Does the Fed’s urgent action indicate a US recession is looming?

Simon Turner

Wed 25 Sep 2024 5 minutesIt’s not often that the Fed cuts rates by 50 basis points in one move. It surely indicates the Fed is worried about the state of the world’s largest economy. If that’s the case, global investors, including in Australia, should sit up and take note.

The key question at this juncture is: does the Fed’s urgent action indicate a US recession is looming?

What Fed rate-cutting cycles look like

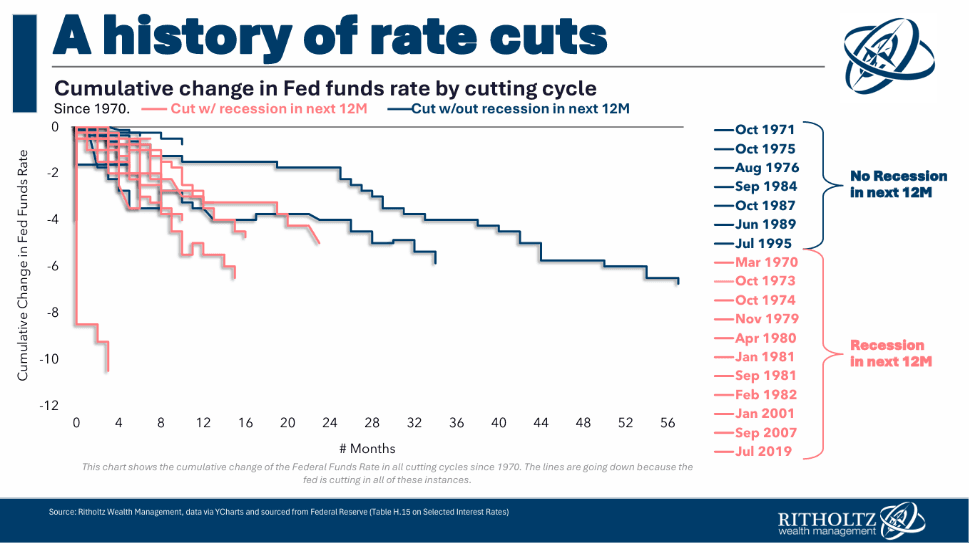

Looking back at every Fed rate-cutting cycle since 1970, it’s clear that each cycle is different and dependent upon the state of the economy, who’s chairing the Fed at the time, and other extraneous factors.

The key takeaway for investors is that in 11 of the last 18 Fed rate-cutting cycles, a recession followed in the ensuing twelve months, while a soft landing was achieved in 7 cases. So we’re dealing with a 61% hit rate of a recession following the first rate cut. It’s not great news.

But let’s focus on the cup being 39% full. The Fed has been victorious in the past. The last successful soft landing was when Alan Greenspan led the 1995 Fed rate-cutting cycle which resulted in one of the biggest economic booms in US history.

