The Case for Corporate Bonds as the New Super Tax Looms

Ankita Rai

Fri 1 Aug 2025 5 minutesCorporate bonds are quietly making a comeback among investors. With the upcoming $3 million super tax set to take a bigger bite out of higher super balances, many investors are shifting their focus toward income-generating and defensive assets.

For those with larger balances or managing sizable self-managed super funds (SMSFs), the corporate bond market is becoming more costly to overlook.

The $3 Million Tax Catalyst

It’s not every day that a piece of tax legislation triggers a rethink across the entire market. But here we are. The planned Division 296 tax will soon double the tax rate from 15% to 30% on superannuation earnings above $3 million.

On the surface, it looks like a policy targeted at the ultra-wealthy, with around 80,000 Australians likely to be impacted. But that number is likely to grow quickly.

The $3 million cap isn’t indexed to inflation (you read that right), so as portfolio values rise, many more investors are likely to find themselves on the wrong side of the line.

This change is forcing a reassessment of investment strategies, particularly among investors who are either approaching retirement or already managing substantial SMSFs.

Even more so because unrealised gains on traditionally popular assets like shares, property, or private equity will now attract a higher tax burden. While these assets may deliver long-term growth, they also come with a potential tax drag and limited liquidity.

Hence, more investors are now looking for assets that offer two key things: income they can count on, and liquidity they can access when needed. Corporate bonds fit that brief, so they’re emerging as a go-to solution for those navigating this new tax environment.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

The Shift Toward Corporate Bonds

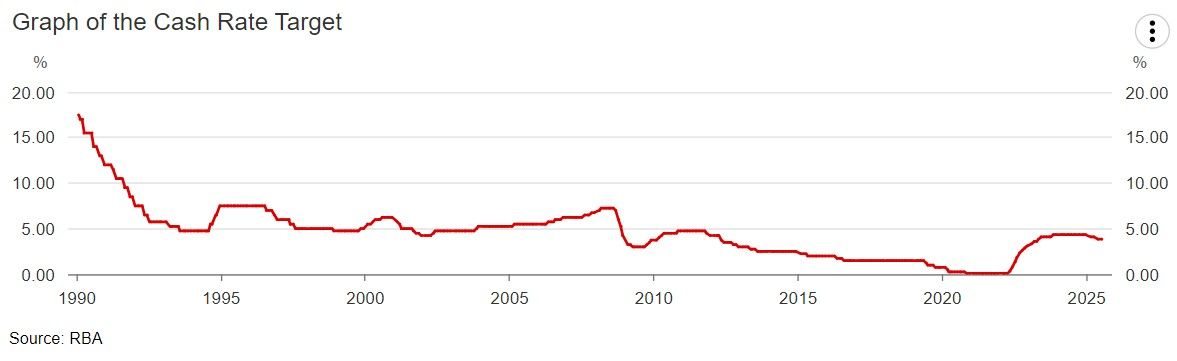

With interest rates cuts expected in the coming months, investors chasing reliable yields are finding fewer places to turn. After the recent RBA cash rate cuts, it’s fair to say that the days of 5% term deposits are probably behind us.

So, where can you turn for reliable income if you’re looking to avoid the higher risk profile typical of equities? One answer is corporate bonds.

Corporate bonds are hitting a sweet spot: more income than government bonds, and less volatility than equities. With those boxes ticked, corporate bonds are becoming a core part of a balanced portfolio for income-focused investors.

Investment-grade floating rate bonds, in particular, are appealing to more investors. They currently offer higher returns than cash or term deposits, whose rates have already begun to slip in anticipation of RBA interest rate cuts.

