SMSF cost-cutting tips every trustee should know

Ankita Rai

Thu 23 Jan 2025 5 minutesSelf-managed super funds (SMSFs) are growing in popularity amongst investors seeking greater control over their retirement savings.

While their benefits are significant, the costs—both setup and ongoing—can pose challenges, particularly for smaller funds.

The good news is there are some costs-cutting tips which make SMSFs accessible to a wider portion of the investing population.

Understanding SMSF costs

Setting up an SMSF involves several upfront expenses, such as trust deed preparation, ABN registration, general trust advice, and ASIC fees if a corporate trustee is chosen.

Once the fund is operational, ongoing costs like audits, compliance, and administration come into play. The overall running costs vary based on the assets held, with more complex funds incurring higher expenses.

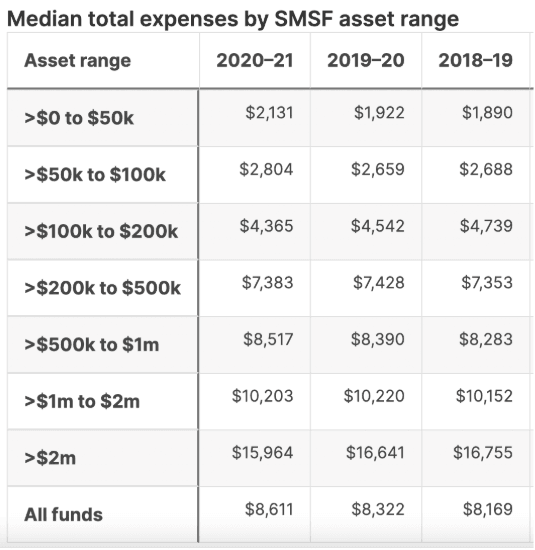

According to the latest SMSF data from the ATO (2020–2021), median total expenses range from $2,131 to $15,964, depending on the fund's asset size. Median operating expenses stand at $4,139.

What makes SMSFs unique is their cost structure. Unlike traditional super funds, SMSF costs are fixed rather than percentage-based. So as the size of the fund grows, the expense ratio decreases, making SMSFs increasingly cost-effective for larger balances.

This is why understanding SMSF costs is so important—it’s not just about how much you’re spending, but also how those costs stack up compared to the size of your fund.

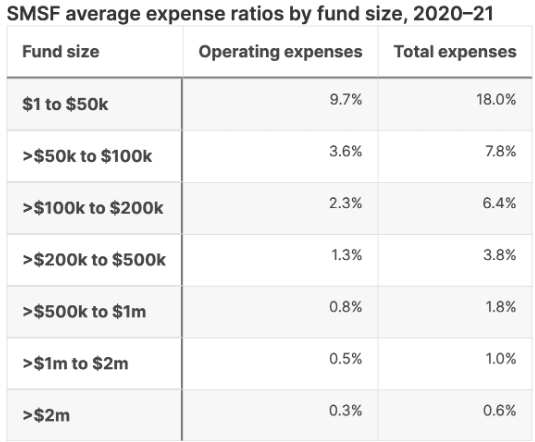

As shown below, SMSF expense ratios differ vastly at various fund sizes.

Why reducing SMSF costs matters

Managing costs is a critical factor in determining the viability of self-managed super funds. Expenses can significantly impact the fund’s return on assets, making cost management essential for maintaining a successful SMSF.

For smaller funds, reducing costs is especially important to ensure the benefits of control and flexibility outweigh the expenses.

The key to minimizing SMSF costs lies in striking a balance between professional support and do-it-yourself (DIY) approaches, simplifying investment strategies, and selecting cost-effective service providers.

Here are some practical strategies to help you reduce costs and maximise your SMSF’s efficiency…

Explore 100's of investment opportunities and find your next hidden gem!

Search and compare a purposely broad range of investments and connect directly with product issuers.

5 tips to reduce SMSF costs

1. Keep it simple

Simplifying your investment strategy is one of the easiest ways to lower your SMSF costs.

Instead of investing in expensive managed funds, consider low-cost exchange-traded funds (ETFs). ETFs are an affordable way to diversify your portfolio, with management fees typically ranging from 0.1% to 0.5% p.a.

In contrast, complex investments, such as borrowing to invest in property, often lead to higher administrative costs and require specialised advice.

Similarly, investments in derivatives or unlisted shares can increase compliance requirements, driving up expenses.

Sticking to straightforward options not only simplifies compliance and reporting but also keeps your investment expenses under control.

2. DIY when possible

By carefully balancing what you outsource versus what you manage yourself, you can optimise your SMSF costs while ensuring compliance.

Many SMSF tasks, such as preparing your investment strategy, tracking contributions, or preparing financials and tax returns, can be done by trustees themselves. The only task that must be legally outsourced is the annual audit, which must be performed by an independent ASIC-licensed auditor.

Valuable resources, such as the ATO’s SMSF guides provide clear, step-by-step instructions to help trustees manage these processes efficiently.

3. Choose the right trustee structure

Selecting the right trustee structure can also impact costs.

For smaller funds, opting for individual trustees instead of a corporate trustee can save you on ASIC registration fees and annual review costs.

However, corporate trustees may be more appropriate for larger or more complex funds.

Therefore, it is important to tailor your choice to the specific needs of your SMSF.

4. Use affordable tools

Expensive administration platforms aren’t always necessary.

Excel spreadsheets can be just as effective for simpler SMSFs, helping you track assets and transactions while keeping costs low.

Prioritise scalable administration platforms that provide the necessary services.

For instance, platforms such as Stake Super and eSuperfund provide competitive pricing options, offering zero setup costs. However, fee structures among SMSF administrators can vary widely, ranging from no setup fees to over $1,000.

Digital platforms also offer real-time data and analytics, enabling you to make informed decisions and adjust your portfolio as needed.

Shopping around for affordable service providers, using basic tools, and staying informed about regulatory changes can help maintain a cost-effective and compliant SMSF without the burden of high fees.

5. Pooling resources

Combining superannuation balances with other members, such as family or close associates, can also significantly reduce costs.

A larger fund spreads fixed expenses across more assets, lowering the expense ratio while opening up greater investment opportunities. This approach works particularly well when members share aligned financial goals.

Subscribe to InvestmentMarkets for weekly investment insights and opportunities and get content like this straight into your inbox.

Cost efficiency is the key to successful SMSF cost management

Whether you are setting up your first SMSF or fine-tuning an existing one, focusing on cost efficiency is essential for maximising your retirement savings.

By simplifying investments and leveraging digital tools, trustees can significantly reduce both setup and ongoing costs while retaining the control and flexibility that make SMSFs so appealing.

Disclaimer: This article is prepared by Ankita Rai for educational purposes only. While all reasonable care has been taken by the author in the preparation of this information, the author and InvestmentMarkets (Aust) Pty. Ltd. as publisher take no responsibility for any actions taken based on information contained herein or for any errors or omissions within it. Interested parties should seek independent professional advice prior to acting on any information presented. Please note past performance is not a reliable indicator of future performance.