A Concentration Problem: Why Australia’s Best Opportunities Now Lie Beyond the ASX 20

Simon Turner

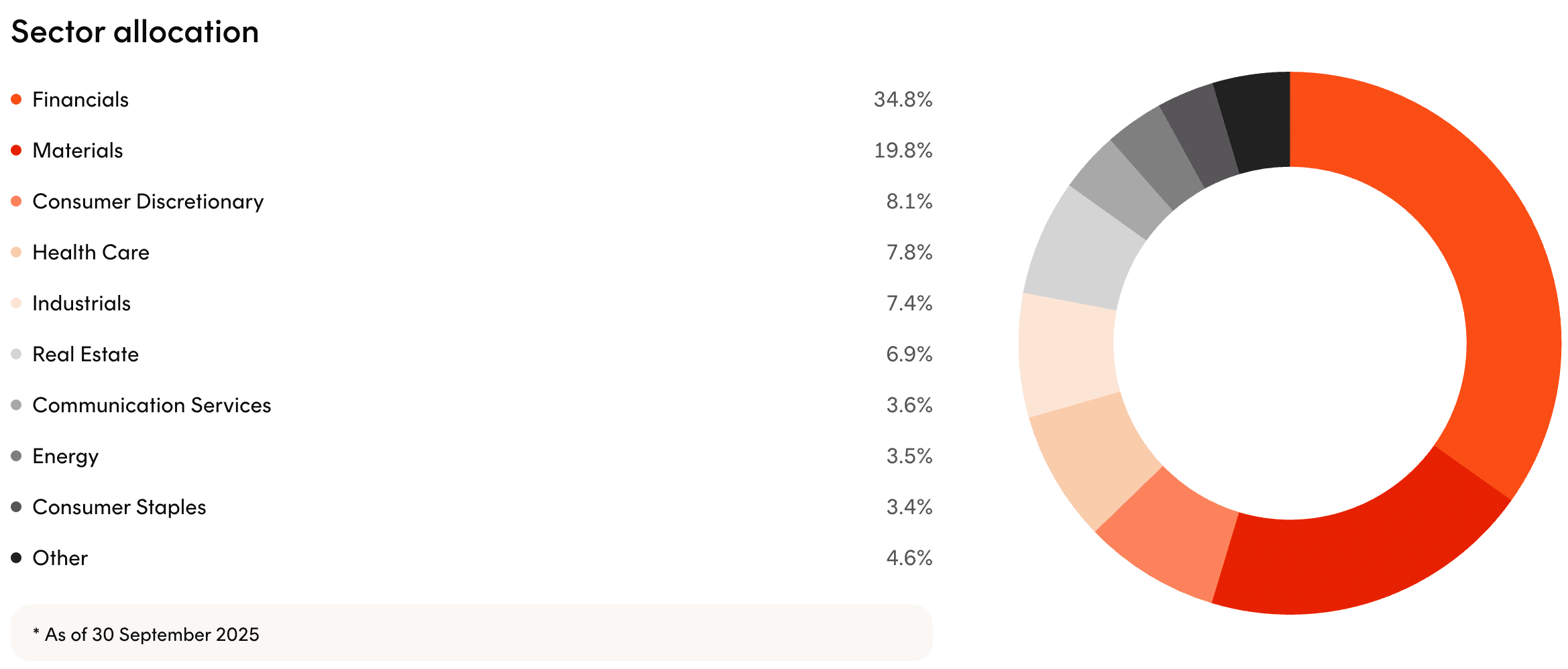

Mon 10 Nov 2025 7 minutesAustralia’s stock market has a concentration problem: the top ten companies in the ASX 200 account for 48% of the entire index, with three of the top six names being banks and representing over a quarter of the index. Commonwealth Bank alone represents 11.3% of ASX 200. Think about that for a moment. One bank represents over a ninth of the index of Australia’s two hundred largest companies.

This means if you buy the market through most standard index ETFs, you’re not really buying the Australian economy. You’re just buying a handful of large, well-loved companies, mostly banks and miners, along with a couple of global healthcare and logistics champions. That’s an extraordinary skew that surely needs a portfolio solution…

When the Big End Moves, So Does the Market

The numbers are hard to ignore. Excluding the top ten stocks, only half of the ASX 200 is left for Australia’s 190 next largest Australian companies.

