Tips for investors to keep the ATO from knocking

Ankita Rai

Wed 9 Jul 2025 7 minutesNo one loves tax time. But as the new financial year begins, it’s a good time to get your tax affairs in order, especially if you want to stay off the ATO’s radar.

Yet many taxpayers continue to push boundaries by claiming eyebrow-raising deductions such as claiming swimwear as workwear, air fryers as tools of trade, and designer wardrobes as job essentials.

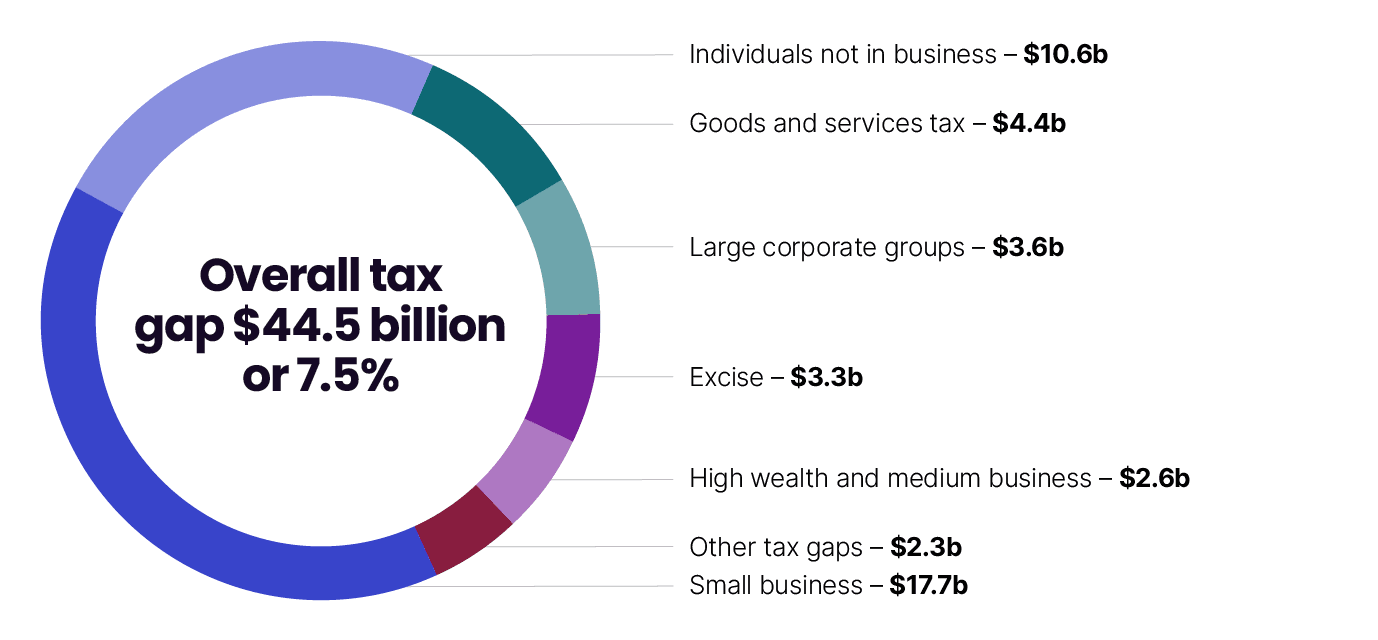

Considering that individuals contribute around $10.6 billion to Australia’s tax gap (as shown below), it’s no wonder that key categories such as work-related expenses, working-from-home deductions, undeclared income, and rental property claims are a focus for the ATO this year.

Here are our top five tips to help you stay out of ATO trouble this tax season:

1. Don’t Wrongly Claim Work-related Expenses

The number one area where taxpayers tend to stumble is with work-related expenses. To make a claim, it needs to meet three basic checks: you paid for it yourself, it’s directly related to your job, and you have proof to back it up.

While the proposed $1,000 instant deduction for work-related expenses won’t apply this tax year, the usual $300 rule still stands. If your total claim is $300 or less, you don’t need a receipt, but you do need to show that you spent the money and explain how it relates to your work. That might be as simple as marking a bank transaction and adding a short note.

The ATO also compares deductions across similar jobs. If yours are a lot higher than average, you might get a second look.

The best thing is to keep your records clean and accessible, and maybe try using the myDeductions tool on the ATO app to keep your receipts and invoices in one place.

2. Navigating the Tricky Terrain of Working from Home

With over 10 million Australians claiming working-from-home deductions last year, this remains a key focus for ATO scrutiny.

To avoid the most common pitfalls, it’s important to understand how to correctly claim deductions for home-based expenses.

For the 2024–2025 financial year, the ATO has increased the fixed-rate method to 70 cents per hour. This rate covers internet, electricity, stationery, and similar running costs, which means these items can’t be claimed separately.

If you choose the actual cost method instead, you’ll need to maintain detailed records, including receipts and clear documentation showing how each expense relates to your work.

