Should You Tap into Your Home Equity in Retirement?

Ankita Rai

Thu 9 Oct 2025 5 minutesFor many Australians heading into retirement, the family home is more than a roof. It’s a lifeline, a legacy, and often the biggest financial asset they’ll ever own.

After decades of price growth, with the typical home now costing around ten times the average wage, that equity is more valuable than ever.

But rising living costs and higher housing prices also mean more retirees are still paying off home loans well into their 60s and beyond.

The dream of a debt-free retirement is slipping further out of reach, held back by longer loan terms and later entry into the housing market.

In fact, Colonial First State’s Rethinking Retirement (2025) report found 28% of Australians aged 50–64 still have a mortgage, and 14% of retirees haven’t finished theirs. Most also want to stay in their family home, with only 13% with a mortgage planning to downsize.

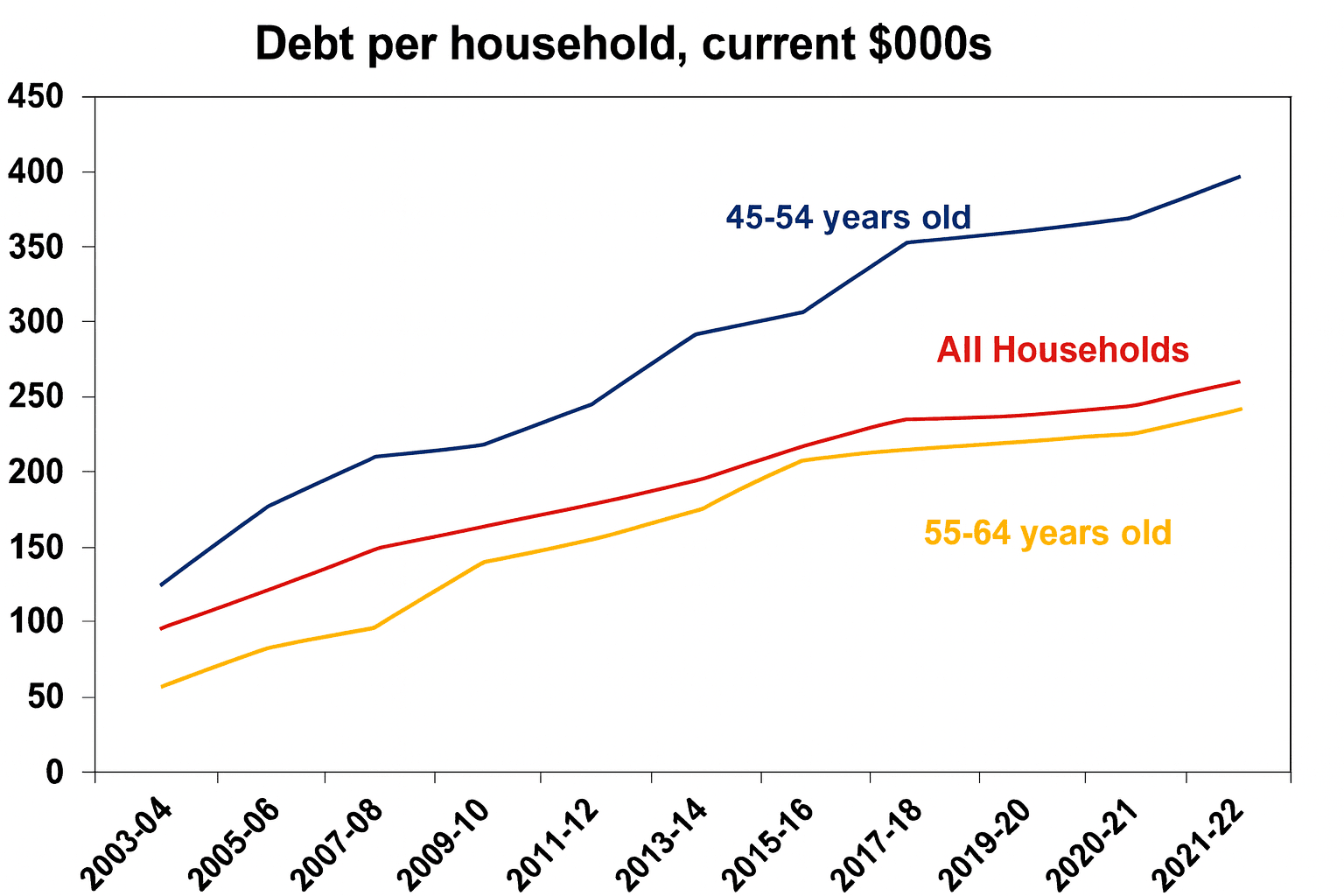

The AMP chart below shows that household debt for Australians aged 55 and over has quadrupled over the past 20 years.

Census trends tell a similar story. Over the past 20 years, the share of 55- to 64-year-olds who own their homes outright has almost halved, while first-home buyers over 37 have risen by about 16%.

All of this is reshaping the retirement landscape and forcing conversations about how to maintain your lifestyle and independence in later years. While some people delay retirement or dip into their super to reduce debt, those options aren’t always realistic.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How Reverse Mortgages Work

Reverse mortgages, once considered niche, have been on the rise since the federal Home Equity Access Scheme (HEAS) was revamped in 2019. By early 2024, more than 12,000 Australians were using HEAS (up from 9,700 in 2023), and commercial lenders like Heartland Group and Gateway Bank also reported growing demand.