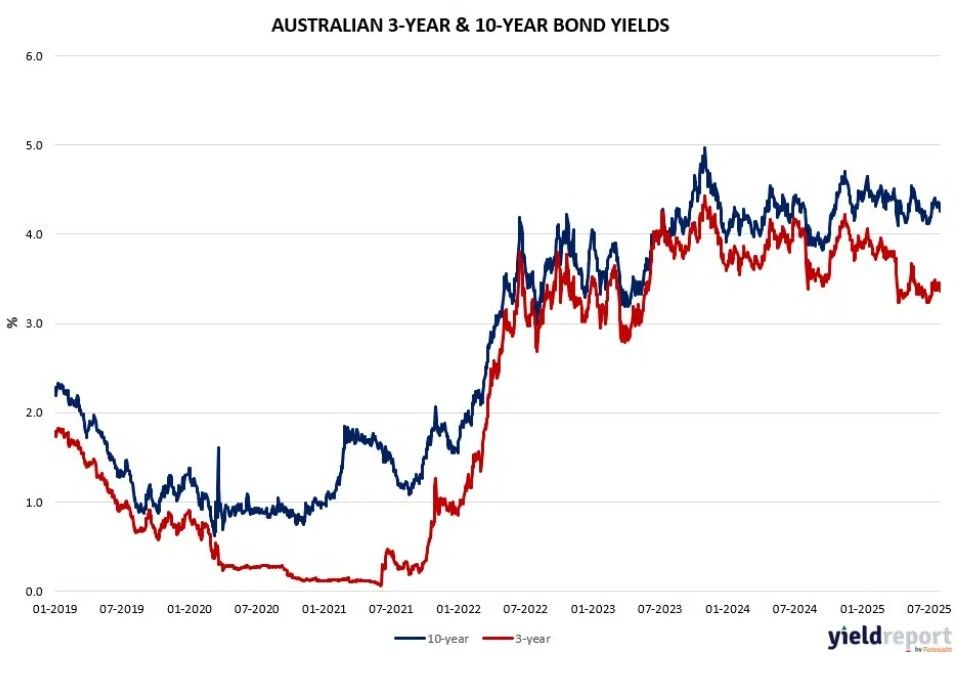

Investment-grade corporate bond yields currently exceed 5%, with some issues pushing past 6%. Compare this to term deposit rates at 3–4%, and government bonds which are barely yielding 4.3%, and corporate bonds look compelling.

As a result, the corporate bond market is buzzing with activity. Recent issues from well-capitalised companies with strong credit ratings, such as Melbourne Airport, Macquarie Bank, and One Rail Australia, have attracted significant investor interest.

Timing-wise, the stars seem to be aligning too. With rate cuts already underway and inflation easing, the opportunity to lock in strong fixed yields is narrowing.

That said, income isn’t the only consideration, tax treatment matters too.

Corporate Bond Tax Implications

Interest from corporate bonds is taxed at your marginal rate. So, unlike fully franked Australian equities, they don’t come with built-in tax credits.

But in the context of Division 296, tax certainty also matters.

While no structures outside of super currently tax unrealised gains, it’s a different story inside super. That makes assets prone to large revaluations, such as shares, property, and private equity, less attractive to hold within super going forward.

In contrast, corporate bonds, particularly floating-rate bonds, tend to offer stable pricing while minimising unrealised capital gains. That’s a major advantage, given the new tax applies to changes in asset values, not just realised income.

If investors purchase these bonds around par and hold them to maturity, the expected price fluctuations are likely to be minimal.

Since most corporate bond returns comes from regular coupon payments which is taxed as income there’s little risk of inflating your super balance with paper gains that attract additional tax.

For SMSF trustees, floating-rate corporate bonds offer clarity and control. By holding income-generating assets like bonds inside super, and growth assets outside, investors can reduce valuation volatility and manage their Division 296 exposure more effectively.

Understanding the Risks

While appealing, corporate bonds aren’t without risk.

Unlike government-backed term deposits, corporate bonds aren’t guaranteed. However, defaults on investment-grade Australian corporate bonds remain exceptionally rare, placing them among the safer options within the fixed-income sphere.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Corporate Bonds as a Defensive Solution

As the Division 296 tax approaches, investors aren’t just chasing returns anymore. They’re rethinking how and where they invest their wealth.

The game has shifted to tax efficiency, liquidity, and predictable income. In this new playbook, corporate bonds are quickly becoming one of the most useful asset classes to navigate the upcoming tax changes.

But like any asset, corporate bonds aren’t a one-size-fits-all solution. They sit alongside cash, fixed deposits, equities, private credit, and property in the wider income investing toolkit. Understanding how they align with your goals is key.

Whether you’re building a retirement strategy or rebalancing a large super portfolio, now’s the time to get deliberate about your income investing plan.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.