Why Salary Sacrifice into Super Still Stacks Up

Ankita Rai

Thu 5 Jun 2025 5 minutesSalary sacrificing into super has long been one of the most effective ways to manage taxes while building long-term wealth.

Even with new rules on the horizon—like the proposed tax on super balances above $3 million cap—the fundamental attractions of this strategy remain unchanged.

In a high-tax environment, it’s worth taking a fresh look at how this tax-efficient strategy fits into your broader financial plan.

What Salary Sacrifice Means

Salary sacrificing is an agreement with your employer to redirect part of your pre-tax salary into your super fund. That lowers your taxable income now while boosting your future savings.

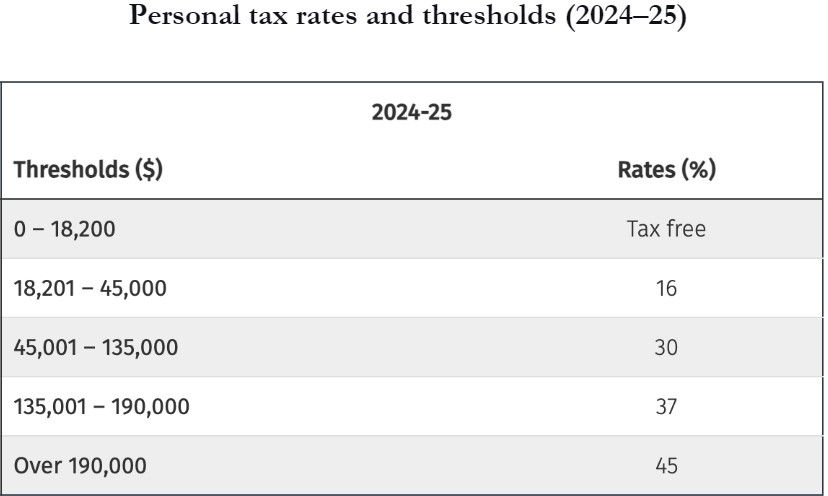

Since concessional contributions are taxed at just 15% versus up to 47% at your marginal rate, you are letting more of your income work for your retirement.

That’s why salary sacrifice has long been popular: it’s tax-efficient and designed for long-term growth. For those in higher tax brackets (as shown below), the difference is immediate and meaningful.

What makes this strategy so powerful is the compounding advantage. Contributing before tax means more of your income stays invested, and inside super’s lower-tax environment, that money has a longer runway to grow.