So how do they work, and why are they gaining popularity?

A reverse mortgage lets you take a loan against your home equity, with an amount based on the value of the property and your age.

According to the MoneySmart, a 60-year-old can usually access about 15–20% of their home’s value, with the limit increasing by roughly 1% for each year over 60, with a minimum loan of around $10,000.

You can take the money as a lump sum, a steady income, or a line of credit, with no mandatory repayments while you live in the home.

The loan is usually repaid when you sell, move into aged care, or pass away. However, you can make voluntary repayments to keep compounding interest in check.

For many retirees, it’s this flexibility that makes a reverse mortgage appealing. It can be especially useful if you’re:

- Still carrying a mortgage but ready to stop working;

- Asset-rich but cash-poor;

- Keen to stay in your home and community;

- Looking for a lump sum or steady income to maintain your lifestyle.

The funds are tax-free too, and if used for non-assessable purposes such as home repairs or travel, they’re unlikely to affect your Age Pension entitlements.

The Real Costs to Consider

Despite the benefits, a reverse mortgage isn’t for everyone. It comes with long-term costs that deserve careful thought.

Because you don’t make regular repayments, interest compounds over time, which can eat into the value of your estate and reduce what’s left for beneficiaries.

Reverse mortgages often attract higher rates and fees than standard home loans, typically around 1.5% to 2% above the usual variable rate. Commercial lender rates generally range from about 8.25% to over 9.25% p.a., while the Australian Government’s Home Equity Access Scheme (HEAS) offers a far lower rate of 3.95% p.a.

Lenders may also charge ongoing fees and require regular property valuations. You’ll need to keep your home in good condition, stay up to date with council rates, and maintain insurance.

