Why Convenience Retail Has Evolved into a Core Property Play

Simon Turner

Thu 6 Nov 2025 5 minutesAs the commercial property recovery gathers pace, investors are being selective in how they gain exposure. The post-pandemic challenges have taught the market valuable lessons about how the world has changed in recent years. One of the relative winners is the humble neighbourhood, supermarket-anchored centre and the broader convenience sector. What makes convenience retail compelling at this point in the cycle is its combination of dependable income growth and solid relative value.

The Charter Hall Moment

The convenience retail sector was revealed to be in high demand when Charter Hall launched its $2.5 billion Convenience Retail Fund (CCRF) in August. This was a strong institutional signal that everyday needs retail is now a core play for portfolios seeking resilient, inflation-linked income.

Recent transactional evidence across the sector tells a similar story. Long-WALE, covenant-rich convenience retail assets are transacting at tighter yields as more investors are seeing their attractions.

For example, Region Group’s sale of the supermarket-anchored Greystanes Shopping Centre in Western Sydney at a 5.5% cap rate represented the lowest yield for a local neighbourhood shopping centre valued at over $50 million in over three years. And Charter Hall’s recent $290 million Bunnings portfolio purchase cleared at yields between 4.75% and 5.75% (depending on lease term and review structure), providing further confirmation that cap rates are tightening in retail segments with durable cash flows.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Cycle is Supportive

The macro backdrop for the convenience sector is also constructive.