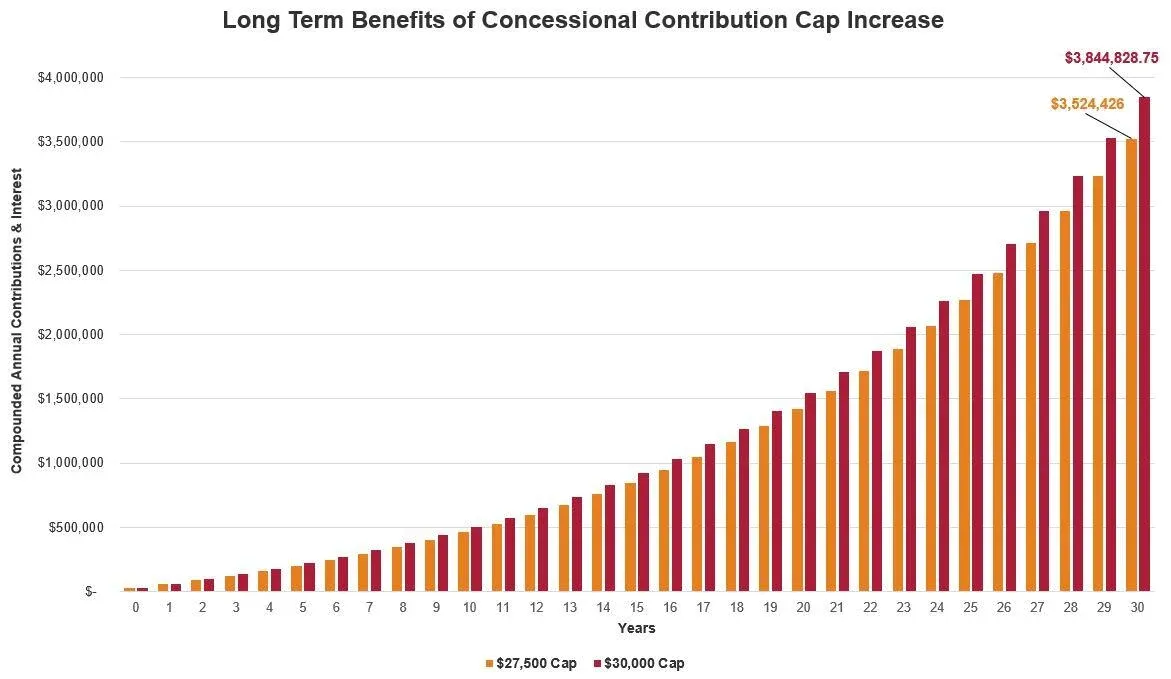

Even a modest boost to your annual contributions from $27,500 to $30,000 can add up significantly over time. As shown below, that extra $2,500 p.a. could translate to over $166,000 more in super after 30 years, assuming a 5% annual return.

That said, this approach works best for those in a position to take the long view—typically middle to high-income earners who:

Have enough financial flexibility to reduce their take-home pay;

Prefer to prioritise long-term goals over short-term spending;

Are comfortable locking away funds until retirement.

If your income is stable, your emergency fund’s sorted, and you are planning ahead, salary sacrifice can be a straightforward way to build your super without cramping your lifestyle.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Know Your Limits

There’s no hard cap on how much of your salary you can sacrifice (unless your employment agreement sets one), but there are some important rules to keep in mind.

If you’re considering increasing your salary sacrifice contributions, it’s a good idea to review your total contributions for the year:

The concessional contributions cap is $30,000 for the 2024–25 financial year. This includes employer super, salary sacrifice, and personal deductible contributions. It’s the maximum you can contribute at the concessional tax rate before additional tax kicks in.

If your super balance is under $500,000, you may be able to catch up using unused cap space from the past five years. That’s especially useful if you’ve had lower income years or received a bonus.

For higher-income earners, Division 293 tax can also apply. Once your combined income and concessional contributions exceed $250,000, a portion of your super contributions may be taxed at 30% instead of 15%.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Case for Staying the Course

Salary sacrificing into super is one of those strategies that can even hold up well when markets get rocky.

Because contributions are regular and aligned with your pay cycle, you are naturally dollar-cost averaging. You buy more when markets dip and less when they rise. Over time, this helps smooth out returns and lower risk.

Plus, the upfront tax savings give you a built-in buffer. That kind of downside protection is hard to replicate elsewhere.

Even with the looming tax on balances above $3 million, the fundamentals of this strategy hold up. Yes, the cap is frustrating—it’s not indexed and may hit more people than intended over time.

But that’s no reason to abandon a good strategy. Super remains one of the most tax-effective long-term wealth builders out there. And rules can (and do) change.

Staying the course still stacks up.

Don’t Ignore the Trade-offs

Salary sacrificing isn’t without its downsides.

The biggest trade-off is that the funds are locked away until preservation age—usually between 55 and 60, depending on date of birth—or 65 if the investor is still working.

That means no access for purchases like a house deposit or a new car. Super is strictly for retirement, and the rules reflect that.

It also reduces your take-home pay, which can make it harder to save for short-term goals or meet mortgage repayments. And while it lowers your taxable income, it may also reduce your borrowing capacity — not ideal if you’re juggling high living costs or planning for big near-term expenses.

A Strategy That Favours the Long View

Salary sacrificing isn’t about chasing short-term returns. It’s about building habits and structures that take advantage of Australia’s tax system in a way that’s relatively hands-off.

It doesn’t promise overnight riches. But that’s exactly why it works. It’s built on fundamentals: lower your tax, invest more, and let time do the heavy lifting for you. And while no strategy is immune to rule changes, the idea of using pre-tax dollars to build long-term wealth remains as solid as ever.

In a world full of noise, this quiet strategy still has the potential to deliver.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.