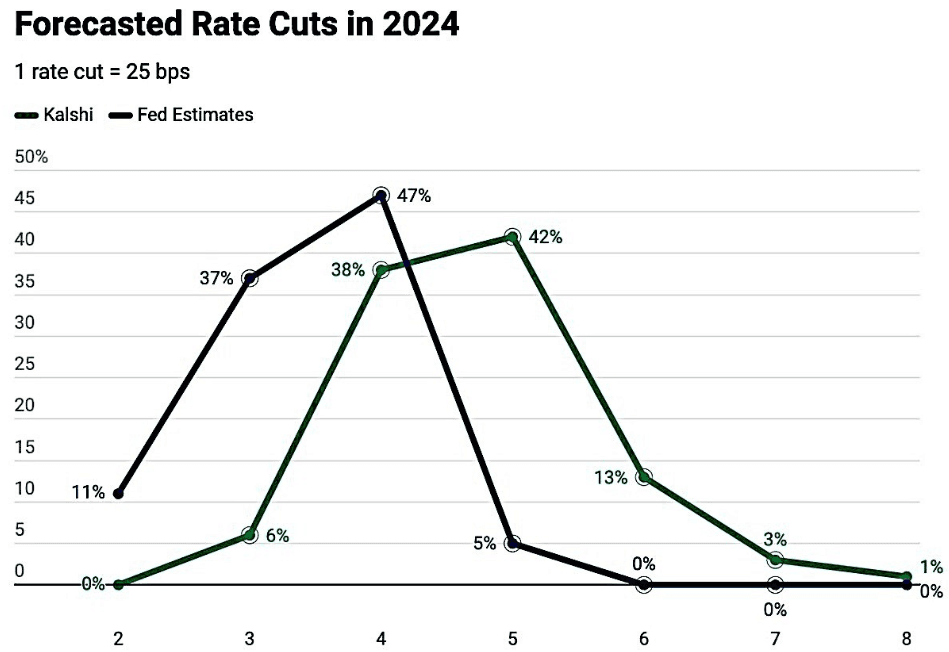

Powell is aiming to end the Fed’s almost thirty-year soft-landing drought. The Fed is expected to cut rates by at least another 75 basis points of cuts this year to make that happen.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Reasons to be optimistic and pessimistic about the US economy

Economic outlooks are rarely simple—and that’s the case in the US at the moment.

There are compelling reasons to be optimistic about the US economy at present:

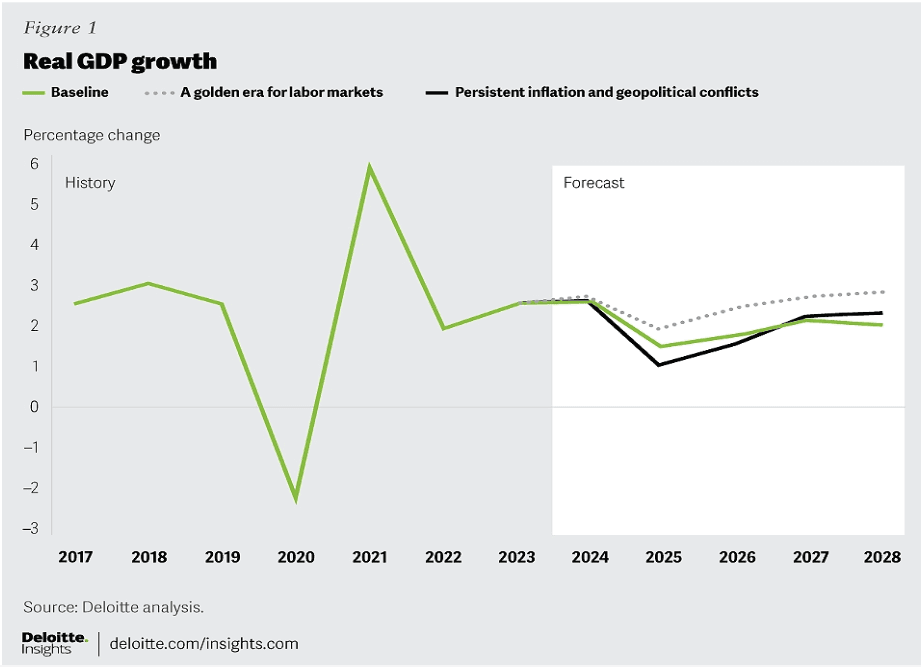

The number one reason to be bullish is that the US economy has a track record of outperforming expectations due to robust consumer spending and high business investment. Deloitte expect this to continue with 2.7% real GDP growth in 2024 followed by 1.5% in 2025, and an economic recovery thereafter. Whilst that outlook represents a significant slowdown in growth next year, it’s the best case soft landing scenario that the Fed is striving for.

