Protect your Wealth from the Greedy Hands of Inflation

Simon Turner

Wed 2 Apr 2025 6 minutesIn most developed markets, including Australia, higher interest rates have tempered inflation but it’s proving stickier than most central bankers expected. In short, the journey to tame inflation is taking longer than expected and remains far from won.

Whether or not you believe central bankers will indeed win the battle, navigating inflation is a significant consideration for all investors. Understanding how to protect your wealth from its greedy hands is foundational to most asset allocation strategies…

The lowdown on local inflation

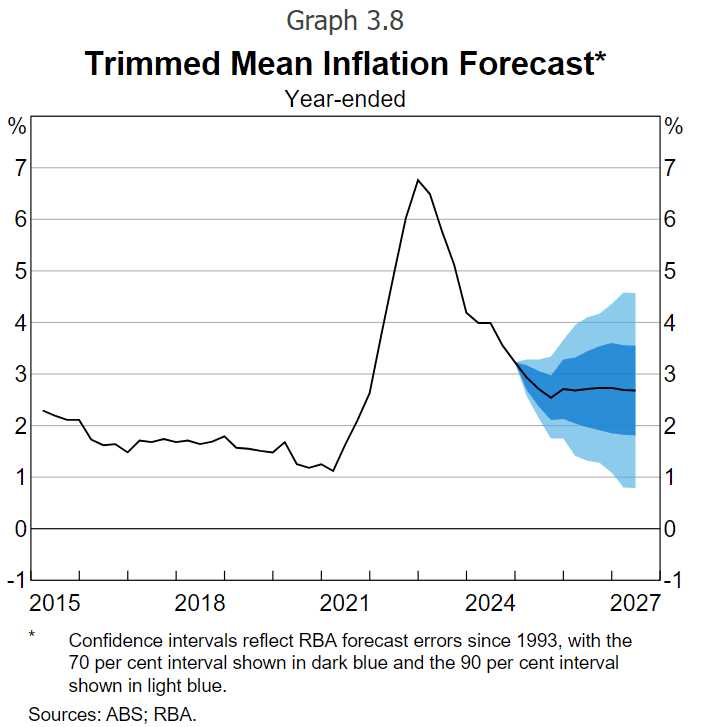

In Australia, the RBA took heart from the weaker-than-expected inflation read of 2.4% in the December quarter, which was down from 2.8% in the previous quarter. Unsurprisingly, they surmised that this change indicated ‘more spare capacity in parts of the economy than previously judged.’

Don’t crack open the champagne just yet. Despite the good news, the RBA remain as hawkish as ever due to their expectations of growing inflationary pressures thanks to the government’s unwinding of various cost-of-living measures, such as electricity rebates.

The upshot is that the RBA believe underlying inflation will remain ‘a bit’ above the midpoint of the 2–3 per cent range from late 2025 onwards, rather than hitting the midpoint as they forecast in November.

Whilst ‘a bit’ isn’t exactly helpful guidance, in economist terms it surely translates into central banker fear that inflation will remain higher for longer.

So inflation remains a major investment consideration which will continue to bring with it risks and opportunities—and that situation is unlikely to change anytime soon.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

How to protect your wealth from inflation’s greedy hands

There are plenty of voices across markets telling us how the various asset classes respond to inflation.

But what does the data tell us?

