Six Money-Making Secrets from Australia’s Wealthiest Investors

Simon Turner

Wed 30 Jul 2025 5 minutesAustralia’s family offices, known for their ability to make money while protecting their capital, have been repositioning their portfolios of late.

In the face of intensifying macro headwinds such as geopolitical fragmentation, persistent inflation, and higher-for-longer interest rates, there’s a general awareness amongst them that generating future performance may be harder than it has been in recent years. So deliberate, intentional, and customised investment strategies have become the name of the game.

Now may well be a good time to learn from this successful group of investors who’ve collectively let go of blindly chasing alpha in favour of purposeful, tax-aware allocations with long-term thematic resonance.

Here are six of the main lessons the rest of us can learn from this group of winners…

1. Active Exposure Where It Counts

One of the bigger themes is the gradual shift back to active fund management we’ve witnessed across the family office sector in recent years—in the market segments where they perceive passive strategies fall short.

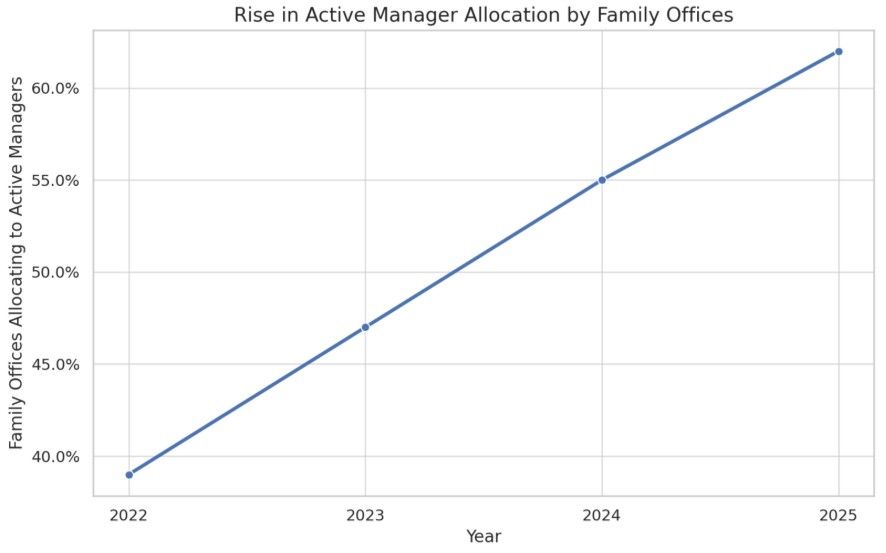

Case in point: according to a 2025 survey by KPMG Private Enterprise, 62% of Australian family offices increased their allocations to active global managers in the past year, up from 39% in 2022.

So which markets segments are benefitting from greater family office interest in active management? Here are three of the more prominent ones:

Private Credit: With major banks tightening their lending standards, family offices are accessing the superior risk-adjusted returns on offer in parts of the private credit world.

Emerging Markets (EM): Rising EM allocations reflect growing family office conviction that alpha generation is more achievable across emerging markets due to their lower efficiency relative to the developed world.

Small- and Micro-Cap Funds: Smaller companies are one of the few market segments which remain inefficient, especially in Australia where specialist managers are often able to identify unloved or under-researched stocks well positioned to outperform.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

2. Core-Satellite Still Reigns

Family offices are increasingly adopting a core-satellite approach to portfolio management which balances low-cost passive investments (the core: 60-80% of a portfolio) with actively managed or higher-risk assets (the satellites: 20-40% of a portfolio).

True to core-satellite theory, most family office portfolios hold 30-35% in active funds these days.

The main reason for this shift is that ETFs are still efficient, but family office outperformance often comes from targeted active strategies, especially in complex markets. This reflects a broader trend toward intentional, outcome-oriented portfolio engineering.

3. Tax-Efficient Structures & Intergenerational Planning

Tax efficiency has long been front and centre for family offices. After all, preserving wealth across generations is not just about investment returns, it’s also about tax structure.

As such, Australia’s family offices are increasingly leaning into vehicles and strategies that preserve their after-tax wealth, such as:

Investment Bonds: These are long-term fund exposures wrapped up for tax deferral, and they’re ideal for estate planning.

SMSFs: Holding ETFs and managed funds within SMSFs allows for concessional tax rates to be paid on income and capital gains.

Family Trusts & Testamentary Trusts: These are not just used for income splitting, but also to ring-fence and protect multi-generational capital.

4. Liquid Alternatives Gaining Traction

Family offices increasingly want access to alternatives funds without the lock-ups, cost, or opacity of traditional private equity or hedge funds. That’s led to explosive interest in liquid/listed alternatives funds.

According to Morningstar, listed alternative ETFs and LICs assets under management have grown by 27% YoY as at June 30th 2025.

Popular listed alternatives vehicles include:

Listed Private Equity Funds: Such as VanEck Global Listed Private Equity ETF.

Listed Private Equity Listed Investment Trusts (LITs) and Listed Investment Companies (LICs): such as Bailador Technology Investments Limited.

Listed Diversified Alternatives LICs: such as WAM Alternative Assets Limited.

Listed Hedge Funds: such as Fat Prophets Global High Conviction Hedge Fund.

5. Global Reach with Local Anchors

Although international exposure remains vital, family office home market bias remains pronounced as many want to protect themselves from geopolitical volatility and currency risk. That’s hardly surprising given the mounting geopolitical risks in 2025.

Conscious of the limitations of their home market bias, family offices are often buying currency-hedged ETFs and funds, especially for exposure to U.S. and Eurozone equities.

6. Direct Indexing & AI-Led Portfolios

Leading-edge family offices are exploring AI-driven investment tools to further enhance and personalise their exposure. There are a few emerging developments worthy of note:

AI Portfolio Tools: Some are utilising AI platforms that use real-time tax-lot optimisation and scenario analysis to rebalance their portfolios automatically.

Direct Indexing: Others are crafting their own customised indices that reflect their ESG values, sector tilts, and tax preferences.

ETF–Stock Hybrids: Some are blending direct equities with ETFs to reduce their costs while optimising their exposures.

Family Offices Positioned to Keep Winning

The modern Australian family office is becoming more sophisticated. Not by chasing complexity, but by curating portfolios that are efficient, forward-looking, and intentional.

That means they’re increasingly using a core-satellite architecture to improve their efficiency and alpha, while exploring thematic and technological frontiers without losing sight of liquidity or transparency.

As markets evolve, so too will the toolkit of these titans. Having said that, timeless investment principles like diversification, a long-term investment horizon, and strategic alignment with personal circumstances remain the cornerstones of all smart investing.

Disclaimer: This article is prepared by Simon Turner. It is for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.