Can AI Really Give You Quality Financial Advice? We’re Closer Than You Think

Ankita Rai

Thu 15 May 2025 6 minutesAI-powered financial tools are quietly transforming how Australians access financial guidance. From robo-advisers to digital advice apps, these platforms offer personalised, licensed advice on demand, without the waitlists, paperwork, or high price tag of a traditional adviser.

It’s a compelling offer, especially as investors’ financial lives grow more complex, shaped by rising assets, changing family structures, and shifting retirement goals.

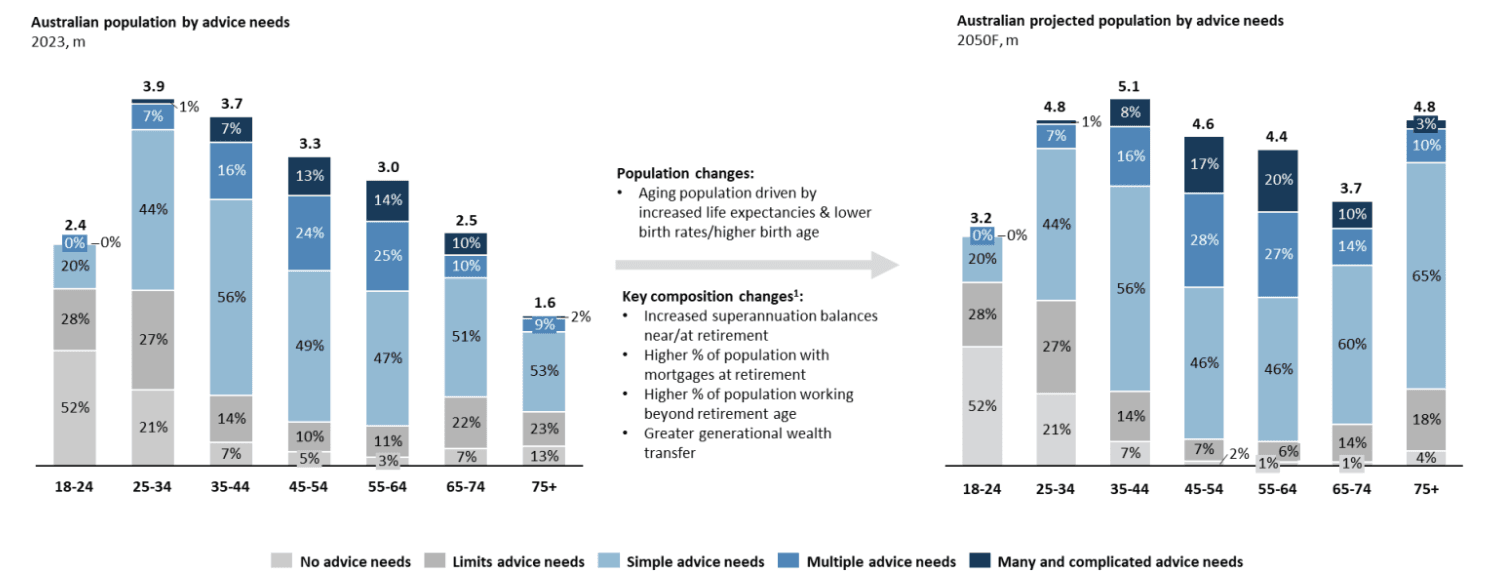

Yet many Australians continue to have unmet advice needs, and the number with complex needs is expected to grow by 70%, from 4.3 million to 7.2 million over the next 25 years as shown below:

Meanwhile, the number of licensed advisers has dropped by nearly half in just six years, while rising compliance costs have pushed the median price of advice to $3,960.

This has created a widening advice gap, one that technology and tools like AI-powered digital advice, may be able to help fill. One that AI claims it can help bridge.

But do these platforms live up to the promise? Can they offer meaningful support that is tailored, trustworthy, and aligned with your actual goals?

That’s what I set out to explore. I trialled two of Australia’s leading AI-powered advice tools, looking at:

- Affordability,

- Personalisation,

- Reliability,

- And most importantly—whether they helped me feel more confident in my decisions.

1. Otivo: Smart, Personalised, and Easy to Use

I started with Otivo, a platform that blends traditional financial modelling with an AI interface.

The core engine covers the essentials such as life insurance, investments, superannuation, and retirement planning, and automatically updates its advice as your circumstances change. But the real standout is the Ask Otivo layer.

Unlike a generic chatbot, this one is licensed, intelligent, and surprisingly intuitive. It creates tailored plans based on individual needs and even throws in practical tips along the way.

