The ‘Never Been Better’ Emerging Markets Opportunity

Simon Turner

Wed 16 Jul 2025 6 minutesAccording to VanEck’s Eric Fine, the emerging markets (EM) opportunity has ‘never been better’. Those are strong words worthy of delving deeper.

The long term argument in favour of EM investment has always been compelling: most developed economies are grappling with demographic stagnation, high debt burdens, and subdued growth, while most EMs offer a blend of accelerating GDP growth, structural reform momentum, and attractive market valuations.

Throw a weaker U.S. dollar into the mix, and you’ve got yourself a potentially significant shorter term catalyst which could ignite EM outperformance in the coming years.

Superior GDP Growth Prospects

Superior GDP growth is an important part of the EM investment thesis.

EMs are positioned to benefit from four powerful structural economic growth drivers over the long term:

- 1. Demographic Advantages

EMs are home to over 85% of the global population, with a median age well below that of their developed market counterparts. This demographic dividend supports long-term consumer demand and labour market dynamism across EMs. India’s working-age population, for example, is expected to grow by over 100 million in the next decade alone.

2. Digital and Financial Inclusion

From mobile banking in Kenya to digital payments in India, EMs are leapfrogging many traditional development paths. In particular, smartphone penetration and internet access are quickly unlocking innovative business models and higher productivity. That’s why Brazil, India, and Indonesia are already among the top markets for fintech adoption globally.

3. Urbanisation and Infrastructure

Rapid urbanisation is reshaping EMs. According to the World Bank, over 1.5 billion people will move to urban areas in EMs by 2040, fuelling enormous demand growth for housing, transport, energy, and services. The investment needed to support this transition presents vast opportunities across EM economies.

4. Economic Reform and Policy Stability

While their economies have historically been more volatile, in recent years many EM governments have adopted inflation-targeting frameworks, built foreign exchange reserves, and liberalised their capital markets. As a result, Mexico, India, and Indonesia have seen credit rating improvements and rising investor confidence.

Driven by these structural growth drivers, EMs are expected to significantly outpace developed economies in the coming years.

According to the IMF, EMs are projected to grow at 4.2% p.a. in 2025, compared to 1.6% p.a. for advanced economies. This divergence is underpinned by favourable demographics, urbanisation, and the rising digital economy across Asia, Africa, and Latin America.

China and India, the EM titans, continue to drive this trend. India, for example, is forecast by the IMF to achieve 6.8% p.a. real GDP growth in 2025, powered by technology-led services, manufacturing incentives, and a burgeoning consumer class. Meanwhile, Southeast Asian economies such as Vietnam, Indonesia, and the Philippines are consistently posting economic growth in the 5–6% p.a. range, reflecting rising exports, infrastructure spending, and consumption.

The superiority and structural entrenchment of EMs economic growth is important for investors to understand at a time when U.S. economic growth, in particular, appears to be faltering.

