Why Childcare Infrastructure is So Defensive

Simon Turner

Wed 29 Oct 2025 6 minutesMost investors think of healthcare property as the pinnacle of the commercial property defensiveness. But there’s another essential service property which is on the rise in defensive allocations, and for good reason: childcare infrastructure.

Australia’s early learning sector has evolved into an essential infrastructure play supported by billions of dollars of public funding and long-duration private capital. As a result, childcare property now looks and behaves like defensive social infrastructure with long leases, CPI-linked rent growth, resilient tenants, and structural demand growth underpinned by favourable demographics and policy.

Structural Demand Growth

All truly defensive investments depend upon demand growth that’s structural in nature. That appears to be the case in childcare infrastructure care of two long-term growth drivers which appear to be about as sustainable as they come:

-

Higher Childcare Subsidies

Despite recent progress, childcare remains the largest barrier to female labour-force participation, so policy pressure to expand access and reduce costs persists. In fact, the Productivity Commission’s final report recommended that every child should be able to access at least 30 hours (≈3 days) a week of high-quality early education by 2036.

Supportive action is happening. The Cheaper Child Care reforms lifted subsidies in July 2023 by raising the maximum Child Care Subsidy (CCS) rate to 90% for families earning up to $80k, and tapering with income levels. This shift materially improved childcare affordability for millions of Australian households.

We can expect more of the same looking forward. The message from the ACCC’s inquiry into the sector, published in January 2024, was clear: the Government must make the childcare market work via continued funding support, and closer oversight of fees and quality.

These multiple policy signals suggest there’s a long runway ahead for childcare capacity and quality investment. -

