The LIC/LIT Opportunity: Pay 80-90 cents for each Dollar of Assets

Simon Turner

Wed 19 Mar 2025 5 minutesWhat if I told you of an investment sector in which you could pay 80-90 cents for each dollar worth of assets?

Welcome to the current state of affairs in the Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) sector.

The question is: do these discounts represent an opportunity worth pursuing, or a risk worth avoiding?

What are LICs and LITs?

Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) are closed ended vehicles which provide exposure to a basket of underlying securities such as shares and bonds.

LICs and LITs are listed on the ASX which provides investors with daily liquidity. Both can trade at premiums or discounts to their net asset value (NAV).

LICs are incorporated as companies, so they pay tax at a corporate rate and have the ability to pay franked dividends.

In contrast, LITs are established as trusts which means that all their net income and realised capital gains must be distributed to investors on a pre-tax basis, leaving investors to pay tax on those returns. Trust distributions carry the franking levels allocated by their underlying investments.

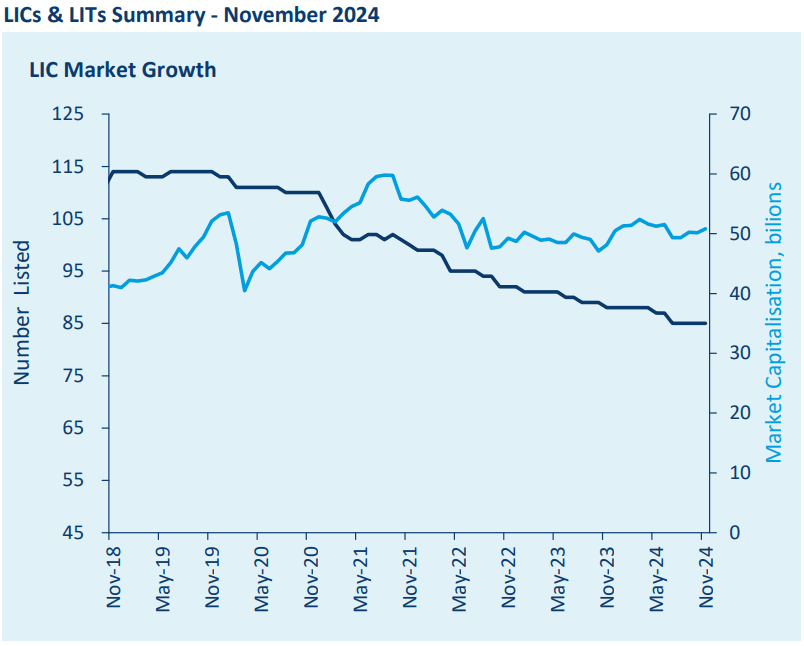

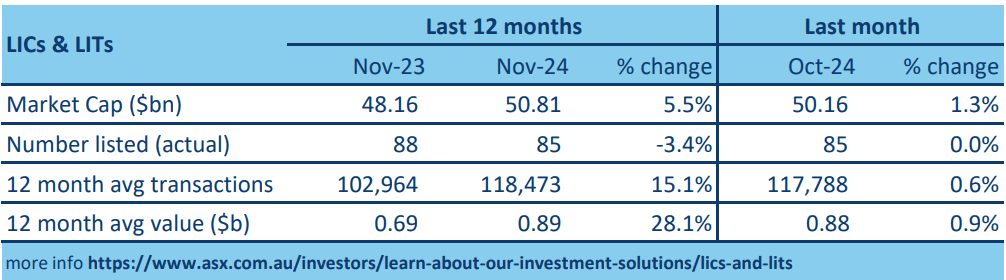

According to the ASX, there were 85 LICs with a market capitalisation of $50 billion as at November 2024. The number listed on the ASX is down from a peak of 115 in 2019, which represents a reduction of 30 LICs and LITs over the past six years.

There’s also been a noteworthy decrease in the market cap of listed global equity LICs/LITs over the past year, while property and fixed income LICs/LITs have fared better.

Pros and Cons

The main attraction of LICs and LITs is that their committed capital remains intact while liquidity is derived from a secondary market. In other words, the fund managers don’t need to sell any assets to fund redemptions. Liquidity comes purely from the listed market.

As a result, LICs and LITs are dependent upon fund managers consistently marketing their funds to ensure there are enough buyers in the secondary market.

