The Importance of Holding Cash in this Precarious Market

Simon Turner

Mon 9 Jun 2025 5 minutesThe world has changed and global markets appear to be trying to tell investors something important: this is a time for caution, not bravado.

As global economic and geopolitical uncertainties deepen, one of the most underrated advantages you can give yourself is simple but not easy: holding a sizeable cash weighting…

Why Volatility Isn’t Going Anywhere

If you were surprised by the Trump Dump, it’s time to get on the front foot for what’s coming next.

There are three main reasons why volatility is likely to return across global markets in the coming weeks or months:

1. Developed Market Debt Levels Are Creating Uncharted Risks

Let’s not beat around the bush: we’re no longer operating in a typical developed market environment.

The U.S. and many major economies, Europe and Japan included, are showing characteristics that resemble emerging markets more than the stable, fiscally responsible developed markets they once were.

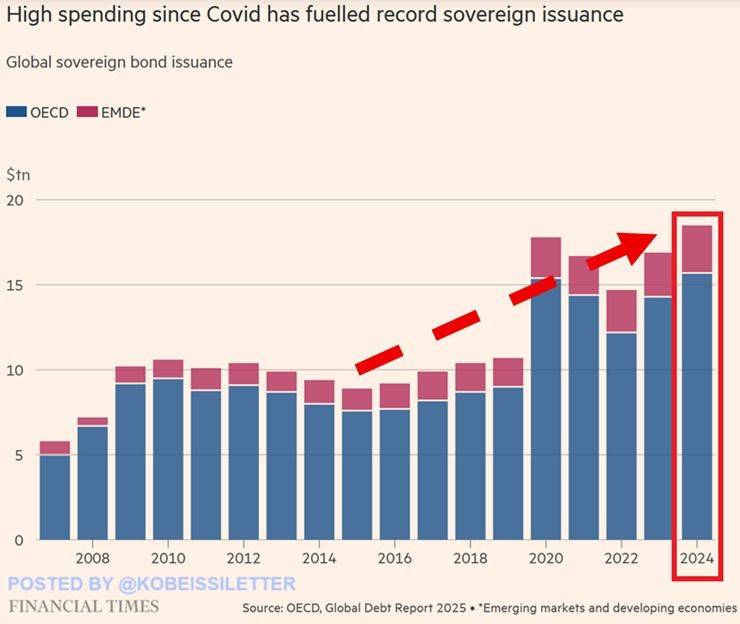

As a result, global sovereign bond issuance continues to rise with government fiscal control becoming a thing of the past:

No historical roadmap exists for what’s occurring or what’s coming next, and that alone should raise investors’ guards.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. Long-Dated U.S. Rates Are Telling a Worrying Story

