Learning from the permabears without becoming a pessimist

Simon Turner

Tue 18 Mar 2025 6 minutesHave you ever met a true permabear? It sometimes seems like this pessimistic breed of investors are preprogramed to celebrate all bad news and criticise all good news.

But what if we can all learn from permabears, without being pessimists or doomsdayers? What if the bearish reasoning behind the ultimate permabear trade may, in fact, contain the seedlings of some sensible investment advice?

The historical context driving many permabears to be permabears

Ask most permabears why they’re so bearish, and many will reference their expectation of a replay of the 1970s when escalating global geopolitical risks, high inflation, and energy shocks controlled the macro narrative and drove global equity markets.

We get it. The similarities between the 1970s and today’s market narrative are hard to ignore…

The Fed clearly wants to cut rates due to signs of a US economic slowdown. However, with inflation remaining above its target, and Trump boosting government spending and raising tariffs, inflationary forces are conspiring against a significant rate cutting cycle.

Trump’s first few weeks in office have significantly raised global geopolitical risks thanks to his initiation of an aggressive tariff strategy which is straining long term relationships, not to mention his divisive rhetoric regarding the Ukraine war and Greenland, and JD Vance’s ideological assault on European leaders.

Oil inventories are currently dangerously low while investment in new capacity has been low for many years. Rarely has the oil market been so vulnerable to a shock.

In short, the case for a return of higher inflation has rarely been stronger. Add in a bearish mind-set, and you’ve got yourself a negative macro outlook.

The ultimate permabear trade

So how do permabears aim to profit from their bearish expectations?

There’s one hallowed pair trade which perfectly expresses the view of most permabears: long gold, short US Treasuries.

Both sides of this trade are likely to be profitable in the event that inflation rises faster than expected and the US Government’s debt burden continues to rise.

That’s not exactly a cheery outlook but is reflective of permabears’ belief that the financial world is about to implode. In the words of permabear Russell Clark: ‘The long gold and short bonds trade is in its early stages. The price of gold could double to $US6000 an ounce while long-term bond rates could be more than double to 10 per cent, which would halve bond prices.’

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The long gold rationale

The long gold position has historically attracted a particular breed of permabear, known as gold bugs, who believe the system is on the brink of collapse, and that the best way to avoid being exposed to those systemic downsides is to buy gold.

Warren Buffet famously denounced gold as an asset class for this cynical philosophy of betting against the system. But what if gold bugs are finally correct in their prognosis for gold and the system?

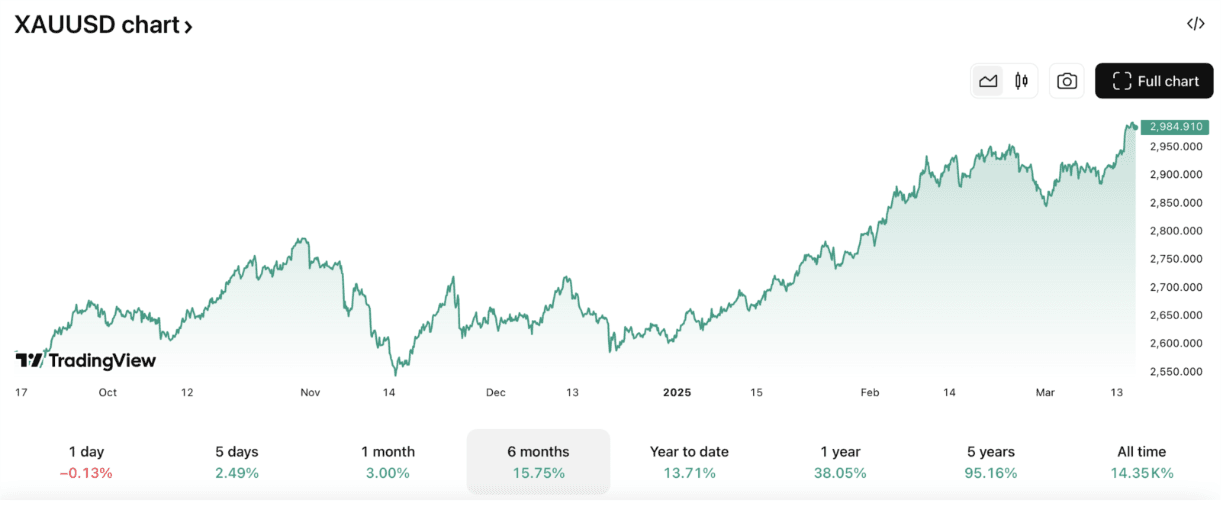

Recent gold performance has certainly been encouraging—as shown below.

With gold entering a new bull market like this, there’s been a growing chorus of gold bugs proclaiming it’s being driven by financial oppression, currency debasement, and financial mismanagement by governments.