Favourable Demographics

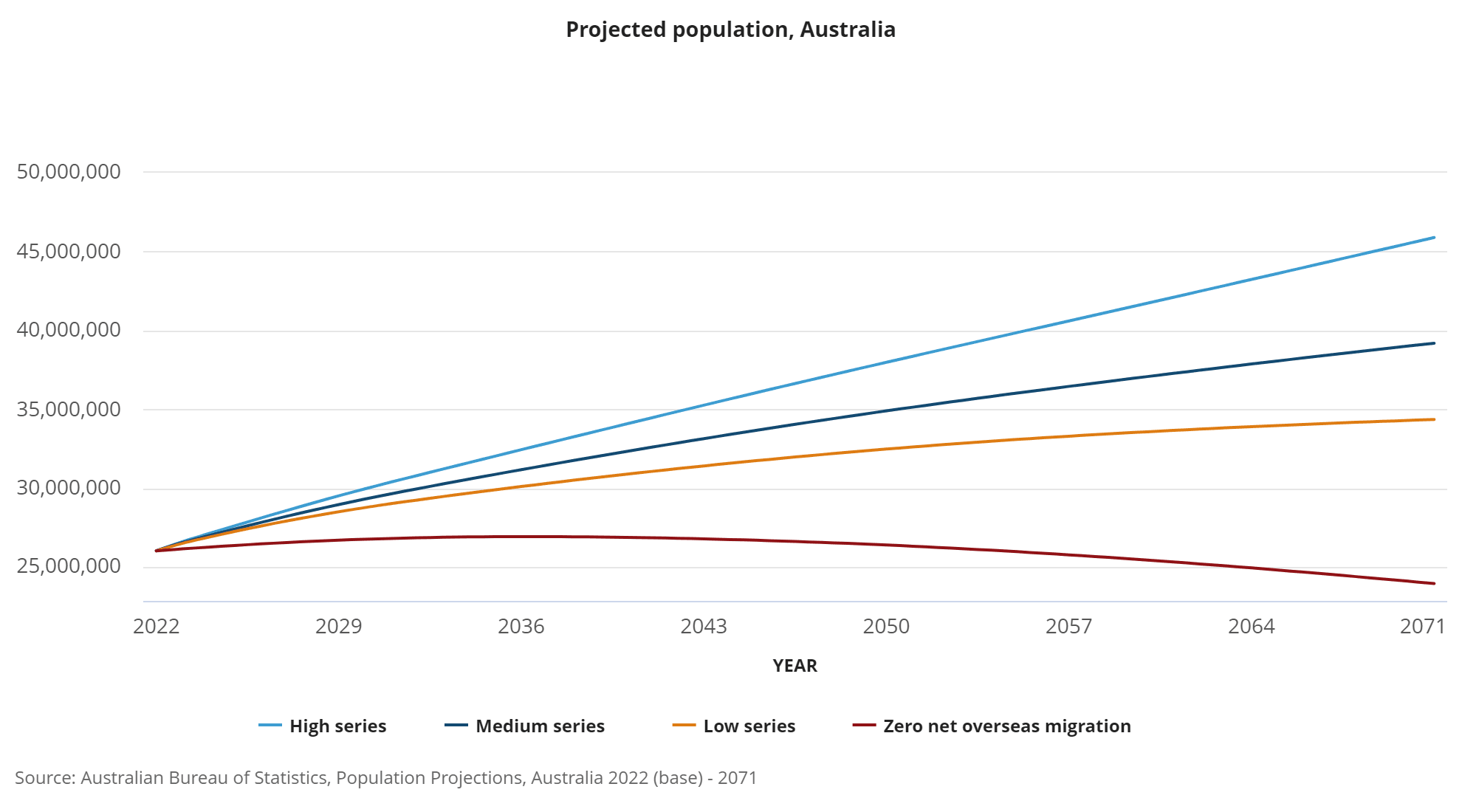

Like healthcare, the childcare sector is positioned to benefit from a growing population of parents and children needing its services. Enter demographics as a structural growth driver. In particular, net immigration represents a consistent, long-term growth driver for the sector. The numbers are compelling. Net overseas migration added 536k people to the Australian population in FY24, 446k in FY24, and a projected 335k in FY25. If those net migration numbers were to continue, the population growth outlook is roughly aligned with the ABS’s high migration scenario presented below.

This demographic backdrop spells solid childcare demand growth for years and decades to come.

The Defensive Features of Social Infrastructure

Structural demand growth is one thing, but a truly defensive commercial property investment requires more than that. In particular, childcare infrastructure offers three important attributes which tick the boxes property investors need to tick with their defensive allocations:

-

Very Long Leases

Property investors wanting defensive exposure like knowing their property funds offer long-term, predictable recurring income. Childcare offers this.

For example, of the major listed players, Arena REIT (ASX: ARF) has a WALE (Weighted Average Lease Expiry) of 18.5 years and Charter Hall Social Infrastructure REIT (ASX: CQE) has an 11.9 year WALE.

Leases this long term are common across the sector, and align with a sector facing a shortage of spare capacity. In addition, childcare operators tend to be very aware it takes years to build a thriving business in a chosen location. In other words, they want to know their time and money investment has the opportunity to create value for them. Very long leases give them the visibility they need to build a thriving childcare business. That’s great news for investors.

-

High Occupancy Rates

Occupancy rates tell the real story of market demand versus supply, and it’s a good one in the childcare sector. In short, most operators are at full capacity, or close to it. For example, Charter Hall Social Infrastructure REIT (ASX: CQE) has 100% occupancy rate.

-

CPI or Market-linked Rental Reviews

Inflation protection is also a must-have for all defensive commercial property plays. Childcare infrastructure funds also tick this box.

For example, Charter Hall Social Infrastructure REIT (ASX: CQE) reported a 3.5% weighted average rental uplift in 2024. Their management also highlighted that 43% of their income is subject to market reviews over the coming four years, after reporting a 16.4% increase on their recent rent reviews.

That spells under-renting as a theme across the sector.

Arena REIT (ASX: ARF) is in a similar boat. 95% of their FY25-FY28 rental reviews will be contracted at CPI, or the higher of CPI or fixed.

That’s about as much inflation protection as you’ll find in any commercial property funds.

These textbook social-infrastructure traits combine to create a bond-like income profile with inflation protection, while development yields in the ~5–6% range (on long WALEs) help maintain attractive total returns through cycles.

A Few Risks to Be Aware Of

Of course, no investment is without risk. There are a couple of main ones to be aware of in the childcare infrastructure sector:

-

Policy Risk

More than a few investors are cautious about investing in sectors which are dependent on government policy. Fair dues. The Government remains the ultimate childcare co-payer via the CCS.

While the direction of travel in policy is clearly toward broader childcare access, which is historically supportive of occupancy and rental growth, this pathway does depend upon consistent, long-term government policy regardless of the political party in power at the time.

At this time, this appears likely, but it’s arguably the most significant risk to be aware of.

-

Cap-rate Sensitivity

As with all real assets, childcare infrastructure valuations are affected by interest rates. The main offsets are contracted rent growth (CPI/fixed/market reviews) and development pipelines.

But there’s no escaping the fact that the direction of interest rates will influence sector asset valuations. i.e. if interest rates fall, child care centre valuations will rise, and vice versa.

Childcare Exposure

Investors should arguably treat quality childcare infrastructure funds as core social infrastructure exposure: a diversifier versus traditional office and retail property, with inflation-linked cash flows and long duration. In short, it’s ideal commercial property exposure for investors wanting to increase their defensive allocation via real income-generating assets.

An Unlisted Childcare Fund Worth Checking Out

Learn More at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.