Pay Down Your Mortgage or Top Up Your Super: What’s the Better choice?

Ankita Rai

Thu 7 Aug 2025 6 minutesOne of the more common questions many Australians face is deciding whether to use spare cash to pay down their mortgage or to top up their superannuation.

It can seem like a straightforward choice. After all, average variable mortgage rates are currently 6.4% p.a., while many growth-oriented super funds have recently delivered returns closer to 9% p.a.

However, those numbers don’t tell the whole story. Super may offer better long-term growth and tax advantages, but financial decisions aren’t made on spreadsheets alone. Your comfort with debt, your stage of life, and your long-term goals all play a part.

Here are a few key factors to weigh up that could influence the best outcome for you:

1. Tax Considerations

One major advantage superannuation holds over mortgage repayments is tax efficiency. Concessional super contributions are taxed at only 15%, significantly lower than the marginal tax rates (up to 47%) faced by higher-income earners.

For example, someone earning $150,000 who saves $500 a month from their take-home pay for extra mortgage repayments could instead salary sacrifice around $800 into super. Their take-home pay would still fall by $500, but because super contributions are taxed at just 15%, more of their money would stay invested.

The size of this benefit depends on your income. For someone earning around $50,000, the tax difference is minimal. So they may be better off focusing on their mortgage.

It’s also important to keep the concessional super contributions cap in mind, currently set at $30,000 per year. Contributions above this are taxed at the marginal rate, and for incomes over $250,000, Division 293 tax further reduces the value of adding extra to super.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Mortgage & Liquidity

In contrast to super’s tax benefits, mortgage repayments offer certainty and liquidity. Each extra dollar paid goes straight toward reducing interest and cutting down the loan term, delivering a clear return.

Offset accounts take that further by giving flexibility. Funds in an offset account remain accessible, which can be useful when unexpected expenses arise. This strategy often appeals to those who value having control over their money in the short to medium term.

There’s also a psychological benefit. Watching your loan balance decline can ease financial stress, particularly during periods of economic uncertainty.

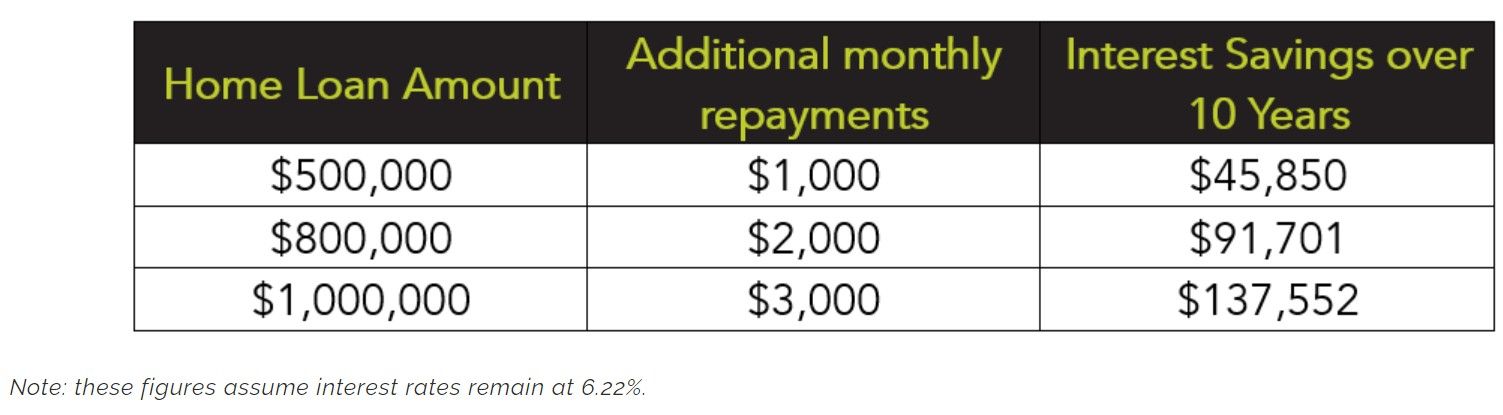

And the numbers can really add up. For instance, a $500,000 loan with an extra $1,000 in monthly repayments could save around $45,850 in interest over 10 years. Increase that to $2,000 a month on an $800,000 loan, and the interest saved rises to over $91,000.