Attractive Valuations Relative to Developed Markets

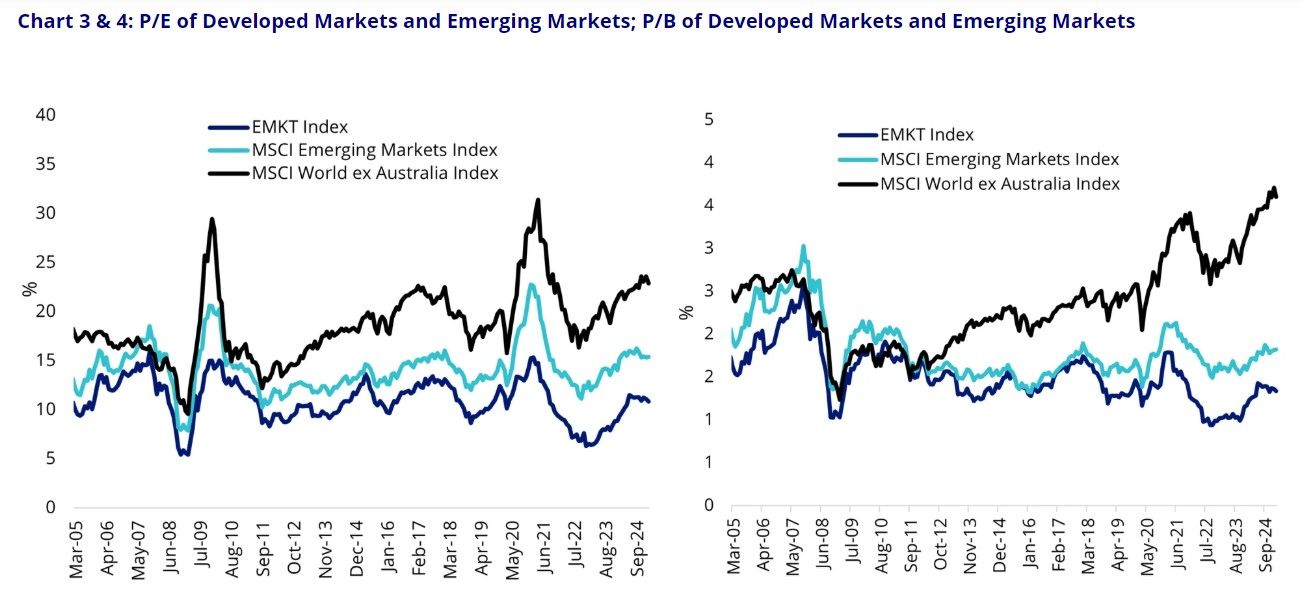

Valuations are also core to the EM opportunity.

On this front, EM equities currently trade at a sizeable discount to their developed counterparts. As of mid-2025, the MSCI Emerging Markets Index trades at a forward price-to-earnings (P/E) ratio of 11.8x, compared to 19.6x for the MSCI World Index. The price-to-book (P/B) ratio tells a similar story: 1.6x for EM vs 3.1x for developed markets.

This valuation gap persists despite EM stocks delivering strong earnings growth. In fact, EM corporate earnings are expected to grow at 10.2% p.a. over the next three years, driven by the financials, technology, and industrials sectors in particular.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Meanwhile the U.S. Dollar & U.S. Treasuries Appear to Faltering

Although once a taboo topic for EM investors, a rounded EM discussion needs to allude to recent vulnerability of the U.S. dollar and the U.S. Treasuries market. This awareness has recently entered mainstream investor consciousness for the first time in a long time.

Why? It starts with EM fundamentals. Many EMs maintain low debt levels, allowing their central banks to operate independently, pay higher real interest rates, and thus maintain stronger currencies. These factors have been in place for over a decade, but the relative backdrop has never been more supportive.