With the concentration of Australia’s equity market this high, investors are increasingly exposed to the same stock drivers and risks. For example, when the banks rally on hopes of lower rates, the whole market tends to rise. When bulk commodities stall and the resources sector tumbles, the whole market generally struggles.

That’s all good and well if you’re a trader who doesn’t care about stock correlations, diversification benefits or risk-adjusted returns. It’s less fine if you’re a prudent, long-term investor who’s executing a well-thought out investment plan with decades rather than hours in mind.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Where the Market Still Misprices Growth

So what’s an investor to do when most index funds are exposed to the same expensive few stocks?

Enter the small and mid-cap universe.

These are the smaller companies that don’t drive the index, are often barely covered by brokers, and yet, if chosen well, can deliver the type of growth that compounds into extraordinary returns.

Despite the obvious attractions right now, this part of the market remains neglected and noisy. Often, small caps are covered by only one analyst, and coverage can disappear quietly, leaving stale or misleading consensus figures.

So here’s the rub and the opportunity all in one: when information is patchy and sentiment volatile, the price of smaller companies can significantly diverge from fair value for long stretches.

Mispriced doesn’t mean cheap for a reason. It means the market hasn’t yet priced in the durability of cash flows or the probability of dominance because the company is still too small to matter to benchmarks. For patient capital, that’s where future alpha is likely to come from.

A Brutal Few Years & a Reset

None of this will be a surprise to the small cohort of small and mid-cap investors who’ve remained invested throughout the past few tough years.

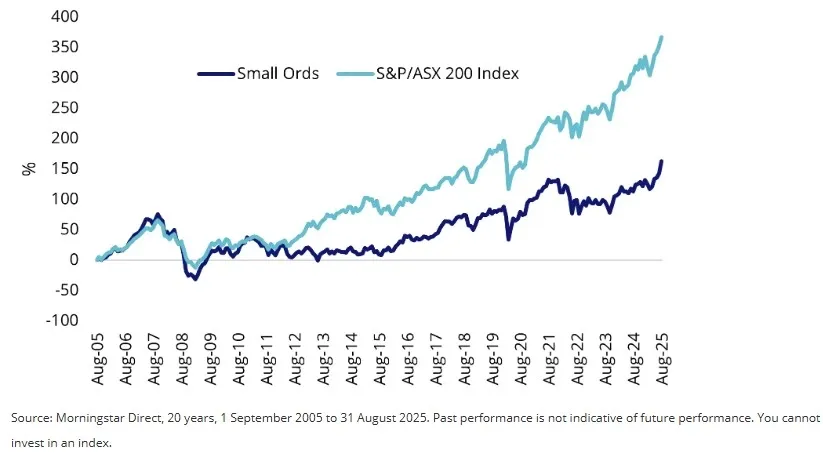

As Morningstar notes, Australian small caps have lagged their large peers and often screen as lower quality, a conclusion that should sound alarm bells for anyone treating them as an easy shortcut to riches.

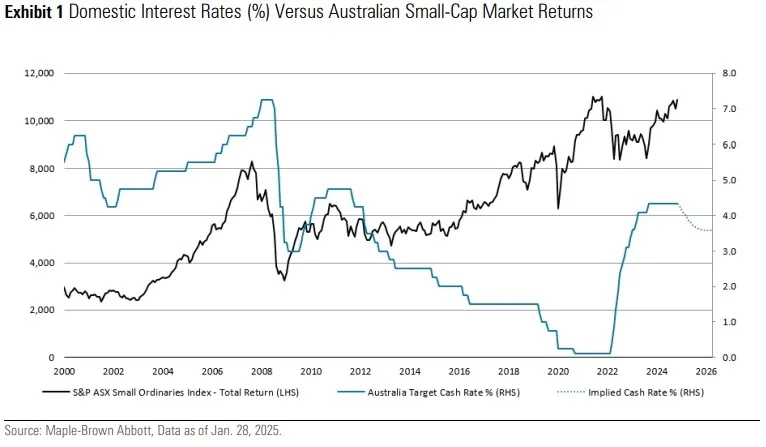

Rates have been front and centre in sector’s recent challenges. Rising rates punished all businesses reliant on cheap capital, and there were many smaller companies in this category.

When liquidity tightened, the market essentially stopped paying for promises and started asking impolite questions like:

Can you really fund your growth plans?

Do you generate free cash flow?

Is this operating leverage at play or wishful rhetoric about operating leverage may look like in the future?

