The big dollars being made in infrastructure

Simon Turner

Thu 12 Sep 2024 6 minutesBlackstone and Canada Pension Plan Investment Board have agreed to acquire AirTrunk, an Australian digital infrastructure business, for $24 billion. It’s great news for the AirTrunk investors who will reap the rewards of an enormously successful exit. It also highlights the attractions of infrastructure investing, particularly in the fast growing digital infrastructure space.

With deals like AirTrunk highlighting the opportunity, it may be worth asking: have you got enough infrastructure exposure?

What is infrastructure investing?

Infrastructure investing involves investing in essential assets such as:

Energy: Oil and gas storage and transportation, and renewables projects.

Transportation: Railways, roads, bridges, toll roads, and airports.

Utilities: Water, waste, gas, and electricity networks.

Communications: Satellite and telecommunication services.

Data centres: managed data centres, enterprise data centres, hyper-scale data centres, colocation data centres, cloud-based data centres, and edge data centres.

Social facilities: Schools, hospitals, and prisons.

Given the essential nature of these assets, they tend to generate solid risk-adjusted returns over the long term, with much lower volatility than the broader market. So infrastructure investing has a stabilising role to play in many investors’ portfolios.

Infrastructure’s rock solid track record

Infrastructure assets have a history of delivering solid returns throughout the economic cycle.

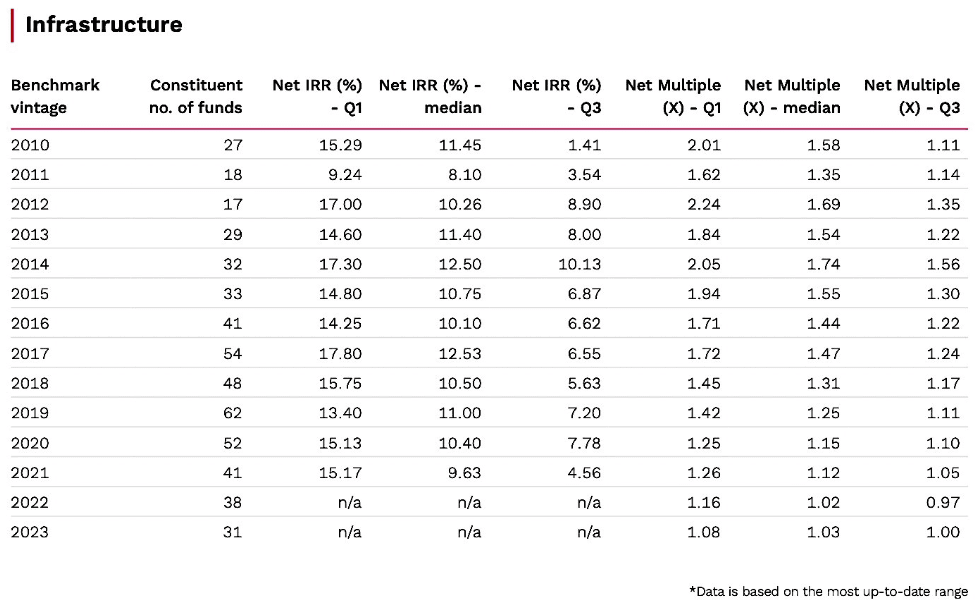

This is confirmed by the most recent Preqin data on the unlisted infrastructure sector which shows that the sector’s median net IRR has remained relatively stable at 10-12% p.a. for the past decade of vintage years. Importantly, and in contrast to a number of private market sectors, infrastructure returns have not trended lower in recent years.

Herein lies the main attraction of infrastructure assets. They deliver solid returns year in, year out with minimal sensitivity to economic growth. These assets also tend to offer inflation protection since infrastructure tolls and fees usually include an annual CPI adjustment.

From a risk-adjusted perspective, a 10-12% p.a. return from defensive assets which structurally benefit from inflation is particularly attractive for most investors.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Digital infrastructure case study: AirTrunk

Sorry to do this to you, but are you ready to experience a little bit of FOMO in hindsight?

Let’s delve into the AirTrunk case study for a view of what’s possible in the digital infrastructure space.

Macquarie and PSP Investments acquired an 88% stake in AirTrunk in 2020 for $3 billion from Goldman Sachs and Sixth Street Partners. It was a chunky price tag for an emerging business with a high risk profile. This wasn’t a surprise at the time as both the sellers were well known for achieving top dollar.

But in this case, the buyers were savvy.

After owning their stake in AirTrunk for four years, the business was sold for $24 billion. It’s a big number and symbolic because it represents Macquarie’s biggest portfolio company sale, Blackstone’s biggest investment in Asia Pacific, the world’s largest data centre sale, and Australia’s biggest M&A deal this year.

Time for some rough maths … AirTrunk was carrying about $10 billion of debt and required a ‘few billion’ of capex investment (let’s assume $3 billion), so the net capital return to equity investors was around $11 billion after four years of investment. That implies the gross IRR achieved by fund investors was 30%+ p.a. Please note: these are guesses rather than real numbers.

The after fee IRR is likely to be lower due to the $1-1.3 billion of performance fees JP Morgan estimate Macquarie is due.

Regardless, the returns to AirTrunk investors were about as good as you can expect from a niche infrastructure play.

What we can learn from the AirTrunk story

The AirTrunk deal highlights some valuable lessons for investors:

Think long term about infrastructure. AirTrunk’s valuation looked high when it was last sold four years ago, but the optimal infrastructure investment strategy is generally to hold onto these types of assets over the long term.

Competition for quality assets is rising. The AirTrunk deal will further raise the profile of digital infrastructure as an asset class, which is likely to lead to greater investor interest and more competition for high quality assets in this space.

Investing in infrastructure with thematic tailwinds behind it is often a lucrative strategy. For example, data centres are benefitting from structurally growing demand for data storage driven by all aspects of the digital economy. It’s hard to think of a more visible or sustainable thematic tailwinds, nor a better way to gain exposure to it.

The funds which invest big when they find a compelling opportunity like AirTrunk are often the ones that generate the highest returns. Infrastructure investing is an asset class which is well matched to a high conviction investment strategy.

Gaining access to the best infrastructure assets is a highly competitive process given the number of unlisted and listed managers on the lookout for deals. Hence, the best route to gain access is often via a managed fund.

Valuations of the highest quality infrastructure assets reflect the strength of investment demand for these assets. In other words, they don’t come cheap. Value investors may find it challenging to stomach the kind of valuations common across the sector whereas growth investors are more likely to focus on the growth rates and thematic tailwinds.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

How to invest in infrastructure

Whilst there are listed investment options across global markets, some of the best infrastructure opportunities are unlisted. So this is an asset class which is well matched to investing through managed funds and ETFs. For example:

The Magellan Infrastructure Fund is an active ETF targeting stable, long-term returns by investing in globally listed infrastructure.

JP Morgan’s Sustainable Infrastructure Active ETF invests in a high conviction, unconstrained portfolio of global sustainable infrastructure stocks.

Resolution Capital’s Global Listed Infrastructure Fund invests in global infrastructure stocks that are listed, or soon to be listed, to optimise risk-adjusted returns.

Infrastructure funds have a long term role to play

The AirTrunk deal has served to highlight the attractions of infrastructure investing as well as the niche thematic opportunities within the asset class.

Whilst gaining exposure to the next AirTrunk may be a big ask for most individual investors, accessing high quality managed infrastructure funds and ETFs which are positioned to generate solid risk-adjusted returns is far more achievable. Ensuring you have sufficient exposure to this defensive asset class could well be prudent.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.