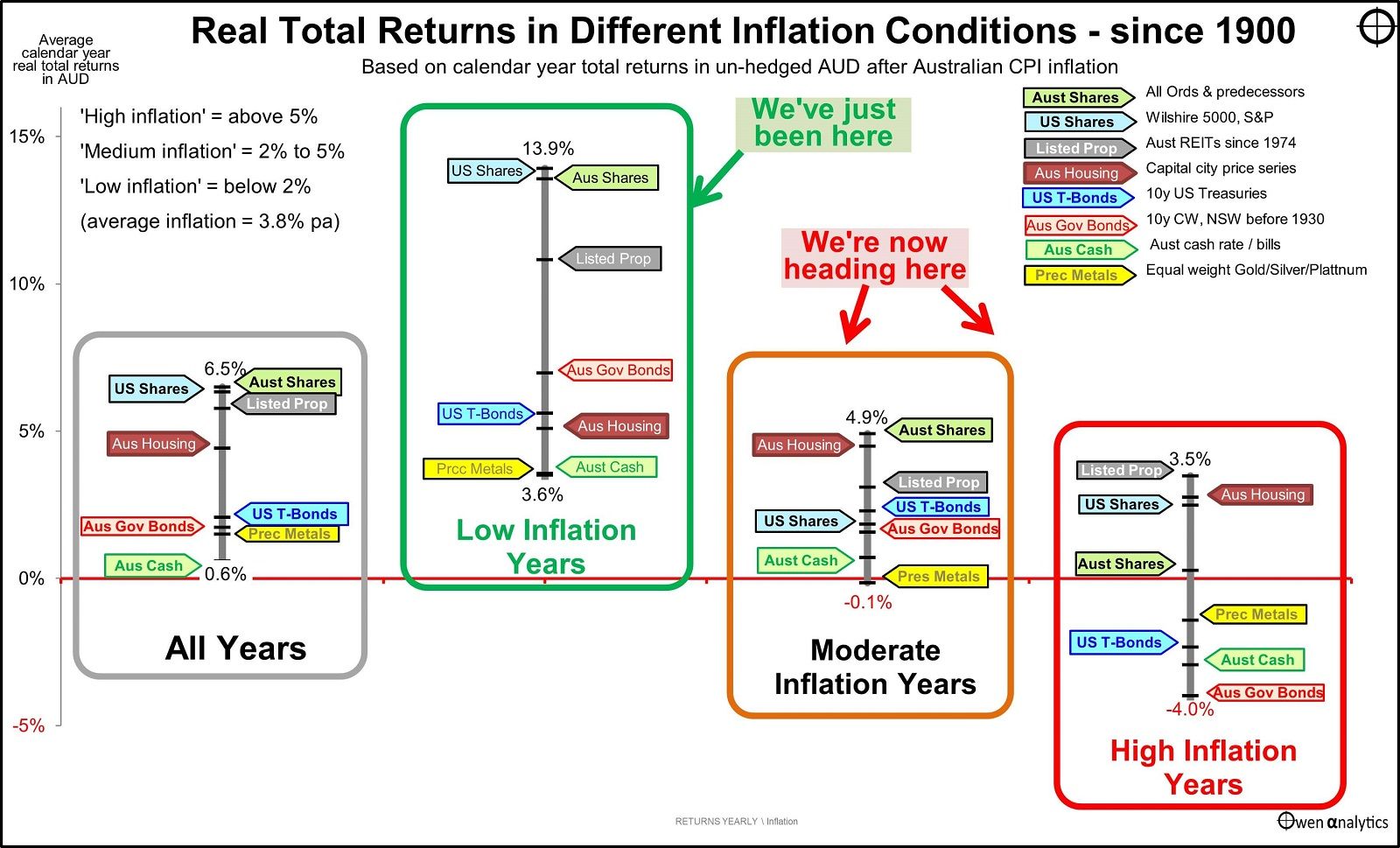

As shown below, global markets have transitioned, or are transitioning, from the ‘Low Inflation Years’ toward the ‘Moderate Inflation Years’. Check out the shift in real returns leadership that occurs on average during this transition…

The implications of investing in a more inflationary environment are significant…

1. Equities provide solid inflation protection but lower real returns

It’s well-known that equities benefit from inflation as it provides companies with a social licence to raise their prices. Whilst that’s undoubtedly the case, the relationship between Australian equities returns and inflation is more nuanced.

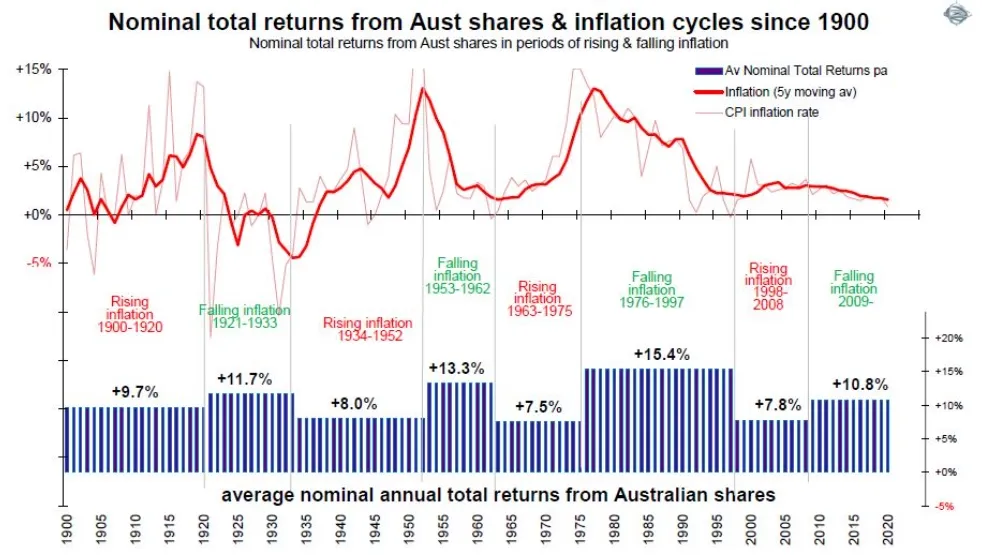

As shown below, Australian equities have generated nominal returns of 10% p.a. over the very long term, but returns during periods of rising inflation have generally been slightly lower: 9.7% p.a. in 1900-1920, 9.0% p.a. in 1934-1952, 7.5% p.a. in 1963-1975, and 7.8% p.a. in 1998-2008.