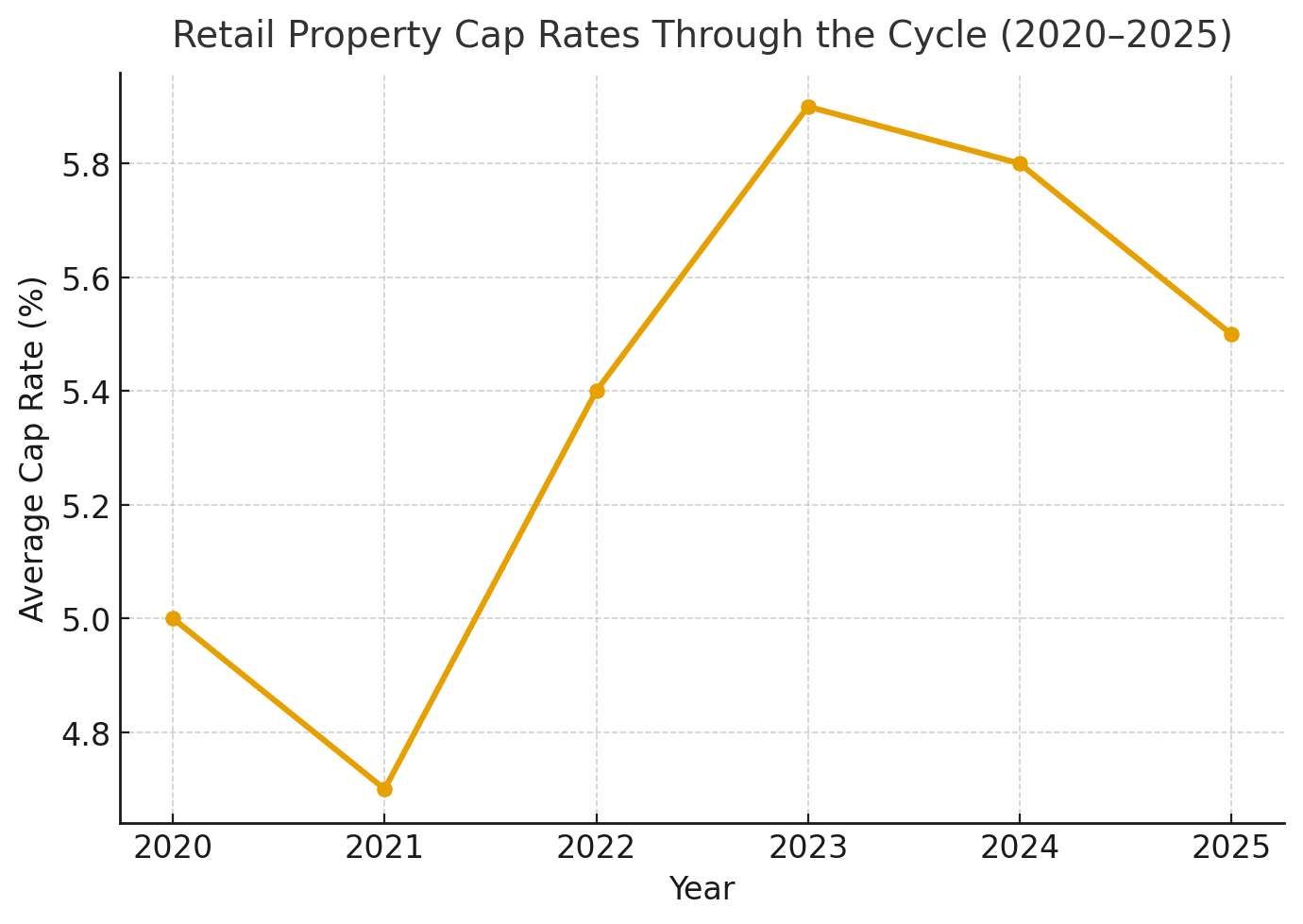

Yields in neighbourhood and sub-regional centres have been compressing in 2025 as the market has been discounting further RBA policy easing.