3. Long-Term Growth Potential

But where mortgage repayments deliver certainty, super offers the power of compounding over time. Even small, regular contributions can lead to substantial growth, thanks to its tax-friendly structure and reinvested investment earnings.

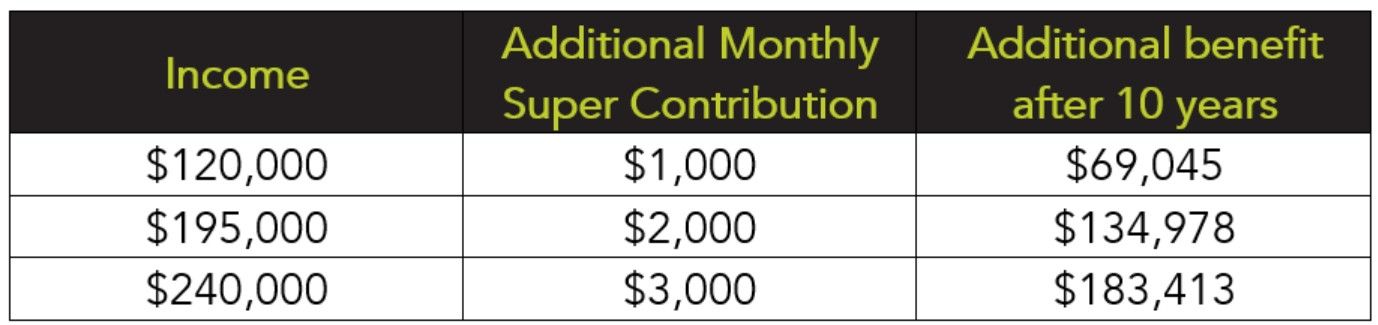

In fact, based on a 7.6% p.a. return, someone contributing an extra $1,000 per month to super could see their balance grow by roughly $69,000 over 10 years. With $2,000 a month, that jumps to around $135,000—and close to $183,000 for $3,000 monthly contributions. These figures factor in both tax savings and compound growth.

That said, superannuation comes with a major trade-off: access. Unless you’ve met a condition of release (like retirement), those funds are locked away. So while the return potential may be attractive, it won’t suit every situation, particularly if you need the flexibility to access your money in the short to medium term.

The Logic Behind Both Options

Looking purely at the numbers, super contributions often come out ahead. But that’s only one side of the equation.

The right choice depends on what matters more to you right now: flexibility and certainty, or future-focused growth. And that balance shifts as you move through different life stages:

- In the 30s: Flexibility First

This decade often comes with major life transitions, such as buying a home and starting a family. At this stage, financial flexibility tends to matter most. Extra mortgage repayments or using an offset account can help reduce interest while keeping funds within reach if needed.

At the same time, maxing out concessional super contributions each year should be sufficient to build early momentum, while you focus on investing outside super.

And for those with capacity, a few lump sum mortgage payments early on can shorten the term and deliver meaningful interest savings.

- In Your 40s & 50s: Focus on Tax Efficiency

This period often coincides with peak earning potential and more predictable expenses, making tax-effective super contributions especially appealing. Salary sacrificing into super is an excellent way to convert taxable income into long-term wealth.

Mortgage repayments remain essential, but at this stage, the tax benefits and leverage gained from super typically outweigh the guaranteed returns from mortgage repayments alone. A balanced approach here is often optimal.

- In Your 60s: Stability Takes Centre Stage

As retirement approaches, debt reduction generally becomes a priority. Clearing your mortgage can dramatically simplify your financial situation, reduce retirement expenses, and offer greater financial freedom.

Super also continues to play an important role, enabling tax-free withdrawals after age 60 to reduce remaining debt or fund retirement lifestyle costs.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Not Either-Or. It’s What Matters to You

Ultimately, the decision between mortgage repayments and super contributions isn’t about picking a universally superior option but aligning the choice to your individual goals and circumstances.

Often, the optimal approach blends both strategies, adjusting the balance as you progress through different life stages.

In the end, the best financial decision would be the one providing immediate reassurance today and lasting peace of mind into retirement.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.