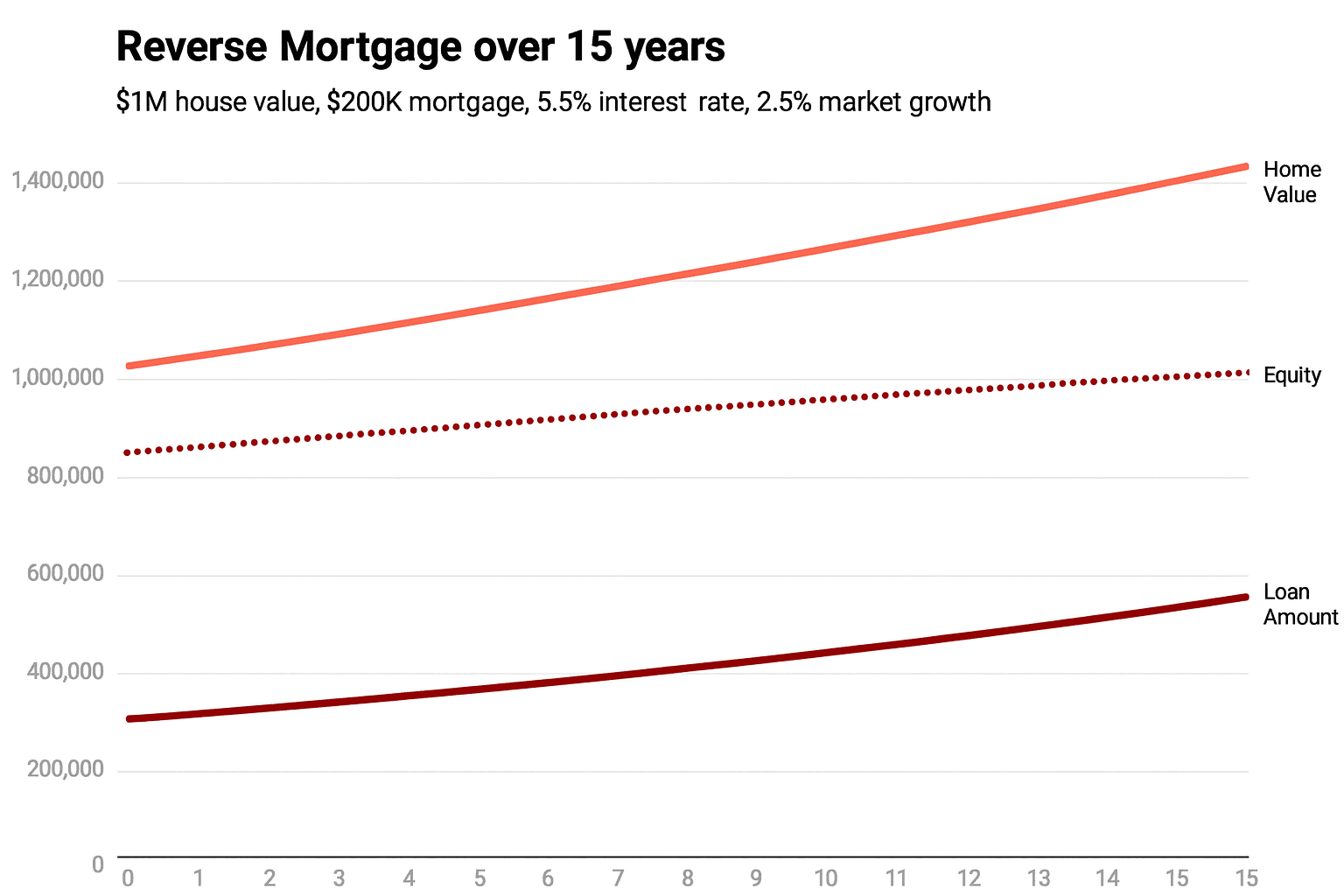

To put the numbers in perspective, here’s a simple example based on calculations from SimplyRetirement, (excluding establishment and monthly account fees).

If your home is worth $1 million and you borrow $200,000 at 5.5% p.a., assuming property values grow by around 2.5% a year, then after 15 years your loan could rise to about $455,000. Over the same period, your home’s value may increase to roughly $1.39 million, leaving you with around $992,000 in equity.

So while compound interest causes your debt to grow over time, steady property growth can help balance things out, softening its impact in the long run.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Before you Decide

A reverse mortgage can be a logical way to access your wealth and improve your quality of life in retirement as long as you understand the trade-offs and plan carefully for the long term.

These loans come with their own rules, costs that can catch borrowers off guard. The key is to go in with your eyes open. Know how the interest compounds, what fees apply, and how and when the loan must be repaid — often through the sale of your home.

So, if you plan to leave the property to your children, talk to them early so everyone understands the arrangement.

And above all, don’t borrow more than you truly need. It can be tempting to take the full amount available, but a smaller drawdown can help preserve your equity and give you more flexibility later.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.