Harnessing Currency to Enhance Your Portfolio Returns

Simon Turner

Mon 28 Jul 2025 6 minutesAs the world adjusts to the knock-on effects of Trump’s new tariffs, currency markets are playing an increasingly pivotal role in driving portfolio outcomes. Whilst currency exposure is often an after-thought for Australian investors, it can be a powerful lever for both risk management and performance enhancement.

In short, now’s the time to ensure currency is your portfolio’s friend rather than its foe…

Why Currency Matters for Investors

Currency exposure impacts your investment performance in two key ways:

1. Return Enhancement or Erosion

For all investors with international exposure, unhedged gains (or losses) in foreign currency holdings are reflected in your portfolio returns.

For example, if you hold a US ETF and the AUD depreciates against the USD, your investment will benefit from a currency tailwind when converted back to AUD.

However, the opposite happens when you’re on wrong side of a currency move. In this example, a stronger AUD would mean your portfolio returns will be impacted by a weaker return from your US ETF.

2. Diversification & Risk Management

Diversified currency exposure can also serve as an effective risk management strategy.

Growing evidence suggests that selective currency exposure, rather than full hedging, can boost investors’ risk-adjusted returns, especially during periods of policy divergence like we’re experiencing now:

For example, during local economic downturns or periods of political instability, foreign currencies often appreciate relative to investors’ domestic currency, helping to offset local equity market weakness.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Currency Trends to Be Aware Of

So currency matters for all investors with international exposure.

Let’s break down the main currency trends at play, and how they could be tactically used to enhance your portfolio returns…

While a stronger AUD reduces the value of foreign holdings when converted back to AUD, it can offer entry opportunities into foreign markets at a lower cost. So recent AUD strength against some currencies may present opportunities.

If you believe recent AUD strength is unsustainable, this could be an ideal time to diversify globally, particularly into currencies which have weakened against the AUD, like the USD. If this is your objective, you’ll want to invest in unhedged global ETFs and funds which benefit from AUD weakness.

However, if you believe the AUD will continue to strengthen due to ongoing USD weakness or a continued risk-on market environment, you’ll want to invest in hedged funds and ETFs to ensure your returns aren’t eroded.

Investors may be prudent to consider reducing their unhedged USD exposure unless it’s in the form of defensive assets positioned to benefit from USD weakness such as gold and other commodities.

Australian investors aiming to take advantage of recent AUDUSD strength, but without having a view on the AUD, may be better placed to buy currency hedged funds and ETFs with exposure to the US.

For yield-seeking equity allocations, investors may be prudent to invest in euro- or pound-denominated ETFs where the currency trends are more favourable.

Investing in unhedged European equity or bond funds or ETFs may capture market returns and a possible continuation of the recent currency uplift.

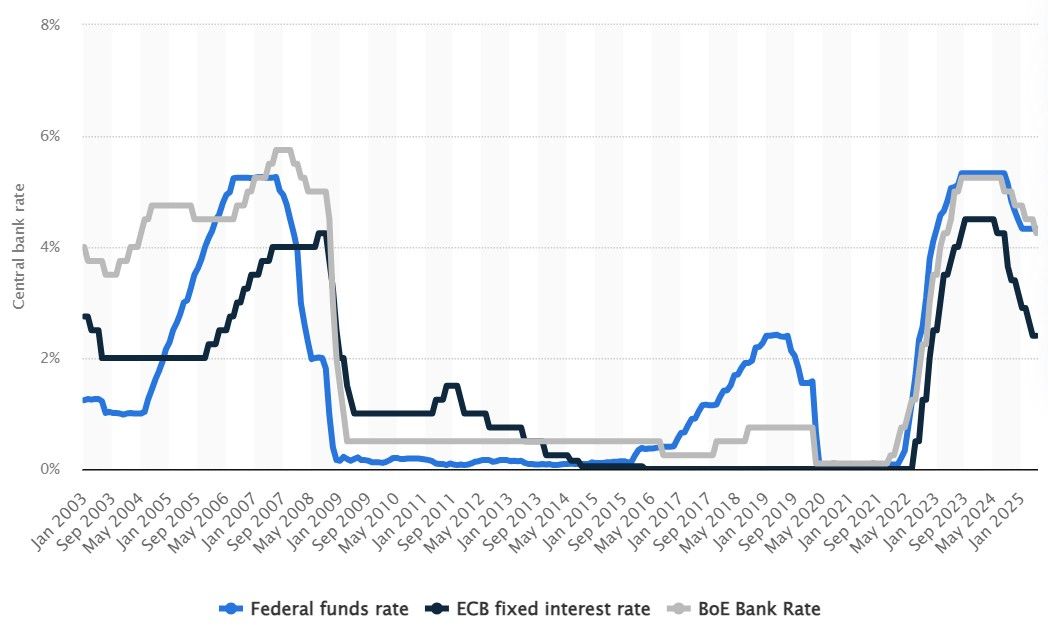

However, beware political risks such as the Ukraine War and ongoing U.S. tariff developments and their impacts. The ongoing Fed-ECB rate divergence of 1.9% could also lead to a reversal of recent currency trends.

