Why an ASX 300 ETF May Be the Core Domestic Exposure You Need

Simon Turner

Wed 6 Aug 2025 6 minutesFor Australian investors seeking long-term capital growth, stable income, and broad-based local market exposure, ASX 300 ETFs have emerged as one of the most efficient and intelligent portfolio tools. With their low fees, excellent diversification, and wide-ranging exposure to the Australian economy, these funds are increasingly being used as a mainstay form of domestic equity exposure by self-directed investors, SMSFs, and financial advisers alike.

Beyond their passive management attractions, ASX 300 ETFs can help investors optimise their performance through fee savings, automatic rebalancing, and the removal of emotional biases from the investment process.

Introducing the ASX 300 Index

The S&P/ASX 300 (XKO) is a market capitalisation-weighted index that provides broad exposure to the 300 largest companies listed on the Australian share market. It contains all the ASX 200 companies and the next 100 largest companies, and accounts for 82% of Australia’s total equity market capitalisation (July 2025).

The ASX 300 has greater breadth and depth than the ASX200, particularly amongst small and mid-cap stocks which are underrepresented in narrower indices.

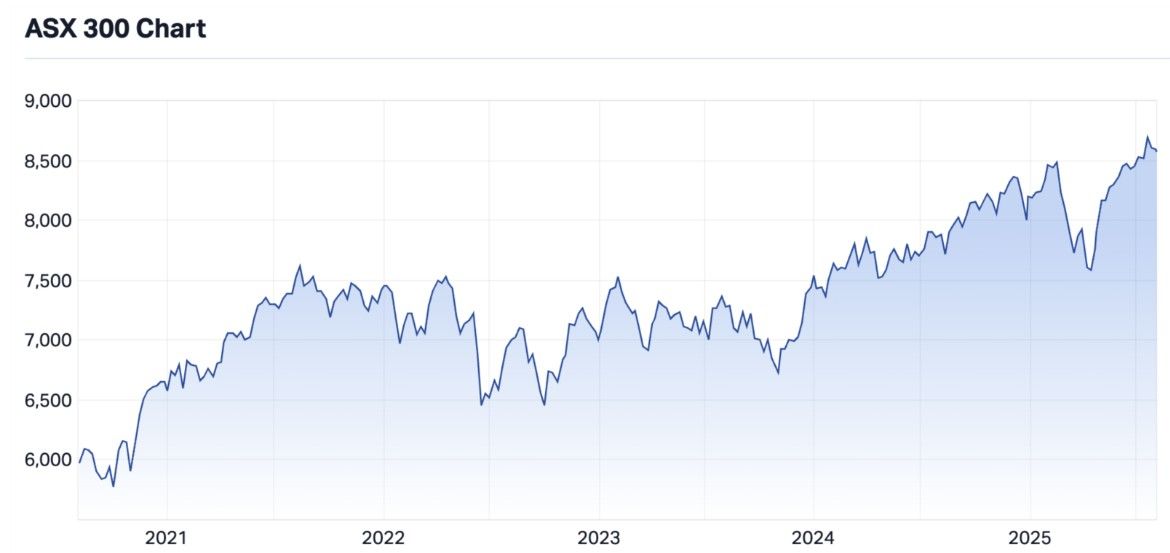

The index has performed well in recent years. As shown below, the ASX 300 is up 44% over the past five years and 13% over the past year.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Six Reasons ASX 300 ETFs Make Strategic Sense for Many Investors

Whilst many Australian investors still invest directly in ASX-listed stocks, many will testify to the fact that regularly outperforming the broader market is challenging, and often stressful. Plenty of investors learn the hard way that ETFs are an easier, less stressful way to invest while ensuring underperformance is no longer an issue.

If you’re in this boat, ASX 300 ETFs may well align with your investment goals.

Here are the six main benefits they offer:

1. Comprehensive Diversification with One Trade

Investing in an ASX 300 ETF gives investors exposure to 300 stocks across a wide range of sectors. This diversification significantly reduces stock-specific risk, one of the key contributors to underperformance in self-managed portfolios.

In contrast, ASX data reveals that the average Australian retail investor holds only 5 to 10 individual stocks, and are often overweight the banks and miners. This concentration risk can lead to underperformance during periods of significant sector-specific divergences, such as during the pandemic recovery when tech and healthcare outpaced financials.