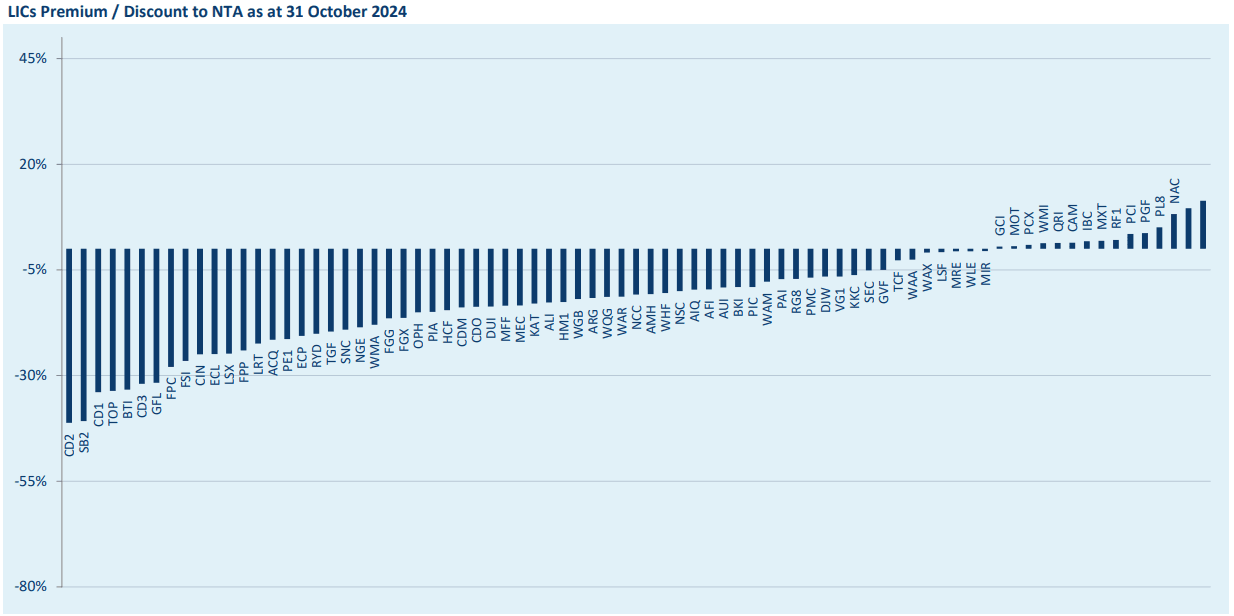

That brings us to the main disadvantage of LICs and LITs: at times they can trade at a significant discount to NAV—like now. Check out some of the significant NAV discounts below.

Interest rates playing a role

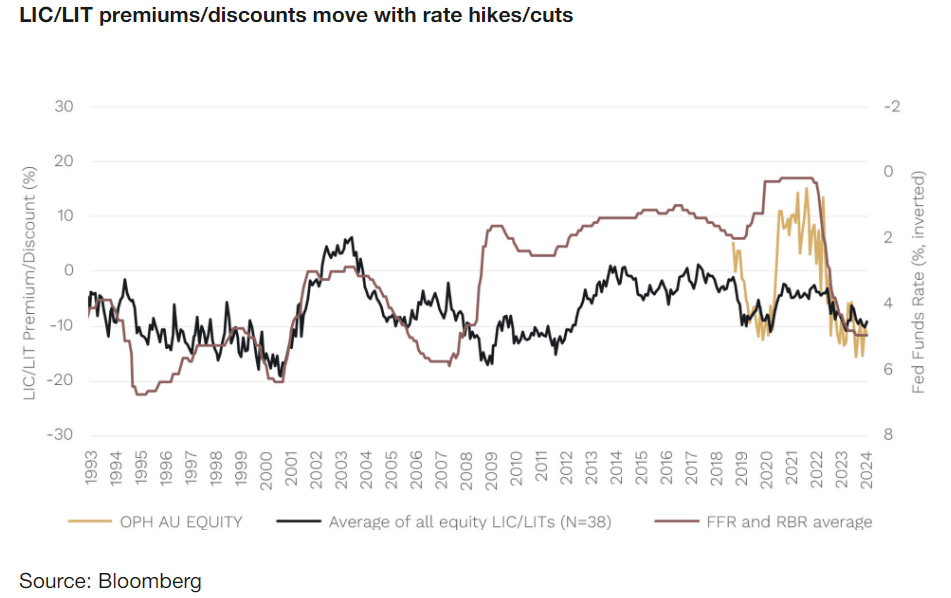

Interestingly, research shows the LIC/LIT sector’s average discount to NAV is strongly correlated with interest rates over the long term. i.e. when interest rates have been lower the sector’s average discount has been lower—and vice versa.

The reason for the correlation with interest rates appears to be the increased attraction of fixed income alternatives in a higher interest rate environment. This makes intuitive sense and explains why the sector’s discounts to NAV are relatively wide at the moment.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

LIC/LIT discounts to NAV = opportunity

Whilst some investors and commentators have criticised LICs and LITs which trade at a long term discount to their NAV, being aware of the longer term picture is useful context.

Wilson Asset Management chair, Geoff Wilson has lived through many sector ups and downs since his career kicked off in 1980. Geoff believes the recent widening of LIC/LIT discounts to NAV is unsustainable:

‘A small number of investors that sought the attractive and regular yield offered by the LIC structure during a low-interest rate environment have now reallocated capital to other asset classes, like term deposits and fixed interest. This is impacting supply across a majority of LICs and LITs that have historically traded at share price premiums to NTA and are now trading at discounts.’

Geoff believes this market inefficiency creates a compelling opportunity for investors:

‘Taking advantage of the current environment of discounted assets allows investors to achieve higher returns as discounts narrow to NTA parity, as well as providing downside protection, enhancing risk-adjusted returns.’

‘In a falling interest rate environment, we believe investor behaviour will again shift towards high yielding assets with stable and predictable income streams, like LICs and LITs. This shift in demand for high quality investments with a proven track record of delivering returns for investors will push share prices back towards parity to NTA, if not a premium.’

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Take advantage of a market inefficiency

LICs and LITs currently offer investors the opportunity to not only benefit from the performance of their underlying assets, but also from a potential narrowing of the current discounts to NAV on offer across the sector.

Whilst discounts could always further widen in the short term, with the benefit of a longer term perspective the current discounts to NAV are an opportunity for longer term investors.

LICs/LITs positioned to benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.