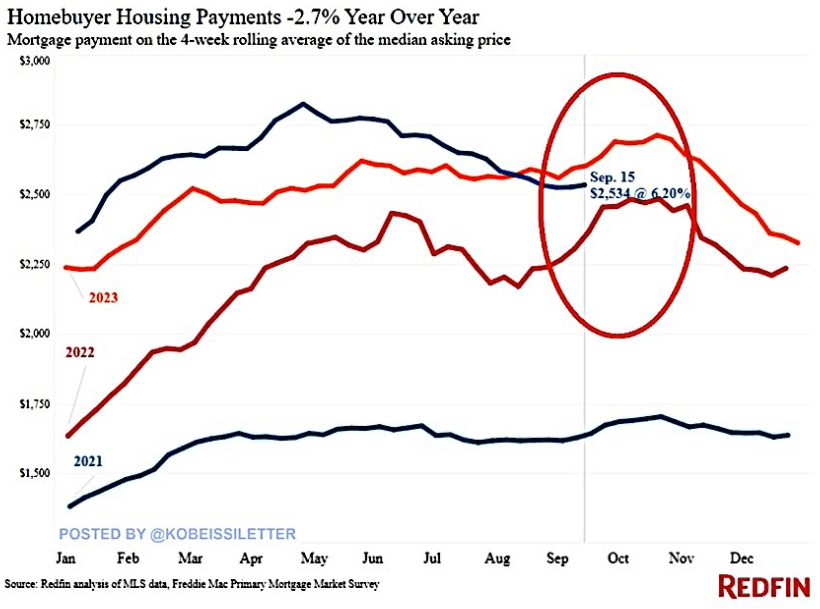

Households are set to benefit as rates fall and mortgage costs decrease. US mortgage payments already fell 2.7% in the year to September and will further fall after the Fed’s recent rate cut.

Unfortunately, there are also compelling reasons to be pessimistic about the US economy:

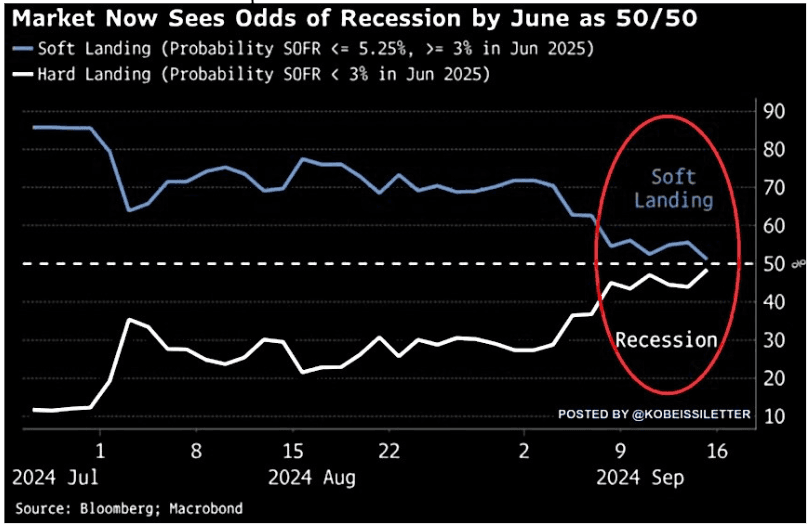

The most significant reason to be cautious is that the market has priced in a 50% chance of a US recession by next June. That’s an unusually high chance of a recession in a market that tends to see the economic cup as half full.

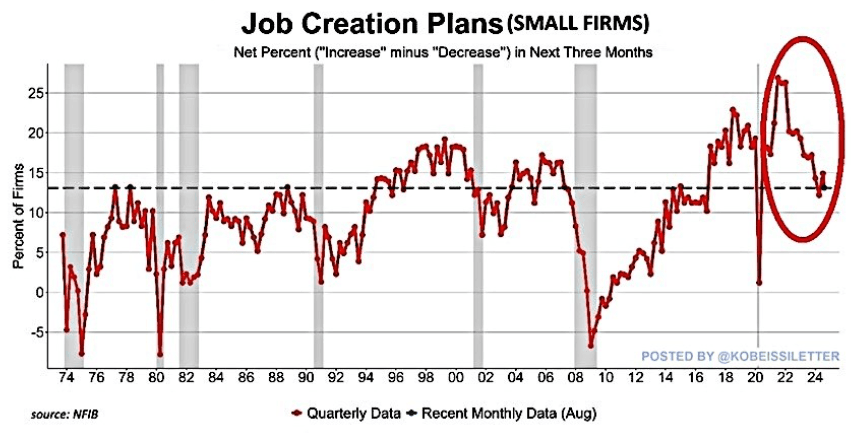

US unemployment increased to 4.2% in August, which is approaching a 3-year high. Worryingly, the unemployment rate for 16-24 year-olds has skyrocketed since April 2023 and hit 9.7% in August. And the percentage of small firms planning to hire over the next 3 months has halved in the past 3 years. These data points are not reflective of a solid economy.

