Profiting from the Great Era of Managed Fund Fee Compression

Simon Turner

Wed 23 Jul 2025 6 minutesLong gone are the days when investors would happily pay a 2% p.a. management fee + a 20% performance fee to their fund managers. Fee compression has been a major theme across both the managed fund and ETF sectors for many years now. This shift has been driven by the rise of passive investing, the democratisation of financial technology, and growing investor awareness of the long-term eroding impact of fees.

It’s great news for investors. Never before have they had access to such a vast range of high quality investment products for the competitive fees that are currently being charged. But it’s only great news if you’re taking advantage of the opportunity…

The Rise of Passive Investing: A Catalyst for Fee Compression

One of the main drivers of the great fee compression has been the inexorable rise of Exchange-Traded Funds (ETFs), which charge significantly lower fees than their active peers.

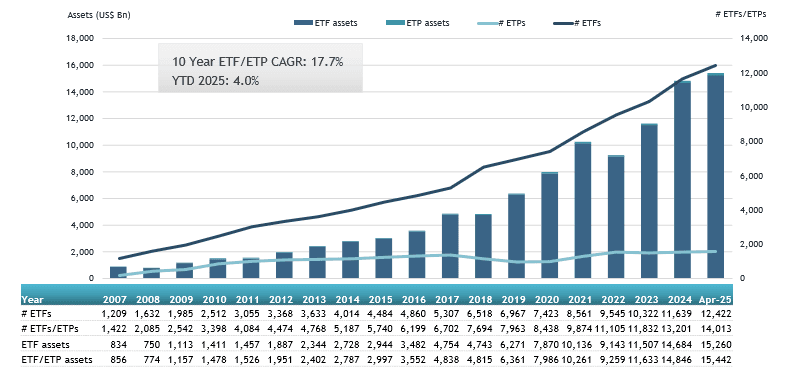

According to ETFGI, global ETF assets have been growing at a solid clip of 17.7% p.a. over the past decade.

The picture has been similar in Australia, with ETFs assets reaching $112 billion in 2024, up from just $24 billion in 2014, representing a growth rate of 16% p.a.

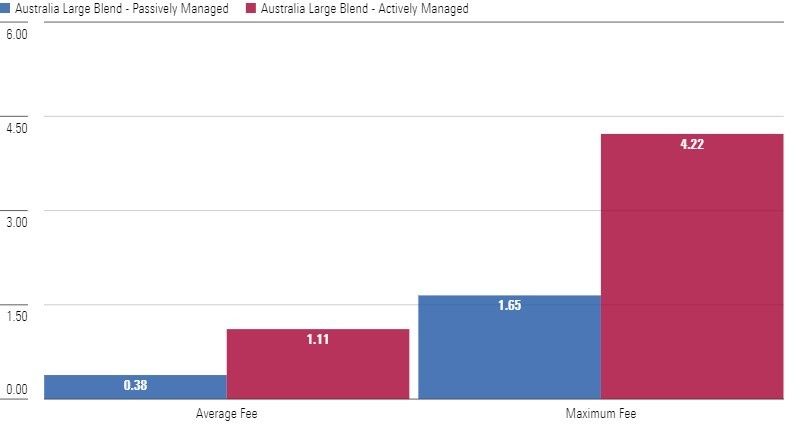

Fees have been front and centre in this shift. As shown below, the average fee for Australian Large Cap ETFs is 0.38% p.a. compared with 1.11% p.a. for Australian Large Cap Managed Funds. That 66% discount is hard to ignore.

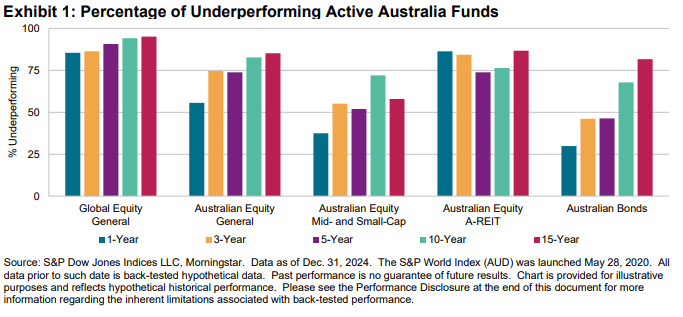

The argument in favour of ETFs is also about performance. The inconvenient truth for most active funds is that the majority of Australian managed funds have underperformed their passive peers over the past ten and fifteen years.

Being asked to pay more for inferior returns has worn thin for most investors. In cost-benefit terms, that equation is hard to justify and has placed significant pressure on actively managed funds to justify their higher fees.

