SMSF Loans: What Trustees Often Get Wrong

Ankita Rai

Fri 25 Apr 2025 6 minutesA growing number of Australians are turning to self-managed super funds (SMSFs) to take greater control of their retirement savings—and for many, property sits at the heart of that strategy.

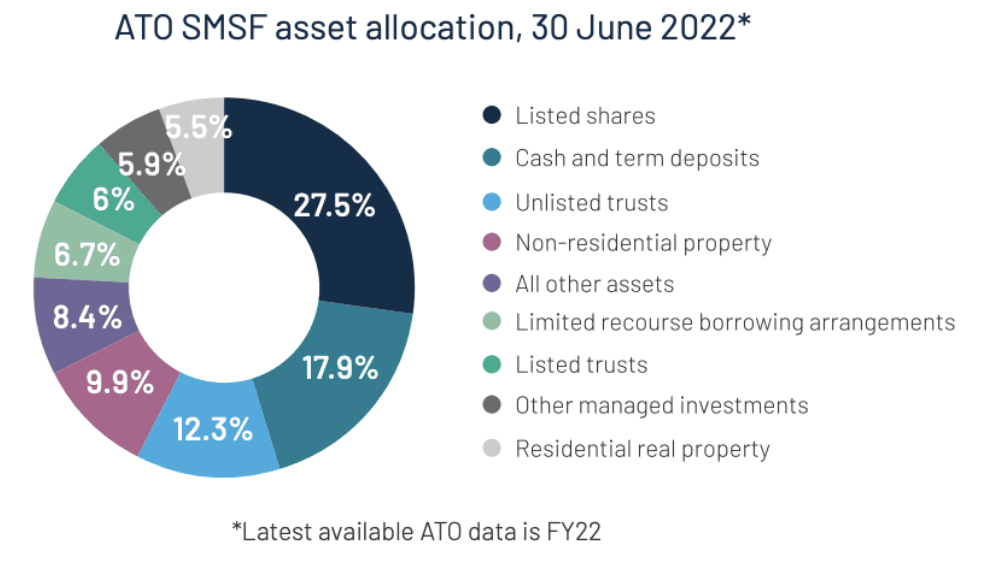

According to the latest ATO figures, SMSFs held $1.02 trillion in assets at the end of the December 2024 quarter. While listed shares remain the largest allocation, direct property makes up 16.5% of total SMSF assets.

With property values climbing in recent years, it’s not surprising that more trustees are turning to limited recourse borrowing arrangements (LRBAs) to increase their buying power inside their SMSFs.

But SMSF loans aren’t your standard mortgage—they come with strict rules and no shortage of misconceptions.

So, how do these loans work, and what do trustees need to know before diving in?

What Makes SMSF Loans Different?

SMSF loans operate under a specific framework called a limited recourse borrowing arrangement (LRBA). Under this setup, the lender’s rights are limited to the asset being financed.

That means if the SMSF defaults on the loan, the lender can only claim that particular property—leaving the rest of the fund untouched.

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

So when can an SMSF actually borrow?

According to the ATO, SMSF borrowing is only permitted in three scenarios:

To pay a member benefit or surcharge liability — for up to 90 days and no more than 10% of fund assets.

To settle a security transaction — limited to 7 days and also capped at 10% of fund assets.

To purchase assets under an LRBA — the most common use case, typically for direct property investment, but it can also be used to acquire listed equities and managed funds.

It’s the third option—LRBAs—that’s shaping SMSF strategies in a big way.

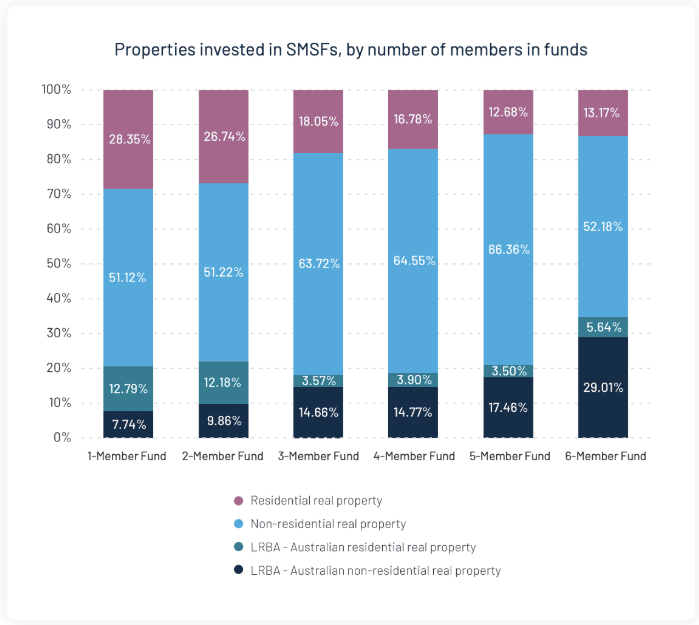

Larger SMSFs—particularly those with five or more members—are leading the charge, using LRBAs to align their portfolios with long-term goals better.