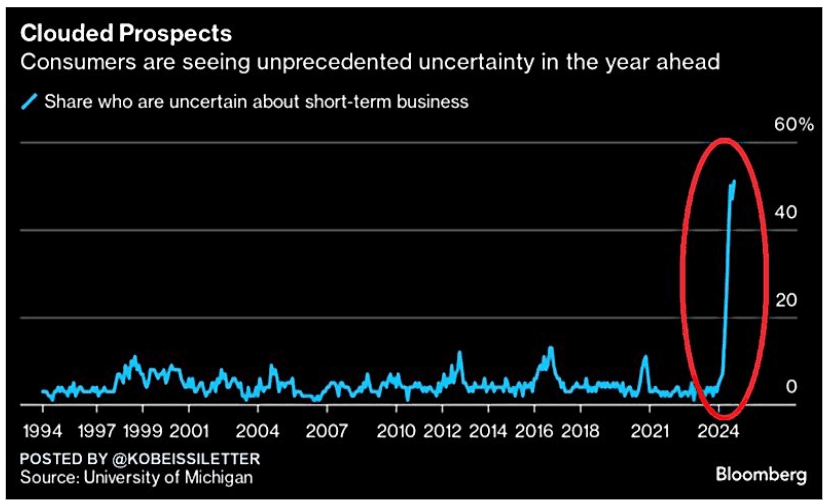

US consumers have never been more worried about the year ahead. It’s hard to overstate how bearish the chart below is considering it includes the GFC and the pandemic.

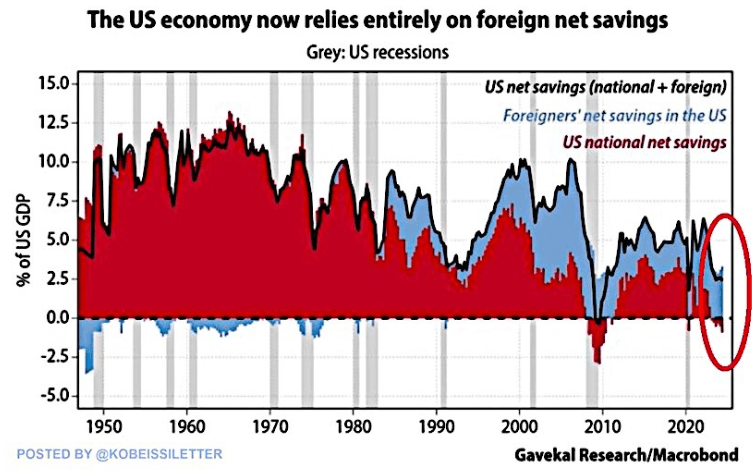

The US net savings rate has been negative for the past 6 consecutive quarters. This is a concern as it implies the US economy is dependent on foreign net savings at a time when the risk of an economic slowdown is high.

Confused by this mixed picture? Good, that means you’ve digested the extent of the economic forecasting challenge. The truth is no one knows for sure what’s coming. The best investors can do is digest the fact that the risk of a US recession is currently elevated whilst the US economy has a track record of silencing the naysayers.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Investment risk has risen

Being realistic rather than assuming one particular US economic outcome is probably the most fruitful strategy right now.

The reality is that Fed rate-cutting cycles have pre-empted US recessions 61% of the time and markets are currently pricing in a 50% chance of a US recession by June next year. So investment risk has clearly risen. That’s not to say a US recession is definitely coming, but the key point for investors is that investment risk has risen, even if markets haven’t yet priced it in.

Even in a best case scenario in which the Fed achieves a soft landing, volatility is likely to rise in the interim as this risk is priced in. And in the worst case scenario of a looming US recession, the downside risk is clearly more significant.

Either way, investors are likely to be well-served by being well-diversified across a range of asset classes whilst remaining committed to their long term investment plans. And don’t forget to dollar cost average as and when volatility next rears its head.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.