How the $3 Million Super Tax Could Rewrite the SMSF Rulebook

Ankita Rai

Thu 24 Jul 2025 5 minutesThe proposed $3 million super tax is one of the biggest shake-ups Australia’s retirement system has seen in decades, forcing many SMSF trustees to rethink their long-held strategies.

For years, managing large super balances followed a familiar playbook: one that rewarded capital growth, long-term compounding, and tax efficiency.

But under the new rules, even unrealised gains on balances above $3 million will attract an additional 15% tax. That’s sending trustees back to the drawing board.

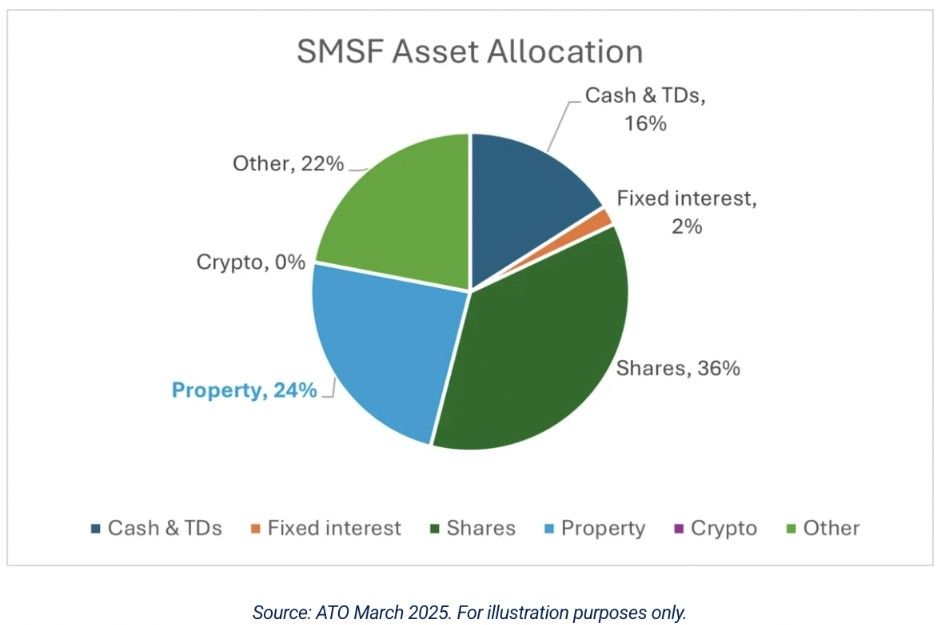

SMSFs now control over $1 trillion in assets, with close to 1.2 million Australians running their own fund. According to the SMSF Association, around 17,000 trustees hold business premises — including family farms and commercial property — worth an estimated $100 billion.

No wonder trustees are already weighing up how to cushion the blow and the answers could fundamentally reshape the SMSF landscape…

Property Strategies Could Be the First to Shift

Property has long been a cornerstone of SMSF portfolios. Trustees have traditionally favoured residential and commercial real estate for its growth potential and perceived stability, especially those running family farms or small businesses.

But Division 296 changes that equation. Any rise in a property's value, even if it’s not sold, could push an SMSF over the $3 million cap, triggering a tax bill on unrealised gains. For trustees holding illiquid assets, that means a tax bill with no corresponding cash flow.