According to the 2024 Class Benchmark Report, these funds are deploying LRBAs more strategically—scaling into commercial property and non-residential assets while reducing reliance on cash and term deposits.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Common Misconceptions About SMSF Loans

Despite growing interest, SMSF borrowing remains a complex and often misunderstood area. From eligibility to investment restrictions, it’s easy to get caught out.

If you’re thinking about using your SMSF to invest in property or other assets through a loan, here’s what you need to know to sidestep the most common pitfalls:

1. SMSF Loans Are Just Like Regular Mortgages

They’re not. SMSF loans are governed by strict compliance rules.

Since SMSF borrowing operates under LRBA, it means that if the loan defaults, the lender can only recover the specific asset financed—such as property—without touching the rest of the fund’s assets.

In addition, the purchased asset must be held in a bare trust. This step ensures compliance with superannuation regulations and maintains asset separation from the SMSF.

Lenders also impose more rigorous servicing requirements. These rules are designed to protect retirement savings and reinforce the fund’s sole purpose: providing for members in retirement.

2. You Can Use Personal Assets as Collateral

No. One of the most important rules in SMSF lending is asset separation. SMSF trustees cannot use personal assets as collateral or guarantees for an SMSF loan.

The ATO mandates a strict separation between personal finances and SMSF assets. Violating this principle risks breaching compliance, potentially leading to penalties, loss of concessional tax treatment, or even the winding-up of the fund.

3. SMSF Loans Are Only for the Wealthy

While a certain balance is needed to justify the costs, SMSF loans are more accessible than most people think.

Many trustees use pooled contributions from family members (like spouses or siblings) to meet the threshold. Some lenders also accept projected contributions as part of the servicing calculation, though this often comes with caps or additional scrutiny.

The key is having a sound investment plan and the proper cash flow rather than being ultra-wealthy.

4. Borrowing Power Is Unlimited

In reality, SMSF borrowing is tightly regulated and conservative by design. Most lenders cap loan-to-value ratios (LVRs) at 60–70% and require the fund to hold at least 10% of the property’s value in liquid reserves.

They also assess the fund’s income—such as rent, contributions, and investment returns—before approving a loan.

Interestingly, as major banks have exited the SMSF lending space, non-bank lenders have stepped in. Some now offer LVRs of up to 90%, though higher borrowing often comes with steeper interest rates. Still, refinancing an SMSF loan tends to be more complex than refinancing a regular home loan.

5. It’s only for Residential Property

Contrary to popular belief, SMSFs can also use loans to invest in commercial real estate—think warehouses, offices, or business premises.

This can be especially beneficial for business owners. If the SMSF purchases a commercial property, it can be leased back to a fund member’s business, provided it’s done at market rates and all compliance rules are followed.

Commercial assets may also offer longer leases and higher yields. However, lender appetite varies; some may exclude regional or off-the-plan properties.

6. Professional Advice isn’t Essential

It is. Most lenders require trustees to obtain independent legal advice and a financial advice certificate before finalising an SMSF loan.

These aren’t just formalities—they’re important safeguards to ensure trustees understand the structure, responsibilities, and potential risks involved. In fact, engaging an adviser early helps ensure the strategy is compliant and and tailored to your SMSF’s goals.

SMSF Borrowing: A Strategy Worth Considering

For trustees with the right setup, borrowing through an SMSF can be a powerful way to diversify investments, access tax advantages, and build long-term wealth. The limited recourse structure adds a layer of protection, while the ability to invest in property or listed assets offers meaningful growth potential.

But this isn’t a quick win. Higher interest rates, strict compliance rules, and repayment constraints mean SMSF borrowing isn’t for everyone.

If it aligns with your fund’s goals—and you’re prepared to manage the complexity—it could be a smart, strategic move.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.