Longevity: The Underestimated Risk Retirees Can’t Afford to Ignore

Ankita Rai

Thu 18 Sep 2025 8 minutesWhen we picture retirement, most of us already have a rough idea of what’s in our toolkit. How much super do I have? What’s my home or investment property worth? What’s the value of my shares and savings? Will I qualify for the Age Pension? And so on.

But the harder part is working out how to make those resources last, and how to use them in a way that supports the kind of retirement we actually want.

From the fear of running out of money to market crashes (sequencing risk), inflation, unexpected health costs, and even the rise of so-called ‘grey divorce,’ retirees face a long list of risks that can steadily erode their financial security.

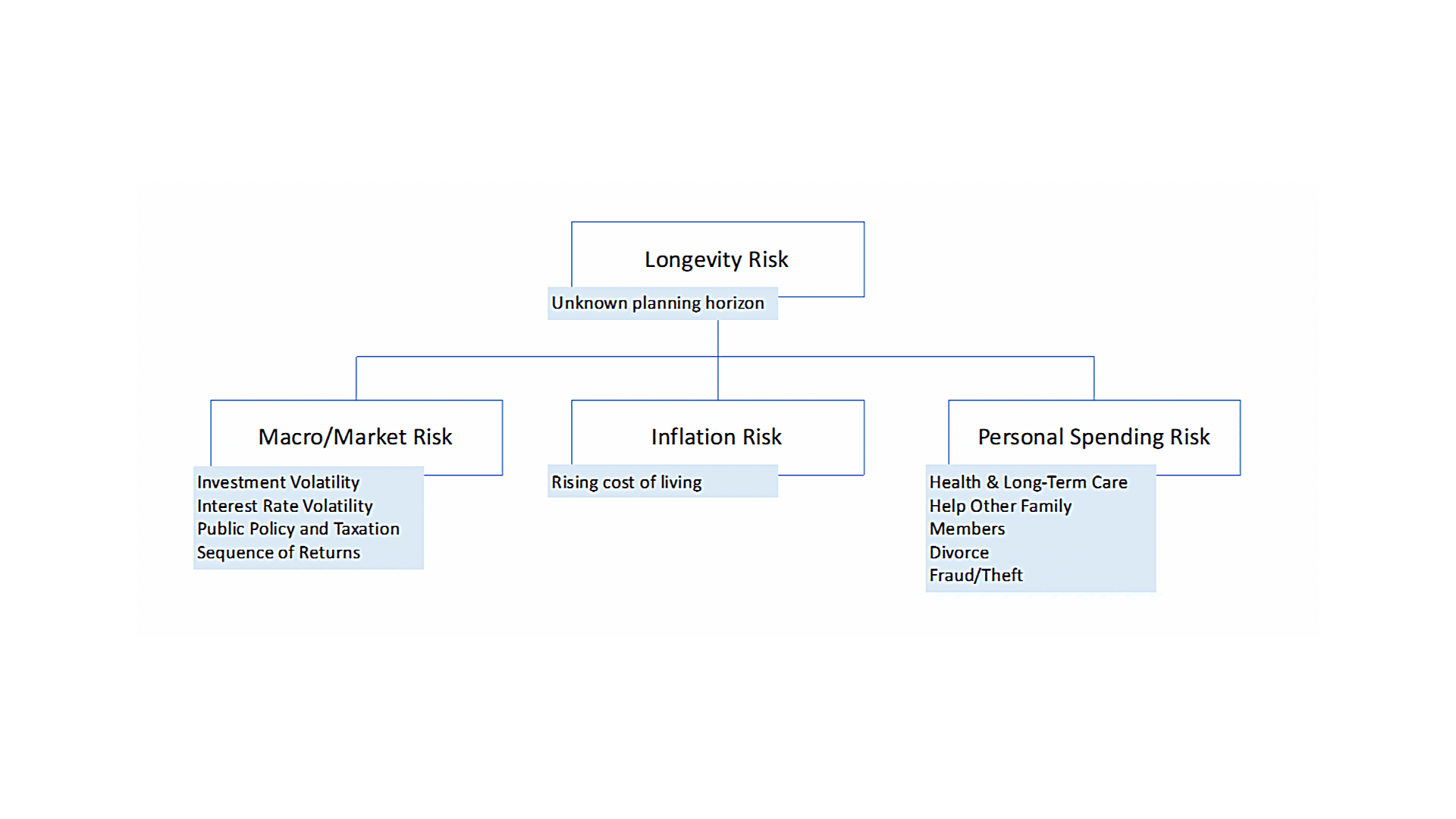

But it is the longevity risk that’s arguably the ‘mother of all risks,’ because the longer you live, the more exposed you become to every other challenge along the way.

