The Quiet Private Markets Revolution

Simon Turner

Wed 12 Nov 2025 6 minutesA quiet reallocation toward the private markets is reshaping Australian portfolios. It’s not an anti-public market rebellion. Liquidity, transparency, and governance still matter. But it’s a recognition that the public markets are no longer the whole market. More of the world’s future cash flows are now owned by private investors.

As always, investors are fast adapting to this new reality. They’re lifting their private equity allocations, accepting less liquidity for more control, and building direct and co-investment capacity. And a growing class of specialist private equity managers is helping investors participate in this shift, democratising what was once institutional turf.

The Foundations of an Improving Cycle

Official interest rates have been front and centre in the shift to the private markets.

For most of the post-Covid bull run, public equities, especially the Magnificent Seven, seemed to be the only game in town.

The 525-basis-point lift in Fed rates between March 2022 and July 2023, led to a freezing in private market deal-making. Exit windows were slammed close. Debt costs surged.

But what looked like weakness at the time was often manager discipline. Many private equity managers simply refused to pay yesterday’s multiples with today’s money.

With rates now easing, those headwinds have turned into tailwinds. Bain argues that ‘easing rates could improve exit conditions rapidly.’

The industry is ready for the cycle to improve. It’s sitting on roughly $US1.2 trillion of dry powder, which is capital already raised and awaiting opportunities.

For long-term investors, this combination of discipline and firepower is a positive set-up.

Meanwhile, the breadth of global public markets has narrowed. In the US, the number of listed companies has fallen from over 6,500 in the late 1990s to 4,700 today, according to Meketa. Many of the most valuable companies in the AI, software, and advanced manufacturing sectors simply never list, or list much later than they used to. Private giants such as OpenAI raise billions of dollars before ever touching an exchange.