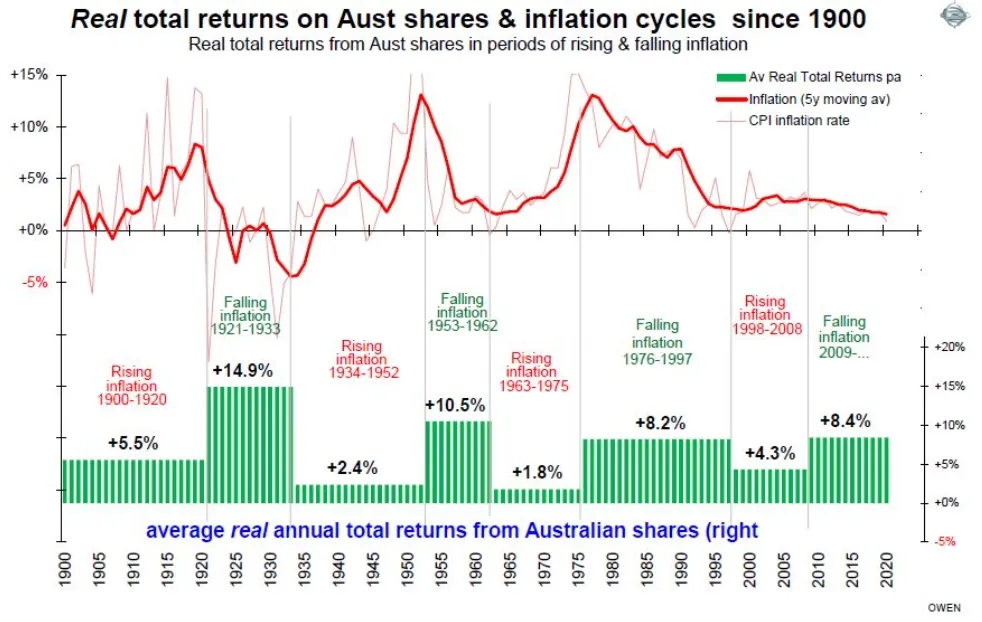

However, real returns (after inflation) are what matter to investors. As you’d expect, the real return numbers are lower during inflationary periods with low single digit returns the being norm—as shown below.

So investors should expect lower real returns when inflation is higher. But most importantly, they should still expect positive real returns.

Takeaway from investors: Australian equities have provided solid inflation protection over the long term as evidenced by the positive real return data during every single period of rising inflation. Having said that, investors should be prepared for lower real returns when inflation is higher.

2. Listed Property Trusts and Housing provide excellent inflation protection

The real returns data during inflationary periods is positive for property in general—particularly for Listed Property Trusts and Housing. Both have consistently generated solid real returns during high inflation years.

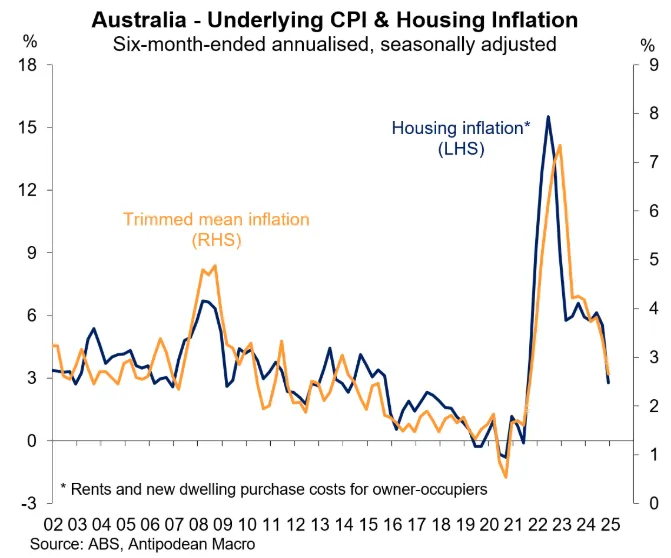

The resilience of property during high inflation years makes sense. Most leases including periodic inflation-adjustments aimed at protecting landlords’ real returns. As a result, there’s a high correlation between rental growth and inflation—as shown below.

Hence, Listed Property Trusts and Housing are the gold standard asset class when it comes to inflation protection.