Retirement planning expert Wade Pfau captures this perfectly in this illustration, where he places longevity right at the centre of the web of retirement risks.

Getting Life Expectancy Wrong

Understanding your life expectancy is a crucial part of any solid retirement plan. Living just a couple of years longer than expected can leave you with insufficient income later in life.

There are two ways this can play out. The first, and the one most people worry about, is outliving your savings. The second, less often discussed, is underspending your money and living too frugally, leaving yourself with less income than you could have enjoyed.

While other retirement risks, such as market volatility or inflation, can be somewhat predictable, longevity risk is inherently unpredictable and personal in nature. Averages can only give a rough guide as lifespans vary widely, and our expectations are often way off the mark.

A survey by YourLifeChoices revealed that retirees tend to underestimate how long they might live by several years. On average, people expect a 65-year-old man to live until 82, when the reality is closer to 88. Women aged 65 expect to live to 85, but many will live well beyond that.

That’s because life expectancy isn’t fixed. It increases as you age. Once you reach 65, you’re already a ‘survivor’ and your life expectancy climbs higher.

In fact, the very idea of life expectancy can be misleading. It’s an average, and there are different ways of working out that ‘average’. The method used can change the picture quite a lot.

For example, the Australian Bureau of Statistics estimates life expectancy at 81 years for men and 85 for women. But those figures don’t account for future improvements in medicine, lifestyle, or wealth.