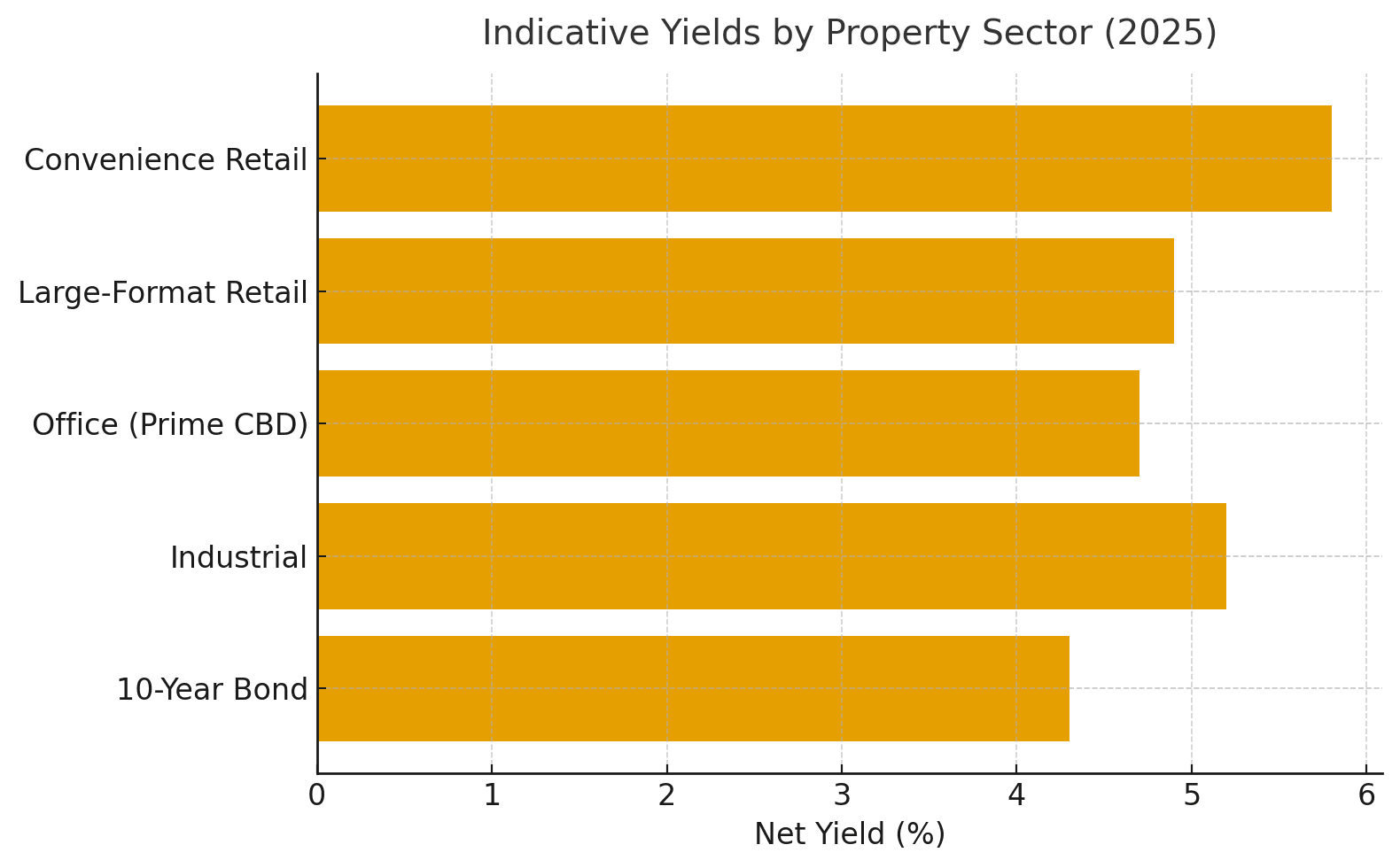

Convenience retail is also benefiting from undersupplied floor space in many parts of the country, robust population growth, and resilient spending in states like Queensland and Western Australia. Add into the mix high occupancy rates, the inflation protection of CPI-linked rental reviews, and long WALEs (Weighted Average Lease Expiry) and you’ve got a retail segment generating high quality income streams at attractive net yields relative to the commercial property world.

Case in point: pure-play Dexus Convenience Retail REIT (DXC), which focuses on service-station and roadside convenience, recently guided to ~7% distribution yields in FY26 on the back of near-full occupancy and solid like-for-like net income growth.

The Low Beta Advantage

For most property fund investors, volatility matters as much as yield. On that note, convenience retail property assets tend to be relatively low beta.

Charter Hall Direct CEO Steve Bennett highlights the importance of this point:

‘Property brings something to a lot of portfolios that’s really beneficial. It’s less volatile. Unlisted property doesn’t move other than independent valuations.’

For example, over a five-year horizon, Convenience Retail’s (using DXC as a proxy) equity beta sits at 0.66, which means the sector is materially less market-sensitive than the broader equity market. While index betas for diversified A-REITs basket have historically run closer to one, the convenience sector’s lower beta reflects its relatively defensive tenant mix and long-dated leases.

The takeaway for investors is clear: convenience retail exposure can help dampen a portfolio’s equity sensitivity while paying you a solid yield.

The Secular Tailwinds

Convenience retail is also benefitting from secular tailwinds in the form of supportive demographics and consumer behaviour.

For example, Australia’s population growth is concentrating in the outer-metro corridors where 15-minute living has become a necessity, not a slogan. So catchment-dense sites with easy car access and click-and-collect spaces are gaining share of wallet as households prioritise time and proximity over discretionary browsing.

Property managers are building new income lines that reinforce their locational advantages and this growing demand for convenience. For example, EV charging bays, last-mile logistics adjacencies, and medical and allied health offerings are becoming more common.

These tailwinds are becoming more visible in the convenience sector’s growing leasing spreads, its low specialty turnover resilience, and the low structural obsolescence risk of grocery-anchored formats.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Enter the Convenience Retail Sector with Your Eyes Open

As with all investments, risk management plays a major role in long-term convenience property outcomes.

Successful convenience retail depends on investing with high-quality managers focused on providing access to best-in-class tenants and locations, while managing gearing and capital expenditure to their investors’ benefits. Focus on managers with relatively modest gearing to ensure your through-the-cycle returns are protected. For example, Charter Hall’s Direct Convenience Retail Fund had a look-through gearing ratio of only 35% at the end of FY25.

Liquidity remains an important consideration, particularly when investing in unlisted funds. Remember: illiquidity premia need to be earned with transparent valuation processes and benchmark reporting.

Stress testing of potential downside risks is also a valuable manager skill, especially during the due diligence process. In particular, single-tenant concentrations should be stress-tested against all possible downside scenarios.

Whilst these risks are real, relative to other commercial property subsectors, risk budgeting in convenience retail buys a lot: lower beta to public markets, CPI-linked rental mechanics, and improving cap-rate dynamics.

Convenience Retail Here to Stay as a Core Property Play

If you want a core, cash-generative property anchor positioned to reduce portfolio volatility while distributions grow through the cycle, convenience retail is worth considering. With the sector rerating that’s already taking shape, it’s showing up in more and more property portfolios. The reason is clear: right now, the corner-store ecosystems, the places where Australians actually live their economic lives, are benefitting from a growing and structural need for convenience.

A Convenience Retail Fund Worth Checking Out

Learn More About Convenience Retail at Our Upcoming Event…

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.