How Much Do You Really Need to Retire Comfortably?

Ankita Rai

Thu 26 Jun 2025 5 minutesOne of the biggest myths in retirement planning is that you need $1 million to live comfortably. It’s an easy target to remember, but for many Australians that number may feel out of reach.

The truth is there’s no one-size-fits-all magic number for retirement. How much you actually need depends entirely on the lifestyle you want and what comfort means to you.

The Price Tag for a Comfortable Retirement

Most Australians can enjoy a comfortable retirement with far less than seven figure super balances, whilst enjoying local holidays, dinners out, and a few leisure activities.

That said, there are some helpful benchmarks to be aware of.

According to ASFA, a home-owning couple needs about $690,000 in super to retire comfortably.

For a single homeowner, that number sits at $595,000 which translates into annual spending of roughly $73,875 for couples and $52,383 for singles, and covers essentials like food, healthcare, transport, as well as the occasional overseas trip.

Take, for example, a suburban couple in their late sixties, recently retired and mortgage-free. With around $700,000 in savings and a partial Age Pension, they could spend about $75,000 a year. That’s enough to enjoy a comfortable retirement, complete with a golf membership, dining out, and an annual trip to Noosa. With no debt and a steady income, they’d even have some breathing room to cover more expenses.

But that’s not the only version of retirement. Some people are more than happy with a quieter, more laid-back lifestyle. Long walks, a bit of gardening, home-cooked meals, catching up with family, and streaming your favourite shows. If that’s more your pace, the numbers look very different.

For this kind of lifestyle, the cost of retirement drops quite a bit, making it achievable even with smaller retirement savings—say around $100,000—and full reliance on the Age Pension, especially if your home is fully paid off.

ASFA estimates that for a more modest lifestyle, with fewer holidays, basic outings, and a simpler car, you’d need much less: about $47,470 a year for a couple and $32,897 for a single person.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Big Wildcard: Housing

Without a paid-off home, retirement becomes significantly more expensive. Renters face much higher living costs, which can dramatically impact their financial security.

ASFA puts the cost of a modest retirement for renters at $64,259 per year for couples and $46,663 for singles, a big jump from homeowners.

So, for a retired couple with $400,000 in super and no home of their own, they might be paying around $450 a week in rent, even after factoring in Rent Assistance. That pushes their total annual spending up to about $64,259.

Even with the Age Pension and supplements, roughly $45,037 a year, they’d still need at least $65,000 or more to maintain even a modest lifestyle. That’s just to cover the basics such as rent, groceries and healthcare.

So, What’s the Magic Number?

There isn’t one.

It really comes down to your goals, your lifestyle, and what you consider essential. That said, a handy guide is to aim for a retirement income that’s around 70% of your current take-home pay, according to Grattan Institute.

It says that the 70% target works well for most people, especially homeowners. The government’s Retirement Income Review backs that too, suggesting a target range of 65–75% of your pre-retirement income. That includes income from super and the Age Pension, but not your other savings.

Now, if you’re still paying rent or carrying debt, that 70% might not be enough. You’ll probably need more to maintain the same lifestyle.

Budgeting and Planning for Longevity

A comfortable retirement isn’t just about hitting a savings target. It’s also about making your money last and building a plan that fits the kind of life you want to live.

That means thinking ahead by asking questions such as:

- When do you want to retire?

- How long might you need your money to stretch?

- Will you sell any assets along the way?

- What income will you be relying on: super, investments, the Age Pension?

It also helps to clarify how you want to spend your time, and whether you’ll need to budget for aged care or support family later in life.

For many Australians, the Age Pension remains a vital part of the mix. It currently provides around $29,000 a year for singles and $44,000 for couples, depending on your income and assets. While it generally covers the basics, even modest super savings can meaningfully boost your quality of life.

