How to make More Money in Bond Funds with a Superior Understanding of Duration

Simon Turner

Wed 11 Jun 2025 7 minutesIn the world of bond investing, few concepts are as powerful, or as misunderstood, as duration.

Often simplified as a measure of interest rate sensitivity, duration can be used as a powerful tool to help investors make more informed and profitable decisions when investing in bond funds.

Moreover, understanding duration at a deeper level can significantly enhance investors’ returns and reduce their risk by optimising timing, improving fund selection, and navigating changing interest rate environments more effectively…

What Is Duration, Really?

At its core, duration measures a bond’s price sensitivity to changes in interest rates, expressed in years.

For example, a bond with a duration of 5 years will decline 5% in price for every 1% rise in interest rates, assuming all else is equal.

But duration also offers deeper insight for bond investors. For example, it’s a proxy for when investors will receive the bulk of a bond’s cash flows, and thus its sensitivity to reinvestment risk, yield curve shifts, and monetary policy.

By way of background, there are two primary measures of duration:

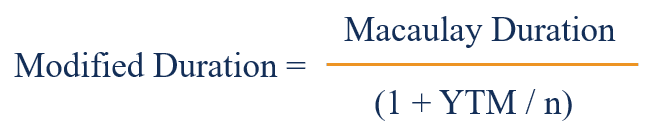

- Macaulay Duration: The weighted average time to receive cash flows.

- Modified Duration: The percentage price change for a 1% change in interest rates.

Here’s the relationship between Macaulay Duration and Modified Duration in a formula:

Bond funds, such as ETFs and managed portfolios, quote an average portfolio duration (using Macaulay Duration). This is generally defined as the weighted average of time to receipt of a fund’s aggregate cash flows.

Understanding how this figure behaves in different market contexts is often the edge that turns competent bond investors into experts.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Why Duration Matters More in a Volatile Rate Environment

In low-rate or rapidly shifting interest rate cycles, as we’ve experienced post-2020, duration becomes even more critical for bond investors.

The reason is simple: interest-rate risk, captured through duration, is often underestimated by the many investors who are focused on yield alone. Indeed, while high-yielding bond funds may appear attractive at face value, they often carry longer durations that expose investors to greater losses if rates were to rise.

Conversely, in environments where interest rates are expected to fall or stabilise, longer-duration bond funds can offer superior capital appreciation in addition to their income payments. This is because as rates fall, bond prices rise more dramatically for those with higher durations.

So making more money in bond funds isn’t just about chasing the highest yields. It’s also about using duration as an important fund selection criterion to ensure future interest rate movements work for you, rather than against you.

How to Use Duration Strategically

With duration introduced, we see three main opportunities for investors to use duration to make more money from their bond fund portfolios:

- 1. Align Duration with Your Outlook on Rates

Aligning your outlook for future interest rates with the duration of any bond funds you invest in is a prudent first step.

If you expect rates to rise, shorter-duration bond funds will be more defensive. That means they’ll experience less price erosion and will allow reinvestment at higher yields sooner than for longer-duration bonds.

For example, some savvy Australian bond investors in 2022–23 reduced their exposure to long-duration bond funds as soon as the RBA began aggressively hiking rates. In hindsight, that move saved them a lot of money.

In contrast, if you anticipate falling or plateauing rates (as may be the case at the moment), increasing duration can enable investors to lock in higher yields while benefitting from capital gains.

The sharp bond rally in early 2024 illustrated how long-duration funds rebounded powerfully once rate expectations shifted.

2. Match Duration to Your Investment Horizon

Duration also serves as a useful guideline for investment horizon matching.

As per Vanguard’s fixed income guidance notes: ‘Investors should aim to match the duration of their bond holdings with their time horizon to reduce interest rate risk.’

For example, if your investment timeframe is three years, a bond fund with similar duration is likely to help you balance your personal circumstances with the fund’s risk and return predictability.

3. Understand the Curve, Not Just the Average

Most investors just look at average duration, but yield curve shape also matters.

For example, a bond fund with 6-year average duration may include bonds ranging from 2 to 30 years.

However, inverting yield curves, whereby short-term rates exceed long-term, can distort how duration plays out. So prior to investing, advanced bond fund investors tend to examine portfolio duration distributions within fund commentaries to ensure they aren’t wrong-footed by a fund’s exposure.

Tip: Lonsec and Zenith research reports often dissect fund holdings by maturity buckets and duration exposures, helping investors better assess this risk.

Risk Management Through Duration Bucketing

As with most investment strategies, there are multiple ways of using duration to your advantage. In other words, you don’t have to pick one duration level and stick to it.

For example, some sophisticated investors use a duration barbell strategy which effectively combines short-duration and long-duration funds. The argument in favour of this strategy is that short-duration bonds may offer liquidity and limited downside whilst long-duration bonds offer higher return potential in a rate-cut cycle.

Blending the two strategies together gives a more nuanced risk-return profile, which may outperform single-duration strategies over time, particularly during rate cutting cycles.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Beware the Duration-Yield Trade-Off

Also, a warning: some bond investors are purely focused on yield and gravitate toward high-yield (junk) bond funds without realising that these often carry higher duration and credit risk.

But as MoneySmart cautions: ‘higher returns usually mean higher risks.’

A superior understanding of duration enables investors to clarify whether a fund’s return comes from yield, interest rate exposure, or credit risk, and whether that aligns with their strategy.

Using Tools and Resources

Due diligence prior to investment is the key. Platforms like InvestmentMarkets and Morningstar provide detailed fund fact sheets which generally include a fund’s effective duration, sector allocations, and credit quality.

Investors can use this data to:

- Compare bond funds with similar yields but different durations;

- Evaluate how actively managed funds adjust their portfolio duration through cycles;

- Monitor changes to fund durations over time (a signal of the manager’s macro view).

Duration Is a Profit Lever, Not Just a Risk Gauge

Some investors view duration as a warning label. But for informed investors, it’s a strategic lever to help them tilt their bond fund portfolios toward more favourable outcomes. When used thoughtfully, duration helps time market cycles, structure portfolios around investor goals, and manage risk with far more sophistication.

Ultimately, understanding duration at more than a surface level empowers investors to make more money—not by chasing yield, but by optimising the total return of their bond fund portfolios.

Bond Funds Worth Checking Out

Bond ETFs Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.