However, the real drivers could be less cynical than that…

Firstly, persistent inflation, as we’ve been witnessing all around the world, benefits gold as more investors tend to buy gold as a store of wealth when inflation is eroding the real returns of most asset classes.

Secondly, central bank demand for gold has been rising. It’s likely that central bankers, like gold bugs, are watching global debt levels, particularly US Government debt, with a growing awareness that it’s unlikely to be repaid unless more money is printed. That would further stoke inflation while creating an effective a race to the bottom for many leading currencies. In that context, owning gold is a compelling strategy to protect and stabilize their reserves. For example, the Chinese, Indian, Turkish and Kazakhstani central banks have all been noteworthy gold buyers of late.

Thirdly, someone with deep pockets has been scooping up gold in recent months—like the U.S. Treasury or the Fed for example. One interpretation is that Trump’s government is preparing for a gold audit, possibly in preparation to gold-back the US dollar. Whilst interesting, it’s worth adding this is pure speculation.

So there’s a lot going on in the gold market. The important point for investors to be aware of is that whilst some of these drivers are indeed bearish, others relate to systemic change. In other words, there’s a case to be made to be long gold, regardless of your macro view.

The short US Treasuries rationale

The short Treasuries position also revolves around higher inflation which is negative for US Treasuries due to the increased credit risk and lower real returns in this scenario.

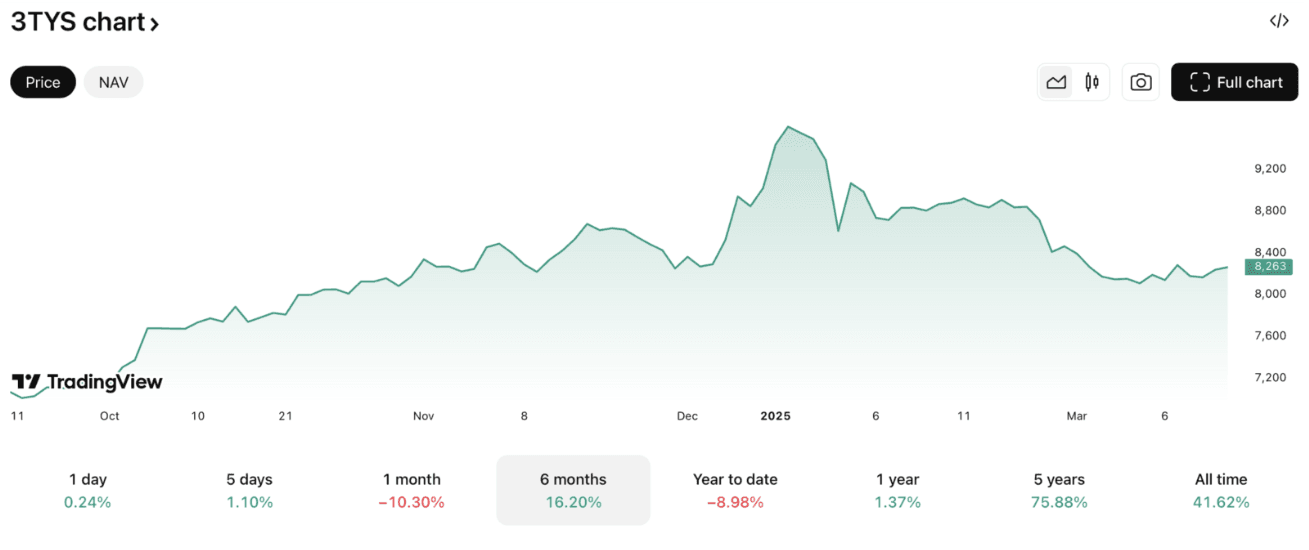

As shown below, this trade has been working over the past 6 months, albeit with a wobble over the past month.

If inflationary forces remain too strong for too long, most permabears believe the Fed will be forced to raise rates rather than cut them. That would obviously be bearish for the US and global economies, while US Treasuries would be particularly impacted. For each 1% increase in US Treasury rates from the current 4.23% yield, the capital values of the bonds would fall by 24%. This is the stuff of dreams for permabears.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Learning from the permabears while remaining optimistic

If you’re reading this article and you’re not a permabear or a pessimist, but you’re still concerned by recent macro developments, you may want to consider one half of the permabear trade: long gold. There are compelling reasons to believe the gold bull market has further to run.

The other strategy to prepare for a higher inflation, higher interest rate world is to invest in other asset classes which tend to outperform during inflationary periods—such as commodities, energy, property and infrastructure.

Of course, there’s also the more aggressive half of the permabear trade to consider: shorting US Treasuries in the expectation that higher inflation will lead to higher interest rates and lower Treasury prices. Whilst there may be merit to this viewpoint, shorting income-generating assets should be regarded as a high-risk, short-term strategy, rather than a sound long-term investment plan.

Funds positioned to benefit

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.