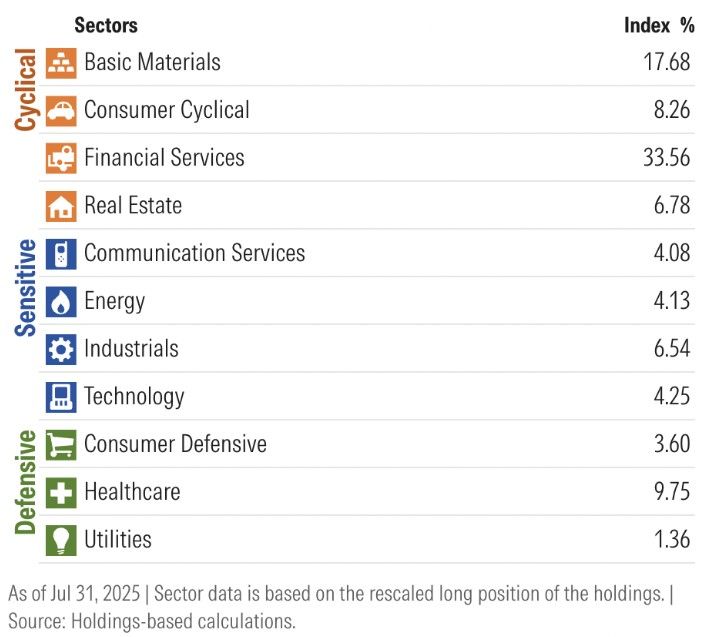

As shown below, the ASX 300 is well-diversified beyond financial services and basic materials (which dominate the ASX200 to a greater extent):

2. Low-Cost Structure Drives Better Compounding of Gains

One of the greatest benefits of ASX 300 ETFs is that their fees are exceptionally low.

For example, Global X’s recently launched ASX 300 ETF (ASX: A300), charges a management fee of only 0.04% p.a., making it the lowest cost ETF of this type in the market. This is a small fraction of the 1–1.5% p.a. charged by many actively managed Australian equity funds.

These fee savings alone make a significant difference to the compounding of investors’ returns over the long-term.

Bearing in mind, Morningstar’s 2024 Australian Active vs Passive Barometer found that only 31% of active Australian equity managers outperformed their passive peers over 10 years, and when fees were factored in that number dropped below 25%, the cost-benefit attractions of an ASX 300 ETF are compelling.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

3. Exposure to Small & Mid-Caps: The Hidden ASX 300 Advantage

The ASX 300 includes 100 small and mid-cap stocks not covered by the ASX 200. After twelve years of underperformance, smaller companies are trading at an unusually large discount versus their large cap peers, and appear well-positioned to outperform.

By investing in an ASX 300 ETF, investors automatically gain exposure to this growth potential without needing to stock-pick or time the market.

4. Franking Credits & Tax-Effective Income

ASX 300 ETFs distribute dividends from the underlying shares they hold, many of which are fully or partially franked. This makes them particularly appealing to retirees, SMSFs, and income-focused investors, who can benefit from the tax refundability of the franking credits.

The ASX 300 generates a 3.4% yield (as of July 31st, 2025), with more than 70% of its dividends franked. This represents a grossed-up yield of 4.4%+, which is relatively attractive in a low-rate environment.

5. Liquidity & Transparency

ASX 300 ETFs are listed and traded like ordinary shares, meaning they offer real-time pricing, daily liquidity, and no exit penalties. Unlike unlisted managed funds, investors know exactly what they hold and can buy or sell with ease.

Each ETF provider also publishes their full portfolios and sector allocations, allowing investors to conduct their own due diligence. This is useful for self-directed investors and financial professionals alike.

6. Less Room for Emotional Biases

Investing in ETFs in general involves less bias and emotion than direct stock investing. That means fewer poor investment decisions which translates into money saved. According to Vanguard’s ‘Advisor’s Alpha’ framework, behavioural mistakes alone can cost individual investors 1.5–2.0% p.a. in returns. This is a bigger deal than many investors realise.

An Easy & Convenient Way to Invest Locally

ASX 300 ETFs offer a compelling blend of diversified exposure, tax-effective income, low fees, and long-term growth potential. For Australian investors, they provide a powerful, efficient, and transparent way to participate in the local economy’s growth and evolution.

Whether you’re starting out or reviewing your existing portfolio, incorporating an ultra-low-cost ASX 300 ETF like Global X’s ASX 300 ETF (ASX: A300) may one of the simplest, smartest moves toward optimising your long-term performance while minimising your stress levels.

An ASX 300 ETF Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.