Takeaway from investors: Listed Property Trusts (and unlisted property funds for the same reasons) and Housing provide excellent inflation protection. For investors who are worried about a prolonged period of high inflation, owning property directly, or through listed and unlisted funds, is likely to help protect their wealth.

3. Bonds are particularly exposed to the wealth eroding effects of rising inflation

Unfortunately, inflation is the arch-nemesis of most bond investors because coupon payments are not generally adjusted for inflation.

As a result, during inflationary periods, both Australian Government Bonds and US Treasuries sometimes negative real returns.

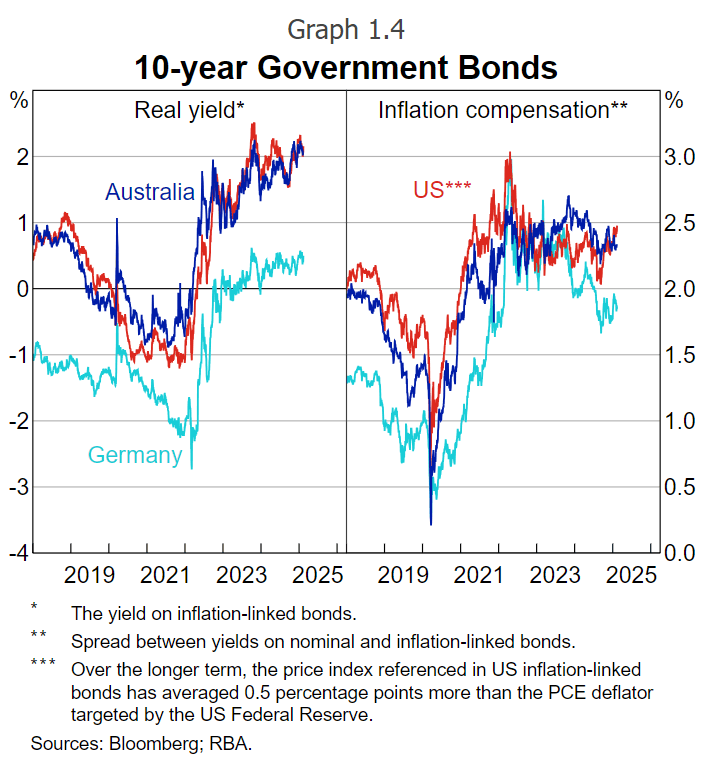

Case in point: as shown below, real yields on Australian Government 10-year bonds are currently around 2%, having been negative during 2020 and 2021. And German real yields are barely positive, even at this juncture.

It’s not just the prospect of negative real yields that impact bond investor returns during periods of high inflation.

It’s the fall in capital values as a result of rising interest rates which take a bigger toll. For example, if the RBA were to raise rates by another 1% to try to combat inflationary pressures, the Australian Government 10-year bond yield would rise from the current 4.45% to 5.45%. All other things being equal, that would lead to a 22% decline in the value of the bonds on the listed market.

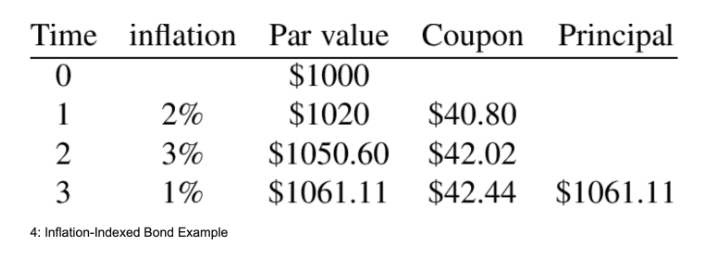

Bond investors aiming to mitigate this risk can consider inflation-linked bonds. These securities and their interest payments are indexed to inflation so they provide protection against inflation risk. For example, an inflation-linked bond’s value and coupon generally increases each year in line with inflation—as shown below.

Takeaway for investors: Bonds are particularly exposed to the risks of high and rising inflation. Beyond investing in inflation-linked bonds, bond investors should be prepared for negative real returns during periods of higher inflation.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Navigating inflation means protecting your expected real returns in a range of scenarios

Whether or not the RBA and other central bankers are successful in conquering inflation doesn’t change the fact that investors need to navigate inflation now and in the future. It’s a core part of all asset allocation decisions.

In short, if you believe inflation is likely to remain lower for longer, Australian equities, US equities, and Listed Property Trusts are likely to best position you for what’s coming.

And if you believe inflation is likely to remain higher for longer, Listed Property Trusts, Australian equities, and Housing are likely to best position you for what’s coming.

The good news is that a couple of these asset classes are likely to perform well in both scenarios: namely Australian equities and Listed Property Trusts.

Real return funds positioned to benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.