The Hidden Biases holding your portfolio back

Ankita Rai

Thu 20 Mar 2025 6 minutesInvesting is often seen as a game of numbers, charts, and cold, hard logic. Except, in practice, that’s not how it works for most investors. More often than not, investment decisions are driven by emotions, biases, and mental shortcuts.

As Benjamin Graham puts it: ‘The investor’s chief problem—and even his worst enemy—is likely to be himself.’

Most investors underestimate just how strongly their own biases work against them—whether it's clinging to losing assets or chasing trends at exactly the wrong moment.

In fact, Morningstar’s 2024 Mind the Gap study found that poorly timed decisions—usually fuelled by emotional reactions—cost investors roughly 15% of their potential gains over the last decade.

As such, understanding these mental traps is the first step toward making smarter, more disciplined investment decisions.

Here are some of the biggest biases that trip up amateur and professional investors alike…

1. The Illusion of Genius

One of the biggest dangers in investing is knowing just enough to feel confident—or worse, overconfident.

Ever picked a top-performing stock, fund, or ETF and thought, ‘I’ve cracked the code’? That’s exactly when you're most vulnerable.

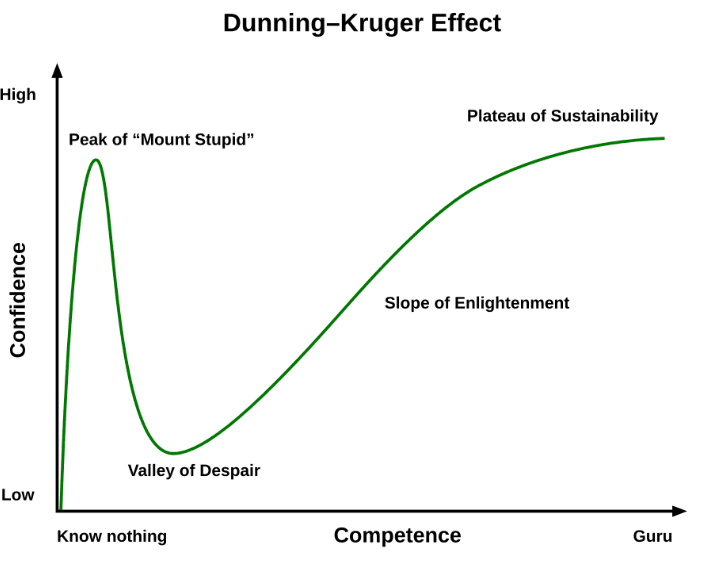

This is the Dunning-Kruger Effect—a cognitive bias where limited knowledge leads investors to overestimate their abilities. It results in risky behaviours like chasing recent winners, timing the market, or abandoning disciplined strategies.

Remember, markets have a habit of humbling overconfident investors. To sidestep this trap, assume you know less than you think and stay disciplined—even when tempted to chase short-term success.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

2. The Fear of Letting Go

We’ve all been there—holding onto investments that are clearly sinking, thinking, “It’ll recover eventually.” But waiting for a recovery often does more harm than good.

Three psychological biases fuel this behaviour:

- - Loss Aversion

Studies show losses feel about twice as painful as gains feel rewarding, which explains why investors cling to poor-performing investments. But hope is not a strategy, and waiting too long often worsens losses.

- Endowment Effect

Simply owning an asset leads investors to irrationally overvalue it, skewing perceptions of its true worth. Emotional attachment replaces objective evaluation of an investment’s future potential, resulting in poor decision-making.

- Anchoring Bias

Reinforcing both biases is anchoring—fixating on initial prices or outdated data points. This leads investors to hold onto declining assets or avoid rising ones out of fear they have already peaked.

The key to overcoming these biases is adaptability. Market conditions evolve, and past prices don’t dictate future value. Investors should reassess their holdings based on current data, not outdated emotions.

3. Fear of Regret and Herd Mentality

Have you ever hesitated to adjust your portfolio because you are afraid you will regret it later? That’s regret aversion—a common bias that leaves investors frozen, and anxious about making decisions they might second-guess.

Ironically, this fear often leads to the very outcomes investors dread — missed opportunities.

Another powerful force at play is herd mentality, closely linked to recency bias. This bias makes investors believe that recent market trends will continue indefinitely, leading to impulsive decisions like chasing hot stocks.

From the dot-com bubble to the Bitcoin frenzy, history shows that today’s hype rarely guarantees long-term success.

4. The Struggle Between Now and Later

Present bias is the tendency to prioritise immediate rewards over bigger, long-term gains. It’s why saving for retirement often loses out to impulsive spending, even though we know future rewards matter more.

This bias can lead to frequent trading, chasing short-term performance, or abandoning carefully crafted plans because of temporary market shifts.

The fix? Stay the course. Set clear goals, follow your strategy, and prioritise long-term growth ahead of short-term emotion.

5. The Trap of Comfort Investing

Familiarity feels safe, but in investing, it can lead to missed opportunities and unnecessary risk.

Familiarity bias keeps investors anchored to what they know, often leading to an overweight in domestic assets like stocks, bonds, or traditionally safe sectors such as real estate.

This lack of diversification can limit growth and increase vulnerability to downturns. A well-balanced portfolio should include a mix of global stocks, bonds, commodities, real estate, and alternative assets to spread risk and enhance long-term returns.

6. Outsmarting yourself

One of the biggest investing pitfalls is mental accounting—treating money differently based on where it came from.

For example, people often splurge tax refunds or bonuses while being overly cautious with their regular income. This flawed thinking often leads investors to take on unnecessary risk.

Money is money—treat every dollar as part of a single, well-planned strategy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Breaking Free from Bias

You can’t completely eliminate biases—they’re hardwired into human nature. But you can recognise them, plan for them, and build guardrails to keep them from derailing your investments. That’s where structure comes in. You can build systems to minimise their impact:

a. Set rules and stick to them – Have a clear investment plan and follow it. A disciplined, long-term strategy beats emotional, gut-driven decisions.

b. Automate decisions – Set up systems like dollar-cost averaging and periodic rebalancing to keep your strategy on track. Automating these processes ensures consistency and prevents impulsive reactions to market fluctuations.

c. Think long-term – Stop obsessing over daily market swings and tune out the financial noise. A well-diversified portfolio, held over time, outperforms reactionary trading. Avoid excessive monitoring—often, the best move is no move at all.

Winning the Mind Game of Investing

Investing isn’t just about picking assets—it’s about managing your own psychology. By recognising that their biggest obstacle is often themselves, investors can take control of their biases, make more rational decisions, and set themselves up for long-term success.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.