The GBP is expected to remain volatile and may continue to weaken versus the euro, although ongoing strength against the USD is also likely.

Hedged GBP exposure is likely to make sense for most portfolios after the recent strength which may be unsustainable.

The yen’s recent weakness presents opportunities for currency-hedged Japanese equity funds and ETFs, especially in the tech and export sectors.

Investors should watch inflation and wage data closely. Any shift in the BoJ’s recent stance could lead to a sharp JPY rebound.

1. ↑ AUD – Modest Strength but Lagging Peers

For Australian investors, the Aussie dollar remains the currency which matters most.

The AUDUSD exchange rate has been hovering around 0.66 in recent weeks, benefitting from USD weakness and growing risk-on sentiment. However, the AUD has also been underperforming against the EUR, GBP, and JPY, which have been greater beneficiaries of USD weakness.

Investor Takeaways:

2. ↓ USD – Under Pressure from Debt and Policy Risks

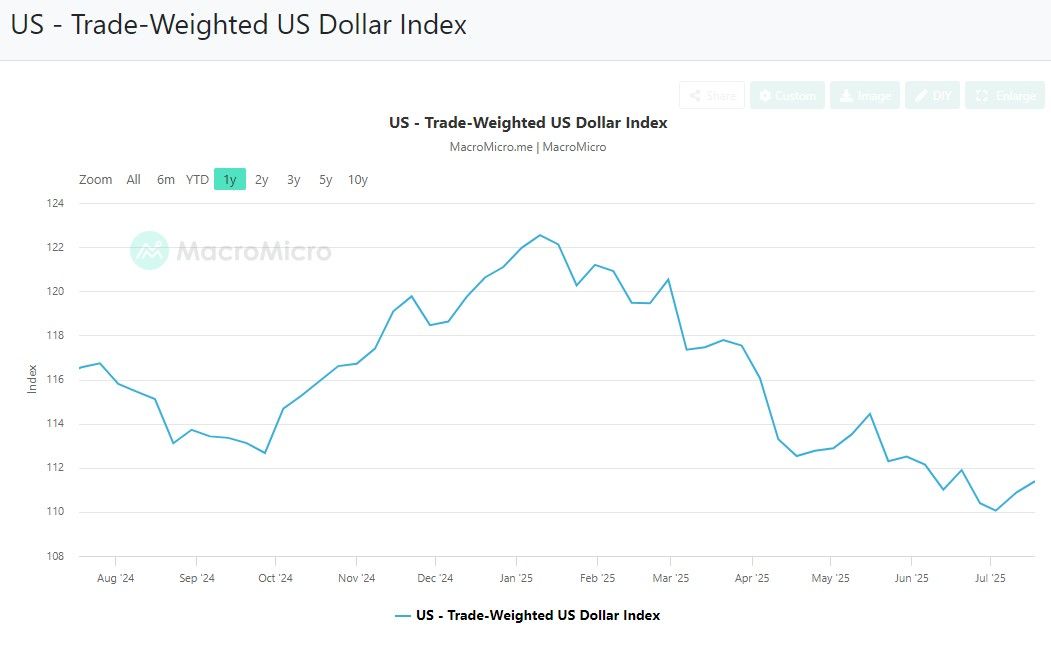

The USD has been trending downwards in recent months, reflecting souring sentiment amid rising US debt concerns (Trump’s ‘One Big Beautiful Bill’ will add US$3 trillion to the U.S. Government’s debt pile), anticipated Fed rate cuts, and geopolitical tensions, particularly in the Middle East.

These issues are likely to dominate the short-term trend in the USD, suggesting further weakness is likely.

Investor Takeaways:

3. ↑ EUR – Relative Safe Haven

The euro has been benefitting from USD weakness and recently hit 1.18 against the USD, a level not seen since 2021. Beyond USD outflows, its rise has been supported by diminishing ECB rate cuts (from 4.5% to 2.15% over 15 months), and improved European economic growth prospects.

Investor Takeaways:

4. → GBP – Mixed Signals Amid Political Turbulence

The pound has recently strengthened against the USD (up to 1.38) but weakened versus the euro, reflecting uncertainty over Chancellor Reeves’ tenure, and the UK’s unstable fiscal situation.

Investor Takeaways:

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

5. ↓ JPY – Weighed Down by BoJ Caution

The yen has recently fallen from 142 to 148 against the USD because the BoJ signalled delayed rate hikes (now targeting October), while safe haven flows failed to materialise amidst stronger US equities.

Investor Takeaways:

Currency Is Not Just a Risk, It’s a Tool

In a macro environment marked by US fiscal disarray, diverging central bank policies, and regional uncertainty, currency is no longer a background actor. It’s a front-line tool for smart, global-minded investors.

💡For Australian investors, here’s the main takeaway: you should invest in hedged global funds and ETFs if you expect AUD strength; whereas you should invest in unhedged funds and ETFs if you expect AUD weakness. And of course, if you don’t have a view on the AUD, the best strategy is to hedge your currency exposure to ensure you aren’t exposed to any surprise risks.

By staying informed and flexible, you can use currency not just to protect your capital, but to enhance and elevate it.

Examples of Currency Hedged Global Funds

Examples of Currency Unhedged Global Funds

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.