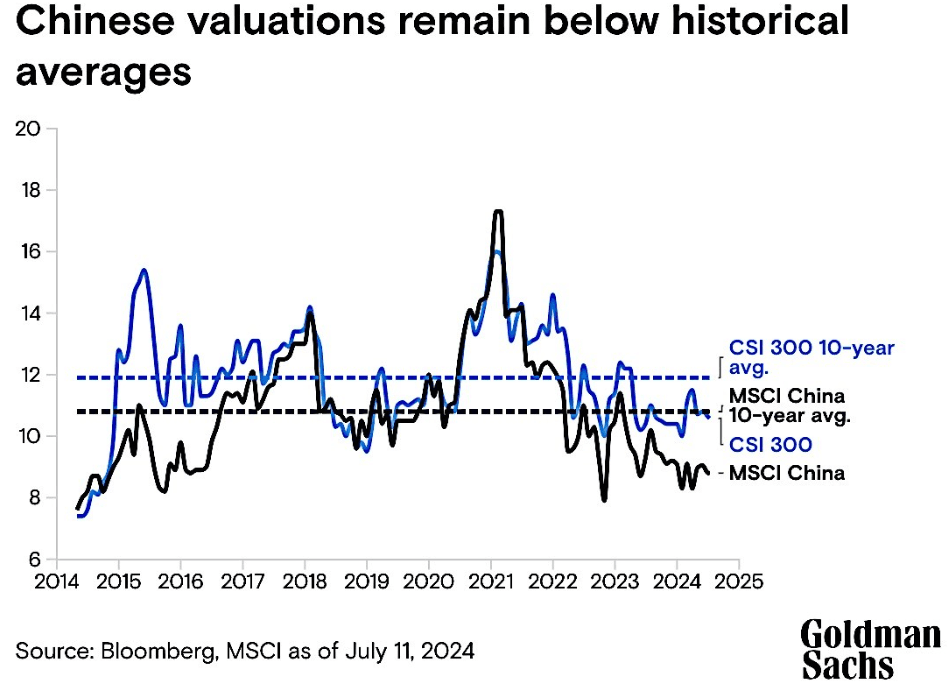

China's equity markets may look cheap, but the economic outlook remains mixed.

While retail spending has improved, structural challenges persist, including weak consumer spending, rising government debt, and the housing crisis. Geopolitical risks, particularly the upcoming US presidential election, are also likely to affect market sentiment.

The CSI300 index, which tracks the top 300 stocks on the Shanghai and Shenzhen exchanges, is trading at a low price-to-earnings ratio of around 13x—much lower than most major markets and has fallen 40% since its 2021 peak.

While Chinese stocks are currently cheap, it's essential to weigh these risks carefully before considering investment.

3. Brazil: the underlying story is healthy

Brazil offers a favourable investment environment in 2024, driven by rate cuts, GDP growth, and attractive valuations. After a strong 2023, during which the Bovespa Index rose by 22.3%, Brazilian equities remain undervalued, trading at a forward P/E of 8x, well below their long-term average.

Despite initial political and economic concerns, Brazil's fundamentals have improved, supported by monetary policy easing and a resilient economy. Companies like JSL and MercadoLibre, leaders in logistics and e-commerce respectively, highlight the growth opportunities.

4. Mexico: poised for continued growth

Mexico has been a strong structural story, benefiting from US economic growth and increased manufacturing investment.

The combination of lower rates, a strong consumer sector, and nearshoring investments offers a favourable backdrop, but risks persist, as the upcoming US elections and US policies on China and trade could significantly impact Mexico’s economy and financial markets.

5. Tech-heavy Taiwan and South Korea

Taiwan and South Korea are emerging as key players within the emerging markets landscape, with both contributing significantly to the MSCI EM Index.

Taiwan stands out for its semiconductor industry leadership, with Taiwan Semiconductor Manufacturing Co. (TSMC) well-positioned to capitalise on the AI boom.

Despite its lower forward price-to-earnings (P/E) ratio of 19.8x compared to competitors like Nvidia, TSMC’s dominance in semiconductor manufacturing suggests strong long-term growth potential.

Leading emerging market ETF managers agree. For instance, the JPMorgan Emerging Markets Research Enhanced Index Equity Active ETF, which holds TSMC and Samsung Electronics as key positions, has achieved a year-to-date return of 8.4%.

While Taiwan’s tech sector is rebounding, driven by AI server demand, short-term earnings may be impacted by challenges in the electric vehicle market.

Meanwhile, South Korea is gaining attention as it benefits from US restrictions on sourcing from China, making it a top investor in the US, surpassing Taiwan.

Historically undervalued due to corporate governance issues, South Korea is focusing on improving its governance and competitiveness, potentially lifting market valuations. Key sectors like financials, industrials, and automotive are expected to benefit, and major chip manufacturers Samsung and SK Hynix are poised for growth driven by rising AI-driven demand.

Choose wisely when investing in emerging markets

Emerging markets offer compelling opportunities, with attractive valuations compared to developed markets and strong growth potential. However, due to unique risks and inefficiencies—such as political instability, currency fluctuations, and varying business cycles—investors are advised to approach these high-growth regions with a degree of caution.

One of the most effective ways to access emerging markets is through ETFs and managed funds, such as Antipodes Emerging Markets Fund, CC Redwheel Global Emerging Markets Fund, and abrdn Sustainable Emerging Opportunities Fund. These funds focus on long-term capital growth and provide the added benefit of diversification, spreading their investments across various sectors and regions to help mitigate the risks.

By leveraging the expertise of seasoned fund managers who understand local market dynamics, these vehicles allow investors to seize opportunities that are often out of reach for individual investors.

Disclaimer: This article is prepared by Ankita Rai. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.