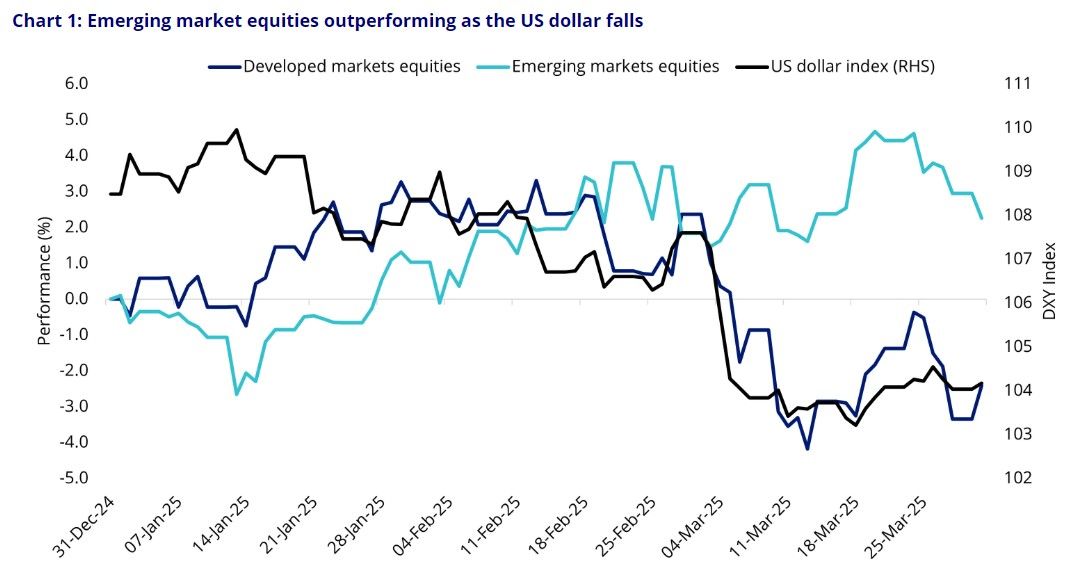

According to VanEck’s Eric Fine, ‘Investors are finally acknowledging the fiscal risks to US monetary policy and the dollar’s status. It’s not just a dollar story. It’s about global asset allocation—and capital is starting to flow out of the US.’

The recent outperformance of EMs versus developed markets concurs:

For investors, the takeaway is clear: as the world rebalances away from the previously dominant US-centric system, EMs are positioned to benefit.

Diversification Benefits

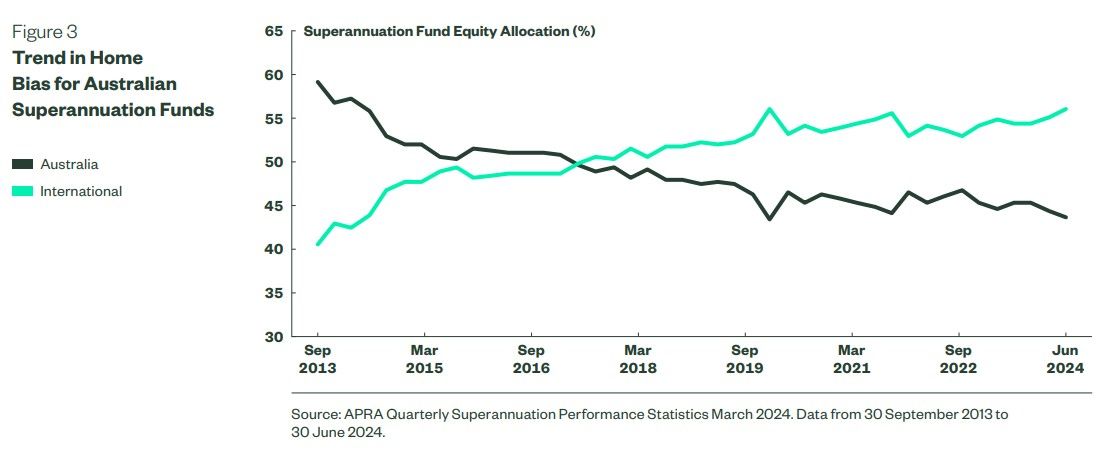

It’s also worth mentioning the diversification benefits EMs bring to Australian investors who often suffer from home market bias. As shown below, Australian investors have 44% of their superannuation funds invested in local equities which remains elevated despite the downward trend in recent years.

The diversification benefits EMs offer aren’t just geographic. EMs also offer sectoral diversification by providing access to sectors underrepresented in the Australian market such as consumer technology, pharmaceuticals, and renewable energy.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Growth with Disciplined Risk

Investing in EMs is not without risks. Currency volatility, political instability, and governance issues need to be factored in. However, by investing in high quality EM funds and ETFs with professional management, geographic diversification, and selective exposure, these risks can be effectively mitigated.

For Australian investors seeking long-term capital appreciation in a slowing global economy, EMs offer stronger and more structural economic growth than developed markets along with more attractive valuations. The EM opportunity may indeed have ‘never been better’, nor more worthy of a thoughtful and measured place in a diversified portfolio.

EM Funds Worth Checking Out

EM ETFs Worth Checking Out

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.