Budget 2025: What Investors Need to Know

Ankita Rai

Thu 3 Apr 2025 6 minutesWith an election looming, the Albanese Government’s 2025 Budget lands exactly where you’d expect: safe, strategic, and politically calibrated. It’s packed with handouts designed to ease household cost pressures, including tax cuts starting from 2026–27, student debt relief, and housing assistance.

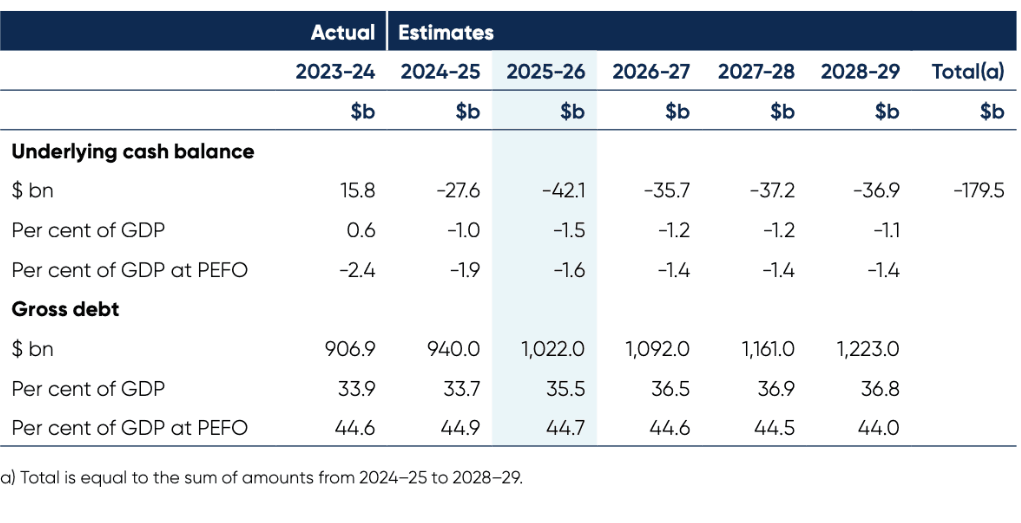

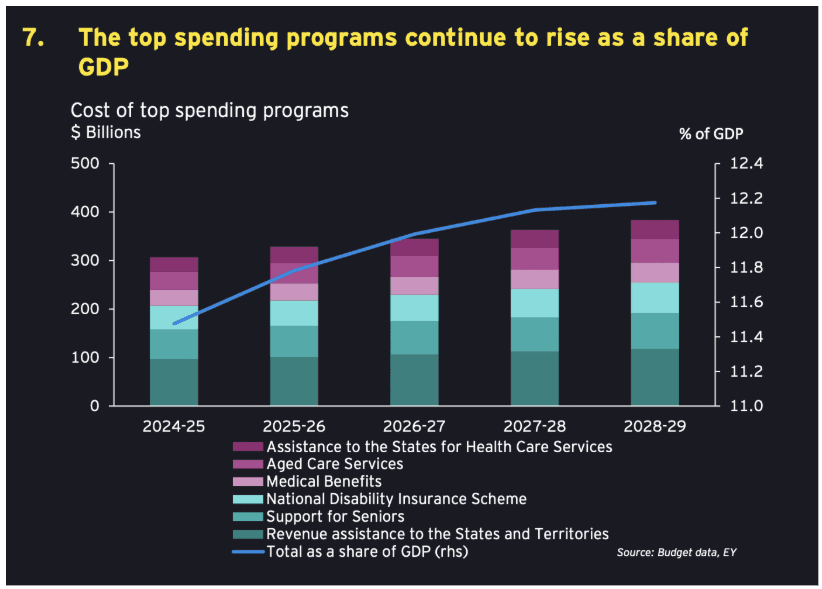

The Budget extends support measures—but at a price. It returns to a deficit with a $27.6 billion shortfall this year and $42.1 billion projected for 2025–26. As a result, gross debt is set to climb to $1.22 trillion by 2028–29, up $283 billion from current levels.

While the government’s economic outlook is cautiously optimistic, it leans heavily on global stability—an increasingly shaky assumption as the US becomes more protectionist under Trump 2.0. Inflation is forecast to return to the RBA’s 2–3% target range, with unemployment expected to hold at 4.25%.

For investors, the Budget may not move the needle dramatically—but it does underscore what’s here to stay.

Let’s break down what matters most…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

1. The $3 Million Super Tax: Still on the Table

Firstly, there’s the elephant in the room: the proposal to tax unrealised capital gains on super balances above $3 million is still alive and well—despite being omitted from the Treasurer’s speech. It hasn’t changed, and all signs suggest it will be taken to the next election in its current form.

Originally announced in the 2023–24 Budget, the measure imposes an extra 15% tax on unrealised gains over the $3 million threshold—which won’t be indexed. It introduces complexity, administrative burden, and uncertainty for SMSFs and high-balance investors alike.

2. Superannuation: Contribution Room Increases

Inflation indexing is kicking in for retirees. From 1 July 2025, the general Transfer Balance Cap (TBC) —the maximum amount you can move into a tax-free retirement phase—will rise from $1.9 million to $2 million. This will allow more retirees to shield a larger slice of their super from tax.

The higher TBC also opens the door for increased non-concessional (after-tax) contributions, depending on your total super balance:

Meanwhile, the final leg of the Super Guarantee (SG) rate increase takes effect from 1 July 2025, moving from 11.5% to 12%. Employers will need to adjust payroll, and anyone salary sacrificing into super should be mindful that these employer contributions count toward the concessional cap—which is $30,000.