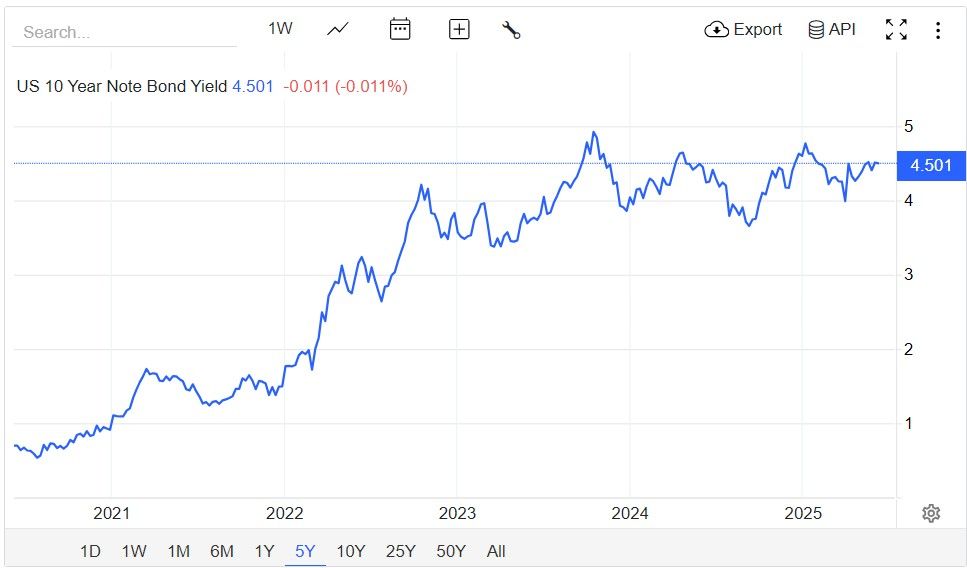

The U.S. Treasury market is already flashing warning signals.

Watch the long end of the U.S. yield curve. The market appears to be pricing in a world of higher long-term U.S. rates, despite current relatively high equity valuations and widespread leverage.

This steepening yield curve appears to be signalling America’s transition from a traditional developed market funding structure to one with more emerging market-like dynamics and risks. That means higher interest rates are likely to be needed to compensate investors for those risks.

While this transition won’t happen overnight, in a highly levered system, breakdowns can occur suddenly and without warning. Refinancing needs are growing, but markets haven’t yet priced in the new realities of higher rates. With U.S. Treasury Notes potentially facing a period of unravelling while huge amounts of private market debt still marked at unrealistic levels, a liquidity crunch could come fast and hard.

When price discovery finally kicks in, many so-called ‘safe’ assets may reprice violently.

If that’s indeed the new narrative, investors’ portfolios should be ready for it.

3. Developed Market Governments Unlikely to Intervene Until It’s Too Late

Of course, markets are used to central banks and governments intervening whenever there’s a problem.But it’s worth remembering that policymakers only generally act when crises hit full force. And their toolbox of solutions is limited. Each crisis brings with it unique challenges, but the typical playbook of developed market governments is injecting liquidity, which only tends to worsen the long-term structural problems catalysing their intervention.

Debt monetisation (governments borrowing money from central banks) and ‘run-it-hot’ economic policies may eventually emerge, but until there’s a coordinated shift in public sector fiscal management, real economy assets will remain exposed to a longer list of risks than investors are used to.

In short, investors shouldn’t expect meaningful government support until something breaks in the system.

Why Holding Cash Makes Strategic Sense

One of the core truths of investing is: protecting capital is far harder than growing it.

So in uncertain times, defence is often the best offense.

Holding cash isn’t about fear; it’s about flexibility. When markets flash red but you’re unsure what may come next, ensuring you have a sizeable cash weighting is conscious preparation to survive the long game.

Warren Buffett showed the world how to make extraordinary returns by thinking like this: hold a large cash weighting, wait for panic, then strike. That’s when you earn superior returns: during periods of dislocation, rather than when everything is fairly priced.

But to do that effectively, you need to raise the cash before the panic sets in. The GFC taught investors a painful lesson on that front: in a true margin call, everything gets hit.

It’s also worth mentioning that holding cash doesn’t mean exiting the market entirely. Remaining invested in your highest-conviction funds, ETFs, and stocks is generally a sensible long-term strategy.

But rather than maintaining your cash weighting of 1-2%, or whatever your normal target is, now may be a sensible time to raise your cash weighting to a relatively high level by your standards—whether that means 10%, 15%, or higher.

It’s about being prudent and opportunistic based on the signals the market is giving investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Final Thoughts: Don’t Push When the Market Pulls

When the market stops rewarding investors’ efforts, the worst thing to do is push harder. Often, these periods of disconnect signal a broader change is underway. Recognising when your advantage is gone and raising a solid cash weighting may be one of the most important skills an investor can cultivate.

Right now, it’s not about chasing what’s next. It’s about preparing for it. Build your cash pile, protect your gains, and give yourself the time and clarity to recognise the next real opportunity when it comes. And it will.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.