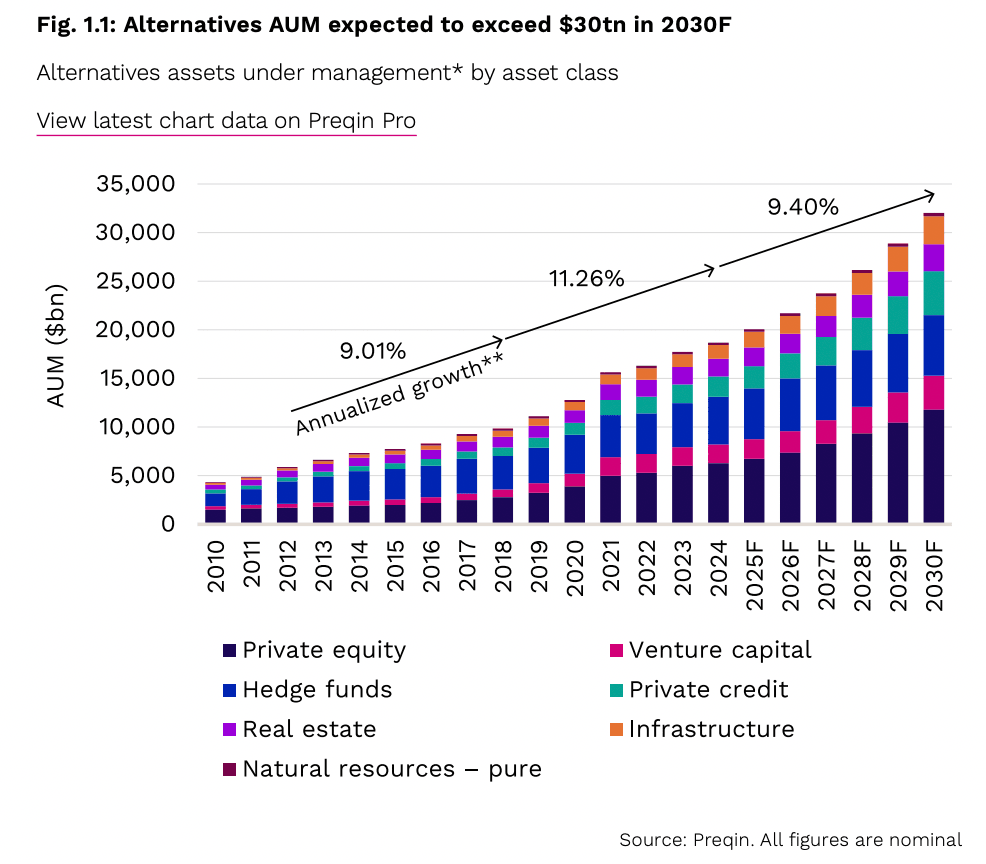

Private markets AUM (assets under management) growth is filling the public markets gaps, as shown below.

The takeaway for investors is clear: if you want access to tomorrow’s best investment opportunities, the on-ramp is increasingly via the private markets. The winners are likely to be the funds with differentiated strategies and operating expertise.

Local Alignment

Australia’s capital markets are heading in the same direction.

According to Rainmaker, Australian super accounts held about $400 billion in private-market assets as at June 30th, 2024, up 34% in just two years. Private equity still represented a modest 4.4% of total assets, but the trend is clearly up.

AustralianSuper, for example, disclosed that 5% of its balanced super option is already allocated to private equity. They plan to lift that allocation toward 8% by 2030 when fund assets are expected to top $500 billion. This move isn’t just about chasing yield. They’re aiming to improve their early access to growth businesses before the public markets fully price them, while also hedging against the unavoidable concentration risk of tech-heavy global indices.

In short, Australia’s largest funds aren’t retreating from private markets. They’re leaning in, carefully.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A Simple Investment Case