I asked it a question I’ve wrestled with for a while: Should I prioritise investing in super or paying off my mortgage?

It didn’t just deliver generic advice. It broke things down clearly by factoring in my tax rate, concessional caps, emergency savings, and even flagged that my Uber Eats habit might be eating into my long-term goals. That felt oddly personal … in a good way.

It explained that boosting super, taxed at just 15%, was a smart move, and that I could still salary sacrifice more while paying down my mortgage to save on interest.

What impressed me most was the nuance within the advice. It didn’t just stick to theory. It offered a clear, staged plan: switch to a high-growth super option to maximise long-term returns, and use any leftover cash flow to chip away at the mortgage.

It also responded intelligently to life changes. When I tested scenarios like getting a pay rise or starting a family, the platform instantly adjusted my plan. That kind of real-time, responsive guidance made the experience feel less like a tool and more like a strategy partner.

For $165, it delivered a level of personalisation I didn’t expect from digital advice.

2. Stockspot: No Gimmicks, Just Quiet Automation

Next up, I tried Stockspot, Australia’s longest-running robo-adviser.

Unlike some newer platforms, it doesn’t try to be everything. Instead, it specialises in exchange-traded funds (ETFs) and offers personalised investment portfolios managed on your behalf.

The onboarding process was straightforward. After a short risk questionnaire, I was matched with a tailored portfolio aligned to my financial goals and risk tolerance. From there, Stockspot takes care of the rest by automatically rebalancing, reinvesting dividends, and adjusting allocations as markets shift.

What stood out for me was its disciplined, hands-off approach. By managing rebalancing in the background, Stockspot removes emotional decision-making, avoids unnecessary trading costs, and quietly keeps your portfolio on track by taking advantage of market highs and buying opportunities during dips.

Its fees are transparent and competitive: a 0.50% annual management fee, plus ETF costs typically between 0.05% and 0.30% p.a. That’s well below what you’d pay for traditional active management.

While Stockspot doesn’t offer holistic financial planning, it’s a strong portfolio engine for investors who value low fees and long-term growth without daily involvement.

Then there’s MoneyGPS, available exclusively through institutions, super funds, advice practices, and employers. It offers ASIC-compliant digital advice from just $55 per topic, making it a low-cost, accessible entry point for those seeking guidance without the hefty price tag.