In the words of says David McFadden, an analyst from Morningstar Australia: ‘The argument for paying higher fees for active management has become harder to defend. Unless a fund can demonstrate a consistent and significant edge over the long term, investors are better off allocating to low-fee passive strategies.’

According to Ravi Patel, a wealth manager at Patel & Associates: ‘The key is to build a portfolio that’s low-fee, well-diversified, and aligned with your long-term goals. For HNW investors, this might mean reducing reliance on active funds that underperform and focusing on core passive strategies.’

In short, fee compression is a trend that’s here to stay.

As more investors become fee-conscious and demand greater transparency, further fee compression is likely in the coming years. According to McKinsey & Company, the global asset management industry is expected to see another 10% to 20% of fee compression over the next decade.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Fee Compression in Practice: How Much Can You Save?

For sophisticated investors managing large portfolios, even a slight reduction in fund management fees can result in substantial long-term savings.

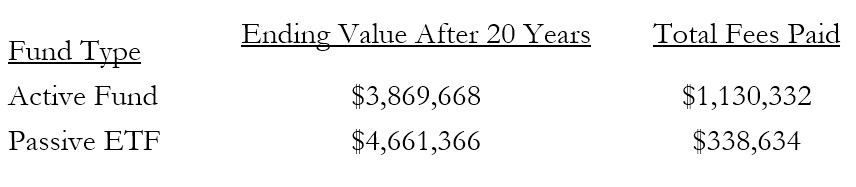

For example, if you’re investing $1 million with a 20-year investment horizon and you’re expecting to generate a 7% p.a. return, the difference between paying a 1.5% p.a. management fee for an active fund and 0.2% p.a. for a low-cost ETF, compounds into a substantial difference.

Here’s how those funds are expected to perform in net terms over that 20-year timeframe:

In this example, the $791,698 difference in the ending portfolio value is due entirely to the fee differential of 1.3% p.a. which compounds into a large number over that length of timeframe.

Hence, investors who are focused on optimising their long-term performance are well-advised to carefully evaluate the fee structures of their portfolios.

The Evolving Role of Active Management: Niche Strategies and Alpha

While the broader trend is towards lower fees, active management still plays a crucial role for most investors, particularly in niches where the market is less efficient.

For example, here are a few asset classes where investors are often justified in investing via active managers with the requisite expertise:

- - Global Equities: While Australia’s market has become more efficient in recent years, global markets, particularly emerging markets and small-caps, still present opportunities where skilled active managers can add significant value.

-Bonds & Private Credit: Active managers in fixed income, particularly in high-yield or emerging-market debt, often continue to generate alpha through their security selection.

- Thematic & Sector-Specific Funds: Funds targeting specific themes, such as technology, green energy, or infrastructure, often warrant an active approach because of their targeted, high-growth potential.

That said, even active managers in these niches must prove that they can add significant long-term value to justify their premium fees. Long-term underperformance is no longer acceptable for any higher-fee active strategies.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A Tactical Approach to Fee Reduction

So there are currently plenty of opportunities for investors to save on fees without sacrificing performance. Here are three strategies which may help:

- 1. Adopt a Core-Satellite Approach

A core-satellite approach allows investors to save fees in their core ETF exposure while pursuing outperformance in their actively managed satellite positions.

For example, it may make sense to use low-cost, broad-market passive ETFs for core positions such as Australian equities, and to use actively managed funds for tactical, high-conviction satellite positions in niche sectors such as small caps, emerging markets, or thematic investing.

2. Negotiate Fees with Your Managers

Larger portfolios allow for greater leverage when negotiating management fees with active managers. So high-net-worth investors should consider negotiating fee discounts, especially for large allocations.

3. Use Fee-Only Advisors

Some investors are turning to fee-only financial advisers, including AI advice, who do not receive commissions or other incentives tied to recommending specific funds. These advisors can help investors optimise their portfolios for lower fees while still achieving their investment goals.

Take Advantage of Fee Compression

Fee compression isn’t just a passing trend. It’s the new reality for managed funds in all asset classes, and we’re likely to see more of it in the coming years. With the long-term data showing that passive funds often outperform their active counterparts, investors are waking up to the importance of minimising fees while maintaining their performance.

So to build a more cost-efficient and performance-driven portfolio, it’s essential for investors to evaluate their existing fee structures, consider a mix of passive and active strategies, and leverage their negotiating power.

Investors who take advantage of the lower fees on offer these days will find themselves achieving stronger net returns in the long run.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.