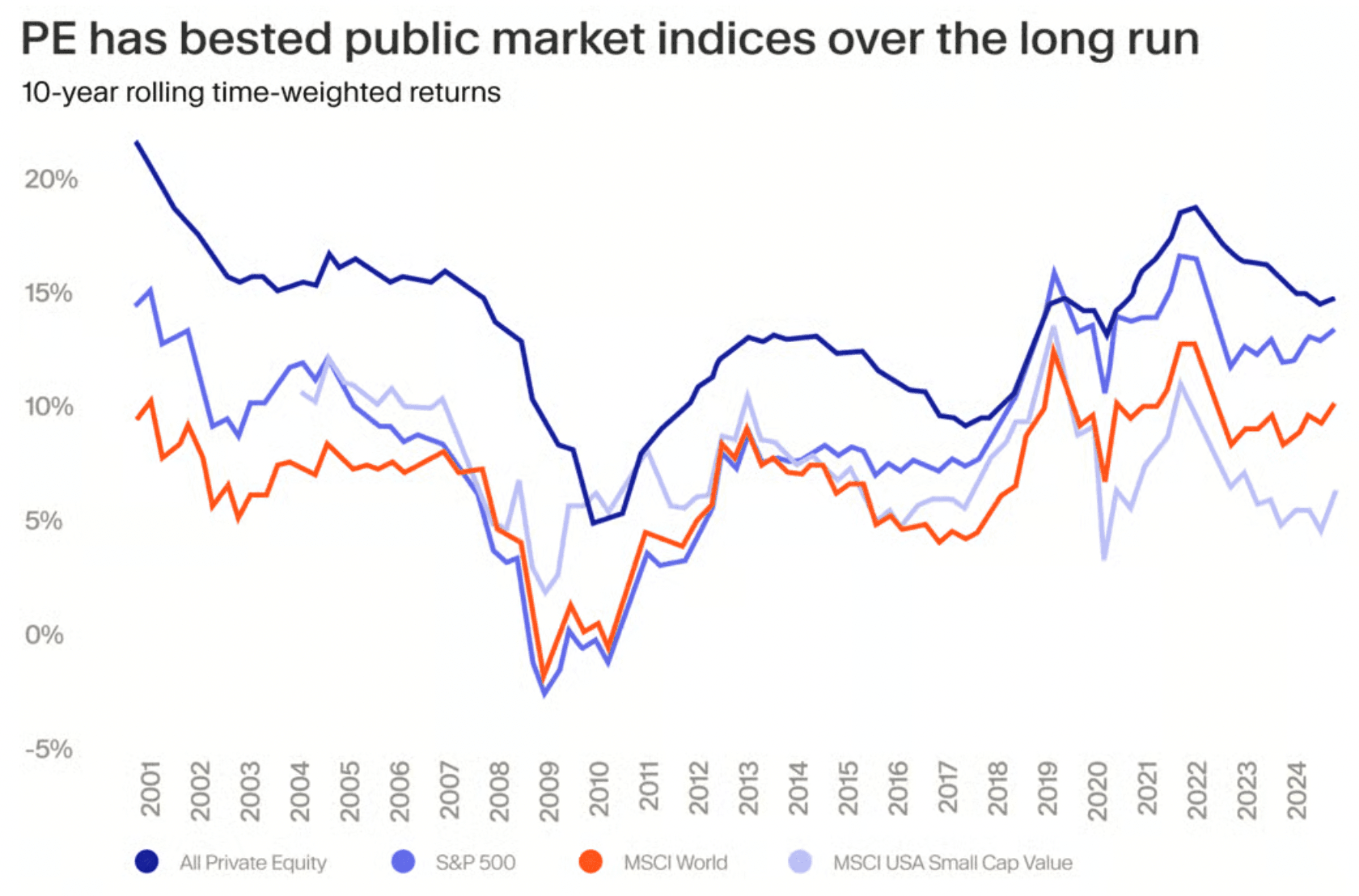

The logic of investing in the private markets is pretty straightforward. Private equity has historically outperformed the public markets over the long term, especially during periods when listed returns have been subdued.

The numbers are compelling. Recent Schroders research notes that ten-year returns for private equity buyout and growth strategies have averaged 16.5% p.a. and 13.7% p.a. respectively, with some portfolios realising IRRs above 20% p.a.

Preqin’s global investor sentiment work concurs. 88% of institutional allocators expect private markets to outperform public ones long-term, so two-thirds of them are planning to increase their private market commitments.

The diversification benefit is also tangible. The public markets are increasingly dominated by a handful of capital-light, global platforms such as the Magnificent Seven. In contrast, private equity offers funds the chance to buy control, drive operational change, and exit on their own timetable, often through trade sales rather than IPOs.

So investing in the private markets isn’t necessarily about taking on more risk. It’s about accessing the growing part of the economy that no longer lists.

The Price of Discipline

The superior returns on offer in the private markets don’t come risk-free.

Private equity funds face all the same risks as publicly listed equities.

They also face a unique exit risk which publicly listed equity investors don’t have to contend with.

On that note, it’s worth bearing in mind that higher rates forced a re-write of the old exit playbook: cheap debt, cost-cutting, bolt-ons, followed by an IPO exit. Financial engineering followed by an easy valuation uplift care of the public markets is a thing of the past. Private equity funds now need to generate organic growth and margin improvement the hard way: through better management, pricing, and scale execution. Bain’s assessment of this state of affairs is blunt: ‘making buy-and-build work can be a major challenge.’

As a result, institutional capital has become more selective about who they back and how. Co-investment rights, transparency, and influence now matter as much as expected returns. Blind pools chasing mega-buyouts are out, while specialist, control-focused managers are in.

This is a world matched to managers who control their own outcomes, rather than those praying for the return of a hot IPO market.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Beyond Either / Or

The biggest risk isn’t market volatility. It’s missing out on the best investment opportunities. When fewer companies list, when more growth remains private for a decade or more, remaining 100% invested in the public markets means walking away from a growing share of future earnings power.

That’s why this moment matters. Rates didn’t kill private equity. They disciplined managers. Through that evolution toward better pricing, greater operational control, and genuinely recurring cash flows, the foundation for its next phase of outperformance has been built.

So the quiet private markets revolution appears set to continue. It’s where a growing part of tomorrow’s market will live, managed by hands-on private equity managers willing to think and act long-term.

A Private Equity Fund Worth Checking Out

Learn More About Private Equity at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.