Copying last year’s claim might seem like a shortcut, but if your circumstances have changed or your records don’t align, the ATO may question it. Without proper evidence, your claim might not make it through.

3. Avoid Costly Rental Property Missteps

Rental property owners continue to be in the spotlight this tax time as the ATO sharpens its focus on common mistakes, particularly around misunderstandings about what can and can’t be claimed.

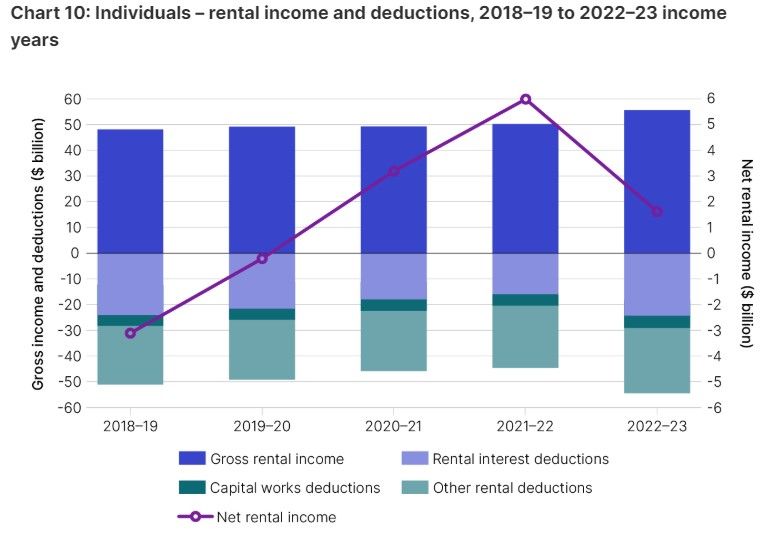

A look at the bigger picture explains why. The chart below shows a persistent gap between gross rental income and deductions, with interest, capital works, and other expenses making up a significant portion of claims year after year.

To help avoid issues, here are three areas where rental deductions often go off track:

a. Understanding What You Can Claim

One of the most frequent issues is a misunderstanding of which expenses are actually deductible, particularly the difference between repairs and maintenance, which can usually be claimed immediately, and capital expenses, which often need to be spread over time.

As a rule of thumb, deductions can only be claimed when they relate directly to income earned in the same financial year.

But not all costs can be claimed right away. A repair, like fixing a leaking tap or patching a wall, can usually be claimed in full in the year it’s done. A capital item, such as a heater, dishwasher, or curtains, generally needs to be claimed over time, unless it costs $300 or less.

b. Holiday Homes and Genuine Rental Intentions

If you own a holiday home, intention matters. You can generally claim expenses even during vacant periods, but only if you're genuinely trying to rent the property out.

Listing it well above market rates, restricting tenants unnecessarily (like excluding children in a family-friendly area), or barely advertising it at all could all suggest the property is being kept for private use. If that’s the case, deductions are likely to be denied.

It’s important to keep clear records, including when the property was available for rent, when it was used personally, and where and how it was advertised.

c. Incorrectly splitting income and deductions between joint owners

If you co-own the property, make sure rental income and deductions are divided according to your legal ownership share. This is one of the most common audit triggers and one of the easiest mistakes to avoid.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

4. Don’t Forget Your Side Hustle Income

Whether you're delivering food on weekends, freelancing after hours, or renting out your spare room on Airbnb, that extra income isn’t flying under the ATO’s radar anymore. They receive data directly from most gig platforms now, which means undeclared side hustle earnings are easier than ever to spot.

If your side gig activity is regular, organised, and aimed at making a profit, the ATO may treat it as a business, even if it started out as a hobby. That means extra obligations such as declaring all income, keeping proper records, and meeting any tax, super, or registration requirements.

If you're a sole trader, a single ABN can cover all your business activities. You can still claim deductions for things like fees and equipment, but only if you have records to support them.

Leaving it out can lead to penalties or follow-up action later.

5. Crypto gains are being watched too

With nearly a million Australians dabbling in cryptocurrency, the ATO has ramped up scrutiny in this space.

What might surprise first-time investors is the sheer variety of crypto actions that count as CGT events in Australia. Using cryptocurrency to pay for goods or services, or earning tokens through activities like staking, mining, or airdrops, can all trigger tax obligations under Australian law.

To stay safe, keep detailed records such as dates, amounts, fees, and transactions. You don’t want to have to explain forgotten crypto gains years later to an auditor.

The Golden Rule: Keep It Simple, Honest, and Documented

The temptation to stretch the rules at tax time is common but the cost of getting it wrong can be huge. Inflated claims or missing records are red flags for the ATO and can lead to audits and penalties.

By sticking to the golden rule of keeping it simple, honest and documented, investors can avoid unnecessary ATO scrutiny. And if in doubt, getting professional tax advice can make all the difference.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.