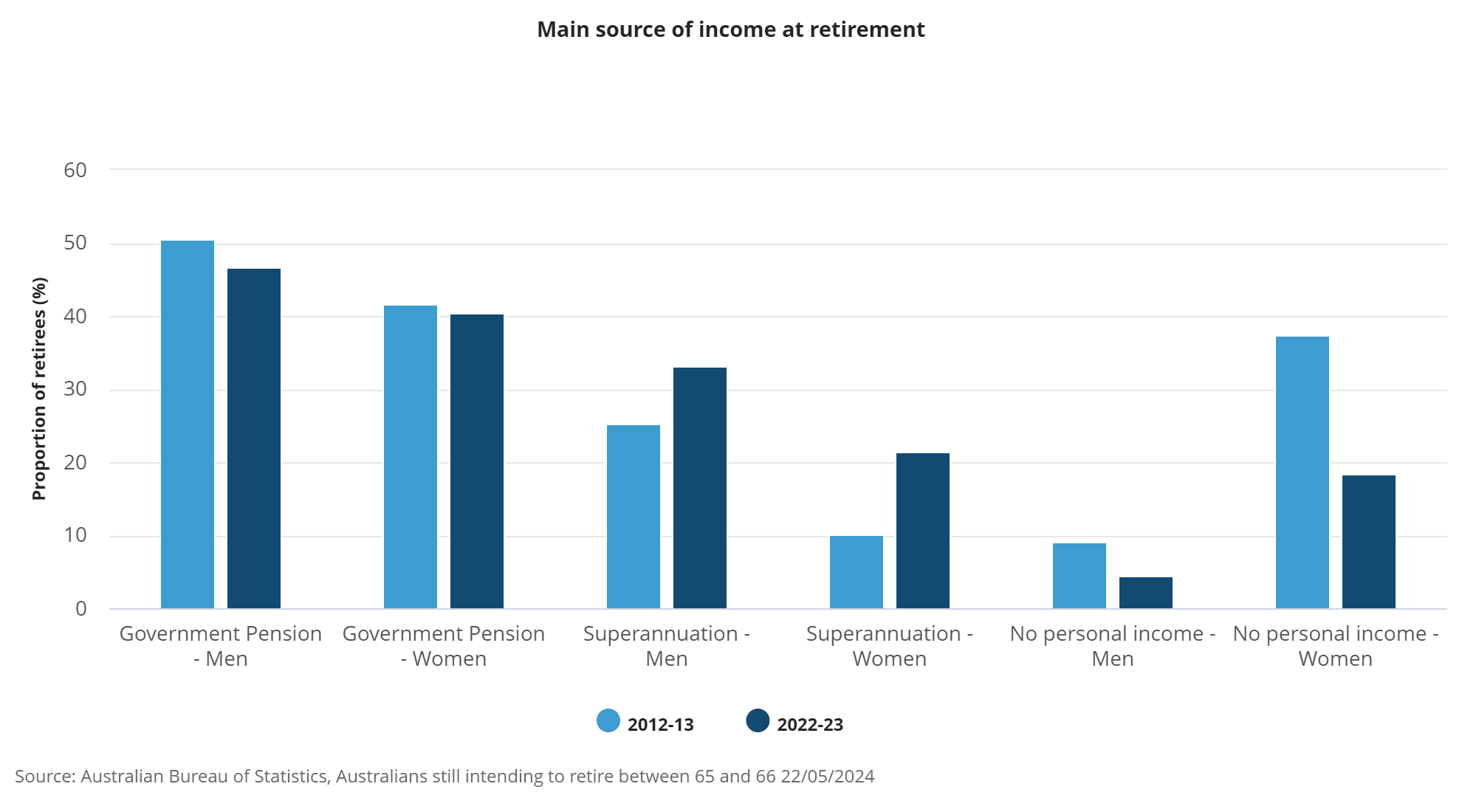

In fact, the Age Pension is still the primary income source for many retirees, followed by super and private pensions, as shown in the chart below

Government concessions—like discounts on healthcare, transport, and utilities—can also add thousands of dollars in annual value. But even with these supports, renters and those with limited super may find their budgets stretched.

That’s why planning, not just for the day you retire but for the decades that follow, really matters.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Retirement on Your Terms

There’s no magic number when it comes to a comfortable retirement. Whether it’s travelling, spending time with your grandkids, or enjoying a daily coffee at your favourite café, the most satisfying retirement is one that reflects your values.

What matters is having diverse income sources—like super, pension, savings, or property—that support the kind of lifestyle you want.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.