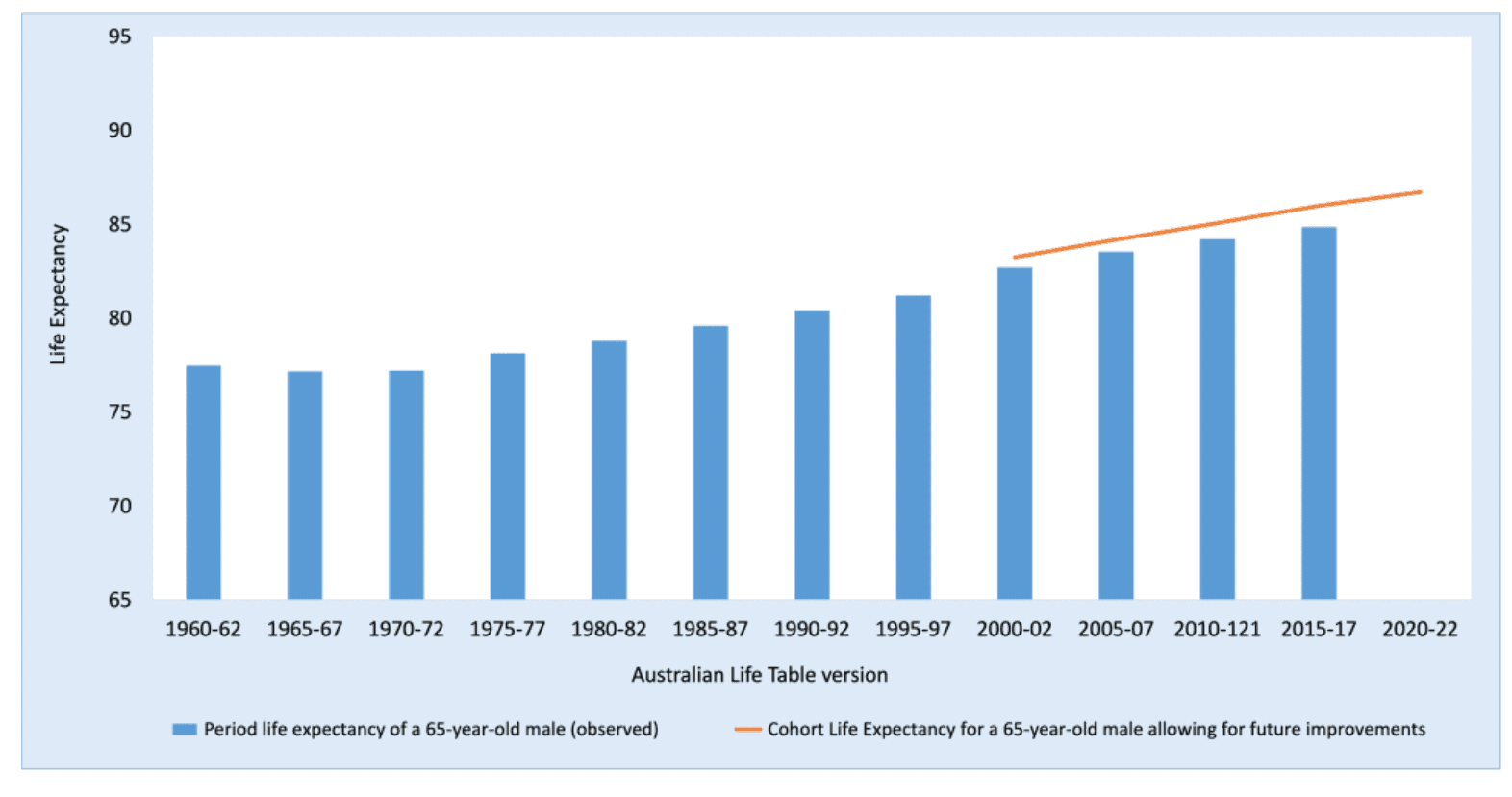

A cohort approach, which allows for those improvements, provides a more realistic outlook, as highlighted by the Actuaries Institute in the chart below.

Period and Cohort Life expectancy of a 65-year-old male

So, for a 65-year-old, the chances of reaching older ages improve over time. Which means today’s retirees are likely to live well beyond the headline averages.

This matters a lot because Australia is ageing fast. The number of Australians aged 65 and older is projected to pass 10 million by 2050.

By 2062–63, almost one in five of us will be retired and drawing on super, up from fewer than one in ten today. This means more people than ever will be relying on their super to last through an uncertain future.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

An Uncertainty that Requires a Safety Net

For retirees, this make the question of how long their savings will last more critical than ever.

As Nobel laureate William Sharpe put it, trying to draw down retirement savings over an unknown lifespan is ‘the nastiest, hardest problem in finance.’

This rings true. After all, super income streams stop when the balance runs out. Income from the share market is unpredictable, and for most people, the Age Pension alone isn’t enough for a comfortable lifestyle.

There’s no single solution. But by combining a mix of tools, it’s possible to build a safety net that makes the uncertainty a little less daunting. For example:

1. Lifetime income streams (annuities)

Annuities are a form of insurance for your retirement. They are an investment product that you can purchase with either your super or non-super funds, and receive guaranteed payments for a set period or even for the rest of your life.