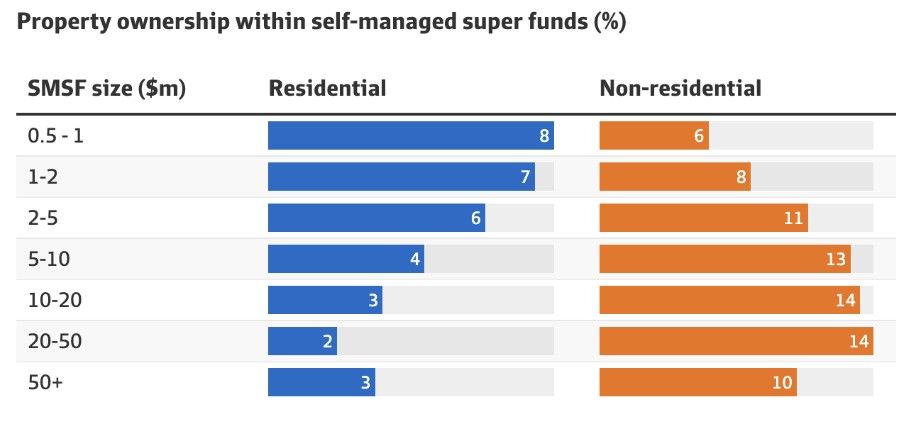

Commercial property is particularly exposed. Valuations can swing sharply, and holdings are often highly concentrated. While about 24% of SMSFs currently hold direct property, the numbers jump with fund size.

According to the ATO, 62% of SMSFs with balances over $2 million own commercial property, putting large-balance funds squarely in the firing line.

This mix of high asset values, low liquidity, and unpredictable revaluations is prompting many trustees to rethink their SMSF strategies.

More trustees are beginning to restructure their property holdings, moving assets into family trusts or other non-super vehicles to limit exposure. Others are reassessing the role of property in their portfolios altogether, leaning toward more liquid, income-producing investments that are easier to manage under the new regime.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

Fully Franked Shares Gain New Appeal

As property becomes less attractive, fully franked shares are likely to gain renewed popularity among SMSF trustees.

Although franking credits won't directly offset the new Division 296 tax, they can significantly boost tax efficiency inside SMSFs by helping reduce the total tax bill.

For example, if an SMSF owns shares in a company that pays franked dividends, the franking credits can be used to reduce the fund’s tax liability, effectively boosting the after-tax yield. Franking credits represent tax paid at the company rate of 30%, while SMSFs in accumulation are taxed at just 15%.

The fact SMSFs are already overweight Australian shares, 27% of assets, compared with 22% in large super funds, gives them a head start in targeting franked dividends that deliver consistent income and favourable tax treatment.

So, as the new tax reshapes the investment landscape, a shift in priorities is taking place. Trustees are looking beyond capital growth alone placing greater weight on after-tax returns, reliable dividends, and the compounding edge franking credits can offer over time.

Shifting Toward Lower-Growth Assets comes at a Cost

One obvious response for trustees looking to limit exposure to the Division 296 tax is to shift toward stable, income-focused assets, such as bonds, cash, or dividend-paying blue-chip stocks, to help reduce unrealised gains.

But there's a catch. Selling growth assets inside an SMSF in the accumulation phase, typically triggers capital gains tax (CGT). So trustees trying to avoid one tax could end up incurring another in the process.

There’s also the broader question of long-term performance. Sacrificing growth in pursuit of short-term tax efficiency might seem prudent now, but reducing exposure to higher-return assets could ultimately limit an SMSF’s earning potential over time.

That said, many SMSFs already hold a significant share of liquid, listed investments, which may help ease the transition. According to 2025 Vanguard/Investment Trends SMSF Report, listed assets, including direct shares (37%) and ETFs (12%), make up nearly half of SMSF portfolios. Cash holdings also remain substantial, at around 15%. This suggests that diversification and liquidity are already front of mind for many trustees, and those qualities are likely to become even more important under the new tax rules.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Time to Rethink the Road Ahead

The introduction of the $3 million super tax isn’t just another tweak to the rules; it marks a shift in how the government views superannuation and wealth accumulation.

For SMSF trustees, it’s a clear prompt to reassess strategies and reconsider the role different assets play within the bigger picture.

Whether that means leaning away from growth-oriented, high-performing assets, shifting toward income-generating or more liquid investments, or simply refining existing allocations, what’s clear is that the regulatory environment is evolving, and it’s becoming an increasingly important factor in long-term portfolio thinking.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.