The Division 293 threshold also stays fixed at $250,000. This means more professionals will fall into the additional 15% tax on concessional contributions as wages increase over time.

3. Deeming Rate Freeze

For nearly a million older Australians, the deeming rate will remain frozen at 2.25%. This rate is used to estimate how much income retirees earn from their assets when applying for the Age Pension.

With term deposits and other cash investments offering much higher returns, keeping the deeming rate low effectively increases pension eligibility and payments.

4. Personal Tax Cuts: Modest Relief

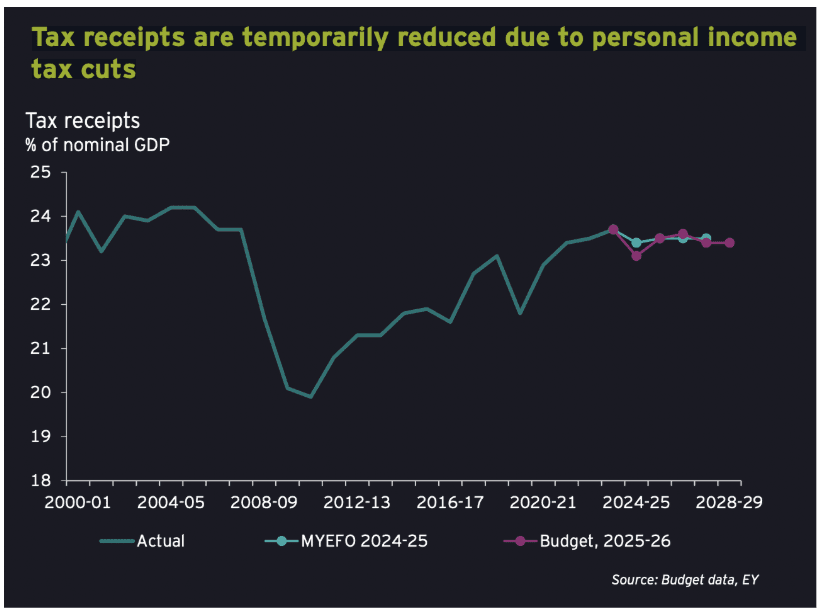

On the personal tax front, Labor has sharpened its tax cut strategy to target low- and middle-income earners.

From 1 July 2026, the 16% marginal rate (for income between $18,200 and $45,000) will drop to 15%, and again to 14% in 2027.

For the average worker, this equates to $2,200–$2,500 in annual savings by 2027. But the benefit tapers off quickly as incomes rise. And while these cuts offer short-term relief, the government continues to avoid broader tax reform—leaving Australia overly reliant on income taxes.

5. HECS/HELP: A $19 Billion Sweetener

In what can only be called a vote-magnet, the Budget proposes a 20% flat discount on all student debt, including HECS/HELP and VET loans—if Labor is re-elected.

With average student debt now at $27,600, this move would shave off roughly $5,520 per person.

This could boost consumer confidence and discretionary spending amongst younger cohorts, with long-term implications for the retail and housing markets.

6. Housing and Infrastructure: Modest Moves, Big Targets

The Budget expands the Shared Equity Scheme, allowing eligible first-home buyers to co-purchase a property with the government. The income cap has been lifted from $90,000 to $100,000, slightly widening access to the scheme.

A two-year ban on foreign buyers purchasing existing homes will also come into effect from April 2025. While politically popular, its actual impact on housing availability is expected to be minimal, given already subdued foreign demand.

On the supply side, the government is promoting faster homebuilding through modern construction methods, including pre-fabricated housing. It has also committed up to $10,000 in support for apprentices in housing-related trades. However, these measures are unlikely to be enough to meet the target of building 1.2 million new homes over five years.

On the infrastructure front, the Budget commits an additional $15.6 billion to new projects—primarily in road and rail—across all states and territories. These investments are aimed at long-term productivity gains, supporting supply chain efficiency and job creation over the coming year.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

7. Cost-of-Living Relief: Broad but Blunt

Beyond targeted measures, the Budget also offers a few universal sweeteners. From July 2025, all households will receive a $150 energy rebate, and small businesses will benefit too.

Healthcare gets a major boost, with $7.9 billion committed to expanding bulk billing—aiming to make 90% of GP visits free by 2030. The Medicare levy low-income thresholds will also increase by 4.7% for singles, families, seniors, and pensioners.

These measures aren’t market-moving, but they do support consumer sentiment, especially at a time when high interest rates are still weighing on spending.

8. Business Investment: Still Missing in Action

One of the biggest structural issues untouched in this Budget is Australia’s persistent business investment slump.

Despite growing calls for stimulus—like a 20% investment allowance or targeted R&D incentives—Treasurer Jim Chalmers offered nothing new to shift the dial.

Private sector investment remains stuck near a 30-year low at just 12.5% of GDP. R&D spending also continues to lag, hovering at 1.7% of GDP—well below the OECD average of 2.73% and significantly behind the US’s 3.5%.

The Budget does allocate over $5 billion to clean energy industries through its Future Made in Australia initiative. But broader incentives to lift business investment across the economy remain absent.

With gross government debt projected to exceed $1 trillion and global capital becoming increasingly selective, business investment remains a key area to watch in future policy announcements.

A Budget Focused on Now, Not Next

Budget 2025 isn’t a turning point—it’s a holding pattern. It offers modest relief, cautious optimism, and clear signs of pre-election positioning.

There’s no bold tax reform, no major changes to super, and little to boost business confidence. What it does offer is predictability—with a few sweeteners.

The message is clear: don’t expect structural change before the election. But do keep an eye on the narrative—because it often signals where policy is headed next.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.