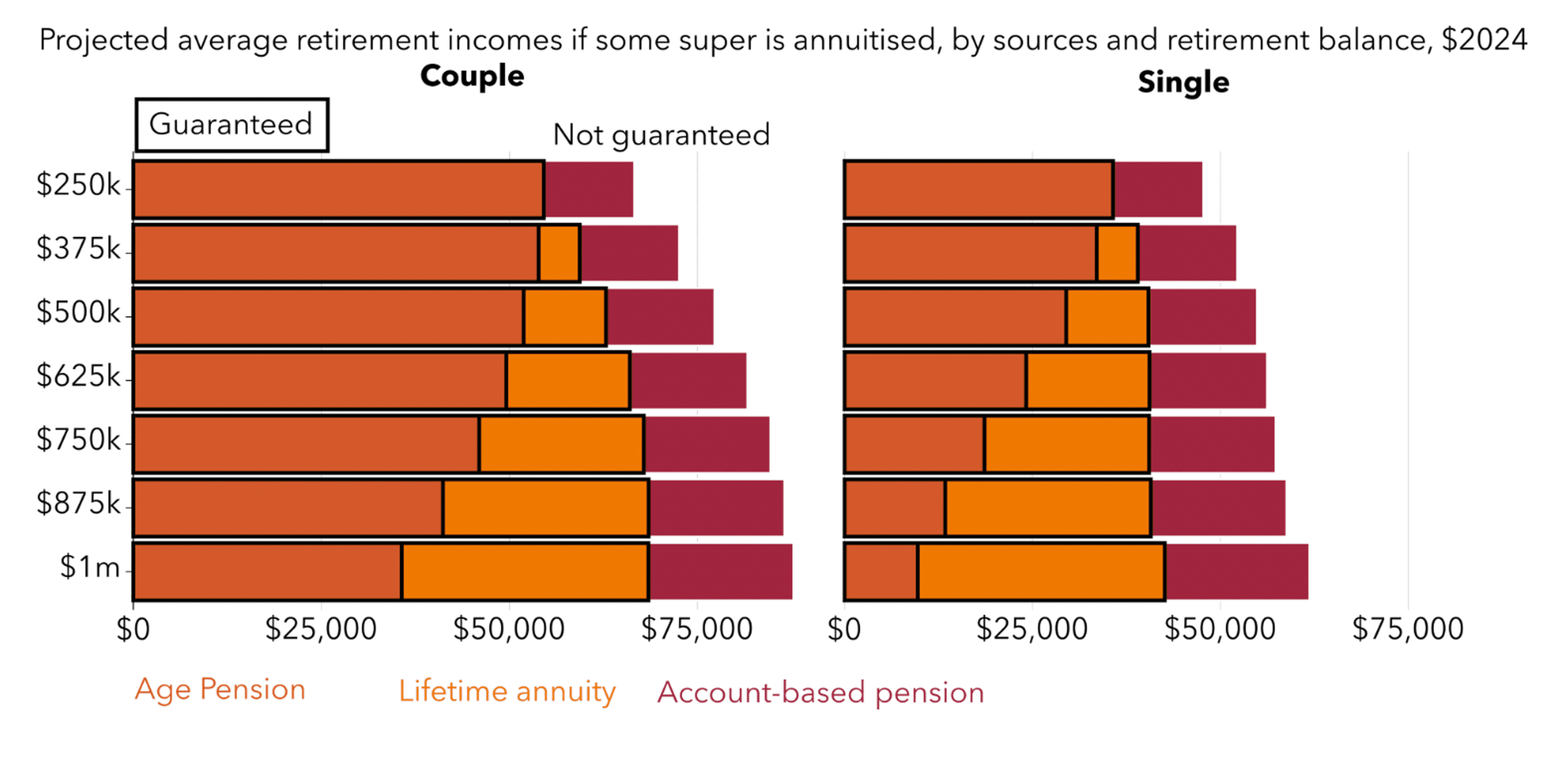

The Grattan Institute estimates that using part of your super to purchase an annuity could lift your retirement income by up to 25% compared with drawing down an account-based pension at legislated minimum rates, as shown below.

That’s because annuities can be structured in different ways to suit your needs. Some are index-linked, meaning payments rise with inflation, so your buying power is protected over time. Others are tied to market performance. Many products also address a common fear of losing everything if you die too soon by offering withdrawal features.

You also don’t have to put all your savings into an annuity. Using just part of your super can create a base level of guaranteed income, while the rest stays invested for growth and inheritance.

2. Income layering

A critical part of all retirement plans is maximising a combination of retirement income from different sources. This is where income layering comes in.

It addresses both immediate and future income needs by adding one or more income streams to a retirement plan.

Typically, it combines an account-based pension from super with something steadier, like a lifetime annuity or an investment-linked stream. If you qualify, the Age Pension adds another layer of certainty. On top of that, non-super assets, shares, managed funds, property, or cash, can be drawn upon when extra income is needed.

The value of this mix is flexibility. If markets dip, the annuity and Age Pension can keep essentials covered, while holding off on drawing from your account-based pension until conditions improve.

3. Home Equity Access Scheme

For many Australians, the family home is their biggest asset, yet it often sits untouched, even as retirees live more frugally than they need to.

The government’s Home Equity Access Scheme gives retirees a way to tap into the value of their home without having to sell it. Think of it like a reverse mortgage, but on far better terms: a low 3.95% p.a. interest rate, payments that are tax-free, and the flexibility to choose between lump sums or regular fortnightly income.

This can make a big difference. It can help cover large expenses such as aged care or medical bills, or simply top up your income-generating assets when markets fall, giving retirees breathing space without having to sell investments at the wrong time.

People are catching on. Participation has jumped more than 329% increase since 2020, with 13,400 retirees signed up by June 2024.

4. Rethinking retirement portfolios

Managing longevity risk isn’t only about identifying and investing in the right products. It’s also about mindset. Many retirees lean too heavily into defensive assets, 70–75% in cash or bonds, which feels safe but risks falling behind over a 30-year retirement.

Remember: the longer your money needs to last, the higher the returns you’ll need in retirement.

That’s why it helps to think of your portfolio across time horizons, such as cash for immediate spending needs, income-generating assets like bonds or dividend shares for the medium term, and growth assets such as equities for the long run.

This spread lets you draw from different sources as markets shift, keeping your income steady without losing sight of your long-term growth ambitions.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Finding the balance

Longevity risk isn’t just about numbers. It’s about how we live our later years.

For today’s retirees, that means recognising you’ll probably live longer than you expect, and setting up safety nets that keep your money growing while giving you peace of mind today.

The risk isn’t just about living too long, but realising too late that you could have lived more fully.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.