The Bigger Picture: The Industry’s Still Playing Catch-Up

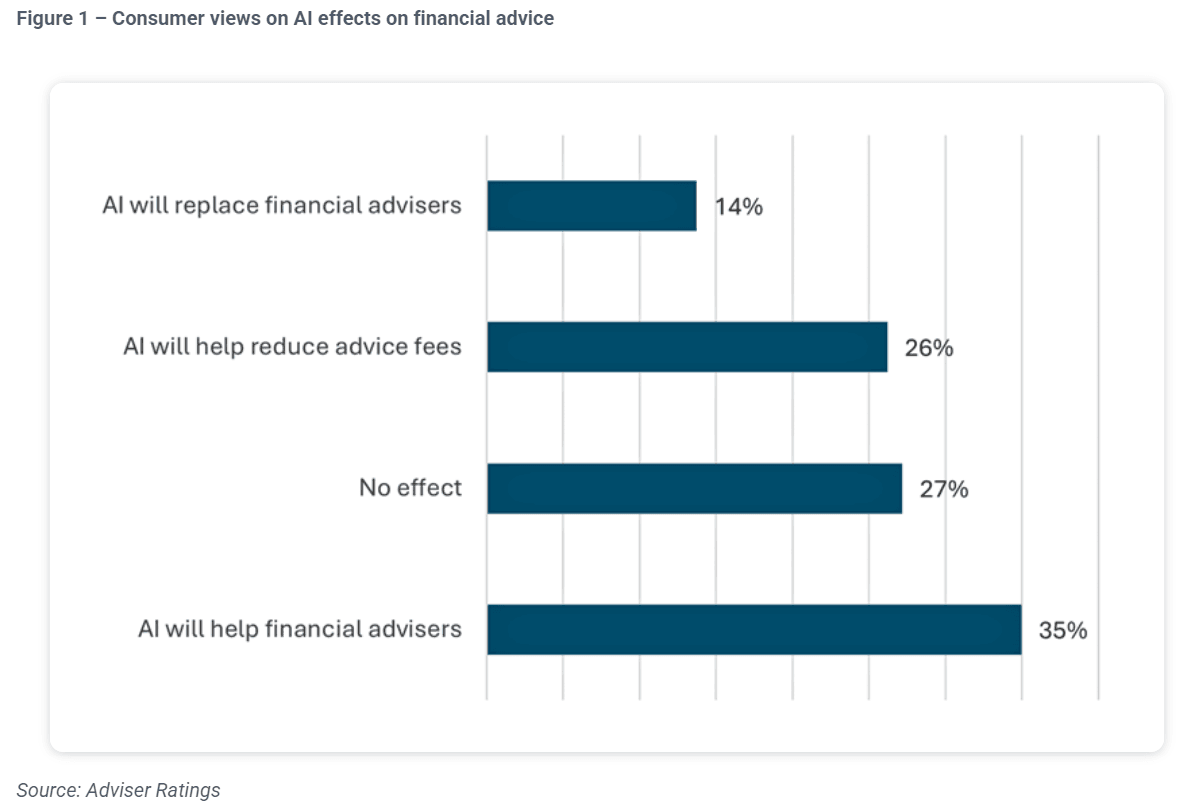

Despite the buzz, AI adoption in financial advice remains patchy. Adviser Ratings data shows fewer than half of advice practices are using or trialling AI tools.

In fact, AI is being used more to streamline the back office. Adviser Ratings data shows 47% of advisers use it for client engagement, 43% for marketing, and 41% to generate Statements of Advice. Only 12% are using it for portfolio management, as shown below:

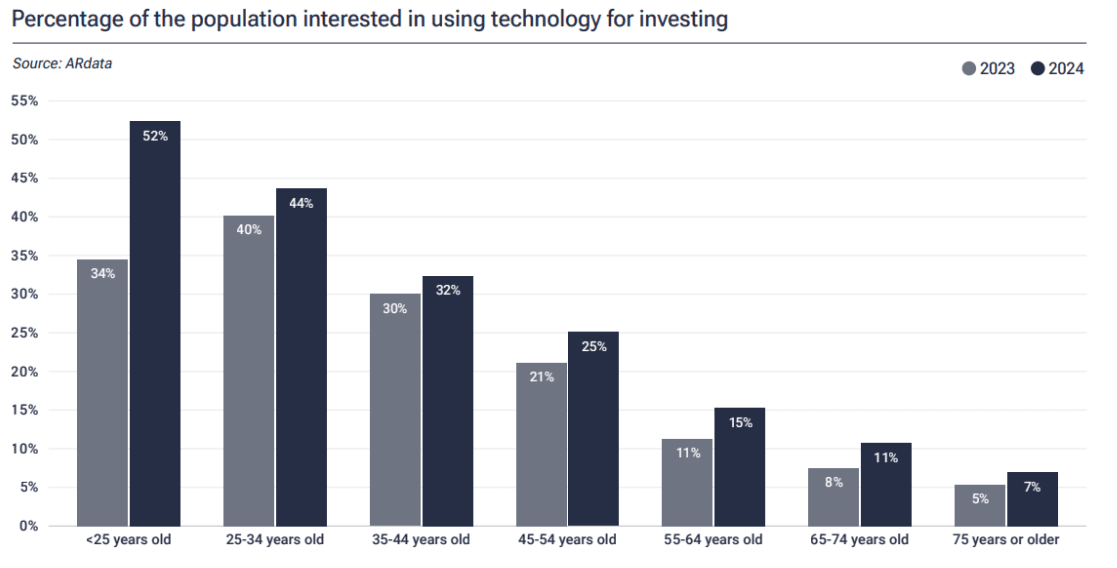

At the same time, consumer demand for digital advice solutions is rising steadily across all age groups, a clear proof that Australians are increasingly open to tech-led financial guidance:

The urgency to make this change is also growing. With around 2.5 million Australians expected to retire over the next decade, the need for affordable, scalable advice has never been more real.

Many younger advisers are already adapting. Some are embracing AI-powered tools, while others are using social media to connect with a new generation of clients.

But challenges remain: outdated systems, low trust in digital tools, and rising scam risks. The path forward lies in transparent, reliable technology and making sure that any adviser or platform you turn to is properly registered.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

A New Kind of Advice Experience

So, can digital advice replace a human financial adviser? Not quite. But that’s not really the point.

What these platforms can do, and increasingly do well, is offer everyday Australians clarity, structure, and confidence in areas like investment management, portfolio optimisation, and retirement planning. Services that were once locked behind high fees and long waitlists are finally becoming accessible.

But for complex, multi-layered planning like intergenerational wealth transfers, SMSFs, estate strategies, the human touch still matters. AI can crunch the numbers, but it can’t read a pause, sense uncertainty, or help weigh deeply personal trade-offs.

Even so, for millions priced out of traditional advice, this is a powerful shift.

Accessible. Affordable. And for the first time in a long time, genuinely within reach.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.