That painful interrogation concluded a while back for most small caps. It also led to positive change with many smaller companies learning how to do more with less whilst capital was scarce.

That bodes well for the sector’s future earnings growth and return on capital employed.

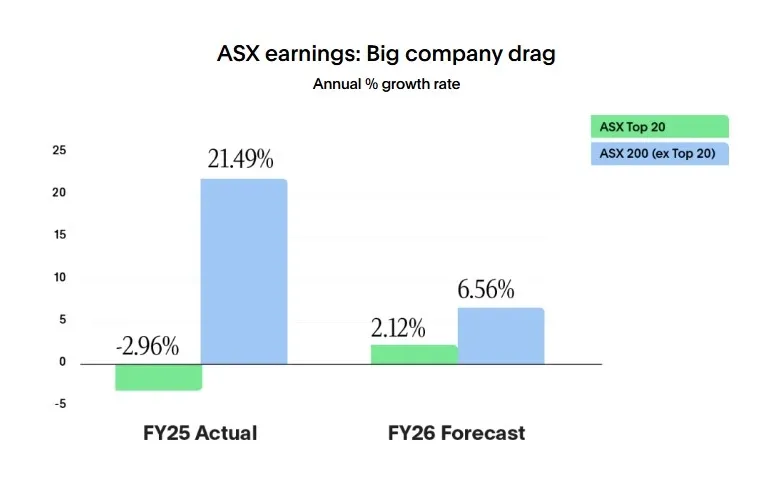

In fact, after generating significantly higher earnings growth than the ASX Top 20 in FY25, the ASX 200 (ex Top 20) is expected to once again generate superior earnings growth in FY26.

Philosophical Alignment

Two philosophical points matter for investors here.

The first is time horizon.

If you’re moving down the market cap spectrum, it’s more important than ever that you’re thinking long term.

For example, most small and mid-cap funds and ETFs target companies capable of delivering 20%+ p.a. returns over five to ten years, a goal that’s arguably incompatible with buying the ASX’s top ten stocks with a shorter timeframe in mind.

This type of goal does, however, align with investing in the under-followed mid-cap software stocks, niche industrial compounders, healthcare innovators, specialised infrastructure plays, and capital-light service businesses Australia quietly produces.

Most sit outside the ASX 50. Some are dual-listed with global revenue footprints but local cost bases. Others are focused category killers in logistics, radiology software, data centres, or niche financial infrastructure, where the addressable market is global even if the listing postcode is Sydney or Melbourne. Think Pro Medicus and Life360 a few years ago.

The second point is structural.

Value3 argues that the next decade’s compounding machines will be founder-led, IP-rich, software-enabled companies with global scalability, and that Australia can produce them well before they’re index heavyweights.

The takeaway isn’t necessarily: buy US tech. It’s that modern wealth creation is birthed from scalable intellectual property, rather than regulated oligopolies. With that lesson in mind, you’ll want exposure to the real engines of future economic growth while they remain mispriced. In Australia, that often means the small and mid-caps the passive funds haven’t yet crowded into.

Liquidity & Visibility

The counterargument against smaller companies investing is the limited liquidity.

Some public small caps carry private-equity-style risks such as limited information, key-person dependency, and execution risk, without the control rights or daily volatility of their larger peers.

But there’s also a rebuttal to this risk that’s in the ascendancy: public markets, even for smaller companies, enforce transparency.

For example, you can see each company’s revenue line, margins, and operating cash flows. You can see if management is converting their corporate narrative into operating leverage, and you can exit if they’re not.

This blend of public accountability with private-style inefficiency may be the sweet spot for active Australian funds willing to do the work.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

The Real Risk Is Missing Out

It may be time to rethink your Australian equities allocation. If you’re mainly exposed to the largest few stocks on the ASX, you’re essentially overexposed to a shrinking set of mega-caps and underexposed to the next generation of growth stocks. Meanwhile, many of the market’s most interesting wealth creators remain under-researched, volatile, and misaligned with their long-term cash flow generation potential.

This isn’t about chasing speculative micro-caps. It’s about deliberately owning diversified funds and ETFs exposed to high-conviction, cash-backed, scalable businesses outside the ASX 20, and holding them with patience. It’s about investing with managers who find super-compounders early, test them conservatively, and insist on economics over hype.

This mind-set isn’t yet mainstream in Australia. But it’s where the serious capital appears to be heading.

Australian Smaller Companies Funds Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.